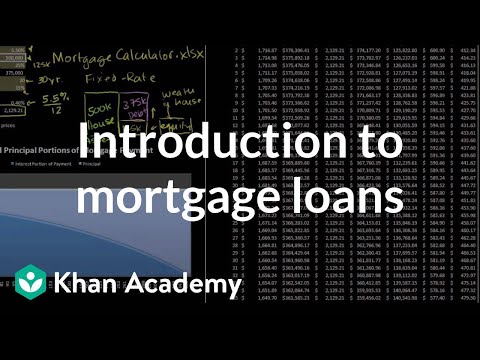

Purchasing a home is a monumental decision, and the mortgage rate you lock in can either be a sweet dream or a recurring nightmare. Today, let’s dive deep and twist up your normal perspective on home mortgage loans rates. If you’re in the market for a new nest or just curious about the housing hubbub, lean in. These facts aren’t just going to shake up your day – they’ll revamp your financial strategies for years to come.

The Rollercoaster of Home Mortgage Loans Rates through Time

The Historical Wild Swings of Home Mortgage Loans Rates and What They Mean for You

Get ready for a flashback because home mortgage loans rates have been on a rollercoaster ride that would put the best Movies Of The 2010s to shame. Once upon a time, in the 1980s, mortgage rates skyrocketed to a staggering average of 18.63%. Can you imagine? That era of rates was like the wild west – untamed and pretty darn scary for homebuyers.

But then, like the calming after a storm, rates began to drop. The ’90s saw a sigh of relief and the 2000s brought new hope with rates averaging between 6-8%. Now, fast forward to our current situation in 2024, we’re sitting on an average five-year fixed rate mortgage at 4.72%. Still, these numbers aren’t set in stone. They wobble more than a toddler’s first steps, rising to just under 8% in October 2023 before excitingly backpedaling.

Understanding this history isn’t just good for trivia night. It’s critical for homebuyers and investors. It shows that timing isn’t just about luck; it’s about trends and patterns. If today’s rates seem high, remember the ’80s, breathe easier, and consider buying now with a strategy to refinance when rates take their next dip.

How Geopolitical Events Can Upend Predictions in Home Mortgage Loans Rates

You might not think that something happening across the ocean could nudge your mortgage rate up or down, but oh, it can, and it has. Mortgage rates are like dominoes in a grand global game – one piece tips, and the impacts ripple through markets.

Take, for instance, the trade wars that erupted in the late 2010s. Tariffs and trade beef affected economies worldwide, making cautious investors jump into the safe-haven of government bonds, inadvertently pulling down mortgage rates. Or let’s chew over how elections cause turbulence. Elections are like Margaritaville cap Cana for mortgage rates – a place of unpredictability where anything can happen. Politicians’ promises and plans can woo or worry investors, pressing rates to rise or fall.

And let’s not sidestep the elephant in the room – the pandemic. Post-pandemic policies, such as stimulus packages, affected inflation and, in turn, influenced home mortgage loans rates. Economists are watching current geopolitical currents closely, with a wary eye on rates.

Decoding the Relationship Between Central Bank Policies and Home Mortgage Loans Rates

The Central Bank – it’s the puppet master pulling the strings of mortgage rates behind the curtain. When they hike up interest rates to curb inflation, oh boy, do we feel it. And when they open their wallets with quantitative easing, we can hear the distant chime of potential rate drops.

For example, in response to inflation, the Fed raised rates, catapulting our mortgage interest rates to that 20-year high I mentioned earlier. And remember, this isn’t just a U.S. solo act. Across the pond and beyond, central banks in Canada, Europe, Asia – they’re all in this economic dance.

Quotes from financial gurus and central bank bulletins give us a glimpse into their crystal ball. While they don’t have a free government Iphone with a future-telling app, their insights are the next best thing for predicting where rates could head next.

The Unanticipated Impact of Technology on Home Mortgage Loans Rates

Think technology is just about the latest gadget or hot Celebrities gracing your Instagram feed? Nope, it has quietly tiptoed into the mortgage market and is stirring the pot.

Fintech, short for financial technology, is the new kid on the block, turning heads with innovations like AI risk assessment tools. These smarty tools evaluate a borrower’s risk faster than you can click ‘like’ on a post. And guess what? If lenders can gauge risk better, they can price mortgages more precisely. This could lead to more tailored rates, potentially making you dance with joy…or not.

But let’s not take my word for it. Industry insiders are buzzing about this techy turn. As they say, the times, they are a-changin’, and for home mortgage loan rates, they’re evolving quicker than ever.

The Psychology behind Mortgage Rates: Consumer Behavior and Home Mortgage Loans Rates

Who would have thought that our collective thoughts and feelings could push mortgage rates around? Well, it’s not so much telekinesis but more about consumer sentiment swaying the market.

Imagine this. A flock of millennials suddenly decides it’s time to put their avo-toast savings into buying homes. Their buying spree can heat up demand, indirectly nudging up home mortgage loans rates. Behavioral economists have their eyebrows raised as they scrutinize every little change in our buying behaviors.

Understanding this psychological power-play isn’t just academic. It’s crucial to getting ahead of the rate game. So next time you’re contemplating the housing market’s ebb and flow, remember, it might just be a matter of collective mindset shifts.

Conclusion: The Ever-Evolving Landscape of Home Mortgage Loans Rates

What a wild ride, huh? From the heart-stopping highs of the ’80s to today’s unpredictable swings influenced by geopolitical dramas, Central Bank soothsayers, tech gurus, and our very own buying quirks – we’ve covered some ground!

Take these surprising tidbits to heart:

– Historical data gives us valuable lessons on the cyclical nature of rates.

– Global events are more connected to your mortgage rate than you’d think.

– Central Bank policies are a giant lever on your mortgage destiny.

– Technology is a quiet game-changer in the mortgage rate world.

– We, the consumers, play a bigger role in rate fluctuations than we realize.

In light of all this, my parting advice to you would be: Study the landscape, but don’t wait on the sidelines for too long. The current house interest rates or a potential house loan interest rate might look daunting, but remember, conditions alter often. If you buy now, you can always refinance at a Homeloan rate that suits you better later when the tide goes out on today’s high rates.

So, is the solution to the mortgage rate madness clear as day? Maybe not, but now you’re equipped with insights and an edge that most homebuyers wish they had. As the famous saying (almost) goes, knowledge is power, especially when it comes to the ever-evolving world of home mortgage loans rates.

Untangling the Web of Home Mortgage Loans Rates

Hey there, future homeowners and finance fanatics! Dive into the less-known tidbits of the home mortgage loans rates world. These nuggets of knowledge aren’t just about numbers; they’re about the quirky side of the mortgage market that often stays behind the curtain. So, grab a comfy seat, because you’re in for some real talk about those home loan digits!

Interest Rates and Time Travel? Almost!

Alright, brace yourselves for a trip down history lane. Did you know that mortgage rates were once as high as the sky—or at least it seems that way now? Back in the early 1980s, if someone told you that home mortgage loans rates would one day drop to below 3%, you’d likely think they were out of their mind! But hey, they were soaring at a whopping 18% back then. Fast forward to recent times, and we’ve seen rates that make those decades seem like a financial fever dream.

The Dance of the Adjustable-Rate Mortgage

Now, put on your dancing shoes because the adjustable-rate mortgage (ARM) is a creature that loves to groove to the market’s rhythm. One minute it’s chilling at a low rate, making you feel like you’ve hit the jackpot. Then, before you know it, it’s sashaying upwards when the economy decides to do a little boogie-woogie. ARMs can be a wild ride, swinging to the beat of interest rates, and leaving you either grooving with extra cash or feeling a bit offbeat with higher payments.

Deduction Junction: Why Your Rate Isn’t Just About the Interest

Okay, here’s where it gets juicy! You see, Uncle Sam wants to get in on the home mortgage loans rates action, too. With an itemized deduction on your tax return, including the interest you pay on your mortgage can actually lead to a chorus of financial “cha-chings!” Understanding What Is an Itemized deduction? is like unlocking a treasure chest in the world of home loans. This little morsel of the tax code can turn your mortgage interest into a potentially lower tax bill.

Locked or Not, Rates Can Trot

Picture this: You’ve found a rate you love, and you’re ready to lock it down—like, put-a-ring-on-it level of commitment. But hold your horses! Even when you lock in a rate, it can still change before closing if there are changes in your application details or if the lender needs to readjust based on market conditions. Yep, those rates can be as fickle as spring weather, so make sure you’re well-versed in the terms of your rate lock agreement.

The Global Butterfly Effect on Your Mortgage

Okay, folks, this is where things get a bit wild. Ever thought about how a butterfly flapping its wings in Brazil could affect your mortgage? Maybe not the butterfly specifically, but global events sure have a way of influencing home mortgage loans rates. When there’s major international economic news, those rates can jitterbug up and down faster than you can say “globalization.” So, next time you’re monitoring rates, remember it’s not just local chatter that counts—the whole world’s events can stir the rate pot!

And that’s the lowdown on the sometimes wacky but always fascinating world of home mortgage loans rates. Keep these facts in your back pocket, and you’ll be the life of any mortgage-related conversation—at least among us finance nerds! Keep those eyebrows raised and your mortgage knowledge updated, because there’s never a dull moment in the land of lending.

What is the current mortgage interest rate?

What is the current mortgage interest rate?

Whoa, talk about numbers climbing up the hill! Right now, the average mortgage rate for a five-year fixed rate mortgage has crept up to 4.72%, a tiny nudge from last week’s 4.69%. If you’re eyeing a two-year fixed rate mortgage, you’re looking at an average of 5.08%, also up from 5.03%. Hang onto your hats because these rates are on the move!

What is a good interest rate for a mortgage now?

What is a good interest rate for a mortgage now?

Well, wouldn’t you know it, “good” is playing hide and seek these days! But here’s the deal: if you can snag anything around the lowest available five-year fixed rate of 3.99% or the two-year fixed rate of 4.38%, then you’re grabbing a steal in today’s market!

Are mortgage rates expected to drop?

Are mortgage rates expected to drop?

Hate to break it to you, but don’t hold your breath for a big dip in mortgage rates. Sure, they’ve had their ups and downs, but the chatter around the water cooler is that 30-year mortgage rates could settle between 5.9% and 6.1% in 2024. So, you might want to jump in now rather than wait for a drop that might just be a mirage.

What bank has the lowest mortgage rates?

What bank has the lowest mortgage rates?

Alright, let’s cut to the chase: finding the bank with the lowest mortgage rates can feel like finding a needle in a haystack. The numbers are always bouncing around, but keeping an eagle eye on competitive lenders who are duking it out might lead you to rates as low as 3.99% for a five-year fixed. Just remember, it pays to shop around!

Will interest rates go down in 2024?

Will interest rates go down in 2024?

Well, we’ve got our crystal balls out, and the signs are pointing to… maybe? Forecasts suggest that interest rates could see-saw a bit, and we might see 30-year rates fall to a cozy range between 5.9% and 6.1% in 2024. But hey, don’t put all your eggs in one basket!

Why are mortgage rates so high?

Why are mortgage rates so high?

Oh boy, strap in—it’s been quite the roller coaster. Thanks to our not-so-little friends inflation and Fed hikes, mortgage rates are partying like it’s 1999 (or rather, hitting a 20-year high). It’s a tough pill to swallow, but that’s the price of doing business with the economy these days.

Is 7% a bad mortgage rate?

Is 7% a bad mortgage rate?

Well, 7% might have you singing the blues if you remember the “good old days” of lower rates. But hey, with average rates nearly knocking on 8%’s door back in October 2023, 7% isn’t looking too shabby. Just make sure it’s the best you can get for your financial situation.

What will mortgage rates be in 2024?

What will mortgage rates be in 2024?

Dusting off the crystal ball again, huh? While we can’t pinky swear on it, predictions are eyeballing 30-year mortgage rates to nuzzle in somewhere between 5.9% and 6.1% in 2024. Just keep an eye out, because the only thing certain about mortgage rates is their uncanny ability to surprise!

How can I get a lower mortgage interest rate?

How can I get a lower mortgage interest rate?

Craving a lower mortgage rate? Here’s the recipe: start with a pinch of solid credit score, a dollop of a hefty down payment, and simmer with shopping around like it’s Black Friday. Don’t forget to ask lenders for their best deals—like your momma always said, “a closed mouth doesn’t get fed.”

Will mortgage rates ever be 3 again?

Will mortgage rates ever be 3 again?

Once upon a time, 3% was the magic number, and we all want to believe in fairy tales. But here’s the straight talk: rates have gone up and it’s unclear if they’ll slip back to those dreamy 3% days anytime soon. Keep your fingers crossed, though—stranger things have happened!

What will the 30 year mortgage rate be in 2024?

What will the 30 year mortgage rate be in 2024?

Let me dust off my magic 8-ball… glimpses into the future say the 30-year mortgage rate may play it cool around 5.9% to 6.1% in 2024. Just keep your ear to the ground because if there’s one thing you can count on, it’s that nothing’s set in stone.

Will mortgage interest rates go down in 2023?

Will mortgage interest rates go down in 2023?

With 2023 already in full swing, betting on rates taking a nosedive is about as certain as a chocolate teapot. We’ve seen them boogie up rather than jitterbug down lately. But hey, stick around; the financial weather might just surprise us.

Can you negotiate your mortgage rate?

Can you negotiate your mortgage rate?

You betcha! Negotiating your mortgage rate is like haggling at a flea market—it’s all about playing the game. Puff up your feathers with a good credit score and shop around like you mean it. A little smooth talking and you could land yourself a deal.

What credit score do you need for the lowest mortgage rate?

What credit score do you need for the lowest mortgage rate?

Vectoring in on the lowest mortgage rate? Aim for a credit score that’s top of the charts; think 740 or higher. That’s your golden ticket to locking in rates that’ll make your wallet sing. But don’t sweat it if you’re not there yet—there’s always room to spruce up that score!

What is the easiest home loan to get?

What is the easiest home loan to get?

If you’re looking for the path of least resistance to homeownership, FHA loans are waving from the sidelines. They’re like the friendly neighbor who’s not too fussy about credit scores or down payments. Just show ‘em you’ve got a steady income and a reasonable debt-to-income ratio, and they might just roll out the welcome mat.