A 750 Credit score can open doors to numerous financial opportunities. But what does it mean to have a 750 credit score, and how does it benefit you? In this article, we’ll provide an in-depth understanding of this robust credit rating mixed with practical advice, making financial decision-making a breeze.

So let’s dive right in!

What is a 750 Credit Score?

First, let’s clarify what exactly a credit score is. Your FICO score plays a vital role in securing credit from financial institutions. It typically ranges from 300 to 850, with 750 considered a good credit score.

Credit Score 750: A Good Thing or Not?

Simply put, yes! A credit score of 750 indicates that you are a responsible borrower with a good credit history. This means that lenders will be more likely to approve your loan requests at favorable interest rates and terms. So, having a 750 credit score can unlock numerous benefits for you.

7 Benefits of a 750 Credit Score You Can’t Ignore

1. Enjoy Lower Interest Rates on Loans

Is 750 a good credit score for lower interest rates? Absolutely! Armed with a 750 credit score, you’re more likely to receive low-interest rates on auto loans, personal loans, and mortgages. This can save you thousands of dollars in interest payments over the life of the loan.

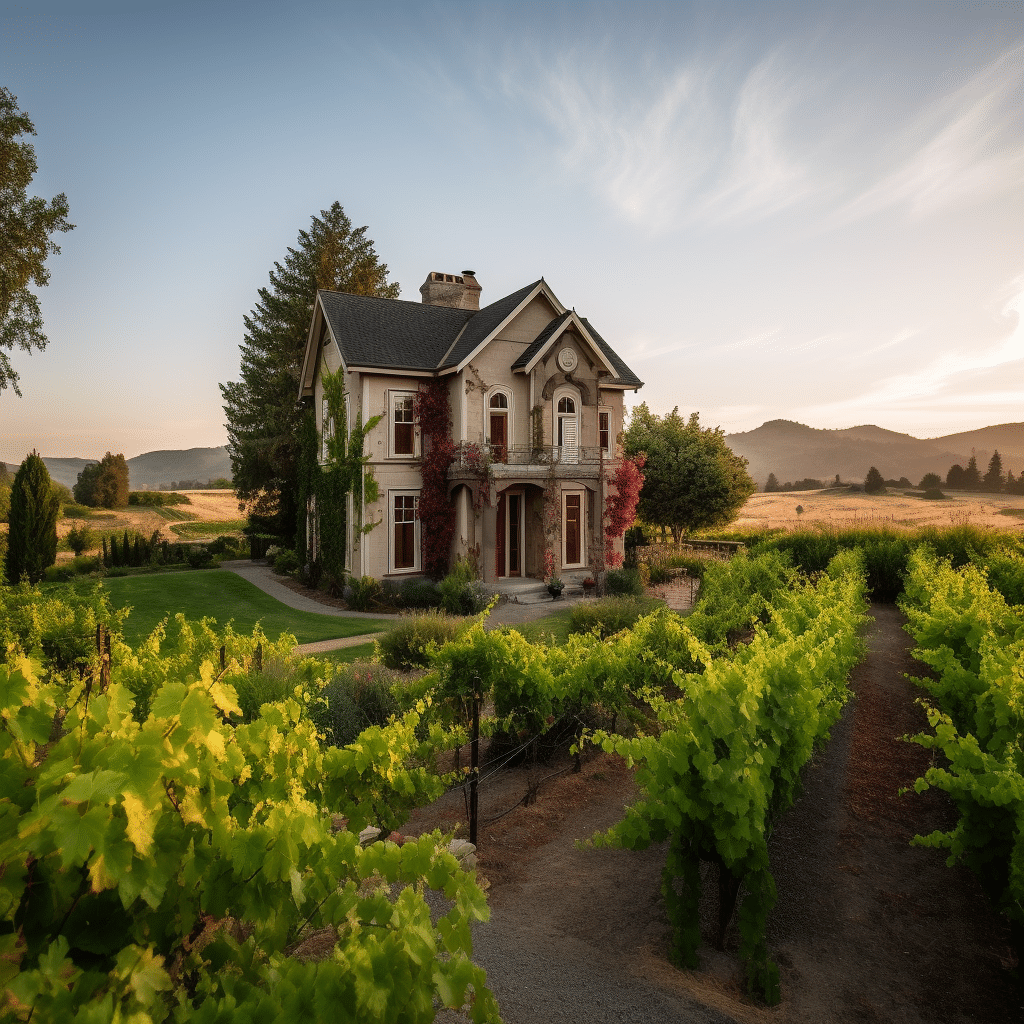

2. Competitive Mortgage Rates for 750 Credit Scores

A 750 credit score can substantially reduce your mortgage costs. With a credit score in this range, you’re likely to enjoy lower mortgage rates, which can save you money on overall housing expenses. Keep in mind that the difference between a good and poor credit score can mean thousands of dollars in saved interest.

3. Greater Access to Credit Cards with Premium Perks

Lenders are more likely to offer credit cards with better rewards and perks to borrowers who have a 750 credit score. This means access to lower interest rates, higher credit limits, better cashback programs, travel rewards, and exclusive offers from various retailers.

4. 750 Credit Score Car Loan Perks

Are you in the market for a new car? A credit score of 750 can help secure an auto loan with favorable interest rates and payment terms. With the average car loan interest rate for 750 credit scores being lower than those with lower credit scores, you could save a significant amount of money in interest payments.

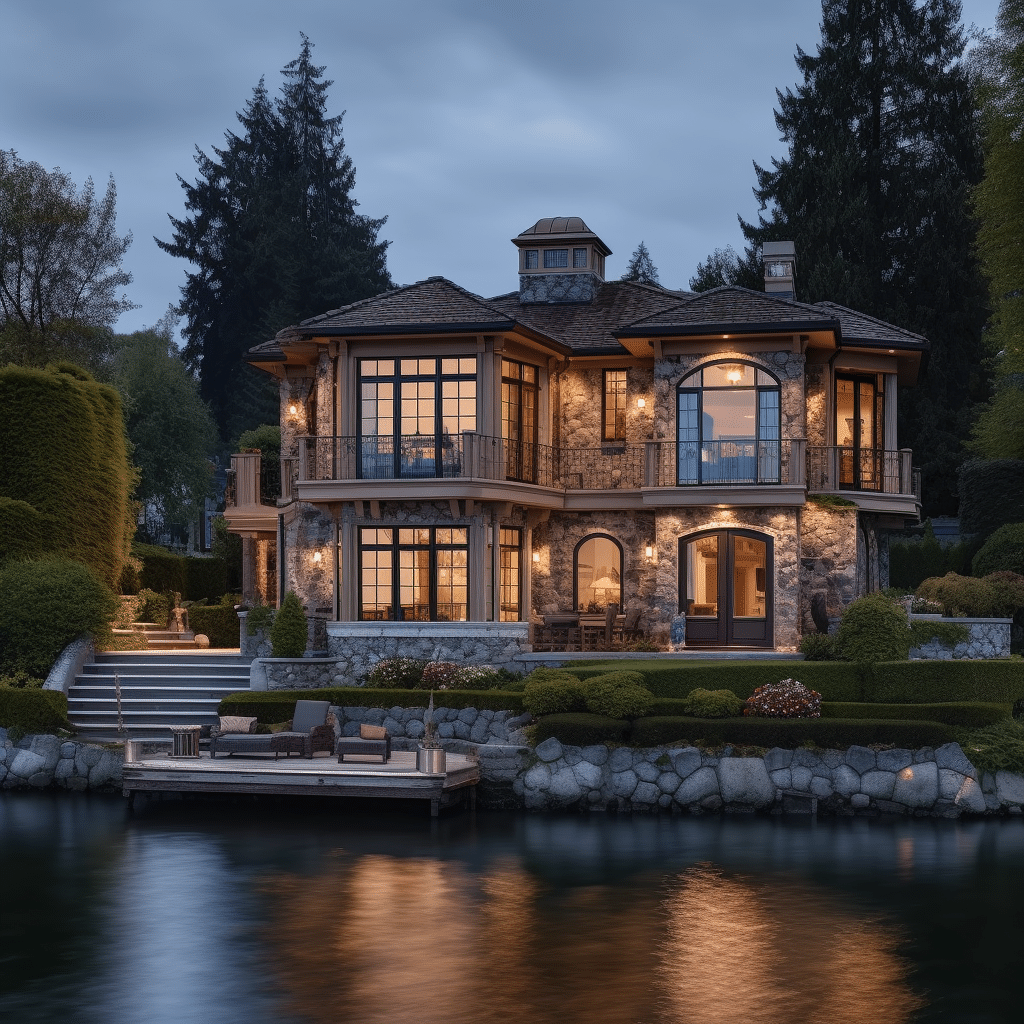

5. Enhanced Leasing and Rental Opportunities

A strong credit score of 750 can pave the way for quicker approval when leasing or renting a house or apartment. Landlords often review credit history to assess your likelihood to pay rent on time. The higher your score, the more reliable you appear to the landlord, which can expedite the leasing or rental process.

6. Lower Insurance Premiums

Good credit can also indirectly lead to lower insurance rates. Many insurance providers use your credit score when determining your premiums. A 750 credit score can often lead to providers offering lower insurance rates on auto and homeowners policies. This can translate into significant savings over time.

7. Enhanced Negotiating Power

Finally, a 750 credit score can greatly improve your negotiating power when requesting better loan terms from lenders. With your good credit score serving as proof of responsible borrowing, you’ll have a stronger position during negotiations.

The Journey to Achieving a 750 Credit Score

So how do you go from being a 600 credit score holder to joining the 750 credit score league? Here are some practical steps to follow:

- Pay your bills on time, consistently

- Maintain low credit card balances

- Limit your debt and avoid opening unnecessary lines of credit

- Monitor your credit report and correct inaccuracies right away

- Don’t close old accounts; their age helps establish a solid credit history

Take a look at the series of articles we have created covering different ranges of credit scores for more detailed information on how to improve your credit rating.

History, Statistics, Trivia, and FAQs

History

The FICO score was created by credit scoring pioneer Bill Fair and mathematician Earl Isaac in the 1950s to help accurately assess consumer credit risk.

Statistics

- The average FICO score in the U.S. as of 2019 was 703, placing a 750 credit score well above average.

- Nearly 59% of Americans have a credit score of 700 or higher

Trivia

- FICO is an acronym for Fair, Isaac and Company, which was the original name of the company that developed the credit scoring system

Other Credit Score Articles

- 600 Credit Score

- 610 Credit Score

- 620 Credit Score

- 630 Credit Score

- 640 Credit Score

- 650 Credit Score

- 660 Credit Score

- 670 Credit Score

- 680 Credit Score

- 690 Credit Score

- 700 Credit Score

- 710 Credit Score

- 720 Credit Score

- 730 Credit Score

- 740 Credit Score

- 750 Credit Score

- 760 Credit Score

- 770 Credit Score

- 780 Credit Score

- 790 Credit Score

- 800 Credit Score

- 810 Credit Score

- 820 Credit Score

- 830 Credit Score

- 840 Credit Score

- 850 Credit Score

- Mortgage Rates

Frequently Asked Questions

Q: How long does it take to improve my credit score from 700 to 750?

A: It depends on your specific financial situation. However, by consistently maintaining good payment habits, low debt, and healthy credit utilization, you can gradually improve your credit score over time.

Q: Can I get a mortgage with a 750 credit score and no down payment?

A: While a 750 credit score will certainly help you qualify for favorable mortgage rates, it does not guarantee approval for a mortgage without a down payment. Most lenders still require a minimum down payment for approving a mortgage.

Q: Does having a 750 credit score guarantee me the best interest rates available?

A: While a 750 credit score will often result in favorable interest rates, other factors, such as income, existing debts, and the amount of the loan, can also impact the final rate offered.

In conclusion, having a 750 credit score undoubtedly offers a plethora of financial benefits. By maintaining responsible financial habits and diligently monitoring your progress, you can strive towards a higher credit score and the many advantages it bestows.

Remember, knowledge is power. So, keep learning and improving your financial situation. Happy borrowing!