Understanding the Basics: What is a Life Estate in 2024?

Deep Dive into Life Estate Definition

Let’s cut to the chase, folks: in the simplest terms, a life estate in 2024 is a type of property ownership, crafted to last through the owner’s lifetime. It’s like buying a ticket to a Willam H. Macy theater fest—the ticket is yours until the festival ends. The same goes for a life estate.

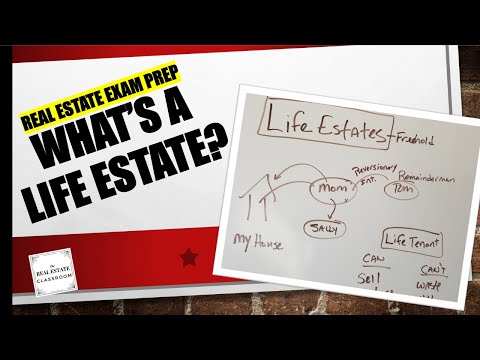

Life estates establish two different categories of property owners—the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner, similar to the lessee, holds exclusive rights to use the property during his/her lifetime. This individual could be a lone ranger or a part of joint Life Tenants. When that final curtain falls, akin to Macy’s festival, the Remainder Owner steps up, taking theater—or property in this case—ownership.

The Evolution of Life Estates

Like everything else, life estates haven’t stayed stagnant. Originating from Common Law, this form of estate planning has adapted and evolved, shaping the landscapes of real estate and inheritance laws. Trust me on this one, it’s like a well-cooked, healthy meal that’s evolved over time using techniques of meal prep To gain weight—a little tweaks here and there, but always maintaining the essence.

The Critical Role of a Life Estate Deed

Intricacies of Crafting a Life Estate Deed

A life estate deed – quite a mouthful, isn’t it? But let’s face it: crafting a life estate deed is as critical as choosing the right property, or even more so, as it outlines the terms of ownership transfer. Think of it as the recipe for the aforementioned meal prep!

Here’s the drill: a life estate deed gives the property “to John Doe for life, then to Jane Doe”. John gets a legit life estate, and Jane holds the remainder.

Potential Pitfalls and Risks in a Life Estate Deed

Now, remember folks, not everything that glitters is gold. While a life estate deed can be a useful tool, it brings with it certain risks. It’s sticky, it’s tricky, it’s not always hunky-dory. You can’t simply reverse a life estate deed; it’s a legal title transfer, stamped, sealed, and delivered. So, jumping the gun could tie your hands in knots.

| Subject | Description |

|---|---|

| Definition | A life estate is a property right that grants a designated person (the Life Tenant) possession of a property during their lifetime. |

| Creation | A life estate is established by a deed that gives the property to an individual for their lifetime and outlines what occurs after their death. |

| Owners | Life estates propose two types of owners. 1) ‘Life Tenant Owner’ who has the exclusive right to use the property during their life. 2) ‘Remainder Owner’ who inherits the property after the Life Tenant’s death. |

| Rights of Life Tenant | The Life Tenant Owner maintains full control and use of the property during their lifetime. This can include a single owner or joint Life Tenants. |

| Rights of Remainder | The Remainder Owner has no rights to the property while the Life Tenant is alive, but the property will pass to them upon the Life Tenant’s death without needing to go through probate. |

| Reversal | Once a life estate deed is executed, it legally transfers the title of the property and cannot be easily reversed. Both parties need to mutually agree for a successful reversal. |

Ownership Dynamics: Who Owns the Property in a Life Estate?

Rights and Responsibilities of the Life Tenant

Imagine being William H. Macy on that stage. You’ve got the limelight, the applause, the freedom to perform. As a Life Tenant, you hold exclusive rights to the property. However, just like Macy’s role requires him to deliver a stellar performance, the Life Tenant’s role comes with some responsibilities. The maintenance, taxes, and insurance all rest on the Life Tenant’s shoulders—oh my!

The Role and Rights of Remainderman

At curtain fall, enter the Remainderman. He inherits the property rights once the Life Tenant exits the stage—aka this world. However, during the Life Tenant’s lifetime, the Remainderman must respect the Tenant’s rights— no impromptu property visits without approval.

Insights into Legality: Understanding the Legal Implications of Life Estates

Role of Life Estates in Estate Planning and Medicaid Eligibility

Now, this isn’t just about owning a property and passing it down. Life estates play a huge role in estate planning and might affect things like Medicaid eligibility. It’s like mapping out a complex property survey—with important legal landmarks to recognize.

Legal Challenges and Solutions in Life Estates

Life estates, like any property deal, have their fair share of challenges. From potential disagreements amongst Life Tenants and Remaindermen to dealing with Medicaid Recovery, life estates need careful navigation. Ah! If only there were survey Companies near me to navigate these issues.

Key Benefits of Life Estate: More Than Just Ownership Transfer

Financial and Tax Advantages of Life Estates

Let’s talk money, honey! Life estates carry a string of benefits, including some serious tax advantages. For instance, with a life estate, the Remainderman may get a step-up in tax basis, meaning lower capital gains taxes on the sale. Sweet, right?

Intergenerational Wealth Transfer and Asset Protection

Here’s the real deal—a life estate is an excellent tool for transferring homes and creating an inheritance, without hassle or probate court drama. And guess what? It also helps protect your assets against potential future creditors, keeping your property safe and sound.

Life Estate in a Contemporary Context: Emerging Trends and Transformations in 2024

Potential Impact of Changing Real Estate Market on Life Estates

With real estate evolving faster than you can say “What Is a land surveyor“, life estates aren’t immune to the changes. Flexibility might make life estates sexier in an unstable market. So, keep your eyes peeled for changes in The realm Of The property survey.

Future Predictions for Life Estates Based on Current Trends

Based on today’s trends, I predict life estates will continue to be a beneficial instrument for many, particularly the aging population. With the perks of asset protection and potential tax benefits, frankly, it’s hard not to see the appeal.

Final Thoughts: Expert Opinions and Practical Advice on Life Estates

When is a Life Estate the Perfect Choice?

So, when is a life estate the answer? If safeguarding your property, ensuring a smooth property transfer, or shielding assets from future creditors is your aim, then my friend, you’re knocking at the right door.

Parting Words of Wisdom from Real Estate Gurus

In the words of Robert Kiyosaki, “Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.” A life estate, when navigated carefully, can be an integral part of that wealth-building journey. So folks, ponder over it—your property, your rights, your legacy. Don’t just rush in; take your time, do your homework and when the time is right—go for it!

What are the disadvantages of a life estate?

In a nutshell, the downsides of a life estate can be a tough pill to swallow for some people. Hold your horses before diving in, because unwanted taxes, an inability to sell without consent from remaindermen, and potential issues with Medicaid eligibility and estate recovery might just rain on your parade.

Who owns the property in a life estate in NC?

In the Tar Heel State, a life estate owner, commonly known as a “life tenant,” owns the property. But don’t let that fool ya, because after their passing, the property goes to the preset “remaindermen”.

What is a life estate easy definition?

Imagine being able to live in a property for the rest of your life but not having full ownership rights to sell or will it freely. That’s the life estate in layman’s terms.

How do you get around a life estate?

Squirming your way out of a life estate can be tricky, but not impossible. For starters, you can consider selling, if the remainderman is on board, or ending it by mutual agreement. Shocking, I know, but it works.

What are the IRS rules for life estate?

Mate, dealing with IRS rules for a life estate can really test your mettle. Mainly, it’s all about how the property in the life estate would be included in the life tenant’s taxable estate, which could potentially land you with estate tax liability.

Does a life estate get a stepped up basis?

In short, yes! Life estates typically do get a stepped up basis. So, the property’s basis would increase to its fair market value at the time of the life tenant’s death.

Can you sell a life estate in NC?

Up in NC, selling a life estate can happen, but it’s like pulling teeth. Both the life tenant and the remainderman need to agree, creating a sometimes complicated dance of negotiation.

How does a life estate work in North Carolina?

Life estate in North Carolina works like a charm for some folks. During the life tenant’s lifetime, they maintain rights to the property, but it transfers to the remaindermen once the life tenant kicks the bucket.

What is the owner of a life estate called?

The lord of the manor in a life estate is known as the ‘life tenant’. Catchy, right?

What is an example of a remainderman?

An example of a remainderman? Picture little Johnny, waiting for grandma to pass on so he can inherit her cute little cottage as the remainderman in her life estate setup.

What are the characteristics of a life estate?

A life estate is unique as a snowflake, with characteristics like the life tenant’s right to occupy, income from the property, and responsibility for upkeep. But remember, they can’t sell or mortgage the property without the remainderman’s nod of approval.

Which of the following is a life estate in property held by a widow?

Well, hold on to your hats! If a widow holds onto a property, it’s likely she possesses what we call a “life estate pur autre vie”. Simply put, she owns the property for the remainder of her life.

How do I remove someone from my life estate in NC?

To remove someone from a life estate in NC, you’ll be jumping through legal hoops. Bottom line, you need a court order or mutual agreement. If it were easy, we’d all be doing it!

How do I remove someone from my estate?

Clearing someone from your estate can feel as complicated as it sounds. Typically, you have to revise or revoke your will or use a codicil to formally drop ’em off your personal asset roster.

What is the Remainderman tax basis?

The Remainderman’s tax basis is a slippery fish. Normally, it’s set at the property’s fair market value at the time of the original owner’s death. Fair’s fair, after all.

Is a life estate a future interest?

If we’re splitting hairs, a life estate is categorized as a ‘present interest’. But the remainderman’s interest? That, my friend, is the ‘future interest’.

What are the pros and cons of a living estate?

Living estates aren’t all sunshine and roses. They can offer peace of mind and reduced probate fees. But, beware of potentially messy situations with remaindermen and issues with Medicaid eligibility and recovery.

Who pays property taxes in a life estate Texas?

Down in the Lone Star State, the life tenant usually pays the property taxes in a life estate arrangement. When you’re in the driver’s seat, you gotta pay the fare!

Does life insurance count against estate?

Oh boy! Life insurance can indeed count against your estate, especially if you’re the policy owner. The death benefit could rope you into unnecessary estate taxation if your overall estate value exceeds the federal exemption limit.