Congratulations, you’ve done it! A 740 credit score is a fantastic accomplishment that can open doors to a wide range of financial opportunities. In this comprehensive yet easy-to-understand guide, we’ll explore everything you need to know about a credit score of 740: is it good, its benefits, mortgage rates, car loans, and more. Let’s dive into the world of credit scores and make sure you’re getting the most out of your hard-earned financial reputation.

The Basics: Understanding Your 740 Credit Score

A credit score is a three-digit number that sums up your creditworthiness. It’s calculated based on your credit history, which includes details such as payment history, type of credits (personal loans, mortgage, credit cards, etc.), credit utilization, and length of credit history. The most widely used scoring system is the FICO Score, which ranges from 300 to 850 ^1^.

A 740 credit score is considered a good score, putting you ahead of the average consumer. However, if you’re aiming for the best deals in the market, you may want to push your score even higher. Before we explore how to do that, let’s evaluate what a 740 credit score can bring to the table.

Mortgage Rates for a 740 Credit Score

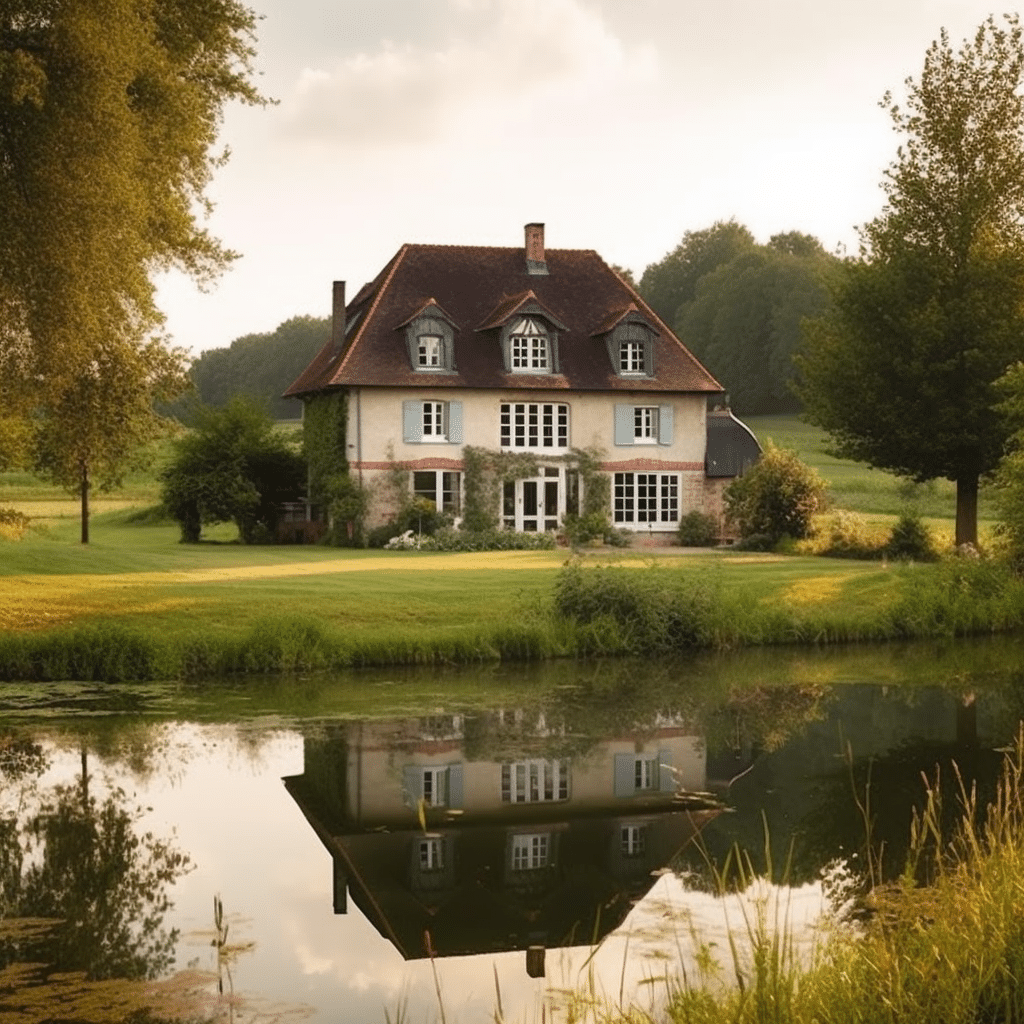

When it comes to buying a house, a higher credit score translates into lower interest rates and better mortgage terms ^2^. Is 740 a good credit score to buy a house? Most definitely. With a score of 740, you’re likely to qualify for some of the most attractive mortgage offers in the market.

Benefits of a 740 Credit Score Mortgage Rate

- Lower Interest Rates: Your 740 credit score gives lenders the confidence they need to offer you lower interest rates. It’s no secret that even a small difference in interest rates can save you thousands of dollars over the loan term.

- Higher Loan Amounts: If you have a 740 credit score, you’re more likely to qualify for a higher loan amount. This means you can afford a bigger or better house. Just remember to be wise with your choices and opt for a home that is within your budget.

- Easier Approval Process: A borrower with a 740 credit score may experience a smoother mortgage approval process. In some cases, you might be able to obtain an instant pre-approval. Keep in mind, however, that lenders will still consider other factors like income, employment history, and debt-to-income ratio.

Car Loans for a 740 Credit Score

Similar to mortgages, a 740 credit score can unlock lower interest rates and better financing options for car loans ^3^. So, what does a 740 credit score car loan look like? Let’s find out.

Advantages of a Car Loan with a 740 Credit Score

- Lower Interest Rates: With a 740 credit score, it’s almost certain that you’ll enjoy lower interest rates on your car loan. This can substantially reduce the total cost of the car and keep your monthly payments manageable.

- Longer Loan Terms: If needed, you may have the flexibility to opt for a longer loan term, which can further lower your monthly payments. Just be mindful of the fact that a longer loan term may result in higher overall interest expenses.

- Pre-Approval Options: Having a 740 credit score may grant you access to pre-approval from some car loan providers, which could speed up the buying process and improve your negotiating power at the dealership. Just remember to accurately assess the total cost of the car loan before closing the deal.

Is 740 Credit Score Good Enough?

Yes, a 740 credit score is good and a commendable achievement. As we’ve seen, it can secure favorable mortgage rates and attractive car loans. However, there’s always room for improvement. To access even better offers and gain greater financial leverage, you might want to aim for an excellent credit score of 800 or above^4^.

Here are some tips to boost your credit score:

- Pay Your Bills On Time: No surprises here; prompt payments are your best ally when it comes to improving your credit score. Set reminders or automate payments to ensure you never miss a due date.

- Keep Credit Utilization Low: Try to limit your overall credit usage to no more than 30% of your available credit. This indicates that you’re not overly reliant on credit and keeps your credit utilization ratio in check.

- Don’t Close Old Credit Accounts: Even if you no longer use an account, keep it open, as older accounts can positively affect your credit history’s average age. Just make sure there’s no annual fee attached to the account.

- Diversify Your Credit Mix: Having a mix of credit types, like credit cards, personal loans, and mortgage, can improve your credit score, as long as you’re able to manage them responsibly.

Brief History of Credit Scores

The idea of credit risk analysis dates back to the 19th century when merchants and individual lenders assessed the risk of lending money based on personal experiences and observations. However, the modern credit score can be traced back to 1956 when engineer Bill Fair and mathematician Earl Isaac founded Fair, Isaac, and Company (now known as FICO) to create credit risk scoring tools based on statistical analysis of data.

Credit Score Statistics

- According to FICO, the average credit score in the United States as of 2020 is 711.

- A study in 2019 revealed that 61.4% of American consumers had a credit score of 700 or higher.

- It is estimated that only 7.3% of consumers have a credit score below 550.

Trivia: 740 Credit Score Fun Facts

- Did you know that 35% of your credit score is determined by your payment history? This includes on-time payments, late payments, and other factors.

- Your credit utilization ratio, or the percentage of your available credit that you’re currently using, accounts for 30% of your credit score.

- Credit inquiries can impact your credit score temporarily. If you’re applying for new credit, try to do so sparingly to avoid hurting your score.

Other Credit Score Articles

- 600 Credit Score

- 610 Credit Score

- 620 Credit Score

- 630 Credit Score

- 640 Credit Score

- 650 Credit Score

- 660 Credit Score

- 670 Credit Score

- 680 Credit Score

- 690 Credit Score

- 700 Credit Score

- 710 Credit Score

- 720 Credit Score

- 730 Credit Score

- 740 Credit Score

- 750 Credit Score

- 760 Credit Score

- 770 Credit Score

- 780 Credit Score

- 790 Credit Score

- 800 Credit Score

- 810 Credit Score

- 820 Credit Score

- 830 Credit Score

- 840 Credit Score

- 850 Credit Score

- Mortgage Rates

Frequently Asked Questions (FAQs)

Q: Is a 740 credit score considered excellent?

A: No, a 740 credit score is considered a good credit score. To achieve an excellent credit rating, FICO generally requires a score of 800 or higher.

Q: Can I qualify for a mortgage with a 740 credit score?

A: Yes, a 740 credit score should allow you to qualify for a mortgage with favorable terms, including lower interest rates, higher loan amounts, and a smoother approval process.

Overall, a 740 credit score is an excellent financial asset that can unlock great opportunities in the mortgage and car loan markets. By following our tips to improve your score even further, you’ll continue to build an impressive financial profile that empowers you to access better deals and make the most of your hard work.