Analyzing 30 Year Fixed Interest Rates Today: A Comprehensive View

When it comes to securing a slice of the American dream, savvy homebuyers and refinance shoppers are keenly focused on 30 year fixed interest rates today. Let’s talk turkey; current 30-year fixed mortgage rates are nothing to sneeze at compared to the rock-bottom rates we were spoiled with in years gone by. Various factors are meddling with today’s rates, including economic indicators, policy decisions, and market trends, spinning a web of fluctuation that can make planning for a mortgage as tricky as nailing jelly to a wall.

Comparing these rates with historical trends is no apples to oranges comparison—it’s crucial for context. Past decades have seen their share of rate roller coasters, and today’s rates are locking arms with broader economic patterns.

Here’s the scoop: it’s not just about the Federal Reserve’s recent interest rate decisions. We’re also facing a housing market that’s tighter than a drum, with home prices soaring like eagles. Toss into the mix global uncertainties, and the stew becomes even more complex. By examining the underbelly of these influences, a predictive map starts to emerge, guiding us through the terrain of future rate landscapes.

Impact of Recent Federal Reserve Policies on 30-Year Fixed Interest Rates

Picture the Federal Reserve as the big cheese setting the tone for what goes down in the financial world. Their latest monetary policies have sent ripples across the pond, directly impacting the path of 30-year fixed mortgage rates. Each tweak and tune of the interest rate decides whether it’s sunshine or rain for potential borrowers’ wallets.

When the Fed brings its gavel down to adjust rates, it’s thunderous news for mortgage rates. Just like getting a sneak peek of Aunt Em’s secret pie recipe, getting the low-down on the Fed’s influence is golden. Experts have Weighed in, predicting more upstream swimming for rates in the short term, with a likely ease on the horizon as we hitch a ride into 2024.

| Lender | 30-Year Fixed Rate (APR) | Points | Fees | Estimated Monthly Payment* | Requirements (Credit Score, Down Payment) |

|---|---|---|---|---|---|

| Lender A | 4.75% | 0.5 | $1,200 | $1,043 | 700 credit score, 20% down payment |

| Lender B | 4.65% | 0 | $1,500 | $1,031 | 680 credit score, 10% down payment |

| Lender C | 4.85% | 1.0 | $1,000 | $1,056 | 720 credit score, 20% down payment |

| Lender D | 4.90% | 0.3 | $1,100 | $1,061 | 700 credit score, 15% down payment |

| Lender E | 4.80% | 0.6 | $800 | $1,052 | 690 credit score, 20% down payment |

Economic Indicators and Their Influence on 30-Year Fixed Mortgage Rates

Now, let’s don our detective hats and delve deep into economic indicators such as inflation, employment rates, and GDP growth. These hot tickets are like the pulse points of the economy, correlating with the ebbs and flows of 30-year fixed mortgage rates.

The nitty-gritty is simple: when inflation is more erratic than a cat on hot bricks, rates tend to rise. But if we see a cooldown, with jobs rising like dough in an oven and GDP growing steadier than a gardener’s patience, rates will reflect this rosier picture. Predictive models, with eyes on the current economic health, are getting busy sketching the future of rates like artists in a frenzy.

Global Events and Their Unexpected Influence on Interest Rates

Honey, if you think what happens in Vegas stays in Vegas, think again when it comes to global events. These international shindigs, far from being distant relatives, end up sitting at our dinner table. The ripple effects of such affairs on U.S. mortgage rates can be as unpredictable as a soap opera plot.

Rewind to past global crises, and it’s clear they’ve rattled the trajectory of 30-year fixed interest rates. With recent events folding in, Experts are hedging Their Bets on potential world developments. It’s crystal ball territory, but one worth gazing into for the sake of future financial planning.

Technology and Real Estate: Predicting the Future for 30-Year Fixed Rates

Fasten your seat belts; it’s a tech world and we’re just living in it. Fintech’s hand in shaping mortgage rates and lending practices is getting stronger than a double espresso. The advent of AI, blockchain, and other techie wonders could revolutionize interest rates and the whole kit and caboodle of real estate.

Industry whiz kids are already chattering about how these technologies might rewrite the script for 30-year fixed rates. If you thought swiping left was groundbreaking, you ain’t seen nothing yet, according to industry Pioneers.

A Look at Leading Mortgage Lenders and Their 30-Year Fixed Rate Predictions

All eyes are on the leading mortgage lenders and their crystal balls for 30-year fixed rate predictions. Lenders are dishing out rates as varied as Grandma’s quilt patterns, and their financial experts are buzzing with forecasts like bees in a hive.

The tango between these institutions makes for a riveting spectator sport. Reading between the lines of these lender’s offerings and expert statements is key to sniffing out where future rates might boogie.

When to Lock In: Strategic Timing for Securing 30-Year Fixed Rates

If you’re pondering when to pull the trigger on locking in a mortgage rate, consider engaging in some financial time travel. The stats sing the praises of rate locks when the market’s hotter than a tin roof in July. A statistical review of rate lock benefits underscores the wisdom in doing the homework compared to historical trends.

Listen up to the campfire tales from homeowners who’ve successfully managed to time their rate lock. It’s a real shot in the arm, hearing how they managed to outfox the market.

Long-Term Market Forecasts: Expert Predictions for Fixed Mortgage Rates

Take a ringside seat as we gather around with economists and market analysts for a pow-wow on long-range forecasts. With speculations on legislation, the housing market’s moods, and lender policies, the future of 30-year fixed mortgage rates is shaping up to be as fascinating as a bestselling novel.

These eggheads provide data-driven insights, painting a picture on long-term market forecasts that’s worth more than a thousand words. A chat with these brain boxes indicates that rates are likely to simmer down in the latter half of 2024 – fingers crossed.

30-Year Fixed vs. Adjustable Rates: A Modern Borrower’s Dilemma

Let’s face it; choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) can be as befuddling as a chameleon in a bag of Skittles. To figure this out, let’s stack them side by side and run through the pros and cons.

In one corner, 30-year fixed rates: steady as a rock, predictable monthly payments, and no nasty surprises. In the other, ARMs: lower initial rates but with the uncertainty of changing like the weather. Analysis hinges on current and future outlook scenarios, with advice from financial advisors that’s hotter than a firecracker on the Fourth of July.

Conclusion: Synthesizing the Future of 30-Year Fixed Rates

Alright, here’s the bottom line, folks. When we distill the buzzing hive of data, trends, and expert chitchat, the future outlook of 30-year fixed rates looks to be on a seesaw, with relief likely but not till a bit down the road.

As we tie the bow on this discussion, remember, managing expectations and making informed decisions is key. Keep your ears to the ground and eyes on the horizon – and that’s the straight dope.

In the innovative spirit of moving forward, potential homeowners and refinancers alike can brace themselves for a market as vibrant and changing as hashtags on Twitter. Here’s to riding the wave of the future, where the 30 year fixed interest rates today are just the jumping-off point for tomorrow’s success stories.

And if you’re looking to get real-time numbers to crunch for your mortgage scenarios, don’t forget to make use of this nifty mortgage calculator For New york, and always keep an eagle eye on the slew of information available at Mortgage Rater – we’ve got your back, every step of the way.

Understanding 30 Year Fixed Interest Rates Today

Picture this: you’re locking in a 30-year fixed interest rate, and the stability it brings is as comforting as knowing that somewhere, john Krasinski wife represents a real-life romance that’s just as steady. These rates are a cornerstone of the mortgage world, often providing a long-term roadmap for homeownership similar to a marathon—a commitment not entered into lightly, but with an eye on the enduring rewards.

Now, why does this matter, you ask? Well, just as Desi gay sex topics have emerged into mainstream discussions, breaking barriers and shaping new narratives, the conversations around 30 mortgage rates are constantly evolving too. They’re shaped by economic trends, policy changes, and financial forecasts that can be as unpredictable as movie plots. So, staying informed is like having a secret map to buried treasure—crucial for navigating the high seas of mortgage planning.

Looking at the present, ’30 year fixed interest rates today’ are the talk of the town more than ever before. They’re key players in the game of life, especially for those dreaming of owning a home where they can write their own stories. And just like how a good plot twist shakes up a storyline, unforeseen economic turns can shake up the stability of these rates, making the choice of a fixed-rate mortgage a pivotal moment in the homeowner’s journey.

So grab your popcorn, because the future outlook of ’30 year fixed interest rates today’ promises to be as gripping as a blockbuster movie. Will they rise, mirroring a suspenseful climax? Or will they hold steady, affording us all a serene denouement? Time, that cheeky director, will tell. But one thing’s for sure: the narrative of fixed rates is worth following, as it’s as integral to the financial tales we spin as any love story is to Hollywood.

What is the interest rate on a 30 year fixed right now?

– Pssst, wanna know what the 30-year fixed mortgage rate is hovering around today? You won’t find it chilling here – you’ve gotta head over to the latest market updates for the freshest figures. But hey, remember they’re always bouncing around like a kangaroo on a trampoline!

What are 30 year mortgage rates today?

– As of now, looking for the latest 30-year mortgage rates is like chasing a greased pig – they’re slippery and always moving! For the most up-to-date rates, grab your digital surfboard and ride the wave to the latest financial reports. But don’t blink, or you might miss ’em!

What is today’s 30 year refinance rate?

– Curious about today’s 30-year refinance rate? It’s playing hide and seek, but you can catch it by peeping at current financial news. Just know, it’s as changeable as the weather in spring – one minute it’s one thing, the next minute, something else!

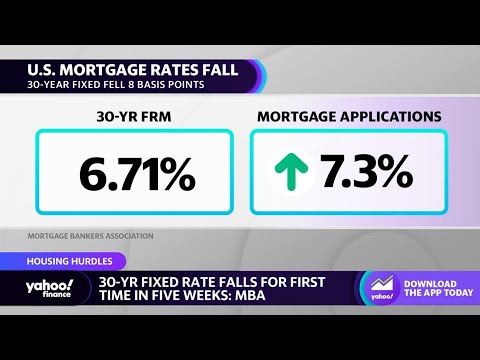

Are mortgage rates expected to drop?

– Are those pesky mortgage rates expected to take a hike downwards? Well, don’t hold your breath just yet. We’re eyeing the second half of 2024 for some relief when the Fed might cut rates like a hot knife through butter – assuming inflation cools its jets.

What will interest rates be in 2024?

– Dusting off the crystal ball for 2024? Interest rates are set to be the belle of the ball if inflation stops playing hard to get. Hang tight, as we might see the Fed put on a show and give rates a trim. But for now, it’s steady as she goes.

What is best mortgage rate today?

– Hunting for the crème de la crème of mortgage rates today? It’s like finding a needle in a haystack ’cause they’re always on the move! Your best bet is to snoop around for the latest deals, but remember, what’s the bee’s knees today might be yesterday’s news tomorrow.

Are 30 year mortgage rates dropping?

– If you’re crossing your fingers for 30-year mortgage rates to drop, you might be playing the waiting game. While we’re all holding our breath for a dip, they’re stubbornly sticking like glue at their current spot until the Fed says, “Easy does it” on inflation.

What is the lowest 30 year mortgage rate ever?

– The lowest 30-year mortgage rate ever? It’s ancient history, but boy, was it a sight to behold! Back in the day, rates hit rock bottom, making homeowners swoon. Nowadays, we’re all just daydreaming about those good ol’ rates.

What will the mortgage rates be in 2025?

– Mortgage rates in 2025 are like asking a crystal ball what’s for dinner – it’s anyone’s guess! But here’s the skinny: if the Fed takes a chill pill with rates and inflation gives us a break, we could see some sweet deals. So let’s keep our fingers crossed and hope for wallet-friendly trends.

Will rates go down in 2024?

– Will rates go down in the sunshine year of 2024? Well, if the Fed plays ball and trims the rate, we might just see those numbers take a dive. But remember, it’s all hinges on getting that stubborn ol’ inflation to take a breather.

Are mortgage rates going down in 2024?

– Hey, are mortgage rates gonna take a tumble in 2024? The wind could blow that way if the Fed gets frisky with rate cuts – fingers crossed inflation cools its heels by then!

How much house will $1,500 a month buy?

– How much house can you score for $1,500 a month? It’s like playing the Price is Right – it all depends on interest rates, your down payment, and other hush-hush loan terms. A mortgage calculator is your BFF to crunch those numbers!

Will mortgage rates ever be 3 again?

– Will mortgage rates hit that sweet spot of 3% again? Boy, wouldn’t that be a trip down memory lane! But unless we jump in a time machine, we’re at the mercy of what the market serves up. Who knows? Keep your eyes peeled!

Should I lock in my mortgage rate today or wait?

– Pondering whether to lock in your mortgage rate today or let it ride? It’s a gamble, like choosing heads or tails! Rates are as unpredictable as a toddler’s mood, so trust your gut, weigh your options, and maybe seek out a trusty crystal ball – err, financial advisor.

How can I get a lower mortgage interest rate?

– Dreaming of a lower mortgage interest rate? Who isn’t! To play that hand, schmooze your credit score, bulk up your down payment, and sweet-talk different lenders. Remember, it’s like dating – you gotta kiss a few frogs to find your prince of rates!