Homeownership: it’s the American dream wrapped up with a white picket fence and a neatly trimmed lawn. But before you leap into this significant investment, it’s crucial to separate fact from fiction, especially when it comes to homeowners insurance—a safeguard that’s as essential as the roof over your head. Let’s dive into the nitty-gritty and bust some common myths surrounding this protective financial umbrella.

Unveiling the Truth Behind Homeowners Insurance

Homeowners Insurance Explained Mold, Fire, Flood & Other Important Topics

$12.95

Homeowners insurance is a crucial investment for protecting one of your most valuable assets: your home. This type of policy covers a variety of incidents that could cause damage to your property and the belongings within it. Among the essentials, homeowners insurance often includes coverage for mold, an issue that can arise from water damage or persistent moisture problems. It’s important to understand the specifics of how mold is covered, as policies might require additional endorsements or have certain limitations.

One of the most feared events by homeowners is a fire, which can lead to devastating loss and damage. Homeowners insurance typically covers the structure of your home, personal belongings, and often additional living expenses if a covered event makes your home uninhabitable. It is essential to review your policy details to ensure adequate coverage limits are in place, so you can rebuild or replace your home and possessions. While the policy usually covers fires caused by lightning, electrical issues, or accidents, intentional acts of arson by the homeowner are not covered.

When it comes to natural disasters such as floods, standard homeowners insurance policies generally do not include flood coverage. Homeowners who live in flood-prone areas must typically purchase a separate flood insurance policy to protect their property from such events. It’s critical to understand the extent of your insurance coverage and consider additional insurance if you live in a high-risk area for floods. Keeping abreast of what your homeowners insurance policy entails and the additional options available will empower you to make informed decisions, ensuring that your home is adequately shielded from these and other potential calamities.

Myth 1: Homeowners Insurance is Optional for all Homeowners

“Now, don’t get hoodwinked!” This often-repeated mantra of mine applies in full force here. Many believe homeowners insurance is something you can casually shrug off. Not true, my friends! While it’s not legally mandated, if you’re like most folks with a mortgage—a whopping majority — your lender will insist on it. Why? Because that home isn’t just yours; it’s security for the money they’ve loaned you.

There are those rare birds who own their roost outright, and for them, insurance might seem optional. But here’s the straight talk: you’re playing financial Russian roulette without it. Imagine Mother Nature throwing a tantrum, and you’re left with rubble where your nest egg once was. Now, that’s a sobering thought!

Myth 2: Homeowners Insurance Covers Every Kind of Damage

If only it worked like a genie in a bottle—just rub it, and every wish is granted. Life isn’t a top song from 2013 that you can just remix to your liking. In reality, your standard homeowners insurance comes with a specific set of inclusions, like damage from fire, storms, or theft. But—and it’s a big but—common exclusions are lurking. Think floods or earthquakes; they usually require additional riders or policies.

The stats paint a stark picture: a stunning number of homeowners are caught off-guard by what’s not covered. Dry socks and peace of mind could cost you extra if the waters rise, so don’t skim on the fine print!

Myth 3: Homeowners Insurance Guarantees Full Replacement Cost

Whispers of “full replacement cost” might sound like sweet music to your ears, but tune in to reality. Insurance can come in various tempos—Actual Cash Value or Replacement Cost. Settling for the former can be like trying to buy a brand-new iphone with the money you’d get from selling one you’d subjected to a factory reset. It won’t fetch the same price it once did.

Tales of underinsured homes are more common than you might think. Regular policy reviews are about as fun as watching paint dry, but they’re essential to ensure you can rebuild your castle should disaster strike. Don’t let your dream turn into a penny-pinching nightmare!

Homeowner’s Book of Records Binder, Organize Household Receipts and Home Repair Record Keeping (Black)

$29.99

The Homeowner’s Book of Records Binder is an indispensable organizational tool designed to keep your household’s financial and maintenance records neatly arranged and easily accessible. This sleek black binder is not only functional but also aesthetically pleasing, ensuring it stands as a professional addition to your home office or filing system. It comes equipped with pre-labeled and customizable dividers, allowing you to categorize your documents by type, such as receipts, warranties, contracts, and repair records. The binder’s durable construction ensures that your documents will be protected from dust, spills, and general wear and tear.

Inside this user-friendly binder, homeowners will find intuitively designed pockets and sleeves tailored to store a range of receipt sizes and document types. There’s ample space to log detailed records of home repairs and maintenance work, which is essential for managing your property’s value and functionality effectively. The structured recording format helps you monitor each project’s costs and outcomes, making it a breeze to reference past work for future decision-making or when dealing with service providers. By consolidating your information in this central location, you can achieve a clear overview of your home’s financial commitments and upkeep history.

The Homeowner’s Book of Records Binder is a must-have for anyone looking to streamline their record-keeping and fortify the management of their home’s paperwork trail. It’s particularly useful during tax season, during home sale transactions, or when planning for renovations. The binder’s design ensures ease of use and adds a touch of sophistication where it’s stored. Owning this binder means investing in peace of mind, knowing that all your vital home-related documents are organized and at your fingertips whenever you need them.

Myth 4: All Personal Belongings are Fully Covered by Homeowners Insurance

“Everything’s covered!” Nope. That’s like assuming those tasman Uggs buried in the back of your closet are enough for a hike up Everest. Your policy probably has limits and caps, especially for high-ticket items like jewelry or fine art. Appraise and insure accordingly, or risk not being able to replace love’s tangible tokens if they’re stolen or destroyed.

A savvy homeowner takes inventory. Think of it as the financial equivalent of spring cleaning—tedious, yes, but oh-so-necessary. And if you have something exceptionally valuable, consider a personal articles floater. It’s an added layer of security, kind of like slipping on cargo pants with extra pockets—more space, more peace of mind.

Myth 5: Homeowners Insurance is Prohibitively Expensive

“I can’t afford it!” This cries out like a late-night infomercial pitch. But let’s spin this vinyl backward and listen to the hidden message: homeowners insurance can be surprisingly affordable. The price can be as varied as skin-care routines—whether you’re slathering on the Barbara Sturm or the drugstore special.

Your specific rate hinges on a smorgasbord of factors—location, claim history, and even your home’s quirks. But scrimp on this, and you could pay dearly. A little birdie told me that in Missouri, it averages at over two grand yearly, but you can work those numbers down with discounts and risk mitigation. It’s not just about protecting your abode; it’s about ensuring financial stability.

Debunking Homeowners Insurance Myths with Data-Driven Insights

Addressing misconceptions could be tougher than chewing on a granite countertop. Let’s get down to brass tacks with the Homeowners Insurance policy dust-up.

Deep Analysis of Homeowners Insurance Policy Types and Trends

Choices, choices, everywhere, and not a drop to drink. Does that sound like your experience with insurance policies? There’s the HO-5, the top-tier cover, offering high coverage limits and fewer restrictions. Then there are the leaner, meaner alternatives. Understanding these can be as complex as navigating a Homeowners Association rulebook.

And just like following trends can lead you to wearing last-season’s fads, banking solely on what’s popular with Homeowners Insurance could leave you exposed. It pays to do your homework to truly safeguard that three-bedroom pride and joy of yours.

Unique Perspectives on the Value of Homeowners Insurance

Let me paint a picture for you. Jim and Pam, not the couple from TV, but real folks from Connecticut, found themselves in hot water when their home suffered extensive damage from an unexpected storm. Thanks to their eagle-eyed approach to their policy, featuring a Coverage that goes beyond actual cash value, they were able to rebuild without nuking their savings.

Flipping the pancake, experts agree that skimming over your policy is akin to signing a Jumbo Loan with your eyes closed—adventurous, sure, but likely to end with you stuck in financial quicksand.

Comprehensive Homeowners Insurance Myth-Busting – Beyond the Obvious

Roll up your sleeves; we’re going beyond the tip of the iceberg. True, you’ve probably heard some of these tales before, but there’s a carnival of exceptions, exclusions, and special clauses yet to explore.

Ever considered how regional quirks could affect your policy? And always, always pay mind to the replacement cost. Without it, that natural disaster could hit you right in the pocketbook, and harder than you might think.

Homeowners Insurance Basics What You Don’t Know Could Cost You Thousands

$19.95

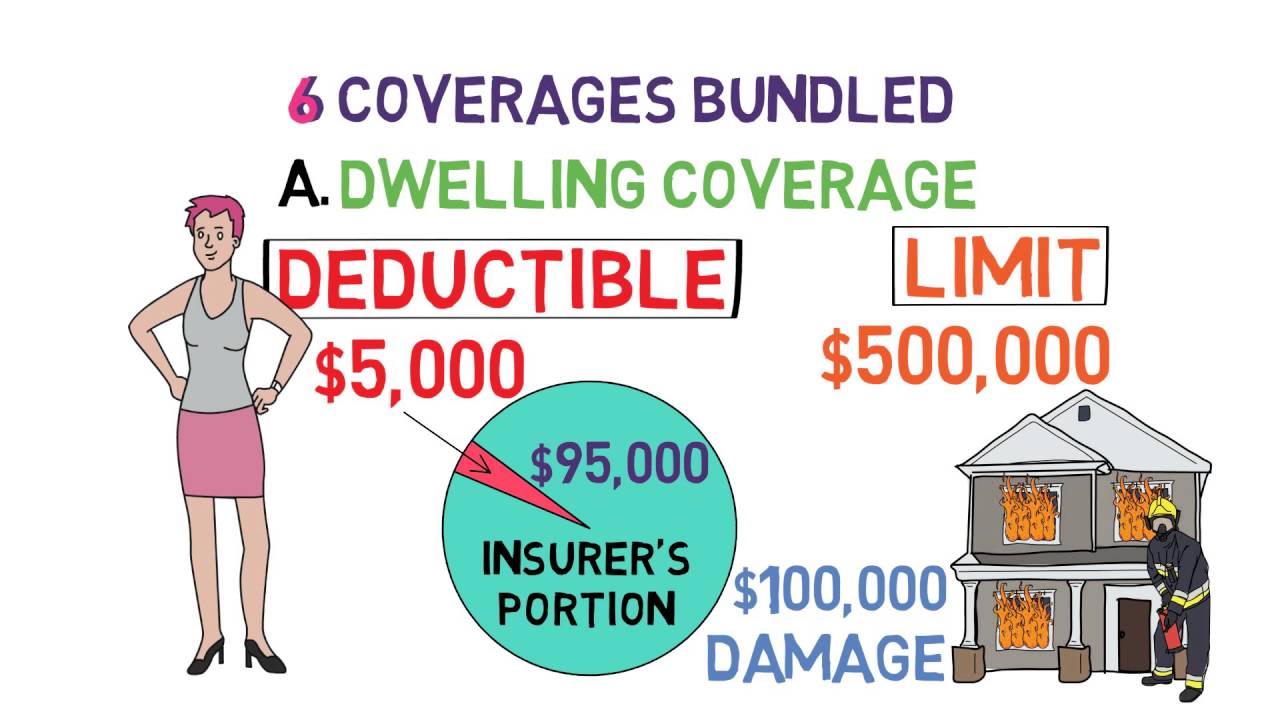

Navigating the world of homeowners insurance can be daunting, yet understanding the basics is crucial to protect one of your most significant investments. Homeowners insurance policies not only cover damage to your property but also protect you from liability for injuries and damage you or your family may inadvertently cause to other people. Most basic policies include dwelling coverage, personal property protection, liability insurance, and additional living expenses. However, many homeowners are unaware of common exclusions within these policies, such as natural disasters like floods and earthquakes, which require additional coverage.

What many homeowners don’t realize is that the amount of coverage they choose heavily influences their financial security in the event of a claim. Underinsuring your home could mean thousands of dollars out of pocket, as insurers only pay up to the limits set in your policy. It’s critical to assess the replacement cost of your home and possessions accurately and not just their market value, which could leave you underinsured. Additionally, failing to update your policy to reflect home improvements or significant purchases can lead to insufficient coverage when disaster strikes.

Another aspect often overlooked is the deductible, which is the amount homeowners are responsible for paying before insurance kicks in. Choosing a high deductible can lower your premiums but at the cost of a higher financial burden if a loss occurs. Conversely, lower deductibles result in higher premiums, but less personal financial stress during a claim. It’s essential for homeowners to balance their comfort with risk against their willingness to pay higher ongoing insurance costs, ensuring a policy that offers peace of mind and comprehensive financial protection.

| Feature | Detail | Price (Samples) | Benefits |

|---|---|---|---|

| Coverage Types | – Interior/exterior damage – Loss/theft of possessions – Personal liability |

Varies by state and provider | Financial protection against property damage and liability |

| Levels of Coverage | – Actual Cash Value – Replacement Cost – Extended Replacement Cost/Value |

Varies by level and provider | Choice of value recovery after a loss |

| Recognized Insurance Provider | Budget Direct – Value Insurance Provider of the Year, Mozo Experts Choice Award | Not specified | Demonstrated value and industry recognition |

| Average Cost in Missouri | $2,579/year ($215/month) for $300,000 dwelling coverage | 47% above national average per year | State-specific benchmark for cost expectations |

| Cheapest Rate in Connecticut | Allstate at $1,103/year | 33.9% below state average | Competitive pricing for Connecticut homeowners |

| Why Insurance is Important | – Natural disasters – Theft – Unexpected risks |

Cost of premiums vs. out-of-pocket expenses | Reduces potential out-of-pocket costs for homeowners |

| Premium Policy (HO-5) | – Replacement cost for items – Higher coverage limits – Fewer restrictions |

Generally higher than basic policies | Superior coverage and protection for assets |

| Timing for Insurance | Upon exchanging contracts for buildings Before moving for contents |

Based upon policy initiation | Legal compliance and protection from day one |

Conclusion: Empowering Homeowners Through Knowledge and Clarity

And there you have it—myth after myth laid out and systematically dismantled, like an Interest-only Mortgage meeting a reality check.

Take a moment—yes, right now—to check in with your policy. Understanding it isn’t just a chore; it’s your financial suit of armor. Stay informed, stay engaged, and above all, stay protected. Because, let’s face it, your home isn’t just where the heart is; it’s where your life, memories, and yes, your hard-earned cash reside.

So, take that step away from fiction and towards enlightenment. Knowledge is more than power—it’s protection.

Dispelling Common Homeowners Insurance Myths

When it comes to protecting your home, there’s nothing quite as essential as a solid homeowners insurance policy. Just like you wouldn’t leave your iPhone without a passcode, securing your home with insurance is a no-brainer. But, hold your horses! There are some pretty wild myths out there about homeowners insurance that we need to clear up, stat!

Myth #1: “Natural Disasters are Always Covered, Right?”

Hold onto your hats folks, because this one’s a whirlwind of misinformation! Many homeowners believe that their insurance policy is like an all-access pass to peace of mind, no matter what Mother Nature throws their way. However, you might be shocked to discover that standard policies often exclude certain natural disasters. Yup, that’s right—things like floods and earthquakes might just leave you high and dry when it comes to coverage. So, before you shake rattle and roll with confidence, double-check your policy to ensure you’re not caught off guard.

Myth #2: “My Stuff’s Covered, No Matter Where It Is!”

Here’s a fun nugget of truth that might surprise you as much as finding your favorite jam from the top Songs 2013 on a forgotten playlist: homeowners insurance doesn’t glue itself to your belongings. That’s right; your policy might cover your things at home, but if your laptop gets swiped from a coffee shop or your luggage gets lost on vacation, you might be on your own. It’s like thinking your umbrella will keep you dry, even when you leave it at home—ain’t gonna happen!

Myth #3: “Homeowners Insurance Is Just for Homeowners, Duh!”

Well, let’s not get ahead of ourselves. Renters, listen up because this one’s for you! Sure, the name “homeowners insurance” sounds like it’s exclusive as a VIP club on a Saturday night, but it’s actually a bit of a misnomer. Renters can—and should!—get a type of homeowners insurance, commonly called renters insurance. It’s like thinking you can’t join in on the game because you didn’t bring the ball. Everyone’s welcome, even if you’re not holding the deed!

Myth #4: “One Size Fits All, Like My Favorite T-shirt!”

Whoa, Nelly! If you think one homeowners insurance policy fits all scenarios, then you’re in for a bumpy ride. It’s like thinking an Iphone factory reset can fix a shattered screen—you’re barking up the wrong tree. Policies vary like the weather, and what works for your neighbor might be as useful to you as a snowblower in the Sahara. Each home has its own needs, and your policy should fit your situation like a glove. So, don’t settle for the first thing that comes your way—customize it, baby!

Myth #5: “Filing a Claim is as Painful as a Root Canal!”

Well, I’ll be! This might just be the tallest tale of them all. Many homeowners worry that filing a claim is going to be some drawn-out, complicated process that’s more trouble than it’s worth. But let’s cut to the chase—while no one’s saying that paperwork is a walk in the park, insurers have come a long way. It’s not like you’re filling out forms with a quill and ink. So, if disaster strikes, don’t shy away from filing a claim. Just be sure you understand your policy’s ins and outs, and you’ll navigate the process like a pro.

There you have it, folks—a handful of homeowners insurance myths busted! Understanding your policy can be as rewarding as finding a forgotten hit in your music collection or refreshing your iPhone to its original glory. Get the facts straight, and your homeowners insurance will be music to your ears, leaving you ready to face whatever life throws at your humble abode.

Introduction to Insurance Covering Life, Health, CarAuto, Homeowners, Travel & Business Insurance Beginners Guide to Life Insurance, Health Insurance, Homeowners Insurance, Car Insurance, more

$12.95

“Introduction to Insurance: Covering Life, Health, Car/Auto, Homeowners, Travel & Business” is a comprehensive guide designed to educate beginners about the crucial aspects of various insurance policies and the importance of having adequate coverage. Tailored for those new to the world of insurance, it demystifies industry jargon and outlines the key elements of life, health, homeowners, car, travel, and business insurance, providing readers with the foundational knowledge needed to make informed decisions. By explaining the subtle differences and exclusions in policies, it empowers individuals to identify the right coverage levels and options for their unique circumstances. This book is an essential read for anyone looking to protect their financial future and gain peace of mind in a complex and often intimidating field.

The section on life insurance introduces readers to terms such as term life, whole life, and universal life policies, while explaining the critical role life insurance plays in safeguarding a family’s financial stability in the event of a tragedy. It highlights the factors that influence premium rates and offers practical advice on determining the amount of coverage necessary to meet one’s needs. The guide also delves into the nuances of health insurance, covering everything from HMOs, PPOs, and EPOs to the implications of the Affordable Care Act for individuals and families. It emphasizes the significance of understanding ones health coverage, especially when navigating employer-provided options and the healthcare marketplace.

Finally, for those seeking protection for their assets, the book provides insightful coverage of homeowners and car/auto insurance, detailing the different policies available and the kind of events they protect against, such as natural disasters, theft, and accidents. It underscores the necessity of comprehending the terms of one’s policy, including deductibles and liability limits. Moreover, the travel and business insurance sections outline how to secure oneself against travel-related mishaps and the variety of risks that businesses face daily. Whether planning a vacation or running a small business, this guide ensures that readers are well-informed on how the right insurance can be a lifesaver in unexpected situations.

What are the three types of homeowners insurance?

– Hold onto your hats, folks! The three musketeers of homeowners insurance are: HO-1 (Basic Form), the minimalist of policies if you will; HO-2 (Broad Form), which steps it up a notch coverage-wise; and HO-3 (Special Form), the heavy-hitter that gives broader coverage and is most popular among homeowners.

Which home insurance is best?

– Well, talk about a toughie! The best home insurance is like asking about the best ice cream flavor – it really depends on your taste… or in this case, your specific needs. But you’ll want to look for a provider with a sterling rep for customer service, solid financial strength, and a policy that covers your bases without leaving your wallet high and dry.

What is the average cost of homeowners insurance in Missouri?

– Lean in, folks—word on the street is that in Missouri, the average cost of homeowners insurance has homeowners coughing up around $1,285 a year. But keep in mind, this isn’t a one-size-fits-all kind of deal; your rate can swing higher or lower depending on your home sweet home’s specifics.

What is the cheapest home insurance in CT?

– Here’s the scoop! Hunting for the cheapest home insurance in the Constitution State? It’s a bit of a moving target as rates can vary like New England weather. But companies like Amica or State Farm often come out swinging with competitive prices.

What to avoid with homeowners insurance?

– Listen up, you don’t want to play with fire when it comes to homeowners insurance—avoid skimping on coverage or missing the boat on regular policy reviews. And don’t even think about underreporting your assets; that’s a can of worms you don’t want to open!

What types of insurance are not recommended?

– When it comes to insurance, some folks might tell you to give a wide berth to anything superfluous—like policies for specific natural disasters if your area’s risk is as low as a snake’s belly. Mortgages are a serious game, so don’t go betting the farm on unnecessary extras.

Who sells the cheapest house insurance?

– Ready for a nugget of wisdom? Whoever sells the cheapest house insurance varies like the weather. It often boils down to your unique situation, but bargain hunters might find solace in scouring deals from companies like Lemonade or Geico.

Who is the number 1 home insurance company in America?

– Numero uno, the cream of the crop in American home insurance, is often hailed as State Farm. They’re like that high school all-star – popular for a good reason, offering a mix of wide coverage options, competitive rates, and a network of agents as extensive as a Thanksgiving family reunion.

How do I get the best quote on my homeowners insurance?

– To score the best quote on homeowners insurance, you gotta roll up your sleeves and shop around like it’s Black Friday. Bundle your policies, hike up your deductible (if you can stomach it), and make your home safer than a turtle in its shell. Carriers love that stuff!

What is the 80% rule in insurance?

– The 80% rule in insurance isn’t about giving it the old college try; it’s serious business. It means your home should be insured for at least 80% of its replacement cost, not counting the land. Otherwise, you might be left short when the chips are down and disaster strikes.

What is the cheapest home insurance in Missouri?

– Hunting for the cheapest home insurance in the Show-Me State can feel like looking for a needle in a haystack. However, some budget-friendly names often tossed around include companies like Safeco and Nationwide—just be sure to peek at the coverage they offer with eagle eyes!

Why is homeowners insurance so expensive in Missouri?

– Oh boy, homeowners insurance in Missouri might have you feeling like you’re paying an arm and a leg because of factors like tornado-happy weather, higher rebuilding costs, and sometimes even the neighborhood. It all adds up to a pricey gumbo that’ll have you dipping into the piggy bank.

What company gives the cheapest insurance?

– If you’re on the prowl for the most wallet-friendly insurance, the wind might blow you in the direction of names like Progressive or Lemonade. But remember, the cheapest may not always be your golden ticket—you’ll want to weigh the coverages more heavily than a stack of pancakes.

Why is home insurance getting so expensive?

– Home insurance skyrocketing? You can thank the usual suspects: wild weather causing a ruckus, homes fancier than a high tea party, and those ever-climbing rebuilding costs. Insurers have to tighten their belts too, which means premiums go up like a helium balloon.

Why is home insurance so expensive?

– You might be asking, “Why’s my home insurance cost more than a space shuttle?” Well, all sorts of things are to blame: natural disasters more common than colds in winter, inflation, and even improvements to your pad can push rates up faster than a rocket.

What are the three 3 main types of insurance?

– Ready for a quick rundown? The three amigos of insurance types are: property insurance (your shield against damage and theft), liability insurance (watching your back if someone gets hurt on your turf), and workers’ compensation insurance (the ace up your sleeve for on-the-job injuries).

What is the difference between HO3 and ho8?

– Take HO3 and ho8; they’re like distant cousins at a family BBQ. HO3 is all welcoming with its open-perils policy coverage, meaning it’s game for protecting your home from all sorts of mishaps unless they’re specifically nixed. Meanwhile, ho8 is like that picky eater—it only covers named hazards for homes that are older or trickier to replace.

What is the difference between HO3 and HO6 insurance?

– Now, if we’re talking about the difference between HO3 and HO6, think of it like apples and oranges. HO3 covers a standalone home inside and out, like a knight in shining armor. But HO6 is more like a loyal sidekick, focusing on condos and co-ops, covering belongings and the inner sanctum, while leaving the exterior to the condo association’s master policy.

What is the most common type of homeowners insurance?

– The most common type of homeowners insurance is the HO3, hands down. It’s like the good ol’ trusted pickup truck – not too fancy, but it’ll haul your needs and protect your home against the unexpected, which is just about everything except what’s explicitly ruled out.