In the journey to homeownership, nothing quite matches the feeling of making that last mortgage payment. But why wait 30 years when you can wield the power of a mortgage payment calculator with extra payments? This isn’t your average calculator we’re talking about; it’s a tool that can potentially clip years and tens of thousands of dollars off your loan’s lifespan.

How Mortgage Payment Calculators with Extra Payments Work

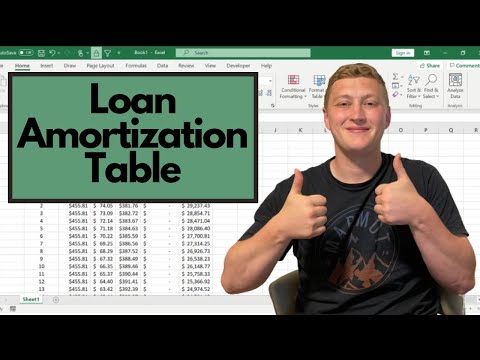

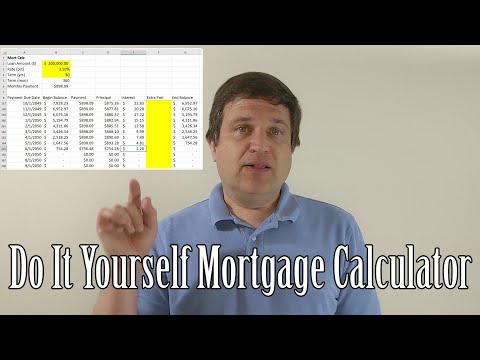

To understand these calculators, you first gotta grasp the basics. A standard mortgage calculator crunches numbers – principal, interest rate, and loan term – spitting out your monthly payment. But an extra principal payment calculator steps up the game. It’s like going from watching black-and-white TV to full HD – suddenly, you see the effects of feeding your loan a little extra cash each month.

The beauty of an amortization calculator with extra payments is in its ability to show you how chipping in more than the minimum payment slashes both your interest and the time you’re shackled to a lender. And let’s face it, folks, in a world where every penny counts; who doesn’t want to save a pretty dime?

Crazy Tip #1: Maximizing Interest Savings with Extra Payments

Picture this: you’re making regular payments, then you start throwing an additional $100 at your mortgage each month. Like magic, that loan amortization calculator with extra payments unveils the curtain to reveal a reduction in interest payments that’ll have you doing the happy dance. Some lucky ducks might even save themselves over $26,500 in interest!

Financial platforms like Zillow or Bankrate can be your trusty sidekick in this quest. They offer robust mortgage amortization calculators with extra payments that can shape up your payment plan and get you out of debt quicker than you can say “financial freedom.

| Feature | Description | Impact |

|---|---|---|

| Standard Monthly Payment | The regular payment amount based on the original loan terms (interest rate, principal, and loan term). | Baseline for comparison. |

| Extra Payment Options | – Additional fixed monthly payment (e.g., $100, $200, $500) – Lump-sum payments (e.g., annual, one-time) – Bi-weekly payments (equivalent to one extra month’s payment per year when added as 1/12th of a monthly payment) |

These options provide flexibility in how and when extra payments can be made, catering to different financial situations. |

| Reduced Loan Term | The number of years you can shave off the life of your loan by making extra payments. Depends on the extra amount and frequency. | Earlier loan payoff means owning your home sooner. Calculators can show the specific reduction in years based on the extra payment amounts. |

| Interest Savings | The total amount of interest saved over the life of the loan when making extra payments. | Substantial savings can be achieved, which can be tens of thousands of dollars. Calculators help to illustrate the long-term financial benefits of making additional payments. |

| Amortization Schedule Adjustment | A revised breakdown of the payment schedule that includes the reduced number of payments and the allocation of each payment towards interest and principal after factoring in the extra payments. | Allows homeowners to see how their payment schedule has been modified and how quickly they are paying down their principal. |

| Online Calculator Accessibility | Many online mortgage payment calculators enable users to input the extra payment amount and frequency to automatically calculate reduced loan term and interest savings. | Provides immediate figures and graphs to illustrate potential benefits without complicated math for the user. User-friendly tools are often free and available on financial websites. |

| Long-term Financial Planning | The calculator’s results assist homeowners in making informed decisions regarding their long-term financial goals and the implications of extra payments on their overall financial plans. | Enables a proactive approach to mortgage management and financial health. |

Crazy Tip #2: Tactical Extra Payment Scheduling

When to pay? Now, that’s where strategy kicks in. Whether you swipe a little extra off your plate monthly, quarterly, or annually, rest assured: each dime’s doing its valiant part. Imagine you have a mortgage calculator extra payment tool at your disposal — it’ll show you that adding 1/12th of your payment monthly equates to one full extra payment a year, without breaking a sweat!

Say you land a hefty tax return or a bonus, these extra payments could shave four to eight years off your mortgage, and that’s not just chump change we’re talking about. Case studies show homeowners waving goodbye to their mortgages years ahead of schedule, all thanks to this simple yet sly move.

Crazy Tip #3: Utilizing Unexpected Income for Mortgage Reduction

Let’s chew on this: what happens when a windfall lands in your lap? Tax refunds, bonuses, grandma’s birthday checks — every extra payment calculator mortgage wizard knows these should be funneled straight into your mortgage. These unexpected cash surges could be your golden ticket to chopping down that loan term and the interest piling up.

With the mortgage calculator with extra payment feature, you can play around with these numbers. Does a $500 extra chunk each month tickle your fancy? How does saving $60,798 in interest over the life of your loan sound? And owning your house 13 years sooner? Yeah, that has a nice ring to it.

Crazy Tip #4: Fine-Tuning Extra Payments for Optimal Results

Trial and error, my friend, trial and error. With an extra principal payment calculator, you can tinker with different extra payment amounts and lengths. It’s like playing financial dress-up with your mortgage, finding the perfect outfit that looks oh-so-glamorous on your wallet.

And it’s not just about hefty sums; small, consistent extra payments bring home the bacon too. By incrementally adding to your principal every month, you whittle down that mountain of debt bit by bit — that’s fewer interest dollars lining the pockets of your lender.

Crazy Tip #5: Alternative Uses for Calculated Savings through Extra Payments

Before you start celebrating your savvy savings, take a beat. Let’s get a mortgage payoff calculator extra payment to paint the full picture. Suppose you roll your mortgage savings into another investment? It’s a bout between eliminating debt and boosting your investment portfolio. Which heavyweight champion takes the belt for your financial future?

This ain’t a one-size-fits-all scenario. Weighing the returns from other investments against the guaranteed “return” of saving on mortgage interest is a classic tale of risk versus reward. And trust me, seeing those investment numbers spike can be as satisfying as watching your loan dissolve.

Unconventional Uses of Loan Extra Payment Calculators

These calculators aren’t just one-trick ponies. Aside from the standard use, a loan extra payment calculator can be a powerful ally in mapping out savvy financial strategies. It’s the Robin to your Batman when it comes to planning for those life milestones.

Moreover, don’t undervalue the psychological boost that loan payoff calculator with extra payments provides. There’s a tangible increase in motivation when you witness the loan’s end date creeping closer. That emotional win is worth its weight in gold.

Paying Extra on Mortgage: Real-World Success Stories

Real people, just like you and me, have used a mortgage extra payment calculator to rewrite their financial stories. They’ve tossed aside the chains of a 30-year sentence and stepped into the sunrise of mortgage liberation much sooner.

These calculators come with names and bragging rights. Take the home loan payoff calculator on MortgageRater.com, for example. It offers features that enable users to crunch numbers in ways that would make even Jane Fonda’s workout seem less intense.

Mortgage Payoff Tactics for Different Loan Types

Whether you’re snuggled up with a conventional, FHA, or VA loan, using a mortgage payment calculator with extra payments unique to your loan type crafts a custom battle plan. And if you’re dancing with an ARM, being nimble with your payments can keep you two-stepping ahead of those fluctuating rates.

Your loan type dictates the moves you make. Like choosing the perfect adaptor for your overseas travels, selecting the right payoff strategy can make all the difference to your financial journey.

Technological Advancements in Mortgage Calculators

In 2024, mortgage calculators with extra payment options are souped-up with the latest tech. From slick app integrations to on-the-go calculations, they’re like the Kia Stinger gt of financial tools – fast, efficient, and designed to get you where you want to be quicker than you thought possible.

Keeping pace with personal finance management tools, these calculators blend seamlessly into your daily digital life, ensuring your extra payments are always on track.

Pro Tips for Navigating Extra Payment Options

Here’s the inside scoop: before you go guns blazing with additional payments, you better get savvy about your lender’s stance on “prepayment penalties.” Some might welcome your extra dough with open arms, while others eye it warily.

Use an extra principal payment calculator to craft your strategy. But also, give a buzz to your lender. Confirm how they handle those extra payments to avoid any financial faux pas.

Conclusion: The Smart Borrower’s Approach to Mortgage Freedom

Congrats, my financially astute friend, you’ve made it to the end! You’ve got the inside track on how a mortgage payment calculator with extra payments can elevate your fiscal health to new heights. It’s like knowing the secret ingredient to your grandma’s legendary apple pie!

Take these tips, your newfound wisdom, and a dash of courage, and plunge into the strategic sea of mortgage calculators. Institutions like “MortgageRater.com” with their “home loan payoff calculator” or mortgage formula expertise stand ready to guide you.

Own your journey to mortgage freedom with passion and purpose. By making informed, strategic extra payments, you don’t just chase financial liberation—you live it. So here’s to you, the savvy borrower, charting your course to a debt-free horizon. Now, go conquer!

Master Your Mortgage: Work Magic with a Mortgage Payment Calculator with Extra Payments

Are you ready to dive into the wacky world of mortgages? Who said home loans had to be all suits and snores? Grab a cuppa and let me spill the tea on how a mortgage payment calculator with extra payments can be your financial fairy godmother.

Extra Payments: Your Secret Weapon

When it comes to chiseling away at that mountain of a mortgage, making extra payments is like arming yourself with a laser-guided pickaxe. Picture this: every extra cent you sneak into that payment is like an invisible warrior battling against your loan balance.

But before you start doubling down on those digits, you might wanna get acquainted with the infamous prepayment penalty—yep, that’s the boogeyman waiting to snatch a slice of your savings if you pay off your mortgage faster than a cheetah on a skateboard.

When Paperwork Becomes Less Work

Think getting your hands on a mortgage is all about signing your life away? Hold your horses! There’s a knight in shining armor you need to meet, and it goes by the name of a quit claim deed form. Trust me, this little piece of parchment is worth its weight in gold. It lets you do a little hocus pocus and transfer property faster than you can say “presto change-o!

Hollywood and Your Mortgage?

Okay, hear me out—what if I told you that strategizing with a mortgage payment calculator was like directing one of those intense Jane Fonda Movies? Yeah, you read that right! Dialing in those extra payments is like directing the perfect scene, where the heroine (that’s your bank account, by the way) triumphs against the evil mortgage villain.

Picture the Finish Line

Sure, using a mortgage payment calculator with extra payments isn’t as exhilarating as skydiving, but imagine the thrill of shouting “Freedom!” once you pay off mortgage early. Tailor those extra payments like you would a vintage suit, and watch as the years and interest melt away.

The Takeaway: It’s Game Time

Now that you’re all jazzed up with these tidbits, remember that playing around with a mortgage payment calculator with extra payments isn’t just for kicks—it’s the smart way to tiptoe towards mortgage freedom. Just don’t get too carried away, or you might find out that your mortgage calculator becomes your new BFF.

So there you have it—whether you’re using extra payment sneak attacks, dodging prepayment penalties like a pro, transferring property ownership with ease, or channeling your inner Jane Fonda, the road to conquering your mortgage doesn’t have to be a snooze fest. Fire up that calculator, and let’s make those mortgage payments shake in their boots!

How much sooner will my mortgage be paid if I pay extra?

Alrighty then, let’s get crackin’ on those mortgage queries!

What happens if I pay 2 extra mortgage payments a month?

How much sooner will my mortgage be paid if I pay extra?

– Paying extra on your mortgage is like giving caffeine to your payment schedule; it perks up and moves a lot faster! The exact time shaved off depends on your loan’s size, interest rate, and the extra amount paid, but don’t be surprised if you shave off several years!

What happens if I pay an extra $500 a month on my mortgage?

What happens if I pay 2 extra mortgage payments a month?

– Oh, doubling down, are we? Making two extra payments a month turns your mortgage into a rapidly shrinking snowball rolling downhill. You could dramatically reduce your interest charges and could be mortgage-free in half the time or less.

How much will 100 extra mortgage payments save me?

What happens if I pay an extra $500 a month on my mortgage?

– Throwing an extra $500 at your mortgage each month is like hitting the fast-forward button. You’ll slash your interest and could potentially cut your loan term by a decade or more, depending on your original loan terms.

How do you pay off a 30 year mortgage in 15 years?

How much will 100 extra mortgage payments save me?

– Dish out 100 extra mortgage payments and watch the savings rack up! You could save a small fortune in interest charges and knock years off your mortgage. It’s like finding a shortcut on the road to owning your home outright.

How to pay off a 30 year mortgage in 10 years?

How do you pay off a 30 year mortgage in 15 years?

– Wanna half your 30-year mortgage? Crank up your payments – think biweekly or even doubling up, cut down expenses, and say ‘no thanks’ to that latte. It’ll take discipline and a larger budget, but your mortgage’s end date will thank you for it.

How to pay off 250k mortgage in 5 years?

How to pay off a 30 year mortgage in 10 years?

– Ready for a sprint? To knock off a 30-year mortgage in 10 years, you’ll need to buckle down. Boost those payments, focus on making extra payments regularly, and keep steady like a turtle (but faster).

What is the 10 15 rule mortgage?

How to pay off 250k mortgage in 5 years?

– Want to demolish that $250k mortgage in 5 years? You’ve got to go all-in! Brace for hefty payments, say goodbye to frivolous spending, and perhaps start a side hustle. Tighten that financial belt, and you’re golden.

What happens if I pay $1000 extra a month on my mortgage?

What is the 10 15 rule mortgage?

– The 10 15 rule is like a secret recipe for mortgage freedom. Basically, if you pay 10% more each month, you could save 15% on total interest. Not too shabby for a simple little tweak, right?

When should you not pay extra on a mortgage?

What happens if I pay $1000 extra a month on my mortgage?

– Forking over an extra grand each month could see your mortgage fading faster than a pop star’s fame. You’ll slice through interest like a hot knife through butter and could end your mortgage years ahead of schedule.

How to pay off $150,000 mortgage in 10 years?

When should you not pay extra on a mortgage?

– Hold your horses on those extra payments if you’re juggling high-interest debt, lack emergency savings, or if the terms of your mortgage come with prepayment penalties that could bite you in the wallet.

What happens if I pay 3 extra mortgage payments a year?

How to pay off $150,000 mortgage in 10 years?

– Set sights on crushing that $150k mortgage in a decade by ramping up your monthly payments, maybe refinance to a lower interest rate, and keep your eyes on the prize. You’re driving down ‘Freedom from Debt’ Boulevard!

What happens if I pay $200 extra on my mortgage?

What happens if I pay 3 extra mortgage payments a year?

– Three extra payments a year, and you’re skating on the fast track to owning your home outright. Apart from feeling like a financial wizard, you’ll cut down on interest big time and could end your mortgage journey early.

How fast can you pay off a 30 year mortgage with double payments?

What happens if I pay $200 extra on my mortgage?

– Toss an extra $200 monthly on your mortgage, and you’re chipping away at it bit by bit, like sculpting a debt-free statue. You’ll pay less interest over time and banish that mortgage sooner than you thought.

Is it smart to pay extra principal on mortgage?

How fast can you pay off a 30 year mortgage with double payments?

– Double payments? Boom – that’s like turbo-charging your debt demolition! You might kiss that 30-year mortgage goodbye in less than 15 years, saving a heap of interest to boot.

How to pay off a 30 year mortgage in 5 7 years?

Is it smart to pay extra principal on mortgage?

– Paying extra principal on your mortgage? Smart as a whip! Less interest, shorter loan life, and before you know it, you’re doing the debt-free dance.

What happens if I pay an extra $100 a month on my mortgage principal?

How to pay off a 30 year mortgage in 5 7 years?

– Ready, set, hustle! To wipe out that 30-year mortgage in 5-7 years, get ready for some serious budgeting. Up those payments, consider refinancing for a better rate, and maybe moonlight as a superhero because you’re going to need superpowers to pull this off.

How to pay off 250k mortgage in 5 years?

What happens if I pay an extra $100 a month on my mortgage principal?

– Splashing an extra $100 a month on your mortgage is like giving each dollar a job. You’ll chop a chunk of interest off and show that principal who’s boss, leading to an earlier mortgage burning party.

What happens when you make 2 extra house payments a year?

How to pay off 250k mortgage in 5 years?

– You’re aiming for a 5-year finish line on that 250k mortgage? Time to dial payments up to eleven, toss any extra cash at it like it’s hot, and trim the fat off your budget. It’s all about dedication and a bit more than pocket change.