A Comprehensive What Is The Current 30 Year Mortgage Rate

When we talk about the current 30-year mortgage rate, we’re dipping into a topic that’s crucial for anyone with a dream of white picket fences and a backyard for barbecues. In essence, this rate determines the fixed amount of interest you’ll pay over three decades of homeownership.

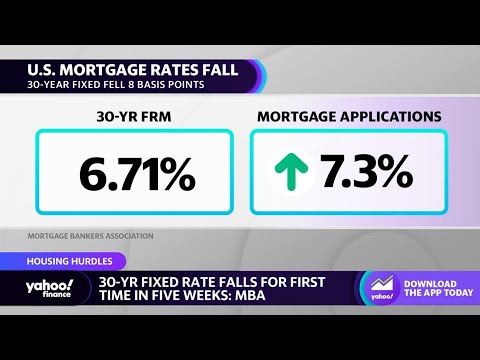

Did you know the current expected trajectory of the 30-year fixed mortgage rate is to simmer down to the low-6% range by the end of 2024, and possibly touch the high-5% region as we step into 2025? Mortgage rates, essentially, are a barometer of economic winds, and right now, they’re hinting at an economy that’s easing off the gas pedal.

Historical Context: The 30 Year Mortgage Rate Over Time

Looking back, it’s like we’ve been on a roller coaster. Once upon a time, and not so long ago (remember 2021?), the rates plummeted to historic lows – we’re talking a jaw-dropping 2.65% in January of that banner year. They had never nosedived below 3% until July 2020. Seeing numbers like that now? Well, that’s as rare as spring breakers admitting they’re just in it for the library access.

| Aspect | Detail |

| Current 30-Year Mortgage Rate | Varies (Please consult a financial institution or current financial news for today’s rates) |

| Rate Direction | Declining |

| Economic Factors | Weakening U.S. economy, slowing inflation |

| Federal Reserve Actions | Expected interest rate cuts |

| Anticipated Rate by End of 2024 | Low-6% range |

| Anticipated Rate by Early 2025 | High-5% territory |

| Historical Low (January 2021) | 2.65% |

| Rate Trend Since 2021 | Increased post-historical low, now expected to decline |

| Considerations for Borrowers | Prospective lower rates beneficial for new mortgages or refinancing |

| Implications for the Housing Market | Potential increase in buyer affordability and housing market activity |

Factors Impacting What the Current 30 Year Mortgage Rate Is

Now, let’s get under the hood, shall we? The Federal Reserve is like the maestro conducting the orchestra of our economy. When they tweak the interest rates, the mortgage rates start dancing to the tune. Economic health markers, such as inflation (the arch-nemesis of buying power) and employment rates, also have their fingers on the pulse of these rates. And don’t even get me started on international events that can make rates jump like Alitas de Pollo on a hot grill.

Comparing Today’s Rate With Recent Years

Here’s where we put on our comparison hats. The rates today, against the backdrop of the past 1, 5, and 10 years, tell tales of times when your mortgage payment might have differed by the cost of a healthy stash of healthy fast food options over the years, all thanks to rate changes influenced by the socio-economic climate.

How the Current 30 Year Mortgage Rate Influences Buying Power

Imagine this: a tiny hiccup in the rates can swell into a mountain of additional interest over 30 years. It’s like comparing a molehill to a mountain. Even the won’t replenish your wallet after that. If you’re not careful, you could end up paying more for your loan than your home’s actual price.

Lenders’ Interpretation of the Current 30 Year Mortgage Rate

Chatting with the big guns like JPMorgan Chase and Wells Fargo? They’ll tell you about their latest 30-year mortgage rate offers like they’re sharing trade secrets. They know these are numbers that can make or break your homeownership dreams.

Strategies for Locking in the Best 30 Year Mortgage Rate

Timing the market for the perfect rate can feel like chasing a unicorn. But, knowing when to bite the bullet can potentially lock in a deal that’s sweeter than your grandma’s apple pie. Then, spruce up your financial muscles so you can flex those solid credit scores and debt-to-income ratios.

Regional Variations in Rates and What They Mean for You

Folks, real estate is as local as your neighborhood Av女优 fan club. Depending on where you hang your hat, the current 30-year mortgage rate can be as varied as the local cuisine. Local economic nuances spice up these variations, so it’s worth digging into the data like a detective.

Future Predictions: Where Is the 30 Year Mortgage Rate Headed?

Forecasting mortgage rates is akin to reading tea leaves or a cloudy crystal ball. Economists, with all their fancy degrees, are peeking into the future and betting on rates either cuddling up to the fireplace or taking a dip in the pool – will they rise or fall? The market’s murmuring is all about predictions for the end of 2024 and beyond.

Navigating Your Mortgage Options in Light of Current Rates

Choosing between a fixed-rate and an adjustable-rate mortgage right now is like deciding whether to walk a tightrope or ride a unicycle. Each has its perks and quirks. With the 10 year mortgage rates looking different from the 30-year rates, you might consider a shorter-term loan that fits your financial fashion.

The Bottom Line: Maximizing the Value of Your Home Purchase with Today’s Rate

Let’s wrap this up with a pretty bow, shall we? If you’re house-hunting or looking to refinance in this climate, knowledge is your golden ticket. Use the current rate to your advantage, make smart moves and remember: this is the long game. Strategic refinancing or property investment can be your highway to a smarter, savvier financial future.

Navigating the ever-shifting sands of mortgage rates requires patience, insight, and a dash of courage. By understanding what the current 30-year mortgage rate means for your wallet and your future, you’re stepping onto the playing field with your best foot forward. Remember, in this game, every little decision counts, and knowledge isn’t just power—it’s profit.

Get to Know: What Is the Current 30 Year Mortgage Rate

Hey there, homeowners and curious cats! If you’ve been hunting down the skinny on what is the current 30 year mortgage rate, you’re in the right place. Let’s dive into a little bit of trivia that’s as refreshing as sipping on the best electrolyte powder after a marathon. Did you know that while you’ve been crunching those housing numbers, the current rates have been dancing more than a reality TV star on a finals episode? It’s true! Rates have seen some dips and dives, making it a rollercoaster ride for potential buyers and refinancers alike.

Now, hold your horses before you think that means rates are in the basement. While they’re not scraping the sky, finding a competitive rate is as crucial as staying hydrated during a desert trek. If you’ve got a knack for comparison, checking out bank mortgage rates can be as eye-opening as your first cup of coffee in the morning. Banks are always jockeying for the top spot, so their rates can be as varied as flavors in a soda stream.

Now, speaking of short and sweet—sort of like your grandma’s cherry pie—let’s look at those sprightly little 10 year mortgage rates today. Did you realize the ten-year option is like the sprinter next to the marathon runner that is a 30-year mortgage? These rates are often lower, tempting folks with the promise of freedom from mortgage shackles way sooner. Whether or not they’re the right choice for you is as personal as your playlist during a long drive.

In the end, remember your mortgage rate affects more than just your monthly payment; it’s a decision that’ll stick to you like gum on a hot sidewalk. But armed with the right info and a dash of fun facts, you’ll be ready to tackle those rates like a pro. Stay savvy, my friends, and may your mortgage rate journey be as smooth as your favorite jazz tune.

What is the current 30-year fixed-rate mortgage?

– Ah, the ever-changing saga of the 30-year fixed-rate mortgage, eh? As we speak, it’s like a kite caught in a bit of a headwind, with rates moving and grooving. But if you’re fishing for a number, the current 30-year fixed rate is fluttering in the low-6% range, expected to take a bit of a dip as we cruise toward the end of 2024.

What is todays interest rate?

– Today’s interest rate? It’s like checking your watch; it changes every moment! But here’s the scoop: we’re hanging out in the low-6% playground for the 30-year fixed-rate mortgage. It’s best to check with your lender though—they’re the keepers of the magic numbers, after all.

Are mortgage rates going down in 2024?

– Will mortgage rates go down in 2024, you ask? All signs point to yes! With Uncle Sam likely tightening the belt and chilling on the rates, we’re expecting to see them shimmy down to friendlier territory in the low-6% range, even peeking into the high-5% zone like a groundhog looking for his shadow.

Are mortgage rates expected to drop?

– Are they expected to drop, huh? Like leaves in autumn, mortgage rates are predicted to fall later this year, taking a gentle slide down to the low-6% range. And let me tell ya, as 2024 waves goodbye, we might even see them dip their toes in the high-5%s.

Will mortgage rates ever be 3 again?

– Will we ever see the golden days of 3% mortgage rates again? Boy, wouldn’t that be a hoot! While we can’t say for sure, rates plunging that low aren’t on the immediate horizon. But dreams can come true, so keep an eye out—you never know!

What will interest rates be in 2024?

– Forecasters are putting on their wizard hats and predicting that interest rates in 2024 will give us a bit of relief, sliding down to the low-6% range. And as the New Year’s ball drops, we may even get a high-five from the high-5%s!

What is a good mortgage rate?

– A good mortgage rate? It’s like asking what makes a good pizza—it depends! But in today’s market, snagging a rate lower than the current average in the low-6%s means you might just be dancing at the victory party.

Who has the highest interest rates right now?

– When it comes to the high-flyers of interest rates, it’s a bit of a horse race. But generally, online banks are sprinting ahead with the highest rates because they’ve got less overhead baggage. Traditional banks? They’re more in the middle of the pack.

Which Bank gives lowest interest rate for home loan?

– Fishing for the lowest interest rate for a home loan? Credit unions might just be your catch of the day. They often serve up the lowest rates with a side of personalized service, since they’re all about their members. Don’t forget online banks, too—they’re lean, mean, rate-fighting machines!

Will 2024 be a better time to buy a house?

– Is 2024 the year you’ll finally get the keys to your castle? Well, with mortgage rates expected to do a little dip, your dream home might not be such a pipe dream. Dipping rates could mean more ‘for sale’ signs are in your stars.

What will mortgage rates be in 2025?

– Crystal ball time! In 2025, we might see 30-year mortgage rates giving us a shy wave from the high-5% range. Of course, it’s all a bit of educated guessing, so don’t bet the farm on it, but it’s looking like a warmer outlook for rate-watchers.

What is the 30-year mortgage prediction for 2024?

– The 2024 crystal ball is getting clearer! The vibe is that the 30-year mortgage rate will likely slide into the low-6% range. Don’t be surprised if it sneaks into the high-5%s as we round the bend into 2025—kinda like an unexpected tax refund.

Should I lock in my mortgage rate today or wait?

– To lock or not to lock in your mortgage rate today? It’s a nail-biter, for sure. With rates expected to dip, waiting could be your ticket to savings. But hey, if you’re a ‘bird in the hand’ kind of person, locking in now means one less worry on your plate.

What is the interest rate forecast for the next 5 years?

– Gazing into the next five years, the interest rate forecast is a roller coaster, my friend—up, down, and all around. But signs point to a gentle slide down the interest rate hill over the next couple of years. Buckle up, though; it’s economics, and anything can happen!

Why are mortgage rates so high?

– Why are mortgage rates higher than a kite on a windy day? It’s a stew of reasons: a strong economy (too much of a good thing, huh?), inflation playing hardball, and the Federal Reserve tightening the reins. It’s like all the cooks in the kitchen are cranking up the heat!