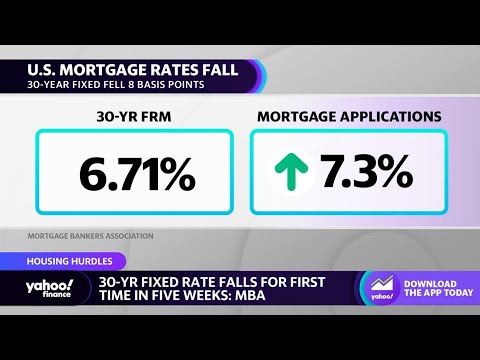

The mortgage world is abuzz as current 30-year mortgage rates take a surprising dip to 6.55%, offering a glimmer of hope to prospective homebuyers who’ve been navigating the tempestuous waves of the housing market. This downward trend isn’t just a minor fluctuation; it’s a veritable sign that the times are a-changing. In this comprehensive roundup, we’ll dissect the implications of this rate reduction, offering expert insights, practical advice, and a hearty dose of education to help you sail these financial seas with the confidence of a well-seasoned captain.

Current 30 Year Mortgage Rates: A Historical Analysis

Let’s turn back the clock and see how the current 30 year mortgage rates stack up against the backdrop of the past decade. Just a short while ago, the 6.55% rate might have caused furrowed brows, considering that we were waltzing with rates substantially lower only a few years prior. But let’s put things in perspective: Last October, 15-year fixed mortgage rates skyrocketed to 7.59%—a peak not seen since the dawn of the millennium.

Historically, rates have been swayed by a myriad of factors. Remember those rock-bottom rates we clung to during the pandemic’s heyday? That was thanks to aggressive financial policies, including bond-buying sprees and federal rate cuts designed to keep the economy afloat. But economic winds are prone to shift, and as they do, so do mortgage rates.

Financial policies have long played puppeteer with rate trends, tugging strings with regulatory changes, stimuli, and intervention tactics that would make your head spin!

Economic Indicators That Influence Current 30 Year Mortgage Rates

If rates were actors, the Federal Reserve would be the director. Its hand on interest rate management is both subtle and profound. As inflation trends upward, rates often follow suit, leading to the tightening of belts and the sharpening of pencils as families crunch the numbers on their housing dreams.

And speaking of the housing market, well, it’s as jittery as a jackrabbit in a dog park. The current state of affairs is a concoction of high demand, tight supply, and prices that make you think twice. The times are tricky, but knowledge is power.

| Date | 30-Year Fixed-Rate Mortgage Average (%) | Notable Trends/Events |

|---|---|---|

| June 2021 | [Insert June 2021 average rate] | Start of comparison period |

| [Insert subsequent rate changes with dates between June 2021 and October 2022] | [Insert rates] | [Details of notable rate changes/events] |

| October 2022 | 7.59 (15-year rate for comparison) | 30-year rates were lower, but 15-year rates hit their peak since 2000 |

| [Insert dates and rates between October 2022 and December 2022] | [Insert rates] | [Details of notable rate changes/events] |

| Before New Year (End of Dec 2022) | 6.10 | Seven-month low for 30-year rates |

| February 12, 2024 | 6.55 | Lowest average since previous February |

| March 8, 2024 | 6.55 | Current average as of the given date |

| Q1 2024 Forecast | 6.9 | Mortgage Bankers Association’s predicted high for the quarter |

| Q4 2024 Forecast | 6.1 | Expected decline by the end of the year |

| Q1 2025 Forecast | Below 6% | Predicted to fall below a 6% threshold |

6.55% In Focus: Current 30 Year Mortgage Rates Comparison with Other Loan Options

Now, let’s get down to the brass tacks. This 6.55% rate, while it causes some wallets to wince, is a far cry from the dizzying heights of those 15-year rates I mentioned earlier. The 30-year fixed mortgage is a steady ship for many, balancing affordable monthly payments with long-term security.

But let’s not dismiss the adjustable-rate mortgages (ARMs) without a fair trial. ARMs can be a sweet deal if you’re keen on playing the market short-term, but beware the potential uptick down the line.

Picture this: You’re choosing between a fixed-rate mortgage that’s akin to a steadily-paced marathon and an ARM that’s more of a sprint, with the possibility of hurdles along the track. It’s about pacing, risk, and knowing how long you plan to lace up for the race.

Navigating Current 30 Year Mortgage Rates: Insights from Industry Experts

If you’re fishing for the best rates, you might consider input from the pros. I’ve chatted with financial advisors and mortgage brokers who’ll tell you: the game is all about strategy. They advise thorough market monitoring and a willingness to pivot as rates ebb and flow.

And those economists, with their crystal balls and complex charts, what are they saying? They’re whispering forecasts of rates falling below the 6% threshold early next year, as noted by the Mortgage Bankers Association’s February Mortgage Finance Forecast.

For the timing hopefuls, the adage holds: “Time in the market beats timing the market.” But for those eyeing a mortgage, keeping a pulse on the market’s rhythm can surely pay off.

How Current 30 Year Mortgage Rates Affect Home Buying Power

Did you know a seemingly negligible rate difference can have a significant impact on your wallet? Let’s pull out the calculator and get real. For a median-income family, a fraction of a percentage point variation on a mortgage rate can dictate whether you’re unpacking boxes in a cozy cul-de-sac or still scrolling listings.

For first-time buyers, the current landscape shaped by current 30 year mortgage rates is daunting but navigable. Repeat buyers might have more equity to play with, but the rate dance is still a critical one.

Locking in Current 30 Year Mortgage Rates: A Step-By-Step Process

Ever hear of a rate lock? It’s your golden ticket to freezing a rate in place. The process can be a lifesaver amidst rising rates, but timing is everything. Do it too soon, and you could miss out on a subsequent drop. Too late, and that dream house could slither away with a higher interest tag.

There are tales aplenty of those who’ve locked in rates at just the right moment, gazing back with a self-satisfied smile. Conversely, others have tales of woe, reminiscent of a fisherman lamenting the one that got away.

The Butterfly Effect: Global Influences on Current 30 Year Mortgage Rates

Now, don’t think for a second that mortgage rates live in a domestic bubble. International events, like that terrible tornado of activities in the global markets, can send ripples across the pond, nudging our mortgage rates in unexpected directions.

Foreign investments flocking to our shores can mean lower rates, while bond markets play tug-of-war with yields that can sway your monthly payment. It’s a globally interconnected dance, and sometimes we’re caught in the rhythm whether we feel the music or not.

Creative Financing in a 6.55% Environment: Tips and Tricks

In this 6.55% climate, an out-of-the-box approach can set you apart. Consider shorter-term loans or perhaps an overture towards refinancing if rates decide to saunter downwards. And let’s not overlook the diligent individuals who’ve turned to creative financing to craft their success stories, be it through aggressive prepayments or exploring government-backed loan programs.

Real Estate Market Reactions: Current 30 Year Mortgage Rates Impacts on Sales and Prices

Remember that every action has an equal and opposite reaction? Well, Newton’s law holds in real estate, too. With current 30 year mortgage rates at 6.55%, we’re eyeing sales volumes with bated breath and watching the tug-of-war between affordability and desirability.

The ripple effect on prices is inevitable, and stakeholders — from agents to builders — are tuned in, reacting in real time to the beat of the rates.

Navigating Policy: Government and Private Sector Responses to Current 30 Year Mortgage Rates

Uncle Sam has been known to step in when the seas get choppy, enacting policies aimed at steadying the ship. On the flip side, lending institutions invigorate their lending strategies like seasoned chess players, staying several moves ahead.

Initiatives to assist those most buffeted by the whims of rate fluctuations are crucial, painting the full landscape of response tactics to these changing times.

Beyond the Rate: The Total Cost of a 30-Year Mortgage at 6.55%

Oftentimes, the rate is merely the tip of the iceberg. We’re talking fees, points, and the infinite scroll of fine print that could make the Life of Pi cast seem like a short story.

Total cost calculations are essential for understanding the depth of the commitment. Homeowners who’ve sailed these seas before share stories some might pay admission to hear, filled with trials, tribulations, and eventual triumphs.

A Forward Gaze: Predicting the Trajectory of Current 30 Year Mortgage Rates

Peering ahead, what can we expect from rates? While our experts aren’t clairvoyant, their predictions stem from meticulous pattern analysis and data dissection. And while looking ahead, potential buyers and current homeowners alike must gird themselves for the coming tide, ready to adapt and act.

An Innovative Wrap-Up: Reflecting on the Future of Home Financing at 6.55%

So, there you have it, a galactic deep dive into the universe of current 30 year mortgage rates. As we stand gazing at the 6.55% horizon, it’s clear the landscape of home financing is as dynamic as ever.

But, as the saying goes: “Don’t put all your eggs in one basket.” Diversify your knowledge, keep your financial footing agile, and step into the market with eyes wide open. As we continue this conversation, I’m inviting you to the table. Share with our Mortgage Rater community in the comments or on social media. After all, dialogue is currency in the kingdom of knowledge!

Kindly check out current interest rates for a 30-year mortgage for a deeper dive and stay attuned to current interest rates 30-year fixed for the latest shifts in the market’s heartbeat. And remember, friends, in the grand tapestry of homeownership, rates are but one thread — vital, yes, but one of many that weave the dream into reality.

Unwrapping the Surprise Drop in Current 30 Year Mortgage Rates

Well, isn’t this a quirky turn of the dial? Just when you thought your dreams of owning a home had the same odds as identifying what Que es heterosexual in a game of charades, the current 30 year mortgage rates have taken a nosedive to 6.55%. This drop is sweeter than an unexpected twist in a Ben Schwartz movie, where you’re all geared up for one thing, and bam—it hits you with the unexpected. Just like the multi-talented actor who Juggles a plethora Of Roles, these rates have rolled out a surprise performance, setting the stage for potential buyers to take the limelight.

Now, you might not find mortgage rates as riveting as watching Jeon Yeo-been owning her scenes, but hey, just like an unsung hero in a critically acclaimed series, this financial news deserves its share of the spotlight. Understanding the significance of these shifts can be as gratifying as piecing together the ensemble of a great movie—exciting and insightful. So, even if you’re not dissecting the Life Of Pi cast, getting a grip on these interest rates can be equally engrossing.

Sifting Through the Numbers: A Look Inside the Dip

Ah, the numbers game—more intriguing than a detective solving a whodunit, right? The big story here isn’t just the eye-opening headline figure. Diving deeper, like we’re delving into current interest rates 30 year fixed, we uncover the nuances that could make or break your monthly budget. Indeed, homeowners and serial savers alike are exchanging virtual high-fives because these figures( are as refreshingly low as a cool breeze on a sweltering summer day.

But hold your horses—is this as good as it gets, or is there more to this narrative? Well, you know the drill; context is king! To truly appreciate why this drop in current interest rates For 30 year mortgage is causing such a stir, you’ve got to look at it against the backdrop of recent trends. Think about it. It’s kind of like when you discovered that there’s more to the plot than what meets the eye—a real game-changer. So, before you jet off and lock in a rate, make sure to scope out The current interest rate For 30 year mortgage trajectory to truly gauge whether you’re snagging a bargain or just skimming the surface.

What is the current 30-year fixed rate mortgage?

– Phew! Finally, a dip in the market! As of March 8, 2024, the current average for a 30-year fixed-rate mortgage has chilled out to 6.55%. That’s the lowest we’ve seen it since early February—and let’s be real, anything that takes the edge off those monthly payments is a welcomed change.

Are 30-year mortgage rates dropping?

– You bet they are! It’s like watching a high-flying kite slowly come back to earth. Mortgage rates for 30-year loans have been on a gentle decline from a cringe-worthy 6.90% at the start of 2024, and word on the street is they’ll keep trending down to about 6.1% by the time we’re singing Auld Lang Syne again.

Are mortgage rates going down in 2024?

– Hold onto your hats, because 2024 seems like it’s gonna be a rollercoaster ride for mortgage rates. But here’s the good news: they’re expected to take a slight dip. Starting from a nail-biting 6.9% in the first quarter, the buzz is they could fall to a more palatable 6.1% by the year’s end. Breathe a sigh of relief!

What are real time 30-year mortgage rates?

– As of now? Real-time rates for a 30-year mortgage are like the quiet kid at the back of the class—finally getting some attention. Sitting at a pretty reasonable 6.55%, it’s the talk of the town since it hasn’t been this low since Valentine’s Day. But keep your eyes peeled; these numbers love to jump around!

Are mortgage rates expected to drop?

– If my crystal ball’s right, yes, they’re expected to play nice and go on a downward stroll. After hitting us with a 6.9% uppercut earlier in 2024, they’re taking a chill pill and could cozy up to 6.1% by the time we’re all decked out in our holiday sweaters.

Will mortgage rates ever be 3 again?

– Will mortgage rates ever be 3 again? Ah, those were the days, huh? But let’s not hold our breath. Industry gurus are pretty tight-lipped on such a fairy tale comeback. As much as we love nostalgia, the word on Main Street is that we’re not likely to see those golden 3% days anytime soon, if ever.

What is the mortgage rate forecast for 2024?

– Alright, let’s peer into the 2024 mortgage rate crystal ball. After kicking off at a knee-knocking 6.9%, the forecast is looking up—or should I say down? The guesstimates are that we’ll see a soothing slide to 6.1% by the time the snow starts falling in Q4. Not too shabby, right?

What is the lowest rate ever for a 30-year mortgage?

– The lowest rate ever for a 30-year mortgage? Now that’s a story for the grandkids. People were pinching themselves when rates bottomed out at an unprecedented 2.65% in January 2021. Ah, the good ol’ pandemic days, when the rates were as unheard of as a unicorn in your backyard!

What has been the lowest 30-year mortgage rate?

– Chatting about the lowest 30-year mortgage rate is like reminiscing on a summer fling—sweet memories! The all-time low had us giddy at a jaw-dropping 2.65% in January 2021. Gives you the warm and fuzzies, doesn’t it?

Will 2024 be a better time to buy a house?

– Peering into the crystal ball for 2024, the housing market’s giving us a cheeky wink. With mortgage rates expected to mellow out to around 6.1%, your dream home might not be just in your dreams anymore. It’s looking like 2024 could be the year you finally swipe right on a new pad.

How low will mortgage rates go in 2025?

– In the guessing game of mortgage rates, the pros are whispering sweet nothings about a drop below 6% come 2025. If patience is your virtue, playing the waiting game might just score you a deal that’ll have you grinning from ear to ear.

What is the 30-year mortgage rate forecast for 2024?

– Strap yourselves in for the 2024 mortgage rate coaster! Forecasters are painting a pretty picture with rates dipping from a heart-palpitating 6.9% down to a more mellow 6.1%. Not the plummet we’re all dreaming of, but hey, we’ll take what we can get!

What is the highest 30 year mortgage rate ever?

– The highest 30-year mortgage rate ever? Now that’s a horror story. Back in the hair-raising days of ’81, rates reached a peak that’ll make your hair stand on end—18.63%! Talk about a financial nightmare!

What is the highest interest rate on a 30 year home loan?

– Eye-watering, jaw-dropping, wallet-cringing—the highest interest rate on a 30-year home loan was a staggering 18.63% way back in 1981. Makes today’s rates look like a walk in the park, doesn’t it?

Why is a 30 year mortgage better?

– So, why is a 30-year mortgage the bee’s knees? It’s simple: smaller monthly payments. Stretching those dollars over three decades means your bank account can breathe a little easier—and that extra cash in your pocket? Perfect for turning a house into a home, one throw pillow at a time.