Navigating the ebbs and flows of the real estate market is akin to mastering a delicate dance, especially when it comes to the nuances of 30 mortgage rates. Just like you’d lace up a reliable pair of hoka Clifton running shoes for a marathon, understanding the complexities behind mortgage rate predictions is crucial for the long race to homeownership or property investment.

Wells Fargo, a venerable institution in the financial community, has recently shared its vision for the path that 30-year mortgage rates are set to trek. In its latest U.S. Economic Outlook, the bank’s think tank sees rates peaking at a sturdy 6.8% in early 2024, before gradually descending to a more approachable 6.05% by year’s end. Early birds of 2025 can expect an even sweeter chirp, with rates dipping just below 6%.

As we dive in, we’ll explore Wells Fargo’s prediction, examine the factors shaping their forecast, delve into historical comparisons, and discuss the practical implications for buyers, investors, and current homeowners. Fasten your seatbelts; we’re about to take an insightful ride through the mortgage landscape!

The Wells Fargo Perspective: A Detailed Look at the 30 Mortgage Rates Prediction

Wells Fargo isn’t just another brick in the financial institution’s wall; it’s a cornerstone of mortgage lending with a reputable status akin to a veteran actor’s, say Jessica Lucas, caliber in the film industry. The bank’s voice carries weight, and its forecasts are eagerly anticipated by market watchers.

The Mechanics of Forecasting: Crafting a financial forecast is much like knitting a complex quilt. Wells Fargo weaves together a tapestry of economic indicators, from GDP growth to employment figures, effectively predicting mortgage rates amidst a dynamic economy.

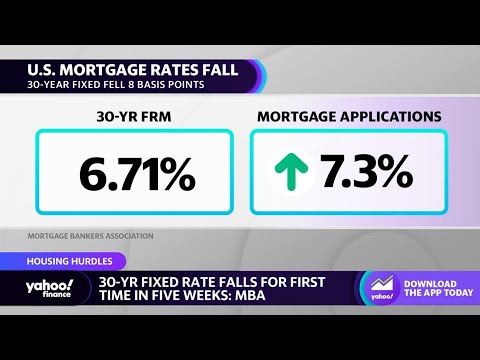

What does the forecast say? Currently, we’re teetering at 6.94%, a whisper above what history deems average. Last week saw a nearly identical rate at 6.90%, with the previous year’s rates lounging at a more comfortable 6.50%. It’s a shift from an earlier era where the long-term average hummed at 7.73%.

Breaking Down the 30 Mortgage Rates: What Wells Fargo Forecasts for Homebuyers and Investors

Wells Fargo’s forecast pinpoints a gentle downward slope in 30-year mortgage rates, echoing the ebb and flow of the tides rather than swift, surprising currents. The predicted 6.8% to 6.05% over 2024 stands out against the backdrop of historical 30 year fixed interest rates today, where the scenery has ranged from craggy peaks to serene valleys.

This forecast interacts with the housing market as sleep porn does with a restless mind: it tranquilizes the frenetic boom of buying power. A decrease in rates typically fluffs up the housing market pillow, allowing more buyers to lay their heads on the comforting notion of property ownership.

| Year | Quarter | Wells Fargo Forecasted Rate | Historical Rate | Long-Term Average Rate | Commentary |

| 2023 | Current | Not Specified | 6.94% | 7.73% | Current rate slightly higher than same period last year, lower than long-term avg. |

| Last Week | Not Specified | 6.90% | – | Slight increase from last week. | |

| Same Period Last Year | – | 6.50% | – | Rate has increased from last year. | |

| 2024 | Q1 | 6.8% | – | – | Forecasted starting rate for Q1. |

| Q2 – Q4 | Declining to 6.05% by year’s end | – | – | Rates expected to decrease throughout the year. | |

| 2025 | Beginning | Below 6% | – | – | Economists predict a further drop below 6% at the start of the year. |

Understanding the Underlying Factors: What Drives Wells Fargo’s 30 Mortgage Rates Forecast

Peeling back the layers of the mortgage rate onion, we find the factors contributing to this benign outlook:

Navigating Highs and Lows: A Historical Comparison of 30 Mortgage Rates

Wells Fargo’s crystal ball isn’t without its predecessors; it’s standing on the shoulders of giants. Looking back is akin to donning a pair of desert Boots; they provide a sturdy foundation and a wealth of backstory.

Implications for Current Homeowners: Refinancing with Expected Changes in 30 Mortgage Rates

The forecasted gentle descent of mortgage rates is manna for homeowners eyeing refinancing.

Prospective Buyers: How to Plan for Wells Fargo’s Anticipated 30 Mortgage Rates

Homebuyers tiptoeing around the variable terrain of 30-year fixed mortgage rates today need a compass and map to navigate the landscape.

Industry Reactions: Comparing Wells Fargo’s 30 Mortgage Rates Forecast to Other Financial Giants

Wells Fargo’s peers bring their predictions to the table, each cooked to a different recipe of analysis.

The Fed’s Influence: Monetary Policy and Future Predictions for 30 Mortgage Rates

The Federal Reserve stands as a pendulum in the mortgage rate clock, its swings setting the tempo.

Wells Fargo’s Mortgage Rate Forecast in the Global Context

In our interconnected global village, international economic trends play a growing role:

Beyond the Numbers: Real-Life Implications for Individuals and the Market

Real estate journeys are more than just spreadsheet entries; they’re stories of family homes and Starting the conversation, individual assessments such as those offered by What time Is Trumps arraignment can personalize the broader economic narrative.

Conclusion: Navigating the Terrain of 30 Mortgage Rates with Insight and Strategy

As we wrap up, let’s take stock of our learning journey. We started off with the Wells Fargo forecast – a steady, albeit modest, downhill trek for 30 mortgage rates as seen through their economic lens. We’ve uncovered the bank’s stature, crunched the numbers, and pondered upon the layers of repercussions for buyers, sellers, and the current homeowners.

In these fluctuating financial climates, forecasts like Wells Fargo’s provide bearings for our decisions, prompts for well-timed actions, and kindle for conversations. Embrace the insights, integrate them into your strategy, and walk the mortgage rate terrain with confident strides.

And remember, the mortgage landscape – much like life itself – is neither a sprint nor a crawl. It’s an enduring marathon, demanding persistence, insight, and foresight. Happy house hunting, and here’s to making savvy, educated mortgage choices in 2024 and beyond!

The Intriguing World of 30 Mortgage Rates

Did you know that the 30 year fixed mortgage rate today” is much more than just a number? It’s a reflection of the economy, policies, and market sentiments. If you think about it, these rates are like the heartbeat of the housing market—constantly fluctuating with the health of financial systems. Interestingly, the concept of a 30-year loan isn’t as old as you’d think! It emerged during the Great Depression to help stabilize the housing market, and boy, aren’t we thankful for that?

Now, hold onto your hats, because you might find yourself blown away by this little nugget of information: specific numbers within mortgage rates often become more popular or infamous over time. For example, hitting a “30 year fixed mortgage rate” that is considered low can feel like spotting a shooting star; it’s a rare, luminary event that can signal fortuitous times ahead for prospective homeowners. And just when you think rates might be settling down, they could take off or drop, almost like they’ve got a mind of their own!

So, why do these numbers play such hard to get? Well, they’re influenced by everything from inflation to Federal Reserve policies, to how many people are trying to buy houses at any given time. They’re more connected to the big picture than most realize, tethered to the ebbs and flows of the broader economy. And here’s a quirky twist: though we use the term “fixed” in “30 year fixed mortgage rate,” there’s nothing fixed about the impacts these rates have on people’s lives—they can change the whole trajectory of a person’s financial journey!

Between you and me, diving into the world of mortgage rates is like opening a box of chocolates; you never know what you’re gonna get. So whether you’re a potential homebuyer or just curious, keeping an eye on these ever-changing rates can be both a hobby and a smart move. After all, when it comes to the 30 year fixed mortgage rate today, being in the know could mean the difference between snagging your dream home or having to wait for the stars to align once more.

What is the current interest rate on a 30 mortgage?

– Hold onto your hats, folks! As of the latest buzz, the current interest rate on a 30-year mortgage is playing hopscotch around the 6.94% mark. It’s a wee bit higher than last week’s 6.90% and has seen a bit of a jump from last year’s 6.50%, just to keep us on our toes.

What’s the current 30 year fixed mortgage rate?

– Right now, the 30-year fixed mortgage rate is strutting its stuff at 6.94%. It’s inching up from last week but don’t worry, it hasn’t gone rogue—it’s still under the long-term average groove of 7.73%.

Are 30 year mortgage rates dropping?

– Well, isn’t that the million-dollar question! The crystal ball—aka Wells Fargo’s economists—whispers of a gentle slide downward, with the 30-year mortgage rate dipping its toes to about 6.8% in early 2024, then tiptoeing down to around 6.05% by the year’s end.

What is a great 30 year mortgage rate?

– A “great” 30-year mortgage rate is like a unicorn, rare and fabulous! In the current market, anything significantly under the average—say hello to anything below 6%—would have borrowers doing a happy dance.

Are mortgage rates expected to drop?

– You betcha, eagle-eyed watchers are predicting that mortgage rates will chill a bit in the near future. Wells Fargo’s brainiacs think we might even see them sneak below the 6% mark as we ring in 2025!

Are interest rates going down in 2024?

– So, the forecast for 2024—straight from the horse’s mouth at Wells Fargo—suggests interest rates are giving us a slow nod downwards. We’re eyeing around 6.8% at the starting gate of 2024, slipping to about 6.05% when we bid the year adieu.

What is best mortgage rate today?

– The best mortgage rate today is like the catch of the day—it’s fresh and depends on where you cast your net! Keep an eye out for rates dancing below the average, especially if they’re pulling shapes under 6.94%.

Which bank gives lowest interest rate for home loan?

– Ready for a mortgage scavenger hunt? The bank with the lowest interest rate for home loans changes faster than fashion trends. Do your homework, compare the numbers, and you might just snag a rate that’ll make your wallet sing.

What is the interest rate for a 700 credit score FHA loan?

– Ah, a 700 credit score is like having a golden ticket! For FHA loans, you’re looking nicely positioned in the “good” credit neck of the woods, which could land you a rate that’s the envy of the block. While there’s no one-size-fits-all answer, you’re definitely in a strong bargaining position.

Will mortgage rates ever be 3 again?

– “Ever” is a mighty long time, but as for mortgage rates hitting that magical 3% again, it’s a bit like waiting for lightning to strike. It’s happened before, sure, but… is it likely soon? Experts would give you a wink and a nudge that it’s not on the cards in the immediate future.

What will mortgage rates be in 2025?

– If you’ve got a crystal ball, now’s the time to dust it off! While there’s no exact number floating in the ether, Wells Fargo’s economists are hinting at rates dipping below 6% as we turn the page to 2025.

What was the lowest 30-year mortgage rate?

– Remember when mortgage rates hit the floor at rock bottom? That historical limbo bar was set at an eyebrow-raising 2.65% in December 2020. It’s the stuff of legend—and mortgage rate bedtime stories!

Can you refinance a 30 year fixed mortgage?

– Absolutely! Refinancing a 30-year fixed mortgage is like changing lanes on the mortgage highway. It’s an option to consider when you’re aiming to snag a lower interest rate or change your loan terms—but always watch out for the signs (aka fees and penalties)!

Is 2.75 a good 30 year mortgage rate?

– Is 2.75% a good 30-year mortgage rate? Is the sky blue? Back in the heyday of 2020, we saw rates like that, and if you snatched one up, you’re probably grinning like the Cheshire Cat.

What is today’s prime rate?

– Today’s prime rate is the financial world’s hot gossip—it’s the benchmark that many interest rates do the tango with. Keep your ears perked for the latest number from the big banks to know where it stands.

What was the lowest 30 year mortgage interest rate?

– The lowest of the low, that floor-sweeping 30-year mortgage interest rate, was a jaw-dropping 2.65%. It waltzed into the record books in December 2020 and has since floated up like a balloon.

What is best mortgage rate today?

– The best mortgage rate today is like a pinch-me moment, especially if it’s below the current average of 6.94%. Do a little digging and you might find a deal that’ll make you pop the champagne!

Is 3.25 a good mortgage rate for 30 year?

– Oh boy, 3.25% for a 30-year mortgage would be like hitting a home run in the bottom of the ninth. These days, it’s a bit of a nostalgia number, but who knows what the market will pitch in the future?

What are the 15 and 30 year mortgage rates today?

– Turning the spotlight on today’s 15 and 30-year mortgage rates: they’re like a seesaw, each with its own ups and downs. To find the latest, most attractive numbers, take a dive into the deep end of today’s loan offers, and don’t forget to come up for air!