Examining The 30 Year Mortgage Rate Chart Historical Perspective

Delving into the past can be as engaging as watching the intricate plots of Movies by Emma watson. In a similar fashion, an examination of the 30-year mortgage rate chart reveals the twists and turns of economic narratives. Historically, mortgage rates have been influenced by a variety of factors ranging from inflation to federal policy changes. When we graph these rates over the past 30 years, a story unfolds that is as dramatic as the cast Of The movie Hair.

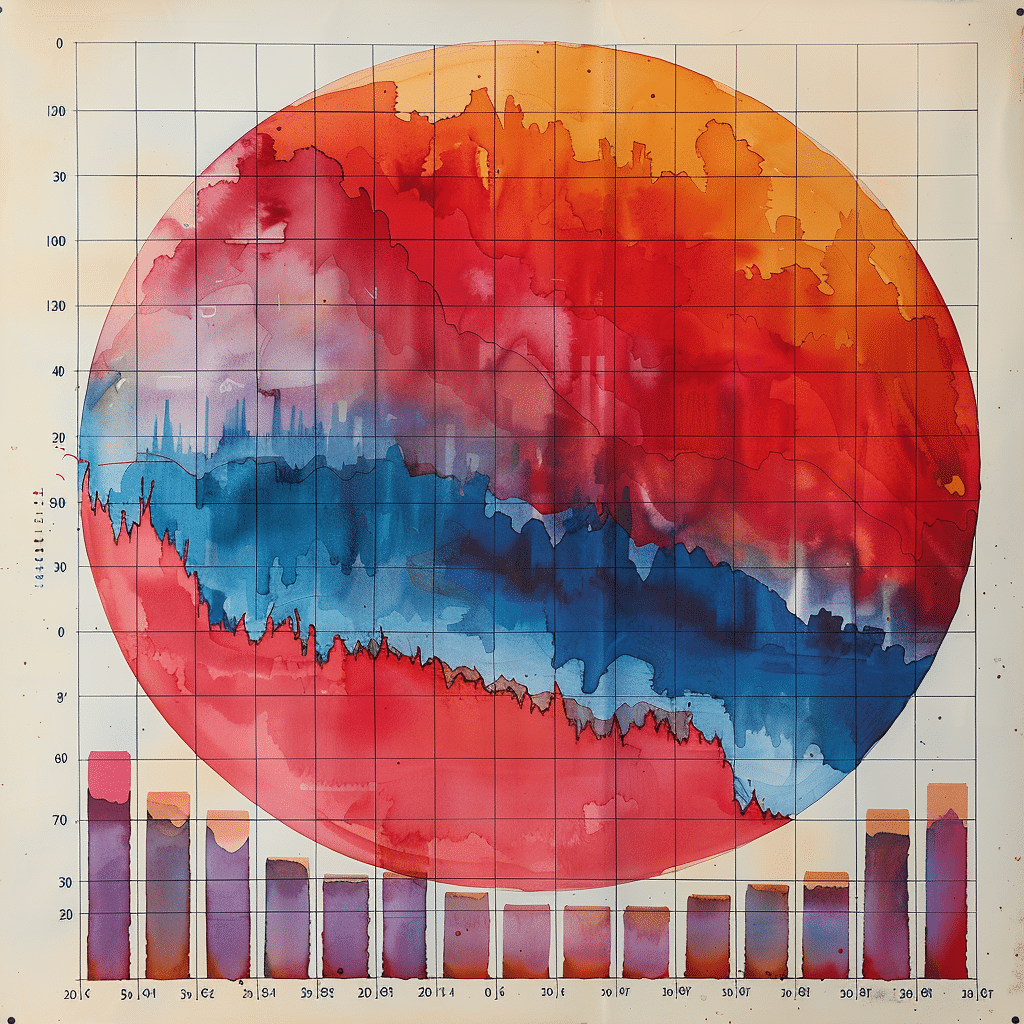

During the early 1990s, the economy recovered from a recession, leading to relatively high mortgage rates by today’s standards. However, as we progressed into a technologically driven era and encountered global financial crises, the Federal Reserve took actions which pushed rates to record lows. We can visualize these fluctuations on the 30-year mortgage rates chart, observing the peaks and valleys that map out the economic landscape we’ve traversed.

The Current Landscape of 30-Year Mortgage Rates

As of now, homeowners are experiencing a market that’s equivalent to finding a rare item at a mainstream store. The current 30-year mortgage rates are a reflection of various inputs, including Fed policies, inflation rates, and the health of the economy. A look at mortgage rates today exposes a landscape that has been experiencing upward pressure in recent years, departing from the historical lows of the previous decade.

Although the market shows bullish signs, pressures such as geopolitical tensions and public policy can swing into bearish territory with little warning. What we’re seeing in the recent 30-year mortgage rates chart daily is a slight ascent, which we’ll dissect later. It’s a moment-to-moment saga, akin to the fluctuating rhythm in “Something in the Way” by Nirvana — a gentle lull followed by an unexpected crescendo.

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Yearly Average |

| 2018 | 4.03% | 4.15% | 4.27% | 4.34% | 4.59% | 4.57% | 4.53% | 4.55% | 4.63% | 4.83% | 4.87% | 4.64% | 4.54% |

| 2019 | 4.46% | 4.37% | 4.27% | 4.14% | 4.07% | 3.80% | 3.77% | 3.62% | 3.61% | 3.69% | 3.70% | 3.72% | 3.94% |

| 2020 | 3.72% | 3.47% | 3.50% | 3.31% | 3.23% | 3.16% | 3.02% | 2.94% | 2.89% | 2.83% | 2.77% | 2.68% | 3.11% |

| 2021 | 2.65% | 2.81% | 3.08% | 3.06% | 2.96% | 2.98% | 2.87% | 2.84% | 2.90% | 3.07% | 3.07% | 3.10% | 2.96% |

| 2022 | 3.22% | 3.76% | 4.17% | 4.98% | 5.23% | 5.52% | 5.41% | 5.22% | 6.11% | 6.90% | 6.81% | TBD | TBD |

How to Interpret a 30-Year Mortgage Rate Chart

Interpreting a 30-year mortgage rate chart needn’t be as puzzling as understanding abstract art. The key components to eye are the annual percentage rate (APR) and interest rate fluctuations, which together paint the full cost of a loan. Deciphering this data enables you to make savvy mortgage decisions that align with your financial script.

When pouring over the chart, seek out patterns and projections. Noticing trends here is like spotting the rise of Mens zip up Hoodies in fashion — it’s about acknowledging what’s gaining momentum. A 30-year mortgage rate history chart becomes your crystal ball, allowing you to gaze into the financial future with added confidence.

30-Year Fixed vs. Adjustable Mortgage Rates: A Chart-Based Comparison

Comparing fixed and adjustable mortgage rates can be as contrasting as comparing a classic novel to a blog post. Both have merit depending on the reader’s situation. The 30-year fixed-rate mortgage chart expresses stability, a fixed narrative from start to finish. Adjustable rates, however, mirror the ebb and flow of market conditions — the variable prose of economic storytelling.

In times of low-interest rates, fixed-rate mortgages generally take the lead. Yet, when rates are high and expected to drop, adjustable rates are like snatching up the best deal during a flash sale. A look at their historical tug-of-war through charts presents clearer guidance about who’s currently got the upper hand in the market ballet.

Future Predictions Based on 30-Year Mortgage Rate Chart Analysis

Forecasting the future with a 30-year mortgage rate chart upholds the same excitement as predictions on technological advancements. Analysts piece together data, like assembling the frame of a puzzle, to project where rates may journey next. And while economic indicators like employment levels and GDP growth offer reliable insights, they’re not infallable like a trusted time machine.

Matching predictions to past precision tests provides a benchmark for reliability. Yet, a predictive model’s strength lies in its ability to incorporate real-time data — like steering a ship with a keen eye on the horizon.

Impact of Global Economic Changes on 30-Year Mortgage Rate Charts

In our interconnected global economy, the tides of overseas events can wash ashore and alter the landscape of US mortgage rates. Like the global appeal of a hit song, changes in one region can resonate around the world. International economic shifts can buoy or burden domestic mortgage rates in the same vein as diplomatic relations or trade deals.

Economic indicators that ripple beyond real estate boundaries, such as commodity prices and foreign investment flows, act as harbingers of change for mortgage rates. Detecting these signals requires an attuned awareness, one that parallels a collector spotting a rare find.

Strategies for Homebuyers in Light of 30-Year Mortgage Trends

For potential homeowners, discerning whether to lock in a rate is comparable to choosing the perfect moment to cut into a ripe fruit. Present mortgage chart trends offer insights, but personal circumstances ultimately drive the decision. Grasping the present climate, homebuyers can craft a journey that emulates success stories of past borrowers who effectively utilized trend data.

Weighing the pros against the cons in the current mortgage landscape necessitates a balance of financial wisdom and market foresight. Think of it as strategizing your next move in a game of chess — anticipating not just the board’s state but also the potential plays of your opponent, the market.

Expert Opinions: What the Pros Say About the 30-Year Mortgage Rate Chart

Gleaning insights from top minds in economics, real estate, and mortgage analytics can be compared to attending a master class in finance. The pros offer diverse viewpoints, sparking debates on the trajectory of mortgage rates. Some anticipate climbs akin to a challenging hike, while others predict descents comparable to a breezy walk.

The analysis of their guidance in relation to the chart trends reveals layered perspectives, each adding shades to the holistic picture. As each expert contributes their voice, a composite sketch of the future begins to take form, offering a roadmap for the discerning investor.

Innovative Wrap-up: Riding the Wave of Mortgage Rate Projections

Wrapping our minds around the 30-year mortgage rate chart bestows benefits beyond mere numbers. It’s an exercise in strategic planning, positioning oneself to ride the crests and troughs of the market wave. The mastery of chart analysis grants homebuyers and investors a vessel to navigate these waters more deftly.

Embrace the chart as a tool that enables dynamic financial planning in the varied terrain of real estate investment. As the mortgage landscape progresses, continuous learning remains fundamental. Standing informed, like staying clothed in the latest fashion, equips you to walk confidently into whatever the economic forecast brings.

To conclude, understanding the intricacies of the 30-year mortgage rate chart is akin to having a financial compass in your pocket, guiding you towards a more secure and prosperous homeownership experience.

Unraveling the Past and Present of the 30 Year Mortgage Rate Chart

Historical Twists and Trends

Who would’ve thought a bunch of numbers on a chart could be as moody as a teenager? Just take a look at the 30 year mortgage rate history and you’ll see ups and downs like a wild rollercoaster ride. Back in the day, when your parents were rocking out to the melancholic Something in The way nirvana Lyrics, they might have snagged interest rates that today would blow your socks off! Comparing mortgage rates across the decades is like time travel on a financial scale — you never know what you might find!

Daily Dips and Dives

Now, if you’re glued to the 30 year mortgage rates chart daily, you might spot all the little dips and dives in the rates. It’s like watching a daily soap opera, where every twist and turn could mean more (or less) money in your pocket. You gotta admit, it’s kind of thrilling to watch, like waiting for the next episode of your favorite show. But hey, don’t forget to breathe! Keeping an eye on the Mortgages rates today can ensure you leap at the right moment, just like jumping in at the chorus of your favorite jam.