When you hear “Virginia,” you might think of its rich history, stunning landscapes, or perhaps its nickname, the “Mother of Presidents.” But let’s turn our attention to something that affects every Virginian’s wallet – taxes. Navigating the intricate web of taxes in Virginia can be as complex as designing a stylish Backsplash tile, but stick with me, and I’ll guide you through the maze with the finesse Suze Orman might use to balance a budget, sprinkled with Robert Kiyosaki’s practical insights on financial growth.

Understanding the Landscape of Taxes in Virginia

The Unique History of Taxation in the Commonwealth

Virginia’s approach to taxes isn’t something that sprang up overnight like a pop-up shop. There’s a saga behind it, tracing back to its colonial days. Over time, the system saw major shifts, often tied to economic necessities and political tides. For instance, post-Revolutionary Virginia saw a gradual move from taxes on tangible personal property to a more structured income tax approach during Reconstruction, laying bricks to the financial landscape we see today.

Comparing Virginia’s Tax Policies to Neighboring States

Put Virginia side by side with its neighbors like Maryland, North Carolina, and Tennessee, and you’ll spot some stark differences. Maryland, for example, has a tad higher personal income tax rate compared to Virginia, making it worth your while to understand the intricacies of maryland state Taxes and maryland taxation And assessment if you’re eyeing properties across state lines.

Unveiling the Shocking Facts About Taxes in Virginia

The Astounding Impact of Property Taxes on Virginia Homeowners

It’s no shocker that property taxes can be a thorn in the side of homeowners. If you’re looking to nest in cities like Richmond or Virginia Beach, know that Virginia’s property taxes are somewhat easier to swallow than the national average – a small sigh of relief. But don’t kick up your feet just yet; fluctuations in rates could be on the horizon as the real estate market ebbs and flows.

Virginia’s Surprising Sales Tax Structure and Its Economic Ramifications

Let’s talk shopping. Virginia’s sales tax is simpler than piecing together the “why him cast” why Him cast), with a general state sales tax of 5.3%, and localities can tack on up to 0.7% more. What does this mean for you and local businesses? Well, a lower rate can boost consumer spending, which is like a shot of espresso to the local economy.

How Virginia’s Income Tax Brackets Affect Residents Differently

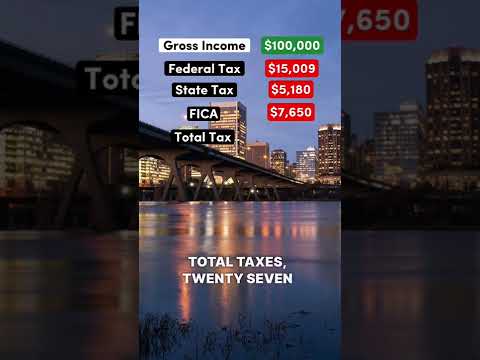

Virginia’s progressive income tax is a bit like lifting weights – the more you pump (earn), the heavier the tax burden you lift. With rates ranging from 2% up to 5.75%, someone raking in $100,000 a year in beautiful VA will net around $72,550 after state tax – leaving a decent chunk of change to invest, perhaps in a scent like Gucci guilty For men or savings for a rainy day.

The Unexpected Burden of Car Tax on Virginia’s Motorists

Here’s a kicker: Virginia’s car tax. Owning a set of wheels in the Commonwealth could have you muttering under your breath come tax time. Known officially as the personal property tax, it’s as beloved as unexpected roadworks and as controversial as pineapple on pizza. Historically a battleground of political back-and-forth, this tax still manages to dent the wallets of Virginians from all walks of life.

Business Taxes in Virginia: A Double-Edged Sword for Growth

As a business owner, you’re in a constant balancing act, akin to finding the perfect shoulder tattoo Women – it’s about precision and the right fit. The Commonwealth’s 6% flat corporate income tax is appealing to many. The environment here can nurture giants, but there’s always the other side of the coin – regulations and taxes that might trip a trotting enterprise.

| Category | Details |

|---|---|

| State Income Tax Rates | Progressively ranges from 2% to 5.75% |

| Corporate Income Tax Rate | Flat rate of 6.00% |

| Sales Tax | State: 4.3%, Local: up to 1%, Combined: 5.3% to 5.75% maximum |

| Average Combined Sales Tax | 5.75% |

| Local Gross Receipts Taxes | Permitted by local jurisdictions |

| Median Property Tax Rate | Below the national average |

| Taxation for Individuals | Taxed on residency or income from Virginia sources |

| Example Income Tax Burden | $100,000 annual income results in $27,451 tax (approx.) |

| State Tax Ranking (sales tax) | Near the bottom among U.S. states |

| Effective Date for Tax Rates | Information as of January 1, 2024 |

Breaking Down the Implications of Virginia’s Tax System

The Ripple Effect of Taxes on Virginia’s Economy and Public Services

Taxes, dear Virginians, are the fuel for our state’s economic engine. They pave roads, keep the lights on in schools, and much more. Without the tax dollars, we might as well kiss goodbye to the infrastructure developments and public services we often take for granted. So, while writing that tax check might sting, it’s also contributing to the Commonwealth’s pulse.

Tax Incentives and Credits: Gimmick or Growth Engine for Virginia?

Now, tax incentives and credits sound delightful, don’t they? They’re like the secret sauce to adding a little zing to our economy. Historic preservations, green energy projects – these incentives are designed to make our state not just a picture of the past, but a canvas for the future. But is it all roses and sunshine? Some might argue we’re seeing more sizzle than steak.

Navigating Taxes in Virginia: Advice for Residents and Business Owners

Practical Tips for Minimizing Tax Liabilities Legally in Virginia

Listen up, because nobody likes to toss money away carelessly. There’s an art to legally reducing your tax hit. Timing is everything – knowing when to make certain financial moves is like hitting the sweet spot on a baseball bat. Embrace deductions and credits like a long-lost friend. It’s not being sneaky – it’s about being savvy.

Resourceful Planning: A Guide to Tax Season for Virginians

Tax season is no one’s favorite time of year. It’s like running a marathon – you don’t want to start training a week before the race. Equip yourself with the necessary artillery: know the deadlines, secure the paperwork you need (keep those receipts!), and if it all seems like a maze – there’s no shame in seeking help from a tax whiz.

Conclusion: Taxes in Virginia – A Balancing Act of Challenges and Opportunities

Wrapping up, it’s clear taxes in Virginia are a balancing act, craftily blending obligation with opportunity. As Virginians, we’re wired to be resourceful – taking the tax system, with all its quirks, and using it to our advantage. Just like a carefully curated cocktail, it’s about mixing the right elements for a flavor that suits you.

So, my friends, whether you’re a homeowner feeling the pinch, a shopper reveling in low sales tax, a motorist begrudging his or her car tax, or a business weighing the pros and cons – remember, it’s the lay of the land here in the Commonwealth. As we march toward the future, let’s not just survive the tax system; let’s thrive within it.

Get a Load of These Shocking Facts About Taxes in Virginia!

Hold onto your wallets, folks! We’re about to dive into some trivia that’ll have you seeing the Old Dominion in a whole new light when it comes to taxes in Virginia. So, buckle up as we embark on this thrill ride of fiscal revelations!

Did Someone Say “Car Tax”?

You heard that right! In Virginia, you can expect to shell out some extra dough for the privilege of owning a car. This “personal property tax” can feel like an unexpected punch in the wallet, but hey, at least it’s not as unpredictable as the weather, right? And if you’re wading through the aftermath of “personal property tax season,” you might want to make a pit stop and seek some sage advice with a Dmaas strategy.

Tax Breaks for Loving the Land

Alright, you tree huggers and land lovers out there, Virginia’s got a sweet deal for you! If you’re protecting your land with a conservation easement, you might just snag yourself a nifty state income tax credit. Now that’s what I call a breath of fresh air! It’s like Mother Nature herself is giving you a high five and a tax break.

Insurance Claim? Ka-ching!

Listen up, because you might not know this one: In Virginia, if your pad gets damaged and you’re going through an insurance check claim process, keep in mind that some insurance payouts might be taxable. What a bummer, right? But knowledge is power and a huge side of relief when tax time rolls around—no surprises are the best kind of surprises, after all.

The Groovy Groceries Tax Twist

Grab your shopping carts, Virginia residents! Here’s a peculiar little tidbit: there’s a reduced tax rate on groceries. So while you’re wheeling down aisle five, take solace in the fact that Uncle Sam’s bite out of your food budget is a tad smaller here. It’s like getting a discount on life’s essentials—now that’s a reason to throw an extra pack of cookies into the cart!

The Old Tax Switcheroo on Services

Last but not least, did you know that services in Virginia are generally not taxed? That’s right, whether it’s getting a haircut or hiring a magician for your kid’s birthday party (because who doesn’t want a magician?), the taxman steers clear. Now that’s some tax magic that we can all appreciate!

So, there you have it—the lowdown on the quirks and perks of taxes in Virginia. Whether you’re groaning over car taxes or celebrating the grocery tax cut, remember: it’s always worth digging a little deeper to find those golden nuggets of tax trivia. Keep ’em in your back pocket; you never know when they’ll come in handy!

What taxes do you pay in Virginia?

What taxes do you pay in Virginia?

Oh, the tax bite in Virginia—it’s a mix, really. If you call the Old Dominion home, you’ll pay state income taxes that slide from 2% to 5.75%—not too shabby—but don’t forget about sales tax at 5.3%, potentially bumped by local add-ons up to 0.7%. And corporations, they’ve got their own flat tax rate of 6% to deal with. Plus, there are local gross receipts taxes. So, it’s safe to say the tax man cometh in a few different disguises around these parts.

Is Virginia a tax friendly state?

Is Virginia a tax friendly state?

Well, whether Virginia gives your wallet a break or not kind of depends on how you squint at it. While the income taxes can feel a bit punchy for some pockets, the sales tax won’t knock your socks off—it’s pretty low. And hey, property tax-wise, you could do worse; Virginia’s hanging out with a below-average rate there!

Does Virginia have high income tax?

Does Virginia have high income tax?

When it comes to income tax, Virginia’s sitting pretty in the middle of the pack. Sure, the rates range up to 5.75%, which might raise an eyebrow, but compared to other states with personal income tax, it’s not through the roof. Remember, of course, it’s progressive—more you earn, higher the rate.

How much is 100k after taxes in Virginia?

How much is 100k after taxes in Virginia?

Imagine waving goodbye to $27,451 if you’re raking in $100k a year in Virginia. But don’t fret! You’re not left high and dry—your net is a cozy $72,550 annually, which breaks down to a tidy $6,046 each month to do with as you please.

What is not taxed in Virginia?

What is not taxed in Virginia?

Guess what? Virginia throws a few financial bones your way—there’s no sales tax on groceries, prescription drugs, and certain medically necessary items. So, while you’re out and about shopping, you can keep a little more green in your jeans on these essentials.

Is Virginia a tax friendly state for retirees?

Is Virginia a tax friendly state for retirees?

Hey, retirees, listen up! Virginia might just roll out the welcome mat for you, tax-wise. With the state not taxing Social Security benefits and dishing out deductions for pension income, you can keep a bit more of your hard-earned cash during the golden years.

At what age do you stop paying property taxes in Virginia?

At what age do you stop paying property taxes in Virginia?

Hold your horses—Virginia doesn’t have an outright age cap for property taxes, but seniors over 65 and folks with disabilities can get tax relief if they meet certain income and asset criteria. It’s a bit of a paperwork rodeo, but worth checking out if you qualify.

What state is best for avoiding taxes?

What state is best for avoiding taxes?

Looking to play hide and seek with taxes? You’ll find the “no income tax” magic in states like Florida, Texas, and Nevada. But remember, they might getcha with higher sales or property taxes. It’s all about the balance—choose your tax battle and choose wisely!

What is the best state to live in for income tax?

What is the best state to live in for income tax?

Income tax got you down? States like Wyoming, South Dakota, and Alaska roll out the tax-free welcome mat when it comes to your paycheck. No state income tax there! But weigh the pros and cons—each state has its own way of making ends meet.

Is Virginia a good place to live?

Is Virginia a good place to live?

Oh, Virginia! With its rich history, diverse landscapes, and a healthy dollop of Southern charm, many find it a mighty fine spot to hang their hat. Sure, it has its quirks with taxes and cost of living, but many say that’s balanced out by great schools, employment opportunities, and a robust community vibe.

What are the tax benefits of living in Virginia?

What are the tax benefits of living in Virginia?

Chomping at the bit for tax perks in Virginia? Well, with moderate property taxes and no Social Security tax, it’s not too shabby. Plus, they offer a hearty deduction for pension income, which can really sweeten the pot for retirees.

Why are my Virginia taxes so high?

Why are my Virginia taxes so high?

Feeling like Virginia’s got its hand deep in your pocket? It could be because you’re hitting those higher income brackets, or maybe you’re in a spot with higher local taxes. The complexity of state and local tax laws can be a real bear, making some folks’ tax bill surprise them more than a jack-in-the-box.

Does Virginia tax Social Security?

Does Virginia tax Social Security?

The good news just keeps coming—Virginia plays nice with Social Security income, keeping its tax mitts off. That’s more change in your pocket and less stress on the retirement nest egg.

How much does Virginia take out of paychecks?

How much does Virginia take out of paychecks?

Virginia’s bite out of your paycheck for state taxes swings from a gentle nibble of 2% right up to a 5.75% chomp, depending on your income. And remember, Uncle Sam also wants his share, so you’ll see federal taxes and FICA showing up to the party, too.

How much is 200k a year after taxes in Virginia?

How much is 200k a year after taxes in Virginia?

Earning 200 grand in Virginia? You’re looking at waving bye-bye to about $54,024 for taxes. But hey, it’s not all a bummer—you’re still pocketing a cool $145,976. That monthly? A sweet $12,165. Not too shabby!

Is Social Security taxed in Virginia?

Is Social Security taxed in Virginia?

Take a breather, folks—Virginia doesn’t tax Social Security benefits. That’s a bit of sunshine for retirees, making that Social Security check stretch just a bit further.

How much tax is taken out of my paycheck in VA?

How much tax is taken out of my paycheck in VA?

Got a paycheck in VA? Well, you’ll see state taxes slice off anywhere from 2% to 5.75%, depending on how fat that paycheck is. And of course, don’t forget—good old Federal taxes, FICA, and any other fun deductions will also have their hands out.

Do you pay local taxes in Virginia?

Do you pay local taxes in Virginia?

Local taxes in Virginia? You bet. While the state sales tax is an easy-to-swallow 5.3%, localities can tack on up to 0.7%, making the maximum combined chew 6%. And then there are those local gross receipts taxes that some areas fancy.

What is the Virginia income tax on $150000 of income?

What is the Virginia income tax on $150000 of income?

If you’re pocketing $150,000 in Virginia, you’d better brace yourself to fork out around $40,587.50 in state taxes. But keep your chin up! You’ll still have a nifty $109,412.50 to take to the bank.