When you’re in the thick of home financing, a prepayment penalty can feel like your worst frenemy. It’s complex, can catch you off guard, and just when you think you’ve got your finances on a smooth ride, it can pop up and make you say, “Aw, come on!” But knowledge is power, and today we’re diving deep into the world of prepaying with an eye-popping look at prepayment penalties.

Understanding Prepayment Penalties: The Basics

What exactly is a prepayment penalty? It’s a fee lenders might charge if you get too eager to pay off your mortgage early. Seems a bit backward, right? You’d think they’d appreciate getting their money back posthaste! In simple terms, the penalty is there to keep the lender’s pockets warm with the interest you would’ve paid over the years.

The nitty-gritty of prepayment penalties includes a smorgasbord of terms and conditions depending on your lender. Generally, it factors in a percentage of your remaining balance or a chunk of interest payments you won’t be making anymore. It’s like being grounded for coming home early – you’re penalized for doing something you’d think was good!

The Origins and Reasons Behind Prepayment Penalties

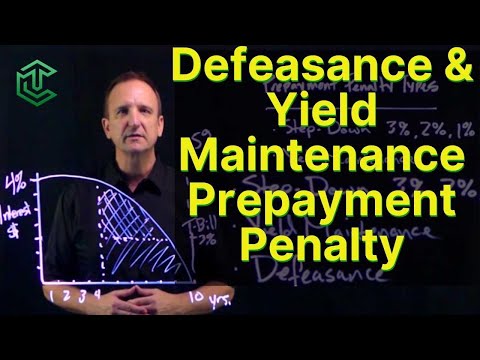

Now, why on Earth did these penalties sprout up? Historically, when interest rates were more like roller coasters, lenders needed a safety net. They wanted to ensure they’d still make a profit, even if borrowers found ways to pay less interest through refinancing or just dumping a heap of cash to pay off a loan early.

From a lender’s standpoint, prepayment penalties make a lot of sense – they mitigate the risk of losing out on the sweet interest they’d planned on. They’re like a baker who bakes a big cake expecting a full party but ends up with a few guests; they need to charge for the whole cake to cover costs!

| Aspect | Details |

|---|---|

| Definition | A fee imposed by lenders for paying off a mortgage loan partially or in full before the term specified in the contract. |

| Purpose | To compensate the lender for the interest income they would lose as a result of the early loan termination. |

| Typical Penalty Examples | A fee equating to a percentage of the remaining balance (e.g., 2%) or a certain number of months’ interest. |

| Penalty Calculation | Often based on the remaining mortgage balance or a set number of months’ worth of interest. |

| Example Scenario | Refinancing a loan within the first two years might incur a $4,000 penalty if the remaining balance is $200,000 (2% of the balance). |

| Avoidance Strategies | Select a lender without a prepayment penalty for conventional loans; refrain from refinancing or selling the home during the penalty period. |

| Typical Penalty Period | Usually up to three years after originating the loan. |

| Legal Considerations | Prohibited on consumer loans and commercial loans less than $5,000; real estate secured loans (mortgages) may still have prepayment penalties. |

| Financial Impact | The penalty can offset potential savings from refinancing at a lower interest rate or can reduce profit from selling the property early. |

| Negotiation | Potential borrowers can negotiate with lenders to remove or reduce the prepayment penalty before signing the mortgage agreement. |

| Current Trend | More consumers are opting for loans without prepayment penalties due to the flexibility of being able to refinance or sell without additional cost. |

Fact 1: Not All Loans Come with a Prepayment Penalty

You might be thinking, “So I’m stuck with this penalty, huh?” Hold your horses! Not all loans are created equal, and not all of them come with prepayment penalties. For instance, while some adjustable-rate mortgages might have them, many fixed-rate home loans are free from this nuisance. There are even states that frown upon these penalties, making it even harder for lenders to include them.

As of 2024, regulations keep swinging the pendulum towards consumer-friendly practices. So, when you’re on the prowl for a loan, scope out those without prepayment penalties. It’s like finding a pair of shoes that are both stylish and comfortable – a win-win!

Fact 2: Prepayment Penalties Can Vary Greatly Among Lenders

Just like snowflakes, prepayment penalties vary from lender to lender. You might see a structure where the penalty decreases over time, almost like a countdown clock to freedom. Comparing the various penalty terms across different institutions could save your wallets from taking a hit.

Take the case of Bulger’s example from January 9, 2024, who mentions a $4,000 penalty for refinancing within two years of the loan – staggering, right? It’s essential to do a deep dive into these specifics before you find yourself in a financial pickle.

Fact 3: There’s Often a Limited Window for Penalty-Free Prepayment

We’ve got a small light at the end of this tunnel – lenders typically offer a short grace period where you can make extra payments penalty-free. Picture this scenario: You’re two years into your mortgage, and you receive a large inheritance (lucky you!). Most lenders won’t bat an eye if you drop some of that cash into your mortgage within the first year. It’s their silent nod to “go ahead, make my day.”

But after this honeymoon phase, the prepayment penalty kicks in, and you have to strategize to avoid it, much like tiptoeing around puddles after a storm.

Fact 4: The Cost of Prepayment Penalties Can Be Substantial

Let’s not sugarcoat it – prepayment penalties can cost you big time. Imagine signing off a chunk of your savings just because you decided to be responsible and pay your loan off early. It can be quite the financial blow, so you have to get your calculator out and crunch the numbers. For tools to simmer down your headache, a home loan payoff calculator can be a lifesaver, helping you visualize the impact on your budget.

Calculating these penalties ahead of time is crucial, as they can dictate whether prepaying is financially savvy or a money pit waiting to happen. You’ll need to consider factors like the loan balance, the penalty’s structure, and the timing of your prepayment.

Fact 5: Prepayment Penalties Can Be Negotiable or Waived Under Certain Conditions

Truth bomb: prepayment penalties are not set in stone. If your negotiating skills are on point, you can discuss your way out of them, or at least reduce the hit to your bank account. Certain situations – think a home sale due to job relocation – can also lead to a lender waiving the fee. Lenders aren’t heartless – they know life happens.

It’s also important to know your rights. With the rise of consumer advocacy and shifts in the legal landscape, more and more consumers are challenging prepayment penalties and coming out on top. It’s like finding an extra wing in your bucket of chicken – sometimes you get a win when you least expect it!

Navigating Around Prepayment Penalties: Tips and Strategies

Now, for the practical Kiyosaki vibes – how do you steer clear of these penalties? First, understand the mortgage formula inside out. Knowledge is your best weapon. Look for loopholes and grace periods and plan your payments accordingly.

Always read the fine print, and when in doubt, consult with a financial planner. They can help you plot a course through the choppy waters of mortgage penalties. And remember, mortgage payment calculators with extra payments are like superheroes for your financial planning – use them!

The Future of Prepayment Penalties in the Mortgage Industry

Predictions are always risky, but with the winds of change in the financial world, we can expect prepayment penalties to become more transparent and, perhaps, less common. New fintech could empower more consumers to avoid these fees or manage their loans in smarter ways, potentially leading to a decline in prepayment penalties’ popularity.

From consumer advocacy to regulation changes, many factors are shaping a future where penalties could become a relic of the past. It’s kind of like thinking about DVDs in the age of streaming – a concept that might soon seem outdated.

Conclusion

Navigating the maze of prepayment penalties isn’t exactly a day at the beach, but with a little prowess, you can emerge unscathed and perhaps even ahead of the game. We’ve walked through the perplexing nature of these penalties, the importance of doing your homework, and the tactical approach to managing or circumventing them.

So, next time you’re gazing at your mortgage papers, remember: a penalty doesn’t mean you’re in the penalty box forever. A vigilant borrower is a victorious borrower, and with every twist and turn the mortgage world takes, staying informed is your ticket to a smarter, more prosperous financial future. Keep this in mind, and your journey through the world of prepaying will be less of a thriller and more of a feel-good rom-com. Now go on, start plotting your path to prepayment proficiency!

The Inside Scoop on Prepayment Penalty

Ah, the prepayment penalty—a pesky little clause that might have you working harder than a reverse cowgirl just to figure out why paying your mortgage off early could warrant a penalty. When navigating the wild ride of home loans, understanding this potential hitch can save you from a financial faceplant. Buckle up, because these 5 shocking facts about prepayment penalties are going to make you as informed as Snoop Dogg’s wife is about the intricacies of her husband’s career!

1. The Sneaky Side of Prepayment

Thinking about trying to pay off mortgage early, eh? Well, just like prepping for some serious neck Workouts, you gotta know what you’re up against. Some lenders are like that one friend who says they’re chill but goes all drama llama when you actually do something unexpected. They might hit you with a fee for paying off your loan ahead of time—because, get this, they were counting on that sweet, sweet interest you’d be paying over the years. Now, isn’t that a kicker?

2. The Plot Twist in Mortgage Payments

Are you the type who brings a calculator to a knife fight? If you are, you’ll love this: there’s a tool out there that’s your ticket to becoming a mortgage payment ninja—a mortgage payment calculator With extra Payments. Yup, you heard that right. This baby lets you play with numbers like a DJ with beats, showing you how making additional payments could shave years and dollars off your mortgage. Just make sure you’re not stepping into prepayment penalty territory, or your budget night turn into a sausage party 2: unexpected expenses edition.

3. A Little Glitter to the Situation

Now, let’s say you’ve got some extra dough—maybe from selling some snazzy shop jewelry For mom—and you’re eyeing your mortgage like a fat turkey on Thanksgiving. Before you go all generous, check for a prepayment penalty clause. It might just turn your smart financial move into a ‘whoopsie-daisy’. Always read the fine print, or it could cost you more than a pretty penny, possibly enough to snag yourself a whole jewelry store!

4. The Not-So-Ugly Truth

Okay, here’s some good news to stop you from fretting. Prepayment penalties aren’t a forever thing. Like sausage party 2 rumors, they usually have an expiration date. Most lenders drop the penalty after a few years, so if you can hold your horses just a tad longer, you might be able to make those extra payments without getting slapped with fees.

5. Knowledge Is Power, But Timing Is Everything

Last but not least, remember: when it comes to mortgages, timing is everything. Picture doing neck workouts without warming up—you’re just asking for a world of hurt. If you’re up to speed on the terms of your loan (prepayment penalty included), you’re less likely to face unexpected costs. And if you’re still feeling iffy about the details, maybe getting cozy with that mortgage calculator can help you avoid pulling a muscle—or in this case, draining your wallet.

So, there you have it—a few surprising snippets about prepayment penalties that’ll have you ready to tackle your mortgage like a champ. Just remember, stay informed, weigh your options, and you’ll boss your way through the mortgage game!

What is an example of a prepayment penalty?

An example of a prepayment penalty? Picture this: You’ve been chucking extra cash at your mortgage to cut it down faster, and bam! Your lender slaps you with a fee for paying too early. That’s a prepayment penalty for ya—it’s like getting grounded for doing your chores too quickly.

How do I avoid a prepayment penalty?

How do I avoid a prepayment penalty? Ah, dodging that fee is key! Here’s the skinny: before you sign on the dotted line, read that fine print like it’s a treasure map. Look for “prepayment penalty” clauses, and if you spot ’em, negotiate or shop elsewhere. And hey, ask before you overpay—some lenders give you a freebie or two.

Why do banks have prepayment penalties?

Why do banks have prepayment penalties? Well, banks are in the money game to make, you guessed it, money! When you pay off loans early, they miss out on interest they were counting on. So, they charge prepayment penalties to make sure they get a slice of that profit pie, even if you bolt early.

Is it legal for a lender to charge a prepayment penalty?

Is it legal for a lender to charge a prepayment penalty? Yep, it’s as legal as pumpkin pie at Thanksgiving. However, lenders gotta lay it out in your contract, clear as day. So, keep your peepers peeled and read that contract like it’s a mystery novel—cover to cover.

How do I calculate a prepayment penalty?

How do I calculate a prepayment penalty? Roll up your sleeves—it’s math time! Calculation methods vary, but here’s one: Multiply your remaining loan balance by the penalty percentage. Or, it could be a few months’ worth of interest. Your contract spells it out, so don your detective hat and decode your terms.

What states do not allow mortgage prepayment penalties?

What states do not allow mortgage prepayment penalties? Good news for some homeowners—places like California and New York have said “no thanks” to these pesky penalties. It’s always best to check local laws though, as they’re as changeable as the weather.

Can you pay off a 72 month car loan early?

Can you pay off a 72-month car loan early? You betcha! But watch for the prepayment ambush. If the coast is clear of penalties, dropping that car loan like a hot potato can save you a heap in interest.

Do all mortgages have prepayment penalties?

Do all mortgages have prepayment penalties? No siree, not all mortgages want to spoil your payoff party. Many are penalty-free, especially since backlash has lenders stepping back from these fees. Always ask—it’s better to be safe than sorry!

What happens if you pay off your mortgage early?

What happens if you pay off your mortgage early? You’re sitting pretty if you do! No more monthly payments, plus you’re saving a bundle in interest. But, keep an eye out for the prepayment penalty boogeyman—he could take a bite out of your wallet.

Who benefits from a prepayment penalty?

Who benefits from a prepayment penalty? Not you, that’s for sure! It’s the lender’s jackpot, ensuring they don’t lose all the dollars they’d earn from your interest payments, even when you’re trying to be debt-free.

Why is prepayment bad?

Why is prepayment bad? Well, it’s not bad for you if you’re itching to be debt-free. But for lenders, it’s like biting into a sour apple—less interest means less profit, and nobody likes less money, right?

Why do lenders not like prepayment?

Why do lenders not like prepayment? Imagine someone pulling the rug out from under you—that’s how lenders feel about prepayment. They bank on that sweet interest over time, and prepayment swipes it away.

What is the 321 prepayment penalty?

What is the 321 prepayment penalty? Think of it as a countdown to freedom. Pay off your loan early, and you might face a penalty that shrinks over time—3% of the balance in year one, down to 1% in year three. It’s the lender’s way of keeping you on the leash, just a bit longer.

Can I pay my mortgage 6 months in advance?

Can I pay my mortgage 6 months in advance? Sure thing! Like a squirrel stashing nuts, you can pay ahead of the game. Watch out for prepayment penalty traps, though, or it could end up costing you.

How can I payoff my mortgage faster?

How can I payoff my mortgage faster? Here’s the inside scoop: throw extra cash at those principal payments, refinance to a shorter term, or make bi-weekly payments. Just be sure you’re not stepping on a prepayment penalty landmine.

Which of the following are examples of prepayments?

Which of the following are examples of prepayments? Think paying your tab before you’ve finished your drink! This could be your rent, insurance, or even that shiny new mobile plan you splurged on—handing over cash before services are delivered, that’s the name of the game.

What is the 54321 prepayment penalty?

What is the 54321 prepayment penalty? It’s a countdown on your cash, and here’s the deal: the penalty starts at 5% of your loan balance and drops each year until it hits the big zero after five years. Lenders sure know how to make an exit plan sting!

What is a prepayment penalty on a personal loan?

What is a prepayment penalty on a personal loan? So, you’re quick on the draw, paying back that personal loan ASAP. Hold your horses! You might get dinged with a fee for breaking the bank’s golden rule: “Thou shalt not pay off thy loan before we get our interest.”