New York, often considered the financial capital of the world, is as unique in its sales tax laws as it is in its bustling city life. For those dipping their toes into the New York market or considering that dream penthouse overlooking Central Park, a clear understanding of the New York sales tax rate (NY sales tax rate) is as crucial as the steadfast commitment of a seasoned Wall Streeter. So, let’s unravel the knotty threads of New York’s tax tapestry, and perhaps even debunk a tax myth or two along the way.

The Intricacies of the New York Sales Tax Rate

Understanding the Foundation of NY Sales Tax Rate

When we talk about the foundation of the New York sales tax rate (NYS sales tax rate), it’s like delving into the underbelly of a giant beast. There’s a base state tax, and then, just when you think you’ve got it figured out, local taxes come into play like a New York minute, altering what you thought you knew! In essence, the New York state sales tax rate is a sum of the state’s base rate and additional local taxes. The current total sales and use tax rate stands firm at 8.875 percent, inclusive of the New York City local sales and use tax rate of 4.5 percent, the New York State sales and use tax rate of 4.0 percent, and the Metropolitan Commuter Transportation District surcharge of 0.375 percent.

For official guidelines, swinging by the New York Department of Taxation and Finance website will give you the roadmap you need, but keep in mind: the new york sales tax rate is as dynamic as the stock market tickers across Times Square.

Uncovering the Historical Shifts in NYS Sales Tax Rate

The history of the NY sales tax rate has seen more fluctuations than a suspenseful day on Wall Street. A quick historical breadcrumb trail could include a 1965 gavel declaring the necessity for a state sales tax, followed by various spikes and dips influenced by economic booms and busts, akin to corrections in the market. Following up with a couple of expert opinions from state economists, courtesy of insightful interviews or academic tax policy reviews, we understand the tax landscape better.

The Crystal Cavern Bash

$N/A

“The Crystal Cavern Bash is an enchanting party board game that transports players to a mystical underground realm where strategy and luck reign supreme. Designed for 2-6 players, this game invites participants to navigate through the twists and turns of an ever-changing crystal labyrinth in a race to collect magical treasures. With brilliant, gem-themed game pieces and a fold-out board that glimmers with a geode-inspired design, the game offers a visually stunning playing experience that captivates players of all ages.

Each player assumes the role of a daring spelunker, using a combination of dice rolls, card draws, and wits to move through the cavern, overcoming obstacles and outsmarting their opponents. Strategic pathways and mystical power-ups enhance the gameplay, ensuring that no two games are the same. Players must balance the greed for crystals with insightful planning to become the grand explorer of the Crystal Cavern.

The Crystal Cavern Bash is not only a delightful way to engage with friends and family for an evening of fun but also a tool for building critical thinking and decision-making skills. With its easy-to-learn rules and engaging gameplay that encourages cooperative and competitive play, this board game is destined to be a treasured addition to any game night collection. Plan your moves wisely, and let the allure of the crystal cavern lead you on an exciting adventure like no other!”

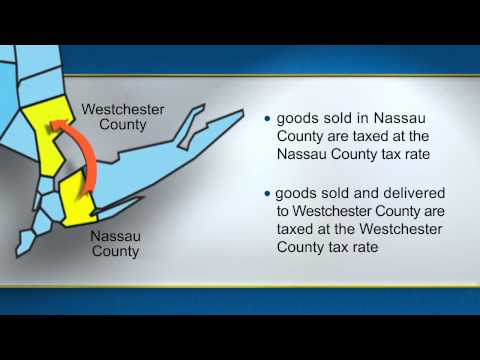

Regional Variations: Breaking Down Sales Tax Across New York

Tax rates in the Big Apple might gobble up a good portion of your dollar, but did you know Buffalo charges a sweet 8.75% while Rochester comes in at 8%? Varying city rates are like the specialized financial portfolios of New York—every municipality has its strategy—tacking onto the base NYS tax rate like a local investment. In some areas, specific taxes are akin to buying into the exclusive stock—only certain zip codes need apply!

| **Category** | **Tax Rate / Detail** |

|---|---|

| NYC Sales Tax (Purchases Above $110) | 4.5% |

| NY State Sales Tax | 4.0% |

| Metropolitan Commuter Transportation Surcharge | 0.375% |

| Total Sales and Use Tax Rate | 8.875% |

| How to Calculate NYC Sales Tax | Total sale amount × 8.875% (Sales tax rate) |

| NY State Transfer Tax (Properties < $3,000,000) | 0.4% |

| NY State Transfer Tax (Properties ≥ $3,000,000) | 0.65% |

| NYC Transfer Tax (Properties < $500,000) | 1.0% |

| NYC Transfer Tax (Properties ≥ $500,000) | 1.425% |

What Is the Sales Tax in New York for Big-Ticket Items?

Now, let’s talk big league – like those show-stopping plays in Madison Square Garden. If you’re eyeing a Tesla or a posh condo, the new york sales tax rate tastes a bit different. For instance, an SUV rolling out of a Manhattan dealership might have an additional 8.875% levied on its sticker price—unless, of course, you’ve got some sales tax exemptions up your sleeve. And talking about properties, if you’re eyeing luxury real estate, don’t forget the New York State transfer tax, which plays a considerable part in your total payout.

Sales Tax Exemptions and Oddities in the Empire State

Now, wouldn’t you know, there’s always an exception to the rule or a quirky side step. In New York, necessities like groceries and prescription drugs often dodge the tax bullet, while clothing under a certain amount also sidesteps the tax man. However, if you’re craving a bagel, be ready to pay up if it’s even slightly prepared for you. It’s one of those tax oddities that could make you giggle or grumble, depending on which side of the counter you’re on.

MET Rx Big Protein Bar, Meal Replacement Bar, G Protein, Super Cookie Crunch, Bars (Pack of )

$21.93

The MET Rx Big Protein Bar, Meal Replacement Bar, with G Protein in Super Cookie Crunch flavor, is an exceptional choice for fitness enthusiasts and anyone looking for a powerful protein boost on the go. Each bar in this convenient pack is loaded with essential nutrients designed to replace a full meal, providing a balanced mix of protein, carbohydrates, and fats. With a substantial amount of G protein, this snack is specifically formulated to support muscle recovery and energy replenishment after intensive workouts or during busy days when meals are missed. The Super Cookie Crunch flavor brings a delightful taste that satisfies sweet cravings while delivering on nutritional value.

Designed for those with a demanding lifestyle, these bars offer a practical solution to maintain your dietary goals without compromising taste or quality. The MET Rx Big Protein Bars are crafted with a unique blend of protein sources, aiding in sustained energy release and muscle nourishment. The layers of crunchy cookie bits and creamy coating add a satisfying texture, making it an indulgence you can feel good about. The pack’s convenience means you can easily stash a bar in your gym bag, office drawer, or backpack, ensuring you’re always prepared with a nutritious snack.

Commitment to quality is evident in the MET Rx Big Protein Bars, which are free from artificial colors and flavors, ensuring you’re fuelling your body with high-quality ingredients. Notably, each bar contains a dietary fiber content that aids in digestion, making it an excellent alternative to traditional, often less nutritious, snack options. With the substantial serving size, these meal replacement bars are designed to keep you full and focused on your daily tasks. The Pack of MET Rx Big Protein Bars in Super Cookie Crunch is the ultimate ally for those striving for a healthy, active lifestyle with the convenience of a grab-and-go meal option.

The Digital era’s Impact on NY Sales Tax Rate

With dot-coms dominating and e-tailers eclipsing brick-and-mortar shops, the Empire State has had to adapt its shield and sword in the form of tax laws. Digital goods and services are now fair game for taxation, bringing that NYS sales tax rate into the virtual realm. With every click to add to cart, New York’s coffers might just be clinking with digital coins.

The NYS Sales Tax Rate: A Comparative Economic Analysis

How does New York’s “basket of goods” weigh in on the national scale? Well, compare it to the sunny sales tax-free days in Oregon, or the 6% of Pennsylvania, and you’ll find that New York’s policy packs a different punch. This impacts everything from consumer spending to business decisions, to relocation considerations. Graphs and charts speak a thousand words here, illustrating the big economic picture.

The Future of Sales Tax in New York

Peering into the crystal ball, tax experts speculate for adjustments on the horizon. With technology’s swift pace, the NY sales tax may need to do its own version of algorithmic trading to keep up. Will drones deliver tax notices in the near future? The debate unfurls as we consider how The Empire State will redefine “taxing” in the ages to come.

Atomic Habits An Easy & Proven Way to Build Good Habits & Break Bad Ones

$13.79

“Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones” is a transformative guide by James Clear that dives deep into the world of habit formation and reformation. Drawing on scientific research and real-life examples, Clear illustrates how tiny changes can yield remarkable results over time, a concept he terms ‘atomic habits’. By focusing on the compound effects of small habitual behaviors, the book provides actionable strategies for overhauling ones daily routines to foster productivity, success, and overall well-being.

Clear emphasizes the importance of establishing systems over setting goals, and the four core components that shape any habit: cue, craving, response, and reward. He skillfully breaks down complex behavior science into accessible, practical steps, revealing why we do what we do and how we can change it. Each chapter is rich with insights on how to overcome common obstacles, sustain motivation, and implement habits that stick.

Not only does “Atomic Habits” showcase how to adopt healthy habits, it also delves into the psychology of breaking bad ones that hold us back. Clear provides readers with a blueprint for reshaping their identities through these habitual changes, empowering them to become the architects of their own lives. With its clear and engaging writing style, this book is an invaluable resource for anyone looking to make lasting personal improvements, harness the power of habits, and ultimately redefine their life’s trajectory.

Conclusion: Reflecting on the Impact of New York Sales Tax Rates

Stepping back, the new york sales tax rate paints a mural of dynamism, complexity, and yes, a touch of eccentricity. It’s financial wisdom with a dash of street smarts. From exemptions to digital adaptations, this has far-reaching implications for consumers, businesses, and the economy at large. Unique? Perhaps as singular as a New York slice, and just as influential in the bustling marketplace that defines the Empire State’s sprawling financial landscape.

Mind-Boggling Tidbits about the New York Sales Tax Rate

Who knew that the topic of the New York sales tax rate could be as entertaining as watching the latest Fivel Stewart flick? Buckle up, because we’re diving into some trivia so intriguing, you’ll want to share it at your next cocktail party.

Did Someone Say Bagels and Taxes?

Holy schmear, Batman! Did you know that in New York, the tax fate of your beloved bagel hinges on how it’s served? That’s right, a plain bagel at the counter may escape the sales tax, but if someone has the audacity to slice it for you – bam! – that tasty ring of dough suddenly falls under a scrumptious “prepared food” category, and your My mortgage budget better be ready for the extra cents tacked on!

The Clothes Encounter of the Tax Kind

Listen up, fashionistas! Gather your Newrez payment savings, because clothing and footwear under $110 per item are sales tax-free in the Empire State. That’s like finding a designer outfit at thrift shop prices, or spotting Eden Sher in a pair of off-brand jeans on the red carpet. Who knew tax codes could be so fashion-forward?

The Tax-tastic City Surcharges

So you might have heard of the basic new york sales tax rate, but did you know New York City said, “Hold my coffee” and slapped a little extra on top? Yep, the Big Apple piles on an additional 4.5% on top of the state tax because, well, it’s New York. They’ve gotta fund that concrete jungle where dreams are made of! It’s like choosing an option definition, except it’s not optional at all.

The Tax Jukebox Hero

Ever purchased a Bts album in NYC? Well, the melodious tunes come with a bit of sales tax harmony. While you’re swaying to the beats, bear in mind that digital downloads also sing to the tune of the state’s sales tax laws. Stream away, but remember, your playlist comes with a fiscal note.

When Plants Are More Than Just Decor

Now here’s a fun twist: in the lively world of New York plant life, if you’re using those green beauties for household decorations or as a Megapersonal statement piece, you’re free from the grasp of sales tax. But if those plants are cozying up to your Córrale as part of a landscaping project, then start counting those pennies, because the sales tax is coming for them. Landscaping transforms your green friends from exempt to taxable faster than you can say “taxing photosynthesis!

In the crazy tapestry that is New York’s fiscal landscape, we’ve only just scratched the surface. From sartorial exemptions to harmonious tax additions, these snippets of state tax trivia show there’s more to the new york state tax rate than meets the eye. So the next time you’re contemplating the wonders of New York, remember these quirky facts and regale your friends with your tax-savvy wit!

Mortgage Taxation and Interest Rates Abstracts of Mortgage Records in Certain Counties of New York, Massachusetts and Pennsylvania; Illustrating the … New Annual Mortgage Ta

$11.97

“Mortgage Taxation and Interest Rates Abstracts of Mortgage Records in Certain Counties of New York, Massachusetts and Pennsylvania” is an invaluable resource for financial historians, legal scholars, and real estate professionals. This comprehensive collection presents a detailed examination of historical mortgage records, providing insight into the fiscal landscape of the past. The abstracts serve as a critical tool for understanding the regional differences and economic trends that have shaped the housing markets in these influential states. This classic reprint offers a faithful reproduction of the original work, ensuring that researchers and interested readers have access to authentic data.

The book delves into the intricacies of the New Annual Mortgage Tax Law, dissecting its implications for property owners and financial institutions within the featured counties. Through meticulous documentation, it showcases how local taxation policies have evolved and the effects these changes have had on interest rates and mortgage terms over time. Each abstract is carefully curated to highlight the most relevant information, aiding in the analysis of historical financial practices and their long-term outcomes. As such, this collection stands as a crucial reference point for anyone studying the progression of mortgage taxation within the American Northeast.

Beyond its academic merits, the publication acts as a unique time capsule, offering a snapshot of the financial environment of a bygone era. The information within allows contemporary readers to contrast past and present tax structures and interest rates, deepening the understanding of today’s mortgage market in the context of historical precedent. For anyone with a vested interest in the history of American real estate finance or the development of taxation law, “Mortgage Taxation and Interest Rates Abstracts of Mortgage Records in Certain Counties of New York, Massachusetts, and Pennsylvania” provides a rich trove of knowledge to explore and learn from. This classic reprint is not merely a reproduction; it’s a bridge connecting the legislative past to the fiscal present.

What is New York sales tax 2023?

Oh, you’re in for the nitty-gritty on New York’s sales tax, huh? Alright, let’s dive in!

What is New York City sales tax rate?

Whew, New York’s sales tax for 2023 is no joke—it’s a combo that’ll have your wallet doing a double-take. For most items, you’ll cough up a standard state rate of 4%, but don’t forget, each county and city can add their own twist.

How do I calculate NYC sales tax?

Talk about a bite of the Big Apple, New York City’s sales tax rate isn’t playing around. You’re looking at a total of 8.875%, which includes the state, city, and Metropolitan Commuter Transportation District (MCTD) charges.

What is the selling tax in NYC?

Calculating NYC sales tax? You’ve got this! Simply multiply your purchase amount by the total tax rate (that’s 8.875%). So, if you’re splurging on some fancy kicks for $100, the tax comes to $8.88.

What items are not taxed in NY?

The selling tax in NYC is just another name for sales tax, and remember, it’s a steep 8.875%. So when you’re out shopping, don’t forget to factor in that extra pinch on your pocketbook.

Is food taxed in NY?

There are some lucky escapes when it comes to sales tax in NY. Necessities like most food (think groceries), prescription drugs, and even newspapers get a free pass. It’s like a tiny financial high-five!

Is NYS sales tax 8%?

Contrary to that delicious deli sandwich, food in NY is generally not taxed if it’s considered a grocery item. However, grab a meal at a restaurant, and yes, they’ll tack on tax faster than you can say “with a side of fries.”

How to calculate tax in NY?

NYS sales tax 8%? Not quite, but close if you’re in the Big Apple. The state rate is 4%, but add local rates, and in some places like NYC, you’ll hit that 8%… and then some, all the way up to 8.875%.

How to calculate sales tax?

To calculate tax in NY, grab that calculator and charge ahead. Multiply the purchase amount by the combined state and local tax rate—bada bing, bada boom, you’ve got your tax total!

Who pays sales tax in NYC?

For sales tax calculation, the formula couldn’t be simpler. Just multiply the price tag of your item by the sales tax rate. It’s like finding x in math class, but actually useful in real life.

How much is the tax on $800 in NY?

Who pays sales tax in NYC? Basically, everyone taking a bite out of the retail world—consumers, that’s you and me, buddy. Merchants collect it, but we’re the ones shelling out the dough.

Which city has the highest sales tax?

If you’ve shelled out $800 in the Empire State, the tax is no small potatoes. In tandem with the 8.875% NYC tax rate, you’ll cough up an extra $71.00. Ouch, right?

Does NYC have its own sales tax?

Searching for the city with the highest sales tax? Don’t look at me! That title often bounces around. But for a hot minute, cities like Chicago and Long Beach have boasted rates over 10%. Yikes!

Does New York have online sales tax?

Yep, NYC fancies itself unique with its own sales tax. Added to New York State’s standard, the city tax makes for that total 8.875% punch to your purchase.

Do NYC restaurants charge sales tax?

You bet, New York doesn’t turn a blind eye to the digital marketplace. There’s an online sales tax, so even your virtual shopping cart isn’t safe from the taxman’s reach.

What are the new taxes for 2023?

Do NYC restaurants charge sales tax? You betcha—they add that 8.875% to your bill like it’s the chef’s special spice. So when you’ve had your fill, expect the check to be a little plumper.

What is the sales tax rate in the US in 2023?

The new taxes for 2023? That’s a can of worms! Changes happen annually and can range from updates in income tax brackets to adjustments in estate tax policies. For sales tax specifics, you gotta keep your ear to the ground for the latest news.

What state has the highest sales tax 2023?

Sales tax rate in the US of A for 2023? Sorry, friend, it’s not a one-size-fits-all deal. It’s a jigsaw puzzle of rates depending on which state, county, or city you’re spending your cash in.

How to calculate sales tax?

High sales tax states? That crown is often passed around. As of my last inside scoop, states like Tennessee and Louisiana were top contenders with rates that’ll definitely make your wallet lighter.