Decoding the 203k Loan: A Comprehensive Walkthrough

The 203k loan, part of the Federal Housing Administration’s arsenal since the late 1970s, is like a phoenix that can resurrect a dilapidated home from the ashes. It’s a potent brew of purchase-plus-renovation mortgage that enables homebuyers to roll the costs of renovation into the, uh, mortgage mix. Let’s sink our teeth into the nitty-gritty, shall we?

At its core, a 203k loan is wrapped tighter than a sailor’s knot around rehabilitation or repairs to a place that you, the mortgagor, will turn into your primary residence. It’s like giving a second chance to a below deck sailing yacht that’s seen better days, enabling a glorious transformation.

There are two siblings in the 203k loan family: the Standard 203k loan for extensive renovation work and the Limited 203k loan, capped at $35,000, for minor repairs without structural work. Either way, you’re looking at a single loan, one application, and one dream-worthy renovation.

Now, don’t get it twisted – a 203k loan isn’t your run-of-the-mill conventional mortgage. While a conventional loan would sneer at the sight of a crumbling staircase, a 203k loan rolls up its sleeves and says, “let’s get to work!”

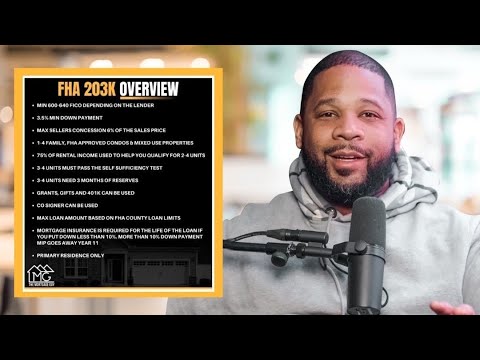

203k Loan Requirements Demystified

So, you’re chomping at the bit to get started on that fixer-upper? First, let’s make sure you can saddle up! Eligibility for the 203k loan expects borrowers to have a credit score no less than 500 and, much like Ben Lawson sets the bar for chiseled fitness, a decent debt-to-income ratio – below 43%, to be precise.

The house in question can range from a humble abode to a two-to-four family dwelling that’s been around for at least a year. No, you can’t splash out on commercial escapades or deluxe pools. Think of it as a budget that’s tight as a drum – it covers necessities.

Get your paperwork ducks in a row: income evidence, purchase contracts, a detailed proposal of the works by licensed contractors, and more. Lenders need to offer 203k loans, so they’re basically as robust as those in the component Technologies field – they’ve got to be FHA-approved tickers.

| **Feature** | **Details** |

|---|---|

| Loan Purpose | Home purchase and renovation |

| Primary Use | Primary residence |

| Credit Score Requirement | Minimum 500 (3.5% down payment if score is 580 or higher) |

| Down Payment | Minimum 3.5% for credit scores 580 or higher; 10% for scores below 580 |

| Mortgage Insurance Premium | Upfront MIP equal to 1.75% of the loan amount |

| Debt-to-Income Ratios | – Front-end DTI (Mortgage Payment Expense to Effective Income): <= 31% |

| – Back-end DTI (Total Fixed Payment to Effective Income): <= 43% | |

| Loan Limit | Up to $35,000 for Limited 203(k) program; higher limits for standard 203(k) depending on area |

| Eligibility | Owner-occupants, nonprofit organizations, and government entities |

| Usage Restrictions | Not for commercial use or luxury items like tennis courts, gazebos, new swimming pools |

| Availability | Not available to investors |

| Closing Timeline | Up to 60 days; requires coordination with sellers due to extended closing process |

| Purpose of Section 203(k) | Finance both the purchase/refinancing of a house and the cost of its rehabilitation in a single loan |

| Types of 203(k) Loans | – Standard 203(k) for extensive renovation projects |

| – Limited 203(k) for smaller projects up to $35,000 | |

| Benefits | – Combines purchase/refinancing and renovation costs into one loan |

| – Provides financing for homes that might not qualify for a standard mortgage | |

| – Encourages rehabilitation of existing housing stock | |

| Cons | – Longer closing process |

| – Requires immediate occupancy | |

| – May involve additional coordination and regulatory requirements | |

| – Not suitable for “flipping” investment properties |

Navigating the 203k FHA Loan Process

Embarking on the 203k fha loan journey is akin to assembling a ship in a bottle – precision is key. Initially, you’ll navigate the waters of pre-approval, resembling reviews like those for Quavo Rocket power reviews, carefully examining financial details to ensure nothing’s off-kilter.

Once you find a vessel – or house – the HUD consultant steps in as your copilot, advising on mandatory repairs and gleaning estimates. Delays can happen, whether it’s a storm at sea or a snag in contractor bids, but the destination is worth it: a transformed home.

The Financial Alchemy of the 203k Rehab Loan

Picture this: a worn-down bungalow reborn into a neighborhood jewel. That’s the magic we’re talking about. With each 203k rehab loan story, from despairing “before” to dazzling “after,” the numbers reveal a wallet-friendly truth. Renovations like these have the power to boost property value significantly, like finding the best time To visit Bali for your investment.

Think ROI and you’re envisioning increased equity and market attractiveness. Each 203k loan case study gleams with potential, offering a hopeful glimpse into the realm of profitable renovations.

The Versatility of 203k Loans: Beyond Residential Repair

Oh, the places you’ll go with a 203k loan! It’s not just about new rooves and revamped bathrooms. Have aspirations of going green? The 203k loan can get you there, funding upgrades like energy-efficient windows or solar panels.

Mixed-use properties and grandma’s old house that needs tearing down for a rebuild? All possible. Even that shiny new fridge can be roped in under the loan’s umbrella, connecting functionality with finance like never before.

Why the FHA 203k Rehab Loan Stands Out

Outshine the competition? That’s the 203k loan’s middle name. It goes head-to-head with other FHA products and emerges as the heavyweight champ, especially if you juxtapose it with limited alternatives like HELOCs or cash-out refinancing.

Homeowners, realtors, they all sing from the same hymn sheet, praising the loan for its flexibility and potency. These testimonials serve as glowing beacons, guiding future navigators through the landscape of home rehab.

What is a 203k Loan’s Impact on Market Dynamics?

The unseen power of the 203k loan pulses beneath the housing market. By injecting life and funds into underloved properties, it stimulates neighborhood rejuvenation and drives market trends toward a brighter horizon. It’s the equivalent to seeding a garden – the loan’s impact sprouts improvements community-wide.

From Paperwork to Paintwork: Leveraging 203k Loans for Your Renovation

To the hopeful renovator: plan like you’re orchestrating a symphony. Budget every penny with the meticulousness of a Swiss watchmaker. Engage contractors with the clarity and commitment of an ironclad handshake. Mind local laws and permits as if navigating a map to buried treasure, and set a timeline realistic as the sunrise.

203k Loan Pitfalls: What to Watch Out For

Oh, the pitfalls can be sneakier than a fox in a henhouse. Know this: misunderstandings about 203k loans are as common as rain in London. Take heed of horror stories of renovations gone awry – they serve as cautionary tales, rich with lessons.

From over-ambitious timelines to underestimated costs, don’t get caught out in the financial cold. Layer up with legal and fiscal know-how like you’re preparing for a blizzard.

Success Stories: 203k Rehab Loan Transformations Unveiled

Let’s pull back the curtain on those glittering phoenixes, shall we? Homeowners, with beaming pride, share their tales of conquest – derelict to delightful, distressing to dazzling. These visual narratives showcase the transformative power of a single loan and the joy it brings to hearts and communities alike, from personal sanctuaries to neighborhood revivals.

Conclusion: 203k Loan Magic Unlocked

In unwrapping the present that is the 203k loan, we’ve seen its many ribbons: the versatility, the financial wisdom, the pure potentiality. It stands as a beacon of hope for the visionary homebuyer, a staple in the smart investor’s toolbox, a catalyst for community vibrancy.

If you’re drawn to the prospect of resurrecting a fixer-upper, let this thorough exploration serve as your guide. With eyes open and a solid plan, the 203k loan isn’t just a product; it’s a passage to the home of your dreams. Sail forth into the vast sea of possibility, and may the 203k winds be ever in your favor.

Unveiling the Magic of the 203k Loan

Alright, folks! If you’ve ever dreamt of transforming a shabby house into your dream home, buckle up! We’re diving into the enchanting world of the 203k loan—a spellbinding financial tool as magical as any fairy godmother’s wand. Get ready for some fun trivia and jaw-dropping facts about this fixer-upper’s fairy dust!

Abracadabra! The Lowdown on the 203k Loan

So you’ve stumbled upon a house that’s screaming potential, but looks like it’s had a bit of a rough go. No sweat! The 203k loan swoops in like a knight in shining armor, ready to finance both the purchase and the rehabilitation of your soon-to-be castle. But hold your horses, what’s the big deal about it, you ask?

Well, my friend, the 203k loan isn’t any ordinary spell in the mortgage grimoire—it’s a special incantation that merges the cost of renovations and the mortgage into one. Imagine waving a wand and all the paperwork, inspectors, and contractors line up, eager to turn that beast of a building into the belle of the ball. It’s nuts!

“HECM” Your Way into Renovation

Hey, I see you leaning in. You must be wondering if there’s a way to combine the rejuvenating touch of a 203k loan with some kind of enchantment for older homeowners. Guess what? There’s another potion in the cauldron— the Home Equity conversion Mortgage (HECM). It’s like the 203k loan’s wise old wizard friend, allowing seniors to tap into their home equity to make the upgrades they need, without having to sell their soul… I mean, their house.

“How Do Reverse Mortgages Work” You Wonder While Wielding a 203k Loan

I know, I know, your head is already spinning with all this magic. But hey, don’t get your spellbook in a twist just yet! Some folks ponder over the mysteries of home finance like How do reverse Mortgages work while delving into a 203k loan adventure. Well, think of reverse mortgages as the curious potions that allow homeowners to receive funds from their equity, while 203k loans are the elixirs that refurbish and revamp. Different spells, different outcomes, but both can be pretty enchanting!

The Dandy Details: Did You Know?

Bet you didn’t know these tidbits about the mighty 203k loan:

Wrapping It Up with a Bow (or a Hammer)

So, the next time you’re gawking at a fixer-upper, remember that a 203k loan could be the magic ticket to your fairy-tale ending. With just a flick of the lending wand, that fixer-upper will go from drab to fab faster than you can say “open house.”

Remember, not all heroes wear capes—some wield a 203k loan like the rockstars of renovation they are. Here’s to making home makeover dreams come true, one enchanted 203k loan at a time!

What is a 203k loan?

Oh, a 203k loan? That’s your ticket to turning a fixer-upper into your dream home! Let’s put it this way: it’s a special type of FHA loan sprinkled with a bit of fairy dust that lets you borrow enough dough for both the purchase of the house and those much-needed renovations. All rolled into one mortgage, it’s a handy little package for folks who’ve got their eye on a place that needs some TLC.

What are the cons of a 203k loan?

Ah, the cons of a 203k loan are like a fly in the ointment—they can cramp your style a bit. For starters, the paperwork can be a beast, and you’ll need some serious patience for the lengthy approval process. You’ve also got to play by the rules and use licensed contractors, which can be a bit of a drag if you fancied a bit of DIY. Plus, there’s the higher interest rates and fees compared to a standard-issue loan.

What are the debt to income requirements for a 203k loan?

When it comes to a 203k loan, your debt to income (DTI) ratio needs to be on point, typically no higher than 43%. But hey, it’s the lender’s way of making sure you’re not biting off more than you can chew, financially speaking.

Which one of the following is not eligible for a 203 k loan?

Now, when it comes to what’s not eligible for a 203k loan, your answer is luxury items—think the likes of tennis courts and gazebos. These loans are all about necessities and making the home livable, not about adding the cherry on top of your personal resort.

Is a 203K loan worth it?

Is a 203K loan worth it? Well, if you’re game for a bit of a rollercoaster and have a knack for seeing the potential in a diamond in the rough, absolutely! It’s a chance to craft your home sweet home, but remember, it’s not a walk in the park and it’ll require a chunk of effort.

Are 203K loans more expensive?

Alright, let’s talk turkey—yes, 203K loans can be more expensive. Why, you ask? Higher interest rates and insurance premiums, not to mention the closing costs and fees. It’s like ordering the deluxe burger instead of the basic—you get more toppings but it’ll cost ya.

How does a 203K work?

Here’s how a 203K loan works: With a wink and a nudge, you get loan approval for both the purchase price and the estimated reno costs. Then, you have this pot of cash that’s released to you in stages, as the work gets done. Just like a mini treasure hunt but for home repairs.

Is a 203K loan tax deductible?

Now, when it comes to your taxes, a 203K loan itself isn’t tax-deductible. I know, bummer, right? But! Some related expenses could be—think mortgage interest and property taxes—so get chummy with a tax pro who can help you sniff out any deductions.

Is there PMI on a 203K loan?

Oh, you bet your bottom dollar there’s PMI on a 203K loan—it’s like an overprotective chaperone for the lender. Since it’s an FHA loan, you’ve gotta pay that mortgage insurance until you’ve amassed enough equity in the property or refinanced.

How is a 203k loan calculated?

Calculating a 203k loan can earn you a pat on the back—it’s not just the home purchase price plus renovation costs. No, sir! They throw in a contingency reserve of 10-20% for unforeseen expenses, and inspection fees to keep the contractor honest, so you’ve got a stew going that’ll cover it all.

How are 203k funds disbursed?

As for disbursing those 203k funds, it’s done in installments—kinda like getting an allowance. You pay for the work as it’s completed, making sure everything’s on the up and up before the next chunk of change rolls out.

What are the two types of 203k loans?

Hold onto your hats—there are two types of 203k loans: the limited 203k, for minor repairs that don’t involve structural work, and the standard 203k, which is for the big kahuna projects that can include structural changes.

What is the difference between a 203b and a 203k loan?

The difference between a 203b and a 203k loan is like comparing apples and oranges. The 203b is your standard FHA loan for buying or refinancing a home, sans repairs, while the 203k’s like an FHA loan on steroids, letting you finance the home and fix-up costs together.

Does 203k loan cover appliances?

Yep, a 203k loan can cover appliances—consider them essential garnishes to your home entrée, as long as they’re part of the property and built-in.

Can you use a 203k loan to build a garage?

Fancy building a garage? You can absolutely use a 203k loan for that. It’s all about adding value to your home, and a garage is like putting boots on a bumblebee—it makes it that much better.

What is the major advantage of a 203K loan through FHA?

Here’s the major advantage: a 203K loan through the FHA is your golden ticket to homeownership with a side of renovations. It’s like getting two birds with one stone, giving you the power to buy and renovate all within a single, manageable loan.

How are 203K funds disbursed?

About how those 203K funds are doled out—like I said, it’s in stages, based on work completed. It’s not like winning the lottery; you’ve got to spend some to get some, and the lender’s gotta give the thumbs-up at each milestone.

How does a 203K loan affect the seller?

Sellers, listen up—a 203K loan might make things a tad slower, but hey, it could also widen the pool of buyers knocking on your door. Just be prepared for a bit more scrutiny and maybe a longer closing time.

What can you use FHA 203K for?

Oh, the things you can do with an FHA 203K! From necessary repairs to modernizing that vintage bathroom, this loan’s got you covered for renovations big and small. It’s all about making sure the abode is safe, sound, and up to snuff.