The buzz around tax season can be as relentless as a New York minute, with many of us scrambling to make heads or tails of the latest adjustments. For those residing in the Empire State, 2024 has ushered in some significant changes to the New York State tax rate, and they’re not as simple as apples and oranges. Buckle up, because you’ll want to be in the driver’s seat for this financial journey!

Deciphering the Latest Adjustments in New York State Tax Rate

Unveiling the New York State Tax Rate Hikes for 2024

Ok, let’s cut to the chase. The New York State tax rate for the 2023 income—filed in 2024—has shimmied up the ladder, with rates spanning from 4% to the proud figure of 10.9%. It’s quite the jump from last year, and for some, it might sting more than stepping on a yellow cab during rush hour!

Comparing these figures to the previous annum, we notice certain brackets inflating like a Macy’s Thanksgiving Day Parade balloon. While a hike’s a given, we’re talking about hard-earned dough being redirected from your purse to Uncle Sam’s pocket.

Understanding the Implications of New York State Tax Rate Changes

So, what does this mean for Joe and Jane Taxpayer? If you’re making $70,000 a year in New York, expect Uncle Sam to write himself a check of $17,361 from your earnings, unlike less in prior years. This leaves you with a monthly budget tightened like a subway during rush hour at $4,387 a month.

Consider Sally, who saw a bump in her salary from $65,000 to $70,000. Last year she was grinning from ear to ear, but this year, the additional tax bites off more of that increase than she’d anticipated. That’s New York for ya – always full of surprises!

The Intricacies of NY State Income Tax in the Current Fiscal Year

Breakdown of the NY State Income Tax Rate by Earnings Bracket

Getting down to brass tacks, NY operates with a progressive income tax rate system bang on an earnings bracket. For a single filer, the rates might start at 4% for the modest incomes but can quickly climb to 10.9% for the high-flyers.

Let’s say Jack’s a high earner, reeling in over $300,000. Last year, he was used to one tax rate, but now with the hike, he falls into a new bracket thicker than a New York cheesecake, causing a heavier slice of tax to be dished out from his income.

Potential Deductions and Credits Affecting NY State Income Tax

But hey, don’t let the taxman get you down just yet. There’s good news in the form of various deductions and credits. Itemized deductions, childcare credits, and the rainbow at the end of the storm—college tuition credits. These can soften the blow, acting as financial cushions to nestle into.

Remember to explore deductions like the standard deduction and earned income tax credit, which could lighten your taxable income like a feather. Think of them as a subway pass to tax relief – the more you know about them, the further they take you!

| New York State Tax Rate Information (2023) | |

| Income Tax Rates | 4.00% to 10.90% |

| Taxable Income Brackets | Varies by Filing Status |

| Standard Deduction Amount | Varies by Filing Status |

| Sales Tax Statewide | 4.00% |

| Average Local Sales Tax (County) | 4.00% |

| New York City Income Tax | Additional Local Tax |

| Residency Status Effect on Taxable Income | Full-time residents taxed on all income; non-residents taxed on New York-sourced income |

| Common Tax Credits | Earned Income Tax Credit (EITC), Child and Dependent Care Credit, College Tuition Credit |

| Potential Tax on $70,000 Income in NY | $17,361 (Estimate)* |

| Corresponding Monthly Net Pay Estimate | $4,387 (Estimate)* |

Adopting Strategies to Navigate the NY State Income Tax Rate Increase

Tax Planning Advice Amidst Rising NY State Income Tax Rate

Now, let’s switch gears and get smart with our finances. My mortgage, for instance, is a significant chunk of my expenses, and it offers deductions that can be as refreshing as a breeze off the Hudson. Whether you’re dealing with a Newrez payment, refinancing options, or even looking into an option definition for your investment portfolio, it’s pivotal to plan meticulously.

Channel your inner Suze Orman and Robert Kiyosaki; it’s time to budget like a boss and track your expenses. Consider putting more into retirement accounts or charitable contributions, as these can impact your tax bracket and overall financial health.

The Future of NY State Tax Rate: Predictions and Economic Forecasting

Peering into the crystal ball for the coming fiscal year, the consensus among egghead economists is that these hikes might be here to stay—maybe even puff up more based on economic trends. They echo the sentiment that advanced tax planning is vital, whether you’re playing it safe or riding the bull market.

NY State Tax Rate Hike: Public Response and Political Repercussions

How New Yorkers are Responding to the NY State Tax Rate Increases

Word on the street is that New Yorkers are as vocal about the tax rate changes as they are about last night’s Barcelona Vs Sevilla game. Opinions range from bitter as black coffee to an understanding that’s smooth as cream cheese on a bagel.

These shifts in mood are crucial because they directly affect consumer spending, which in the big picture, can shape the local economy like a hot knife through butter.

The Political Landscape Post-Tax Hike

You better believe that local politicos are feeling the heat and dishing out promises to cool things down. They’ll hinge their hats on tax reform, with the hope it’ll win hearts come election time.

One thing’s for sure, in New York, the tax talk is as hot as a topic as last season’s American Horror story, and could sway the future of legislation like a pendulum.

Conclusion: Digesting the Reality of New York’s Tax Trajectory

Getting through all this isn’t like a walk in Central Park—but it’s not scaling the Empire State Building, either. We’ve sifted through the nitty-gritty, from the New York State tax rate pinch to the potential cushions available. Whether you’re mouthing the words to your favorite Shania Twain Songs or reminiscing about the glamour of a European getaway with the likes of European model Idalia, remember to keep a savvy eye on your taxes.

Now, armed to the teeth with knowledge, you’re set to make informed choices and dodge the financial potholes on the road ahead. Remember, in the concrete jungle of New York State taxes, staying informed is not just beneficial—it’s downright essential for thriving in a place that never sleeps.

The Lowdown on New York State Tax Rate Hikes

Hold onto your wallets, New Yorkers! The “Empire State” has quite the reputation for its towering skyscrapers and bustling city life, but guess what? It’s also notorious for having some of the highest tax rates in the country. But don’t just take my word for it; let’s dive into some intriguing bits and bobs about the New York state tax rate that might just blow your mind—or at least make you raise an eyebrow.

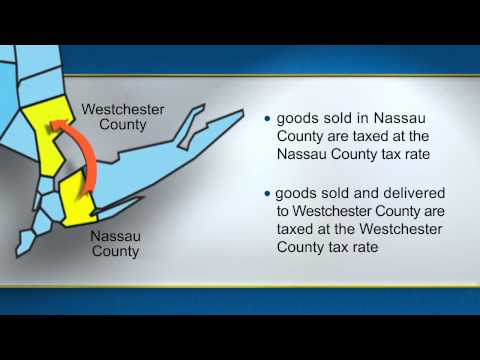

When Sales Tax Gives You a Double Take

You know the drill: you’re out shopping for some snazzy new threads, you get to the checkout, and bam! The price jumps up. That’s your not-so-friendly neighborhood sales tax sliding into your bill. Speaking of which, did you ever wonder what the new york sales tax rate is? It can be as elusive as a cab in rush hour. Well, it varies like the seasons, but it can go as high as a whopping 8.875% in some areas. So next time you’re about to swipe that card, remember, a chunk of change is going towards the state’s coffers!

Working Remotely? Taxes Still Got Ya!

Here’s a kicker for you: decided to dodge the bustling city madness and work remotely from the comfort of your couch? You might think you’ve outsmarted the concrete jungle, but not so fast! The taxman cometh regardless. Remote workers still need to pony up to the “new york state tax rate,” much like their office-bound pals. Yup, even if your daily commute is just from your bed to your makeshift desk. So, for all you savvy remote travel agent Jobs seekers planning to set up shop in the serene countryside while reeling in clients, just remember, tax day doesn’t discriminate based on your zip code!

A Little Tax History for Ya

George Washington might have had wooden teeth, but the shocker here isn’t dental—it’s tax history. Believe it or not, in the 1940s, the “new york state tax rate” wasn’t just a bite; it was a chomp! The state introduced its first sales tax to cover wartime expenses, and guess what? It liked the extra dough so much, it decided to keep the tax around. And since then, like a Broadway star, it’s only gotten bigger and more impressive.

The Silver Lining in the Tax Cloud

Alright, before you start packing your bags and waving goodbye to the Statue of Liberty, not everything about the “new york state tax rate” is doom and gloom. For example, certain items like prescription drugs, and groceries come out unscathed—no sales tax on these necessities. It’s like finding a subway train without a single strange character on board—a pleasant surprise!

So there you have it, folks—a tax rate journey that’s more twisty than a pretzel from a street vendor. Whether you’re window shopping on Fifth Avenue or dialing in from your remote workspace, the tax rate in New York is as big a part of the city as the Yankees or a slice of pizza. But remember, it’s not just about forking over your hard-earned cash; it’s about funding the city that never sleeps. So, grin and bear it, because those taxes…they’re going all over New York State!

What are NY state income tax rates?

Alright, let’s dish out some quick answers to these burning questions, New York-style. Here we go:

How much NY tax is taken out of paychecks?

Well, NY state income tax rates? They’re like a menu with a range of options! They start at 4% for the low earners and can climb up to a steep 10.90% if you’re raking in the big bucks. It’s all tiered, you know, so the more you make, the more you fork over.

What is NY sales tax 2023?

About NY tax taken out of paychecks? It’s a slice of the apple, that’s for sure. The Empire State skims off a piece based on what you earn and how often you get paid. It’s a combo of federal, state, and sometimes even local taxes, so don’t be surprised if it feels like a noticeable chunk is MIA.

How much is 70k after taxes in nyc?

NY sales tax in 2023, you ask? Buckle up—it’s set at 4% on the state level, but local regions can add their sprinkle. End result? It can hit as high as 8.875% in New York City, where they really pile it on.

Is New York State income tax high?

Thinking about 70k after taxes in NYC? Well, don’t count your chickens just yet. After federal, state, and city taxes, including FICA, you’re probably looking at around $50,000 to $55,000 in your pocket, give or take. Location, location, location, right?

How much is 100k after taxes in NYC?

Is New York State income tax high? Oh, you betcha—it’s one of the heavy hitters in the U.S. You’ll feel it more in NYC, where taxes pile up like rush-hour traffic. High earners especially better buckle up for that tax ride.

What is NYS minimum wage?

Dreaming of 100k after taxes in NYC? You might want to sit down for this: You’d take home somewhere in the ballpark of $70,000 to $75,000. Those city and state taxes aren’t joking around—they take a bite out of your Big Apple.

How much is 120k after taxes in nyc?

The NYS minimum wage, what’s the lowdown? It’s got levels like a video game! It ranges from $13.20 upstate to $15.00 in the Big Apple and its surrounding counties. And yep, it’s set to climb even higher, so keep an eye out.

What payroll taxes do employers pay in New York?

Wanna know about 120k after taxes in NYC? It’s not all roses and sunshine. With federal, state, and city tax, you’re looking at taking home around $80,000 to $85,000. Not too shabby, but remember, rent’s no penny candy here.

What items are not taxed in NY?

Employers in New York, listen up, you’ve got payroll taxes to pay! We’re talkin’ unemployment taxes, withholding tax, and the MTA payroll tax if you’re in the right areas. Oh, and don’t forget about workers’ comp—it’s a whole smorgasbord.

How do I calculate sales tax in NY?

Items not taxed in NY—it’s the small victories! Clothes under $110, groceries, and prescription drugs—it’s like a little tax holiday for your wallet.

Are groceries taxed in New York?

To calculate sales tax in NY, grab your calculator, folks. Just munch the numbers by multiplying your purchase amount by the combined state and local rate where you’re shopping. Presto! That’s the extra dough you’ll fork over.

Is $72000 a good salary in NYC?

Ah, groceries in New York—they’re a lifesaver ’cause they’re not taxed! We all gotta eat, right? It keeps the pantry without a padlock, at least tax-wise.

What is a livable salary in NYC?

Is $72,000 a good salary in NYC? It won’t have you swimming in dough, but hey, for a single person, it’s a decent wage. You’ll manage, but in the city that never sleeps, it’s always a hustle!

Is 80 000 a good salary in New York?

A livable salary in NYC, let’s get real! You’ll want at least $50,000 to $70,000 a year to cover the basics without living on ramen. And even then, you’ll be budgeting like a whiz.

At what age do you stop paying property taxes in New York State?

Pondering if 80 grand is a good salary in New York? It’s definitely above average, but it’s all about perspective—you’ll get by more than alright, but if you wanna live large, that number might not cut it.

Does NY tax Social Security and pensions?

When do you stop paying property taxes in New York State? Ah, the golden years—but hold your horses, there’s no magic age where you’re off the hook completely. There are some tax relief programs for seniors, though, so do a little digging!

What is the tax rate for retirees in NY?

Does NY tax Social Security and pensions? Thankfully, Social Security gets a free pass, and many pensions do, too. But double-check, as it depends on the source and your overall income.

At what age is Social Security no longer taxed?

The tax rate for retirees in NY can seem like a riddle. While Social Security is untouched, other retirement income might not be as lucky. If you’re a retiree, your effective rate could be lower, but it’s still a bit of a mixed bag.