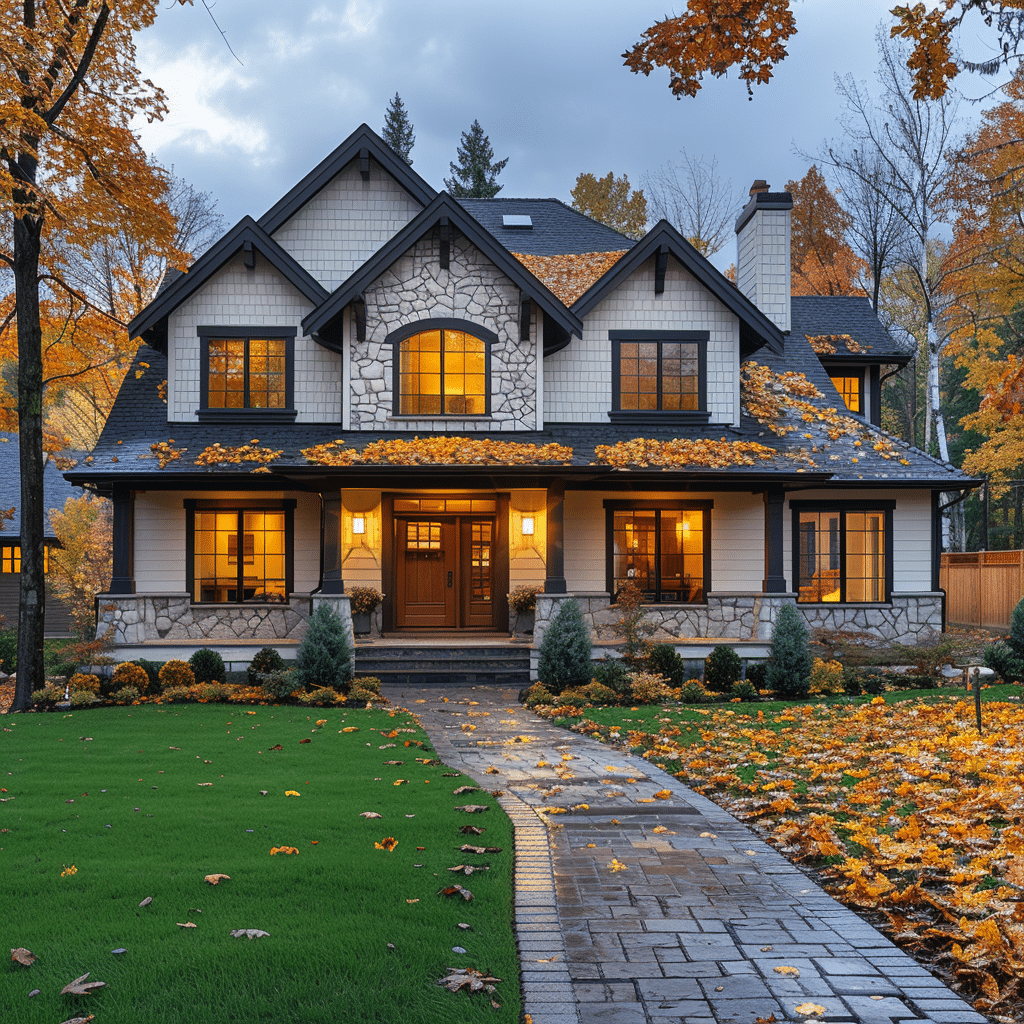

Attention all homebuyers and homeowners! Gather ’round because we’ve got some news that’ll make you want to pop the champagne. After a roller-coaster ride, home mortgage rates are set for a sweet slide down the hill in 2024. If you’re looking to snatch up a piece of the American dream or just itching to refinance, now’s the time to lean in.

The Forecast Trend of Home Mortgage Rates into 2024

Listen up, folks, because the word on the street is that home mortgage rates are trending downwards, and it looks like they may just keep on slipping through the year. After some number crunching and analyzing recent market indicators, such as the dance between inflation and economic activity, it’s looking like this downward trend isn’t just talk of the town – it’s the real deal.

Economists, with their crystal balls polished, point to policies that are taking a turn toward rate cuts, given the economic forecast is for a slow waltz rather than a quickstep. This means, dear friends, those pesky interest rates that have been burdening wallets might be getting a much-needed trim.

If the Federal Reserve decides to cut rates as our home loan rates today suggest, it signals a wave of relief for buyers. In the lending world, this is as sweet as honey on a hot biscuit – cheaper loans for all. But, like money maestro Robert Kiyosaki would preach, let’s not count our chickens before they hatch and keep an eye on those economic policies. They’re always up to something.

Evaluating the Impact of Federal Reserve Policy on Home Mortgage Rates

Ah, the Federal Reserve, our economic overlords. Their decisions on interest rates are like the puppet strings of the mortgage world. Traditionally, when the Fed lowers the rates, home mortgage rates tend to do a happy jig follow suit. But, history’s only a guide, not a guarantor.

Recently, there’s been chit-chat about the Fed changing its tune and adjusting its policies. With a weakened economy in the rearview and inflation slowly backing off like a shy raccoon, the Fed’s got the space to pull those rate levers down. If that happens, we could see home Mortage rates skid into the much more palatable low-6% range, potentially high-5% by early 2025. Now ain’t that a sight for sore eyes?

| Term Length | Expected Rate Range | Potential Benefits | Key Features | Forecast Period | Influencing Factors |

|---|---|---|---|---|---|

| 30-year Fixed | Low-6% range | Lower monthly payments, Interest cost savings | Fixed interest rate for the life of the loan, Stability in payments | End of 2024 | Weakening U.S. economy, Inflation slowdown |

| 15-year Fixed | Historically lower than 30-year rates | Faster equity buildup, Lower total interest cost | Shorter term, Higher monthly payments but less interest over the life of the loan | End of 2024 | Federal Reserve interest rate cuts |

| 5/1 ARM | Varies with market conditions | Potentially lower rates for first 5 years | Fixed rate for first 5 years, then adjusts annually | End of 2024 into early 2025 | Predicted high-5% territory in early 2025 |

Global Economic Factors Influencing a Decline in Home Mortgage Rates

But wait, there’s more! The U.S. doesn’t spin on its axis alone; we’re part of the big, wide world, and what happens beyond our borders can send ripples across our mortgage ponds. International trade agreements and global economic trends are the invisible forces that can tug our mortgage rates this way and that.

When our foreign pals have their economies humming nicely, or their central banks start playing the rate-cutting game, it can mean lower rates back home. Keep your eyes peeled on these international shenanigans – they’re more intertwined with your home-buying dreams than you might think.

Technological Advancements and Their Role in Shaping Home Mortgage Rates

Tech’s been sneaking into every nook and cranny of our lives, and the mortgage industry isn’t hiding from it either. Fintech, that’s financial technology for the uninitiated, is all the rage and it’s stirring up some fierce competition among lenders, which – drumroll, please – could help shove rates even lower.

Slick online mortgage platforms are all the rage now, with home Morgage rates becoming more transparent and buyer-centric than ever before. It’s like the Wild West out there, only with less cowboy hats and more impressive algorithms.

Real Estate Market Dynamics Preceding the Drop in Home Mortgage Rates

Ever watched those nature shows where the predator and prey are in an eternal dance? Well, surprisingly, it’s not too different in the real estate market. Housing supply and buyer demand are doing this intricate tango, and the tempo of that dance dictates mortgage pricing.

Take the hot-as-a-tin-roof San Francisco market – when it starts to show signs of cooling, mortgage rates might just follow suit and take a chill pill too. It’s all about supply and demand, baby.

The Influence of National Economic Health on Mortgage Interest Rates

Gather ’round for a homework assignment, dear readers. Go look up the correlation between unemployment rates, consumer spending, and home mortgage rates. Done? Good. You’ll see that when folks are feeling peachy about their job prospects and wallets, they’re more likely to splurge on a new home, propping up mortgage rates.

But, when the going gets tough and the economy hits a rough patch, like the one we anticipate later in 2024, mortgage rates can shrug off their high horse and offer a friendlier saddle.

Homeowners and Prospective Buyers: Strategies to Capitalize on Falling Mortgage Rates

Alright, time to put on your strategic hats! For all you current homeowners, a declining interest rate scene is like finding an extra cookie in the cookie jar – time to refinance, perhaps? Lock in those lower rates and save yourself a bundle.

Now, all you bright-eyed, bushy-tailed first-time homebuyers, get ready to pounce. Secure that sweet mortgage rate in the forecasted drop, but don’t you dare forget about pesky details like the prepayment penalty. Read the fine print, or you might just find yourself in a pickle.

Mortgage Industry Predictions: Expert Broker and Lender Insight

Oh, to have a crystal ball! Since we don’t, we turn to the prophets of the industry – brokers and bankers. Industry giants like Wells Fargo and Quicken Loans are whispering sweet nothings about these dipping rates, giving us glimpses into their expectations.

Our resident economists, with brows furrowed in concentration, are hesitant to put a stopwatch on this trend. They say, enjoy it while it lasts, because, as we all know, what goes down must eventually trudge back up.

What Lower Mortgage Rates Mean for the Economy and Housing Market

If you’re wondering what a drop in mortgage rates could mean for you and your pocketbook, imagine a more robust economy with consumers spending like they just found a twenty in their pocket. These decreased home buying costs could ignite a spending bonanza that doesn’t stop at just the housing market.

But hold your horses – it’s not all sunshine and rainbows. A drop in mortgage rates might mean houses fly off the market faster than hotcakes, potentially pushing prices up. It’s a delicate seesaw, and we’re all along for the ride.

Preparing for the Future: Long-Term Mortgage Rate Predictions

Thinking long-term, eh? Smart move. Navigating mortgage rates is a bit like herding cats, but with a dash of insight from financial advisors, you’ll be playing the long game like a pro.

We might see the government step in with a steadying hand or a new policy that shakes things up. Remember, in the mortgage game, being prepared is half the battle.

The Regional Variations in Mortgage Rate Adjustments Across the US

One size does not fit all, especially when we’re talking about home mortgage rates across this vast nation of ours. Cities like New York and Los Angeles are seeing their rates jitterbug to a different beat, influenced by unique economic trends at the state level.

Keep your ears to the ground, and get ready for a regional rollercoaster of rates. Just because your cousin in Texas snagged a sweet deal doesn’t mean the same rates are waiting for you in Michigan. It’s a mosaic of mortgage rate madness!

Innovative Wrap-Up: Embracing the New Era of Home Buying

Welcome to the future, friends, where mortgage rate fluctuations are as common as dogs chasing tails. As prospective homebuyers or existing homeowners, navigating this labyrinth can feel daunting – but fear not.

Stay informed, roll with the punches, and don’t lose sight of opportunities that come knocking. Whether it’s locking in a lower rate or jumping on the home ownership train for the first time, keep your wits about you, and remember: in the world of home buying, fortune favors the bold.

So buckle up, readers, because we’re on the cusp of a new era of home buying. Embrace it, empower yourself with knowledge, and let’s ride this wave of change together!

Keeping Pace with Home Mortgage Rates

As we sail into 2024, the tides of home mortgage rates are set to change, possibly making homeownership more attainable for many. Now, speaking of change, here’s a fun tidbit: imagine if your mortgage payment were in the form of banknotes featuring Andrew Jackson’s stern visage. Well, he might not be seen with his intense gaze on your currency anymore. The story behind the Andrew Jackson on the bill situation is quite the roller coaster—much like the fluctuating nature of mortgage rates!

Meanwhile, navigating these waters might be less about who’s on your money and more about who you’ve got navigating the ship with you. It’s a bit like when Larry Bird needed his steadfast partner, Dinah Mattingly, on his team off the court. A stable partnership can weather many storms, and the same goes for finding a reliable mortgage advisor to help steer through the home-buying process.

Curious Connectivity of Rates and Personalities

On another note, did you know that mortgage rates sometimes seem to have as many ups and downs as a rockstar’s career? Take Twiggy Ramirez, for example, whose bass-playing journey has had its fair share of peaks and valleys. Like a musician’s fluctuating fame, home mortgage rates can rock and roll from year to year, making now a captivating moment as they’re projected to drop.

Furthermore, speaking of rock stars in their fields, how about scoring a goal with a mortgage rate that feels like a winner? Just as Lauren Holiday masterfully controlled the soccer field, understanding home mortgage rates requires both strategy and finesness. Securing a low rate now could have you feeling like you’ve just won a championship game.

So, whether you’re trying to navigate the economic currents or merely interested in the quirky connections between money, personalities, and home mortgage rates, remember that timing is everything. Jumping on the chance to lock in a lower rate can be the move that helps you to score big in the real estate game. Keep your eye on the prize, and maybe you’ll be doing your victory dance in the living room of your new home before you know it!

Are mortgage rates expected to drop?

– Well, folks, it looks like there’s a silver lining on the horizon! Mortgage rates are expected to take a chill pill and simmer down later this year. With the economy hitting the brakes and inflation slowing its roll, the Fed’s likely to cut interest rates. So, if you’re playing the waiting game, you might see 30-year fixed mortgage rates dip into the low-6% turf by the tail end of 2024, and hey, they might even sneak into high-5% territory come early 2025.

Are mortgage rates going down in 2024?

– Buckle up, homebuyers and refinancers, ’cause the word on the street is that mortgage rates are going down in 2024. Thanks to inflation taking a backseat, most forecasts are banking on rates to mellow out throughout the year. So if you’re eyeing a better rate, it looks like 2024 could be your lucky number!

What is the current interest rate on mortgages?

– Oh boy, aren’t we all itching to know? Today’s mortgage interest rates are like a rollercoaster, but as of the latest buzz, they’re hovering in the mid-to-high-6% range for your standard 30-year fixed loans. Keep in mind, these numbers can be as wiggly as a fish, so it pays to keep your eyes peeled for daily updates.

What is today’s 30-year fixed rate?

– If you’re wondering about the 30-year fixed rate today, you’re not alone! Everyone’s curious, but you gotta remember, rates fluctuate faster than a cat on a hot tin roof. Right now, we’re seeing rates strut around the mid-to-high-6% catwalk, but remember, that’s just a snapshot and tomorrow is a whole new day!

Will mortgage rates go down to 3 again?

– As much as we’d love to travel back in time, mortgage rates hitting 3% again might be a tall order, like expecting a unicorn at your birthday party. With everything going on, it’s looking like we won’t be revisiting those good ol’ 3% days any time soon, if at all.

Will interest rates go back down to 3?

– Will interest rates waltz back down to the dreamy 3% ballroom floor? It’s a bit like hoping for snow in July – not impossible, but don’t bet the farm on it. The financial forecast doesn’t seem to be in favor of rates that low, at least not in the near future.

Will 2024 be a better time to buy a house?

– Thinking of snagging a new pad in 2024? With rates doing the limbo, it could be prime time to score a deal. As mortgage rates mosey on down, your wallet might just get a break, making 2024 a seriously tempting time to say “home sweet home.”

How low will mortgage rates go in 2025?

– Curious about how low mortgage rates will groove in 2025? While my crystal ball’s a bit foggy, forecasters are predicting we might see them dip into the high-5% groove early on. But as with any forecast, take it with a grain of salt and stay tuned!

What will home mortgage rates be in 2025?

– So, what’s the tea on home mortgage rates in 2025? Pull up a seat, because it’s looking like they could chill out in the high-5% lounge. Granted, 2025 is a bit like a distant radio signal right now, so we’re basing this on the best guess-timates.

Who is offering the lowest mortgage rates right now?

– On the hunt for the lowest mortgage rates? Lenders are shuffling around, so it’s like a game of musical chairs. The trick is to shop around, as different lenders might have different offers – just make sure you’re comparing apples to apples!

Why are mortgage rates so high?

– Mortgage rates are climbing up like a kid on a jungle gym because inflation’s been eating too much sugar, and the economy’s been doing heavy lifting. The Fed’s been hiking rates to cool things off, much to the chagrin of our bank accounts.

Which Bank gives lowest interest rate for home loan?

– If you’re fishing for the bank with the lowest rates for a home loan, your best bet is to shop around. Some banks are more generous than others and might just throw you a bone with a lower rate. Just remember to read the fine print!

What is a good APR on a 30 year mortgage?

– A good APR on a 30-year mortgage is like finding jeans that fit just right – it can vary by person. But right now, a decent APR is anything in the mid-to-high-6% range. Though, just like fashion, what’s “in” can change in the blink of an eye.

Do you have to have 20 down for a mortgage?

– Do you need to put 20% down for a mortgage? Nope, it’s not a must – there are loans out there that ask for less. But dropping 20% can sidestep that pesky private mortgage insurance and might get you better rates – like getting an extra scoop of ice cream for being a good customer.

What is considered a good interest rate?

– A good interest rate is like a thumb’s up from your loan officer – it means you’re getting a solid deal. These days, if you’re scoring anything below 7%, you might just be the cat’s pajamas. But remember, a good rate for you depends on your credit score, down payment, and loan type.