When you’re about to dive into the world of loans, whether it’s for a flashy new 2022 Honda accord or perhaps to fund the white picket fence dream with a cushy suburban home, the concept of ‘interest’ can either be your silent benefactor or an unwelcome guest at the dinner table. Let’s roll up our sleeves and decode this enigma of ‘interest calculations on loans,’ turning a typically convoluted subject into your bread and butter.

Breaking Down Interest Calculations on Loans

Now, sit tight; we’re about to slice and dice everything you need to know down to size! Money isn’t free, and interest is that little extra lenders charge you for using their dough. It’s like the price of renting money – if you get the drift. And just as there’s more than one way to skin a cat, there are different ways to calculate this interesting (no pun intended) cost.

Think of interest as either simple or compound – they’re the yin and yang in the world of finance. Simple interest is a flat rate over the principal – you know, the actual amount you borrowed. Compound interest, on the other hand, is like a snowball fight – it piles on over time.

Whether you’re eyeing a mortgage, car loan, or any other kind of personal loan, knowing your simple and compound distinctions is pretty darn essential. Trust me, your wallet will thank you later.

How to Calculate Interest Rate on Loan: The Fundamentals

“But how exactly do you go about this wizardry?” you might ask. Well, it’s all about the numbers. To get your head around how to calculate interest rate on loan, you’ll have to familiarize yourself with a few key players on the stage – namely, the principal amount, the interest rate (the percentage at which you’re being charged), and time (because time is always money, friend!).

Remember, there’s a little more to it than just these basics. Sure, you’ve got your nominal rate – that’s the advertised rate – but then there’s the effective rate, the one that truly tells the tale of what you’re shelling out after compounding gets its hands on your loan.

| Category | Description | Example Calculation | Remarks |

|---|---|---|---|

| Annual Interest Rate | The yearly rate charged by a lender to a borrower in order for them to loan money. | 6% annually | Represented as a percentage of the principal. |

| Monthly Interest Rate | The rate of interest charged each month. | 0.5% monthly (6% annual rate / 12 months) | Used for monthly payments. |

| Interest Calculation Formula | Standard formula used to calculate the interest on a loan. | Interest on Loan = P * r * t | P = principal amount, r = monthly interest rate, t = time in months. |

| Total Interest Over Loan Term | The total amount of interest paid over the entire term of the loan. | Total Interest = Principal amount * Interest rate * Term in years | This does not take into account any amortization effects in case of installment payments. |

| Monthly Payment Calculation | Used to determine the monthly payment amount including interest on a loan. | Not provided | Amortization formulas or calculators are typically used to compute monthly payments, which combine principal and interest for each month. |

| Annual Percentage Yield (APY) | The actual rate of return earned on an investment due to compounding interest. | Not provided | More accurate measure of the return on investment, taking compounding into account. |

| APY to Monthly Interest Rate | Conversion from annual percentage yield to a monthly rate. | Monthly rate = 12% APY / 12 = 1% monthly | Necessary to understand monthly earnings from the investment. |

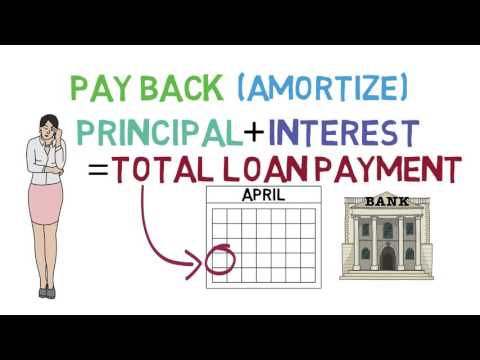

| Amortization | The process of spreading out a loan into a series of fixed payments. | Not provided | The balance of the loan decreases over time as payments are made, and the amount that goes towards interest decreases with each payment. |

Calculating Interest on a Loan: Step-by-Step Process

Alright, it’s showtime! Here’s a tangible walk-through: Say you’ve got a loan balance just sitting there, and it’s a doozy at $10,000 at a 6% annual rate. You’re making monthly payments, so what’s the drill? You slice that 6% by 12 to snag your monthly interest rate – that’s 0.5% (or 0.005 when you’re getting technical). That figure multiplied by your remaining balance gives you the interest for that month. Pretty straightforward, right?

And if you’re inclined for a digital helper, let’s pull up your favorite bank’s online calculators, such as the ones provided by Chase or Wells Fargo. They’ve got this whole ‘ shebang down pat.

Calculating Loans with Interest: Different Methods Explained

Want a deeper cut? There are a bunch of ways this cookie can crumble. The ‘simple interest method’ – it’s straight-up multiplication: principal, rate, and time. But life’s not always that simple, so there’s the ‘compound interest method’ where your interest earns its own interest – talk about inception!

And then there’s ‘amortization’, a real bigwig in the mortgage world. It’s the gradual reduction of debt over time, and it means every payment is part Crusader attacking the principal, part Magician handling the interest – a true balancing act.

Tools and Calculators for Accurate Interest Calculations

You won’t need a crystal ball to see into the future of your loan costs, thanks to some nifty tools and calculators. Websites like Bankrate or NerdWallet are stocked with these digital wizards that can crunch the numbers on your monthly payments or the total interest lickety-split.

Common Mistakes in Interest Calculations and How to Avoid Them

But hey, don’t get too carried away with your newfound savvy! Common missteps like mixing up your interest types or bungling the numbers can throw your whole game off kilter. Remember the golden rule: always double-check your work, and don’t hesitate to cross-verify with online resources like MortgageRater.

Case Studies: Real-Life Examples of Interest Calculations on Loans

Let’s take a stroll through some real-life scenarios. Imagine ‘Sue,’ who diligently used an amortization formula from MortgageRater for her home loan. Armed with knowledge and savvy planning, Sue managed to save a sizeable chunk of change on her interest payments.

Or take ‘Joe,’ whose flourishing small business took a loan leap with eyes wide open, understanding differences in interest calculations that ultimately let him choose the friendliest rates – talk about a strategic move!

Advanced Techniques in Interest Calculation for Loan Optimization

For those looking to level up, there’s more than just regular ol’ calculations. You could chuck in a few extra bucks in your monthly repayments to cut short the compound interest’s party, or swan dive into the world of refinancing for more amenable rates. Advanced techniques in the realm of ‘loan optimization’ aren’t just fancy footwork; they can be real game changers.

How Interest Calculations Influence Loan Choices and Financial Planning

So, how does all this number crunching and strategy talk affect the lay of the land? Knowledge is power, my friend. Being fluent in interest calculations helps you shake hands with the right loans and gives your financial future a solid foundation. It’s like having a financial compass; you’ll never get lost!

Conclusion: The Impact of Mastering Interest Calculations on Your Financial Health

Phew! Quite the journey we’ve had, but now you’re equipped with the financial know-how to tackle those interest rates head-on. Mastering the art of interest calculations on loans doesn’t just add feathers to your cap; it directly impacts your wallet’s heft – and I bet you’re all about fattening that wallet!

Remember, mortgages and loans might seem like Greek tragedies at first, but once you get the hang of them, they’re more like sitcoms – and hey, sometimes you might even find yourself chuckling at how you used to fret over them. So go forth, conquer those rates, and don’t forget to use that MortgageRater ‘loancalculator’ to make your financial episodes hassle-free!

Demystifying Interest Calculations on Loans

Ever wondered how your lender figures out the amount of interest you owe on your loan? It might feel like some magical number-crunching akin to the cast Of Uncle buck whipping up their hilarious antics. But don’t worry, interest calculations on loans are not as daunting once you get the hang of it.

When Math Meets Money

Alright, let’s break it down. Imagine you’re calculating interest as if you were Sasha Roiz solving a mystery on a hit TV show. The intrigue lies in the details, right? Interest rates can either be your best friend or that pesky villain depending on how they are applied. So, How do You calculate interest, you ask? Buckle up; we’re diving in!

Interest calculations are like a secret recipe, but once you’ve got the ingredients, it’s just mixing them together. The principal amount (the dough), the interest rate (the spice), and the time period (the cooking time) are all you need. Easy-peasy!

Ever feel like interest is a chatty neighbor – always hanging around, sometimes helpful, and sometimes not? With a simple interest calculation, it’s straightforward – chatting just about the principal. But with compound interest, it’s like Chatgpt open source – it’s got layers and keeps getting deeper the more you get into it, talking about what you owe last time, too!

There’s a Formula to It

Got a loan repayment due? Think of the loan payment formula like your GPS guiding you home. This little math marvel makes sure you stay on track, telling you exactly how much to pay each month. And just like a reliable GPS, it incorporates the total loan amount, interest rate, and loan term to give you the most efficient route to being debt-free.

And for those who fancy a bit of DIY – would you trust Donny Deutsch with a hammer? Of course! – our trusty Loancalculator tool is your financial toolkit. It does all the heavy lifting for you. Just punch in the numbers and let it construct your payment plan without breaking a sweat.

The Curious Case of Interest Calc

Now, isn’t that fascinating? Interest calculations on loans can be a bit of a caper, but once you’ve got all the clues, it’s no harder than following a recipe from your favorite cooking show. Just remember, keeping an eye on how the interest stacks up is essential – nobody wants a surprise ending when it comes to money. So get out there and take the mystery out of your loan interest—your wallet will thank you, and you’ll be left feeling like the star of your financial journey.

What is the formula to calculate interest on a loan?

Whew, calculating interest on a loan can feel like rocket science, but fear not! The formula’s actually pretty straightforward. Use I = PRT, where ‘I’ is the interest, ‘P’ is the principal amount (that’s the chunk of cash you borrowed), ‘R’ is the annual interest rate (in decimal form, so don’t forget to divide by 100), and ‘T’ is the time in years. Just plug in your numbers and, voila, you’ve got your interest!

How do you calculate the total interest on a loan?

Alrighty, to figure out the total interest you’ll fork over on a loan, you’ll need to dip into some basic math. Take the amount you borrowed (that’s your principal) and multiply it by your annual interest rate and the number of years you’ll be in debt. Here’s a kicker—this calculation works for simple interest, but if you’ve got compound interest tagging along, you’ll need a more snazzy formula or a handy online calculator.

How do you calculate effective interest on a loan?

Calculating effective interest on a loan is like uncovering the true cost of borrowing. For this, you use the formula: EIR = (1 + i/n)ⁿ – 1. EIR stands for Effective Interest Rate, ‘i’ is the annual interest rate again, and ‘n’ is the number of compounding periods per year. Toss those numbers in, do a bit of number-crunching and presto, you’ve sussed out the real rate!

How do you calculate monthly interest?

For monthly interest, the calculation’s a piece of cake. Just divide that annual interest rate of yours by 12 (for the 12 months in a year, right?) and then multiply by the balance of your loan. In other words, Monthly Interest = (Annual Interest Rate/12) x Loan Balance. Easy-peasy!

What is the easiest way to calculate interest?

Looking for the easiest way to calculate interest? Go for the simple interest formula: I = PRT. Can’t get simpler than that! Remember, ‘P’ is your principal, ‘R’ is the rate (make sure to convert to decimal form), and ‘T’ is time in years. Multiplication is all it takes, and you’re on easy street.

How do I calculate interest?

How do I calculate interest? It’s basic math! Grab the simple interest formula, I = PRT, and multiply your principal amount (P) by the rate (R, don’t forget the decimal!) and the time (T). If you’re crunching compound interest, though, better brace yourself for a more complex equation or snag an online calculator to do the heavy lifting.

What is 6 interest on a $30000 loan?

If you’re scratching your head over 6% interest on a $30,000 loan, here’s the skinny: first, make that percentage a decimal by dividing by 100, so 6% becomes 0.06. Then, it’s just PRT—$30,000 for ‘P’, 0.06 for ‘R’, and let’s say 1 year for ‘T’. Do the math, and you’ve got $1,800 smiling back at you.

What is the formula for the rate?

Hunting down the formula for the rate? Look no further than our old chum, I = PRT, but this time we’re solving for ‘R’. So, rearrange to R = I / (PT). Here ‘I’ is interest, ‘P’ is principal, and ‘T’ is the time in years. Just pop those numbers in, and boom, you’ve got your rate!

How do you calculate interest per year?

To calculate interest per year, you can stick with I = PRT. Just remember that ‘T’ is your time, so keep it at 1 year for this rodeo. Multiply your loan’s principal by the annual interest rate, and you’ve caught that interest for the year, hook, line, and sinker.

How do you calculate 12% interest on a bank?

% interest from the bank got you puzzled? Okay, pretend it’s simple interest. Start with I = PRT, convert that 12% to 0.12, choose your principal, and bam, use 1 for ‘T’ because you’re talking one year. Plug and chug, friend, and that interest will show itself.

What is the formula for simple interest monthly?

For simple interest monthly, the formula gets a slight tweak: I = (P x r x t) / 12. ‘P’ remains your principal, ‘r’ is the annual interest rate (in decimal form), and ‘t’ is the time in months. Divide the whole thing by 12, and you’ve got interest on a monthly platter.

What is the formula for interest calculated daily paid monthly?

Interest calculated daily, paid monthly, gets a tad complex, but we’ve got it: I = (P x r x n) / (t x 12). ‘P’ for principal, ‘r’ is the daily interest rate (annual rate/365), ‘n’ is the number of days you’re calculating for, and ‘t’ is the number of days in a year. Mix them up, divide by 12 for that monthly spin, and there’s your number.

What is monthly interest rate?

Monthly interest rate is just your annual rate playing the divide game. Take that yearly interest rate, slash it by 12, and you’ve nailed it. So, Monthly Interest Rate = Annual Interest Rate / 12. A cool move to show who’s boss of your finances.

How do you calculate interest calculated daily paid monthly?

Interest calculated daily, but paid monthly is a two-step dance. First, convert the annual rate to a daily rate by dividing it by 365. Next, multiply this daily rate by your balance, and then by the number of days in the month. Finish it off by adding each day’s interest together for the monthly total. Sure, it’s a bit of legwork, but who said money matters were a walk in the park?