Hello, folks! Today we’re going to dive deep into the world of finance management software with a comprehensive review of Quicken Home and Business 2024. Our mission? To help you navigate the mortgage landscape with the same level of ease as a commuter navigating their familiar neighborhood.

We’re talking about good ol’ Quicken here—one of the foremost in budgeting tools and financial software. We’ll pour over every nook and cranny of the quicken home and business package, so brace yourselves for an educational roller-coaster ride of information!

Explored Review: Quicken Home and Business 2024

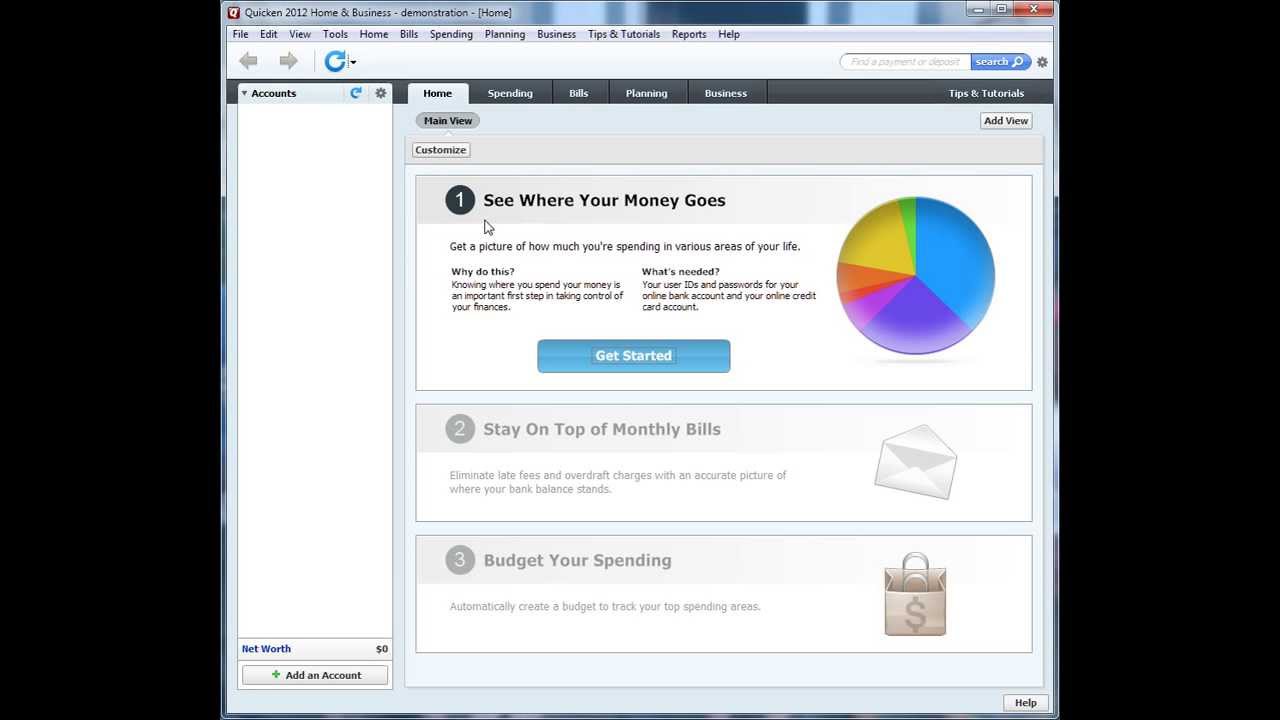

Quicken Home and Business: An In-depth demonstration

The 2024 version of Quicken Home and Business is akin to a massively upgraded version of the reliable old jalopy your dad loves—packed with cutting-edge advances, but still maintains that homely old charm. The ease of categorization between personal and business expenses, the efficient tracking of business profit or loss, and the identification of tax-deductible expenses are some impressive features. The skilful reporting functionalities are designed to make tax filing as easy as pie.

Comparing this edition with its 2024 predecessor offers a study in software evolution. Key upgrades, each more impressive than the last, have given this version an edge, making it the new, user-friendly Metrograph for finances. Bye-bye, old school system!

Analysis of the Interface and the Functions of Quicken Home and Business

Quicken Home & Business Personal Finance Track personal and business transactions all in one placeâ Year Subscription (Windows)

$100.00

The Quicken Home & Business Personal Finance product is a highly efficient software designed to keep your personal and business transactions well-organized and easily accessible. With a year-long subscription designed for Windows, this game-changing software allows you to track all your transactions, simplifying your financial management practices. It presents the ideal solution for small business owners or individuals needing to manage both personal and business finances separately, yet conveniently together in one location.

This comprehensive software goes beyond the standard features of regular financial tracking tools. It includes sophisticated functions like categorizing transactions from your business and personal accounts, tracking possible tax deductions, and generating detailed reports regarding income and expenses. Moreover, it allows for the creation of custom invoices with your logo and colors, helping to elevate your brand’s professionalism, and providing a more personalized experience.

The Quicken Home & Business Personal Finance software is user-friendly, and its intuitive interface makes it easy for those who arenât tech-savvy to navigate. It also offers robust security features, ensuring that your sensitive financial data remains safe and confidential. With this one-year subscription, you can truly streamline your finance tracking and concentrate more on growing your business and achieving your personal financial goals.

Exploring the Technicalities

Plunge into the techy world of Quicken, and you’d hit upon the simplicity of its interface, reminiscent of a helpful concierge—always there when you need them, but never overpowering. The tool interface characteristics show off neatly packaged, intuitive design effortlessly blending powerful features with user-friendly functions.

Now, what about getting around, you ask? Well, the navigation and usability facets of this software are like your trusty compass in a forest—leading the way and making things pretty darn foolproof. The workflow optimization ensures you save time and shake off the typical HR stress, delivering peak kid-on-Christmas-morning vibes.

| Features | Quicken Home and Business |

|---|---|

| Description | A comprehensive personal and small business financial management software |

| Includes | Everything in Quicken Premier plus many more small business and rental property management features |

| Functionality | Easily categorize and separate personal & business expenses. Track business profit/loss, identify tax-deductible expenses, and run Schedule C & E reports |

| Data Storage | Data remains on your computer. Cloud services available for sync to Mobile App or Quicken on the Web |

| Digital Accessibility | Available both on desktop and web. Also includes Quicken on the Web, a companion browser experience |

| License | Subscription-based model. No perpetual license offered; must be renewed annually |

| Best For | Ideal for small business owners and rental property managers. Great for those needing extensive tax support and expense tracking |

| Pricing | Depends on subscription length and additional features |

Personal Capital vs Quicken: A Focused Examination

Investigating their Functionalities

Who can ignore the big guns in the world of Finance Management software—Quicken and Personal Capital? It’s like comparing Shelley Fabares to Audrey Hepburn—both stately, revered, and exceptional in their ways.

Categories of performance, Quicken sets the bar high yet again. The budgeting tools contrast like chalk and cheese—with Quicken’s financial forecasts striking gold, providing a helicopter view of your spending habits, whereas Personal Capital provides a motorbike view!

In the grand arena of investment tracking capacities, it’s a titanic showdown with Quicken boasting a notable edge. Much like a seasoned general overseeing a battle, Quicken provides an in-depth perspective of your investments, like a sharp-eyed hawk scouting its terrain.

Quicken Home & Business [OLD VERSION]

![Quicken Home Business Old Version Quicken Home & Business [Old Version]](https://www.mortgagerater.com/wp-content/uploads/2023/11/Quicken-Home-Business-OLD-VERSION.jpg)

$299.00

Quicken Home & Business [Old Version] is a high-tech software designed to handle personal and business accounting seamlessly. This version may be perceived as old, but it is loaded with features which include tools for tracking personal expenses, income, investments, and more. The brilliance of this version lies in its simplicity and user-friendly interfaces that allow even the least tech-savvy individuals to navigate through the software comfortably.

In addition to managing personal finances, the old version is widely recognized for its excellent business tracking tools, such as tracking unpaid bills, sales and profit data, and tax deductible business expenses. It also offers an option to segregate personal and business expenses to avoid confusion. With Quicken Home & Business, you can easy connect to your bank and import transactions without having to enter them manually, saving time and reducing potential errors.

However outdated it may seem, Quicken Home & Business [Old Version] still offers solid support to small business owners and individual users alike. Its organizational features, combined with its efficiency in executing tasks, make it a valuable tool for managing finance. Indeed, it remains a reliable choice for users who prize functional simplicity and prefer older, proven versions of software over newer, untested ones.

Utilizing Quicken Home and Business for Personal Finances

Advantages and Limitations

There’s more to the tale of quicken home and business software—enter the realm of personal finances. It’s like happening upon a secret river full of glittering jewels in an everyday hike—exciting, right?

Its money management features are equivalent to a skilled acrobat balancing on a high wire. Will it be able to balance your budget? You bet!

Then, we have its real estate and property management aspects. Akin to a vintage bottle of wine, Quicken matures beautifully to manage properties with finesse, surpassing the efficiency of the rent manager software.

However, let’s not forget about a few minor bumps along the road. Some personal finance quirks may raise a few eyebrows and scratch a few heads. Nothing’s perfect, right?

Unpacking the Nuancing Details of Quicken Premier

Quicken Classic Deluxe for New Subscribers Year [PCMac Online Code]

![Quicken Classic Deluxe For New Subscribers Year Pcmac Online Code Quicken Classic Deluxe For New Subscribers Year [Pcmac Online Code]](https://www.mortgagerater.com/wp-content/uploads/2023/11/Quicken-Classic-Deluxe-for-New-Subscribers-Year-PCMac-Online-Code.jpg)

$59.88

Introducing Quicken Classic Deluxe for new subscribers year available as an online code for PC/Mac. This top-tier financial management software is designed to give you complete control over your personal and business finances. With user-friendly features and sophisticated tools, managing your financial obligations, tracking investments, and planning for future savings have never been this convenient and detailed.

The Quicken Classic Deluxe offers seamless integration with your bank accounts, enabling you to easily import transactions and always keep up-to-date with your financial status. It also includes robust budgeting and investment tracking tools, ensuring your savings goals and financial future are always within sight. Immediate access after purchase is guaranteed, simply enter the unique online code on your PC or Mac and immeriurse yourself in a comprehensive financial management experience.

Useful for both personal and business financial management, new subscribers will find Quicken Classic Deluxe a valuable asset. Its innovative features and sleek interface are designed to make long-term financial planning and daily financial tasks more transparent and less time-consuming. Simplify your financial life with proactive features of the Quicken Classic Deluxe for the new subscribers year on PCMac Online Code.

Distinguishing Features

Now let’s delve into the crème de la crème of finance management—the fabulous Quicken Premier. Like a secret handshake among the elite, the Quicken Premier comes with proprieties that leave us awestruck.

It offers investment monitoring and portfolio analysis that outrivals many of its contemporaries. And then there are the investment planning and retirement tools—here’s looking at you, future self!

For those who struggle to keep up with bills, remember, there’s a quicken support feature proved beneficial!

Practical Application and Results of Using Quicken Home and Business

Quicken Home & Business [OLD VERSION]

![Quicken Home Business Old Version Quicken Home & Business [Old Version]](https://www.mortgagerater.com/wp-content/uploads/2023/11/Quicken-Home-Business-OLD-VERSION.jpg)

$39.99

The Quicken Home & Business [OLD VERSION] is software that has been designed to effectively tackle personal finance as well as manage small businesses. This desktop version brings a range of features that automates the process of categorizing expenses while also identifying tax-deductible business expenses to save you money. It aims at improving business performance while enhancing personal financial management, which is why it makes a helpful tool for both small business owners and individuals.

The user interface of this old version is quite intuitive, allowing you to navigate and adapt quickly, thereby saving your precious time. Furthermore, it comes with budget-making tools and allows for the planning and tracking of business profit and loss, aiding in informed decision-making. The software, while old, integrates with Excel, allowing for easy data transfer and report development, making it perfect for creating business presentations and proposals.

While Quicken Home & Business [OLD VERSION] may not have all the latest features and updates, it still provides a robust platform for handling your financial obligations. It integrates with your online banking, automatically downloading transactions and updating account balances. Despite being a dated version, this software delivers on its promise of simplifying money and business matters.

Bridging Theory and Practice

Real-world experiences can often make or break our expectations from a product—and with Quicken, they tend to cement our positive tendencies. Using quicken home and business is as effective in practice as it sounds on paper, and that’s no mean feat!

It captures the essence of finance management and distills it into an intuitive, user-friendly product. There have been stories of smiling faces and joyous testimonials, attesting to the software’s ability to manage their finances expertly.

Forward-looking Perspective: What’s on the horizon for Quicken Home and Business?

Delving into Future Predictions

Aye, let’s look into our crystal ball and prognosticate the future of quicken home and business! Market experts are all over the prospects of Quicken soaring higher than a rocket Png into the nebulous world of financial software.

A host of exciting updates and enhancements could turn up—adding more features, improving existing ones, and broadening the scope of financial management. So, stay tuned and watch this space for more!

Closing Reflections: A Journey through the Quicken Landscape

There we have it—an explorative journey across the exciting world of Quicken Home and Business. It’s been a journey worth embarking on, a true-blue discovery of financial management prowess. But remember, just like any adventure, the real delight is in the exploration itself! Go ahead and give Quicken a shot—you might discover more than you bargained for.

Finance management might not be a cakewalk, but with a tool like quicken home and business in your arsenal, well, it sure does get more manageable. Here’s to your journey towards financial freedom using Quicken! How’s that for an adventure?

What is Quicken Home and business?

Well, Quicken Home and Business is like a supercharged personal finance application on steroids. This handy dandy software syncs your banks, budget, loans, and investments in one nifty spot, while also providing features optimal for small business owners like invoicing and rental property management.

Is Quicken being discontinued?

Phew, rest easy! Contrary to some panic-ridden chatter, Quicken is not being discontinued… yet at least. Even though it’s no longer under Intuit’s umbrella, the software continues to keep humming under its new management, H.I.G Capital.

Can I use Quicken Home and business Online?

Sure, you can use Quicken Home and business Online, but, let’s get this straight, it’s not a web-based application. The online capacity is there to sync your financial data for easier access, but the beef of the functionality lies in its desktop application.

Do I have to buy Quicken every year?

Now, do you have to buy Quicken every year? No siree, it’s not a necessity. But here’s the kicker: Quicken operates on a subscription model now. If you don’t renew, you’ll be left out in the cold when it comes to online services and updates.

What are the disadvantages of Quicken?

Sure, Quicken has its downsides. It’s not all sunshine and rainbows. Some users report it can be a bit buggy, with occasional hiccups in downloading transactions. Plus, let’s be frank, its user interface isn’t exactly a spring chicken, rather old and dated.

Is Quicken worth it in 2023?

Ring the bells, it’s 2023 and Quicken is still worth it. Its robust features for personal and business finance continue to be a valuable asset for savvy money managers.

Is Quicken no longer owned by Intuit?

Say it ain’t so – Intuit no longer owns Quicken! Shocking I know. The software was sold to H.I.G Capital back in 2016, but it’s still kicking and screaming.

Can I use Quicken without a subscription?

Technically, you can use Quicken without a subscription, but beware! You’ll lose access to online services like automatic transaction updates and bill pay.

What is easier to use than Quicken?

Looking for something easier to use than Quicken? You’d be hard-pressed to find a better alternative for full-blown finance management, but for budgeting, apps like Mint or YNAB might do the trick.

Is Quicken or Mint better?

In the epic battle between Quicken and Mint, there’s no one-size-fits-all winner. For streamlined budgeting and no-cost usage, Mint takes the cake. But if you need the bells and whistles for investments and business, Quicken bites the bullet.

Is Quicken good for bookkeeping?

Is Quicken good for bookkeeping? You can bet your bottom dollar it is! With its comprehensive finance tracking and reporting, it’s a powerful weapon in the bookkeeping arsenal.

How many computers can I install Quicken Home and business on?

When it comes to how many computers you can install Quicken Home and Business on, the terms are clear as day. One subscription equals one computer. It’s a straight shot, folks.

How do I use Quicken without renewing?

Using Quicken without renewing the subscription can be a tightrope walk. You can’t access web-based features, but you can continue to manually enter transactions and enjoy the basic device abilities.

Why did Intuit sell Quicken?

Why did Intuit sell Quicken? To be blunt, they wanted to narrow their focus on TurboTax and QuickBooks, so they shot Quicken over to H.I.G Capital.

Is it worth buying Quicken?

Is it worth buying Quicken? Heck yeah, if you’re juggling complex personal and business finances. But if you’re just tracking pocket money and minor bills, maybe not so much.

What are the different types of Quicken accounts?

The different types of Quicken accounts? Boy, it’s like a box of chocolates. You have Checking, Savings, Credit Card, Investment, Retirement, Asset, Liability – phew, and it doesn’t stop there!

Does Quicken Home and Business have a balance sheet?

Does Quicken Home and Business have a balance sheet? Absolutely, it sure does! It’s a bit buried though, you’ll find it under the ‘Business’ tab in the ‘Reports’ option.

What are the different levels of Quicken?

Different levels of Quicken, eh? There’s definitely a ladder to climb. You’ve got Starter, Deluxe, Premier, and Home & Business. Each step up gives you more tools for your financial toolbox.

What can I use instead of Quicken Home and Business on Mac?

Finally, if you’re wanting an alternative to Quicken Home and Business on your Mac, consider checking out Banktivity. They’re like two peas in a pod, but Banktivity is built specifically for Apple users. Now, isn’t that a peach?