Planning for tax season is like preparing for a wintry trek; you want the right gear like a cozy winter hat to keep you warm and a strong sense of direction to ensure you reach your destination successfully. For retirees, the 1040SR 2022 tax form is a key part of their financial navigation, offering opportunities for astounding tax savings. With Suze Orman’s educational insights and Robert Kiyosaki’s practical advice, let’s dive into how to make the most of it!

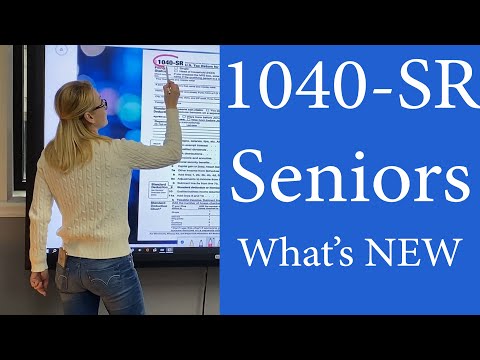

Understanding the 1040SR 2022: A Detailed Walkthrough for Retirees

Overview of the 1040SR tax form

The 1040SR 2022 is a lifeline for savvy seniors aiming to steer through tax waters smoothly. It’s the IRS’s nod to our golden agers, offering a large-print, easy-on-the-eyes document that doesn’t cut corners on benefits. This special form is tailor-made for individuals who have celebrated their 65th birthday by December 31, 2022, making tax filing less of a hassle and more of a breeze.

Eligibility criteria for using form 1040-SR in 2022

You wouldn’t hit the gym in light wash Jeans; similarly, there’s a fit when it comes to tax forms. To wield the 1040SR, you need to be a proud 65 or older – simple as that. Age has its privileges, and if you fancy doing your taxes by hand, this form is your trusted companion.

What sets the 1040SR 2022 apart from the standard 1040 form

If reading fine print makes you squint harder than spotting a needle in a haystack, then the 1040SR’s larger type is a sight for sore eyes. Plus, it puts senior-specific tax benefits front and center, making sure you don’t miss a trick when it comes to optimizing your contributions from a life well lived.

Maximizing Deductions on Your 1040SR 2022

Analyzing standard vs. itemized deductions for seniors

When deciding between standard or itemized deductions, think of it like choosing between a treadmill or free weights. Each has its strengths, but you want what best aligns with your goals. For many seniors, the increased standard deduction (with a bonus if you’re blind), which in 2024 stands at $3,700 for singles and an additional $3,000 for each individual if married, could trump the hassle of itemizing.

Specific deductions suitable for 1040SR filers

Focus here on deductions as caring for your nest egg. Consider deductions for medical expenses exceeding 7.5% of your AGI, real estate taxes, and investment interest expenses.

How medical and dental expenses can lead to significant savings

Rising healthcare costs can swallow your budget like a sinkhole. But documenting all qualifying medical and dental expenses can provide a welcome financial cushion against these costs.

Charitable contributions and their impact on your taxable income

Like the warmth of a good deed on a chilly day, charitable giving is not only good for the soul but also for your taxes. Gifting money to qualified organizations can lower your taxable income, making generosity a gift that truly keeps on giving.

| Attribute | Description / Information |

|---|---|

| Form Name | Form 1040-SR |

| Tax Year | 2022 |

| Eligibility | Taxpayers aged 65 or older |

| Purpose | For seniors to file their federal tax returns |

| Document Type | U.S. individual income tax return |

| Availability | Through IRS website or paper form outlets |

| Features | – Larger print for easy reading |

| – Standard deduction table on form | |

| – Emphasis on senior-specific tax benefits | |

| Standard Deduction | Printed on form for easy reference |

| – Extra $3,700 if single or head of household and blind | |

| – Extra $3,000 per qualifying individual if married and blind | |

| Additional Requirements | Must fill out by hand if not filing online |

| Usage Advantage | – Easier to read for those with vision impairments |

| – Includes senior-specific tax benefits | |

| Filing Methods | Mail-in or electronic through IRS Free File or tax software |

| Cost | Free to download and use; costs may apply for tax preparation services or software |

| Formats Available | – Large-print paper form |

| – Downloadable PDF from IRS website | |

| Other Sources of Income | Seniors can report all other forms of income |

| Accessibility | Designed for manual (hand-written) tax preparation |

| Online Alternatives | Electronic versions of Form 1040 with similar benefits for seniors |

| Note | For the most current tax-related updates, visit the official IRS website |

Deciphering the AGI: What Line Is AGI on 1040

Defining Adjusted Gross Income (AGI) and its importance

Your AGI is like your financial compass; it guides the course of your tax journey. It is the sum of all your earnings minus particular deductions, setting the stage for further tax computations.

Locating the AGI on your 1040SR document

Spotting your AGI on the form is as straightforward as spotting Greg Plitt on a magazine cover – it stands out. Your 1040SR makes this number easy to find, so you can see where you stand at a glance.

How your AGI influences tax calculations and potential savings

The lower your AGI, the lower your tax liability tends to be. It determines your eligibility for certain tax credits and deductions, ultimately influencing how much you owe or get back from Uncle Sam.

The Power of Credits: Reducing Tax Liability for 1040SR 2022 Filers

Elderly tax credits that can reduce your overall tax burden

We all love a good sequel, and in the realm of taxes, credits are a follow-up hit to deductions. They’re dollar-for-dollar reductions in your tax bill, making them heavyweight contenders in your tax-saving strategy.

Understanding the Credit for the Elderly or the Disabled and its application

This particular credit is like finding an extra chunk of change in your pocket; it’s designed specifically for seniors and can knock a significant amount off your tax bill if your income falls within a certain range.

How the Earned Income Tax Credit (EITC) affects seniors still working

Just like 300 Black Men For Only 2 Pounds is an astounding offer you’d double-take, the EITC can be an unbelievable boost to the tax situation of working seniors. If you’re still earning a wage, this credit could be within reach.

Utilizing Retirement Contributions for Tax Deductions

The role of IRA contributions in your tax strategy

Like adding a heavier plate to your gym routine, contributing to an IRA can significantly bolster your tax-saving regimen, allowing your retirement savings to grow tax-deferred or potentially tax-free in the case of a Roth IRA.

401(k) and other retirement plans: How they factor into the 1040SR

Your 401(k) isn’t just a retirement powerhouse; it’s a tax-saving tool. Contributions can reduce your taxable income, aligning your 1040SR with the sweet spot of fewer taxes now and a robust nest egg later.

Optimizing the Saver’s Credit for additional savings

The Saver’s Credit is like getting a pat on the back in the form of a tax credit – it’s a reward for saving for retirement. Eligible lower-income savers can claim a portion of their retirement contributions as a credit for even more tax savings.

Capital Gains and Losses: Balancing Your Investment Portfolio for Tax Efficiency

Reporting capital gains and losses on the 1040SR form

Like the careful balancing of a workout routine, handling your investments requires managing gains and losses. Reporting these on your 1040SR 2022 can be advantageous, as the form simplifies where to list these figures.

Strategies for offsetting gains with losses to minimize tax liability

Offsetting gains with losses can feel as satisfying as a well-earned rest after an intense workout. This tactic, known as tax-loss harvesting, aligns your investments with your tax goals.

Long-term vs. short-term capital gains: Understanding the tax implications for seniors

Long-term gains come from investments held over a year and are taxed favorably compared to short-term gains from assets held for a shorter duration. Knowing the ropes here can save you a chunk in taxes.

Navigating Social Security Benefits on Form 1040-SR

How to report Social Security benefits on your 1040SR

Like an unexpected plot twist in Guardians Of The Galaxy 3 Spoilers, the taxation of Social Security benefits catches many off-guard. But fear not, the 1040SR 2022 makes this straight-shooting, simplifying where and how to report this income.

Strategies for keeping Social Security benefits tax-free or partially taxed

Your goal here is to keep as much of your benefits as possible. By carefully managing your combined income, you might just find that sweet spot where your Social Security remains untouched by taxes.

The implications of combined income on the taxation of Social Security benefits

Like a jigsaw puzzle, combined income – your AGI with certain additions, including non-taxed interest and half of your Social Security benefits – fits together to determine if your benefits will be taxed.

Tips for Responding to IRS Notices and Handling Audits

Best practices for ensuring accuracy and completeness on your 1040SR

Dotting your i’s and crossing your t’s on your 1040SR 2022 is paramount. Double-check figures, triple-check deductions, and make sure every number is where it should be.

Steps to take if you receive an IRS notice regarding your 1040SR 2022 submission

Receiving an IRS notice might seem as daunting as a cliffhanger in a thriller, but stay calm. Review the notice, verify its claims, and respond in a timely manner with any requested information.

Advice for seniors facing audits and how to prepare

An audit need not be a horror scene. Keep meticulous records, stay organized, and consider enlisting the help of a tax professional to navigate this challenging process.

Advanced Tax Planning: Preparing for the Future Beyond 1040SR 2022

Leveraging tax planning strategies for years to come

Tax planning shouldn’t be a once-a-year affair; rather, it should be as routine as a regular workout. A forward-thinking approach will brace you for future changes and keep you on the path to savings success.

Understanding the impact of new tax laws on future retirement income

Tax laws change as often as fashion does. Staying on top of these changes ensures your retirement income is as fashionable tax-wise as a classic granite magazine winter hat is in the chilly season.

Utilizing financial advisers for ongoing tax savings strategy

Don’t go it alone. Like personal trainers in the financial gym, advisers can fine-tune your plan, ensuring every year is more fit and fiscally healthy than the last.

Conclusion: Securing Your Financial Future with the Right Approach to 1040SR 2022

Recap of key strategies for optimizing tax savings with form 1040-SR

Using the 1040SR 2022 is about precision – capitalizing on deductions, understanding your AGI, leveraging credits, and knowing how and when to report various types of income.

The importance of staying informed on tax law changes

Stay on your toes – tax laws evolve, and so must your strategies. Being in the know is half the battle won.

Encouraging proactive, year-round tax planning to maximize benefits for retirees

Don’t leave tax planning to the eleventh hour. Like any solid game plan, year-round attention pays dividends in peace of mind and financial well-being.

The 1040SR 2022 could be the financial hero cape you didn’t know you had in your wardrobe. Embrace it, understand it, and use it to soar towards the financial freedom you’ve spent a lifetime working toward.

The Ultimate 1040sr 2022 Trivia and Fact Smorgasbord

Let’s dive right into the quirky world of the 1040sr form for 2022. Buckle up, because we’re about to sprinkle some fun on the seemingly dry topic of taxes!

The Golden Form for Golden Agers

Did you know that the “SR” in 1040sr stands for “senior”? Yep, this form caters to the young at heart, who’ve seen at least 65 springs. You might be thinking, “Why should the youngsters have all the tax fun?” Well, they shouldn’t! The 1040sr 2022 is like the VIP pass at the tax party for our beloved retirees.

Now imagine this: You’ve spent your life saving up, paying down the mortgage on your white-picket-fence-adorned dream home. Well, here’s where your saved pennies can come back to you. Ever heard of the mortgage interest deduction? If you’re holding onto a What Is a 1098 form in your hand, you’re in for a treat because this form can help qualify you for some nice tax deductions on that interest you’ve been paying. Talk about a sweet return!

Gifting Galore Without the Taxing Despair

Alright, here’s a juicy tidbit for all you generous souls out there. Ever felt like playing Santa outside of December, showering your loved ones with gifts? Well, gather ’round, as the How much can You gift tax free in 2024 question has a pretty nifty answer! Kicking in that not-too-distant future, the tax-free gifting amount is getting a boost, providing the perfect excuse to up your gifting game without the tax buzzkill.

If the idea of giving away money without Uncle Sam reaching into the cookie jar gets you excited, then you’ll be thrilled about how the 1040sr 2022 lets you detail out those gifts. It’s almost like bragging about your generosity while the IRS gives you an approving nod. Here’s to being the family’s favorite!

A Dash More Dough in Your Doughnut Fund

Hold onto your hats, because here comes a tax whisperer secret—the Standard Deduction! This is the magic that could beef up your bank balance, giving you a bigger slice of the tax-saving pie. For all the seasoned taxpayers, the 1040sr 2022 is your golden ticket to claiming a higher standard deduction. Yep, you’re not just a year wiser; you’re a year more tax-savvy too!

In the riveting world of the 1040sr 2022, it’s about making your golden years shine brighter, and who says taxes can’t be fun? Remember, it’s not just about the savings, but how you play the game…and when it comes to the 1040sr 2022, it looks like you’re winning!

What is the difference between filing 1040 and 1040sr?

Well, when it comes to taxes, figure this: Filing the 1040 is like your standard, run-of-the-mill option—it’s for the young guns and everyone else. On the flip side, the 1040-SR is a special treat just for seniors, typically 65 and up, with a font big enough that you won’t need to fish out your specs!

What is the extra standard deduction for seniors over 65?

Ah, the golden years bring more than just wisdom—they wave in an extra standard deduction! If you’re over 65, you get to tack on an additional amount to your standard deduction, kind of like a cherry on top. Sweet deal, huh?

What is the advantage of using 1040-SR?

The 1040-SR is a nifty tool—it’s like the 1040, but with perks dressed to the nines for seniors. It’s clear, easier to read, and lets you hawk-eye your Social Security benefits at a glance. Plus, that extra standard deduction? It’s already baked in!

Is there a 1040sr form for 2022?

Yup, the IRS rollout for 2022 included the 1040-SR. This form is fresh off the press each year, ready to make tax season a breeze for the silver-haired crowd.

At what age is social security no longer taxed?

Guess what? The tax man doesn’t always knock forever. Once you hit your golden years, specifically after you reach the age of Social Security full retirement (between 66 and 67 for most), up to 50% or, in some cases, up to 85% of your Social Security may be taxed, depending on your other income. But if that’s all you’ve got coming in, there’s a chance the tax could be nil, zip, nada.

Why use 1040-SR instead of 1040?

Choosing 1040-SR over the 1040 is a no-brainer for seniors! It’s like picking a walk in the park over an obstacle course. Bigger text, a focus on senior-specific tax benefits, and no need for tech-savviness—what’s not to love?

Do you have to pay income tax after age 72?

Hitting 72 isn’t just about the cake and extra candles—there’s also the Required Minimum Distributions (RMDs) from retirement accounts that the IRS starts expecting. Sorry folks, but Uncle Sam still wants a slice of that pie in income tax.

Do you have to pay income tax after age 70?

Turn 70 and you might be planning to slow down, but does income tax take a breather too? Not quite. While Social Security may not be fully taxed, if you’ve got other income streams, the tax gears keep turning—so don’t ditch your accountant just yet!

Does Social Security count as income?

“Does Social Security count as income?” Sure does, at least partially. It’s a bit like a magic trick—only a portion of it appears when the IRS pulls out the tax rabbit from its hat. Whether it’s taxed at 50% or 85%, depends on your other income.

Do seniors get a larger standard deduction?

Seniors don’t just get respect, they get a bonus at tax time too. Their standard deduction is bulked up—a financial thank you for years of hard work.

What is the IRS standard deduction for seniors?

For seniors, the IRS dishes out a more generous standard deduction to make tax time a bit less taxing. It’s like a senior discount, but for your taxes.

How much of Social Security is taxable?

When Uncle Sam looks at your Social Security, he doesn’t always grab the full amount. Only up to 85% could face taxes—the rest slips through tax-free. It’s all about that income mix and how full your financial plate is.

Do seniors use 1040-SR?

You bet they do! Seniors can opt for the 1040-SR, which is like their VIP pass for easy-peasy tax filing with clearer fonts and a format that respects the seasoned citizen.

How much social security is taxable on 1040-SR?

On the 1040-SR, figuring out how much Social Security is taxable can be like a walk in the park, with clearer lines and instructions tailored for the retirement set.

What is the standard deduction for 1040-SR 2022?

For 2022’s standard deduction on the 1040-SR, think of it as the 1040’s standard deduction with a little extra sugar—it’s sweeter for those 65 or older, giving a well-earned boost to those in their sunset years.

Who gets a 1040-SR?

Who gets to swing with the 1040-SR on the tax dance floor? Seniors, that’s who! If you’re 65 or older, this form’s got your name on it—it’s like the VIP entrance to the tax party.

Do seniors get a larger standard deduction?

Indeed they do! Seniors score a higher standard deduction—it’s like the IRS’s way of giving a high five for reaching those seasoned years.

Which 1040 form should I use?

Choosing between the 1040 forms is like picking your path in a choose-your-own-adventure book. Most will do the 1040, but if you’re a senior, saunter on over to the 1040-SR for that VIP treatment.

What is tax form 1040 used for?

Tax form 1040 is like the swiss army knife of tax forms—versatile and ready for action. Whether you’re a wage earner, self-employed maestro, or a gig economy juggling artist, this form’s where you report your annual financial odyssey to the IRS.