Navigating the financial landscape can be as exhilarating as a ride through the rolling prairies of Nebraska. But when that landscape includes understanding income tax rates, some of us might prefer to take cover in a cozy cottage house. Fear not, dear readers, as we unravel the intricacies of Nebraska’s tax system with the gentle guidance of a sage financial advisor and the firm directional advice one might expect from a ridge wallet nestled securely in your pocket.

Navigating Nebraska’s Income Tax Landscape

A. Nebraska Income Tax: The Basics and Beyond

Welcome to the realm of Nebraska income tax, a topic that might not spark joy but certainly warrants attention. The Cornhusker State boasts a tax system with graduated individual income tax rates that range from 2.46 percent to a perhaps surprisingly stout 6.84 percent. Unlike your budget-friendly TV streaming subscription, the tax system demands from you a share based on your earnings and financial movements.

And let’s not mix apples with oranges—federal and Nebraska state income tax obligations are distinct beasts, each with its own set of rules and appetite for your hard-earned cash.

B. Income Brackets and Nebraska State Income Tax Rates

Dive headfirst into the nitty-gritty of Nebraska’s tax brackets and you’ll see how it’s shaped like a bell curve:

These rates showcase Nebraska’s progressive tax system, engineered to ensure those with broader shoulders carry a larger financial load.

C. Comparing Nebraska Income Tax to Neighboring States

Now, how does Nebraska’s tax tango with its neighbors? Unlike the solitary Great Plains, tax rates are crowded with nearby competitors vying for the most favorable conditions. With no local income taxes to complicate things further, assessing regional tax competition reveals whether Nebraska’s pastures are greener in comparison.

Residents might glance enviously across state lines at times, contemplating the implications for their wallets and wondering if the grass is indeed more tax-friendly in another state’s prairie.

D. How Nebraska Income Tax Impacts Your Wallet

Let’s chat about what this means for your pocketbook, shall we?

Both stories illustrate how effective and marginal rates differ and impact real-life financial scenarios in the Heartland.

E. Deductions and Credits: Minimizing Your Nebraska Income Tax

Minimizing your tax bill legally is akin to finding discounts on a treasure hunt—it all comes down to deductions and credits. Maybe you’ve installed energy-saving appliances, or you’re steadily contributing to a retirement plan; congratulating yourself on wise choices should also come with tax perks.

Common deductions and credits in Nebraska include contributions to college savings plans, classroom expenses for teachers, and of course, the fabled standard deduction, each one a piece of the puzzle in reducing your taxable income.

F. Nebraska Income Tax: Navigating Filing Status and Dependencies

Your filing status serves as a GPS for your tax rates and liabilities, leading you through the terrain of deductions and exemptions. Whether you’re a lone ranger or head of a bustling household, Nebraska wants to know and adjusts your tax obligations accordingly.

And when it comes to claiming your offspring or other dependents, it’s more than a headcount—it’s a way to potentially lighten your tax load, like shedding a heavy winter coat during a Nebraska spring.

G. Future Trends in Nebraska Income Tax Legislation

Keeping one eye on the horizon, we spot changes to legislation and speculate on future shifts. Recent updates—to say, corporate rates that now stretch from 5.58 percent to 7.25 percent—signal the ebb and flow of Nebraska’s tax code that could pivot your long-term financial strategies.

Our crystal ball sees continued legislative adjustments with the aim, always, to balance state funding with taxpayer wellbeing.

H. The Digital Influence: E-filing and Nebraska Income Tax

E-filing, the digital darling of the tax world, has revolutionized the way Nebraskans submit their returns. Praised for its speed, accuracy, and security, the electronic method ensures that you can navigate the submission process as smoothly as driving on I-80 on a clear day.

I. Self-Employed and Business Taxes in Nebraska

For the self-employed heroes and local business tycoons of Nebraska, navigating income tax requires an entrepreneur’s sharp mind. With no distinction in rates between the self-employed and salaried employees, the onus is on the business-savvy to squirrel away sufficient funds for tax time and understand their distinct responsibilities.

J. Relocation and Residency: Tax Consequences in Nebraska

If you’re dreaming of a First-time home buyer Arizona sunshine or pondering the quiet life in Nebraska, moving can shake up your tax situation like a Midwestern tornado. Whether you’re incoming or outgoing, calculate your tax scenario with the care you’d give to finding the perfect home.

K. Navigating Complex Cases: Nebraska Income Tax and Retirement

For the retirees basking in the glory of their golden years, Nebraska offers a blend of taxation on pensions, social security, and IRAs that requires a fine balance to ensure a good monthly retirement income.

L. Seeking Professional Help: When to Consult a Nebraska Income Tax Expert

Sometimes the tax trail becomes too tangled to navigate alone—it’s then you might consider roping in a professional. Complex situations like multi-state businesses, large capital gains, or simply crunching the numbers on potential deductions might demand expertise beyond your scope.

M. YOUR Nebraska Income Tax Strategy: Planning for the Future

Craft a financial tapestry that weaves Nebraska’s income tax rates into its design with year-round planning. Use tools like tax software or a financial advisor to avoid surprises when that tax bill rolls in.

The Blueprint for Mastering Your Nebraska State Income Tax Obligations

As we bring our tax journey to a close, remember to keep one hand on the plow and one eye on the ever-shifting tax landscape. Whether you’re assessing the cost to demolish a house or pondering the rates of Nebraska property tax, your proactive engagement and continued education will bear fruit in your financial future.

Stay curious, stay informed, and most importantly, stay ahead of the game when it comes to Nebraska income tax. Your pocketbook will thank you.

Nebraska Income Tax Trivia: Did You Know?

The Cornhusker State’s Tax Mazes

Well, hang onto your corn husks, folks, because we’re about to take a deep dive into the cornfield of Nebraska’s income tax facts that might just pop like sweet kernels of knowledge!

A Bill by Any Other Name

First off, did you know that the very law that governs Nebraska state income tax was once a sprout of legislation affectionately nicknamed “LB 302”? It’s like each bill is a Husker athlete, vying for a spot in the history books. LB 302 sprinted its way through the legislative fields and blossomed into what we now understand as the current tax structure.

Tiers of Taxation!

Now, hold onto your hats, because Nebraska’s tax system has tiers — and I’m not talking about the kind that come from chopping onions! The state operates on a graduated income tax system, which means it’s quite the hoedown with four brackets that range from 2.46% to 6.84%. It’s like a ladder where each rung takes just a bit more of your paycheck. But hey, that’s the climb!

The Farmer’s Share

Brace yourself though, because this might sting like a tumbleweed in a windstorm: if you make over $31,160 as a single filer, the state cracks open the tax cob and expects a 6.84% share. Yup, even the farmers’ sturdy work boots step into the same tax slurry as city slickers earning the same dough.

Un-Lassoed Deductions

A Deduction Rodeo

Bouncing around this tax rodeo, we also have deductions. They’re like the lassos that catch you some savings. In Nebraska, you can wrangle in what the federal government allows, and then some! They’re quite neighborly, those Nebraskan laws, giving you a chance to round up some of that hard-earned money and keep it in your jeans.

Charity: A Husker’s Heart

And here’s a heartwarmer for you – charitable Nebraskans can pat themselves on the back because charitable contributions are a golden ticket in the tax game. When you give from the heart, it’s not just good for your soul but for your wallet too. Spread the love, and the state tips its hat to you at tax time.

Odd Tax Ends and Fun Facts

The Prodigal Tax Return

Last, but certainly not the least thrilling on our tax trivia trail, did you know that Nebraska was, as far as states go, a bit of a late bloomer in the income tax department? That’s right – the state didn’t even introduce its own income tax until 1967. Imagine that! A whole swath of time where tax returns were as scarce as hen’s teeth in the Cornhusker state.

A Toast to Wine Enthusiasts

For the wine enthusiasts out there, here’s a quirky nugget: Nebraska is one of the few states that actually taxes wine shipments, which might just make your next bottle of Napa Valley’s finest a smidgen costlier. But hey, maybe that’s just more reason to cherish every sip as the sun sets over the plains.

So there you have it, fellow Huskers and knowledge hunters— a cornucopia of Nebraska income tax factoids to chew on. Whether you’re stacking hay bales or pushing papers, it’s always good to know just how your pockets are affected come tax time. Remember, every tax journey starts with a single step, or in this case, a click, so don’t shy away from clicking through and getting to know the tax lay of your Nebraskan land!

What is Nebraska state income tax?

Nebraska state income tax? Well, it’s as sure as corn grows tall in the Cornhusker State! Nebraska’s state income tax system is progressive, which means rates increase as your income does, ranging from a modest 2.46% to a slightly more noticeable 6.84%.

How much are salary taxes in Nebraska?

How much are salary taxes in Nebraska? Ah, the million-dollar question – well, not quite. Your final tax bill in Nebraska is a combo meal of state income tax, federal income tax, Social Security, and Medicare – a full platter that varies depending on how much you make.

How much is $80000 after taxes in Nebraska?

How much is $80,000 after taxes in Nebraska? So, imagine you rake in $80,000. After Uncle Sam and Nebraska get their cut, your take-home pay will be knocked down a peg or two, largely depending on deductions and credits you qualify for. To know for certain, a tax calculator or accountant comes in handy!

What is the Nebraska income tax rate for 2023?

What is the Nebraska income tax rate for 2023? Alright, for 2023, Nebraska’s wallet-nibbling critters (aka tax rates) remain the same as last year, with the state tax gauntlet running from 2.46% to 6.84%.

How much is 70k a year after taxes in Nebraska?

How much is 70k a year after taxes in Nebraska? Earning a cool 70k a year in Nebraska? You’re sitting pretty, but taxes will take their bite before you see your dough. To pin down your exact take-home pay, you’d have to juggle deductions and exemptions, but expect a decent chunk to bid farewell!

Does Nebraska have federal tax?

Does Nebraska have federal tax? Oh boy, does it ever! Just like every other state in the good ol’ US of A, Nebraska residents pay federal income tax, on top of state taxes. You can’t dodge Uncle Sam!

Is Nebraska a high tax state?

Is Nebraska a high tax state? High or low, that’s quite subjective; let’s just say Nebraska’s not the cheapest date. With state income taxes that can climb up to almost 7%, it’s not the lowest tax state, but hey, it’s not the highest either.

How much is $50,000 after taxes in Nebraska?

How much is $50,000 after taxes in Nebraska? If you’re making 50 grand a year in Nebraska, you won’t take it all to the bank. Federal and state taxes will trim it down, but to ballpark your net salary, plug your details into a tax calculator for a clearer picture.

Is Nebraska a good place to live?

Is Nebraska a good place to live? Good? Try great! With its friendly folk, wide-open spaces, and a cost of living that won’t make your wallet weep, Nebraska’s got charm to spare. Just ask any Cornhusker fan, and you’ll get an earful on Nebraska pride!

Which states have no income tax?

Which states have no income tax? Ah, the tax-free life! Currently, states waving goodbye to income tax include Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. Plus, Tennessee and New Hampshire only tax dividends and interest.

Is Social Security taxed in Nebraska?

Is Social Security taxed in Nebraska? You’ve hit the nail on the head! Nebraska taxes Social Security benefits, but only if your income exceeds certain thresholds. It pays to check if you’re in the clear or if it’s time to cough up a little extra.

Does Nebraska have personal property tax?

Does Nebraska have personal property tax? Indeed it does! In Nebraska, you’ll need to pony up personal property tax on tangible items like vehicles and business equipment. It varies by county, so check local rates for the full scoop.

What is the new tax law in Nebraska?

What is the new tax law in Nebraska? Hot off the press, Nebraska’s got a mixed bag of tax tidbits! They’re tweaking some credits and deductions, so keep your eyes peeled. The fine details can be a bit of a maze, but tax professionals are on it like white on rice.

What are the tax changes for 2023 in Nebraska?

What are the tax changes for 2023 in Nebraska? Nebraska’s not shaking things up too wildly for 2023, keeping rates steady. But don’t snooze on local changes or updates on deductions and credits that might save you a penny or two.

Which state has the highest income tax 2023?

Which state has the highest income tax 2023? Bracing for a blow? As of 2023, California is still the king of the castle with a top income tax rate that’ll make your wallet wince. If you’re counting pennies, it’s best to steer clear of the Golden State.

Is Nebraska a tax friendly state for retirees?

Is Nebraska a tax-friendly state for retirees? Tax-friendly is a cozy word, isn’t it? Well, Nebraska’s kind of like that sweater that’s comfy but could be comfier. Social Security is taxed, but there are breaks for pension income. It’s sort of middle-of-the-road.

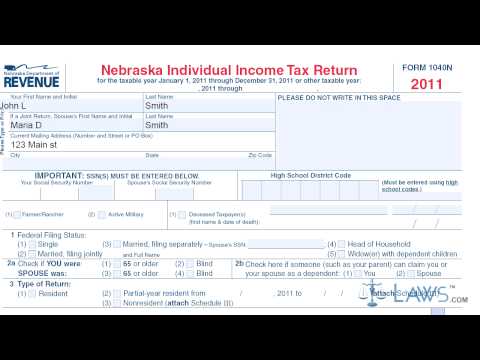

Does Nebraska have a state income tax form?

Does Nebraska have a state income tax form? You betcha! Nebraska’s got its own set of tax forms – the Form 1040N – for state residents to report their annual income. It’s your ticket to sorting out what you owe the state.

Where is my Nebraska state income tax?

Where is my Nebraska state income tax? Waiting on your tax refund is like fishing – it requires patience. If you’re looking for your Nebraska state tax refund, hop onto the Nebraska Department of Revenue’s website and use their handy refund status tool.

What is the income tax rate in Nebraska for 2024?

What is the income tax rate in Nebraska for 2024? Ah, the crystal ball question! The tax rates for Nebraska in 2024 aren’t set in stone yet – they could stick or switch. Keep an ear to the ground later in the year for any updates that come down the pipeline.