Understanding the Significance of a Home Interest Calculator

In today’s fast-paced mortgage landscape, obtaining accurate mortgage estimates is essential for potential homeowners looking to make sound financial decisions. One indispensable tool for achieving this financial clarity is the home interest calculator. With this tool, you can project costs related to mortgage payments over time, considering different interest rates, loan terms, and principal amounts. By breaking down the math, a home interest calculator helps you manage your finances and plan for the future effectively.

Top 7 Home Interest Calculators for 2024

The modern housing market is dotted with various home interest calculators, each bringing something unique to the table. Here are the top seven options for 2024 that promise precision and user-friendliness.

1. Bankrate’s Home Interest Calculator

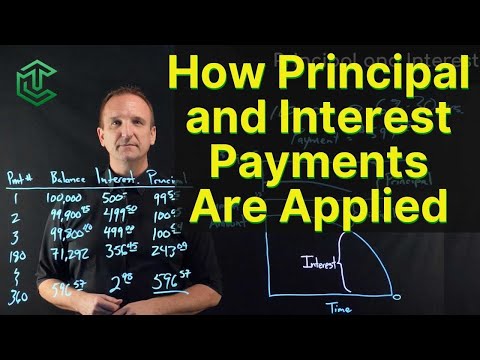

Bankrate’s home interest calculator is highly regarded for its easy-to-navigate interface and detailed results. Users can input different variables such as loan term lengths, interest rates, loan amounts, and down payments. Visual charts show mortgage amortization over time, offering a clear view of your financial journey. The calculator also suggests lenders and displays current market rates, making it a one-stop solution for future homeowners.

2. NerdWallet’s Mortgage Calculator

NerdWallet’s mortgage calculator dives deeper by providing a breakdown of principal and interest payments, along with taxes and insurance. This thoroughness offers a clearer picture of your monthly obligations. The real-time updates on mortgage rates ensure you’re working with the latest numbers, and the educational articles on the platform further cement its value as a premier tool for home buyers.

3. Zillow’s Home Loan Calculator

Zillow’s home loan calculator stands out for its simplicity and integration with Zillow’s extensive property listings. Users can tweak interest rates and loan terms while simultaneously viewing real estate options. This unique combination helps you make more informed decisions by linking potential homes directly with their associated costs, making house hunting more efficient.

4. MortgageCalculator.org’s Payment Calculator

Catering to both novices and seasoned users, MortgageCalculator.org offers a home interest calculator that includes detailed fields like annual taxes, private mortgage insurance, and homeowner association dues. The site even has a refinance calculator module, supported by in-depth financial articles and FAQs, making it a multi-faceted tool for any mortgage-related query.

5. Quicken Loans’ Rocket Mortgage Calculator

Rocket Mortgage by Quicken Loans integrates advanced features like real-time credit analysis and pre-approval processes. This home interest calculator is designed to offer personalized estimates by incorporating user-specific data. When you input your details, you get mortgage estimates that are tailored and precise. Moreover, Rocket Mortgage facilitates a seamless application process, which is a big plus for serious buyers.

6. Chase’s Mortgage Payment Calculator

Chase offers a home interest calculator that excels in clarity. It breaks down total housing costs, including principal, interest, property taxes, and homeowner’s insurance. This calculator is especially useful for those who want to compare different loan scenarios side-by-side. Chase’s brand reliability also adds a layer of comfort for users preferring trusted institutions.

7. Dave Ramsey’s Mortgage Calculator

Dave Ramsey’s mortgage calculator is known for its minimalist yet effective design. It provides quick insights into your financial stance, alongside the ‘Mortgage Payoff Calculator’ feature. This allows users to strategize on how to pay off their mortgage faster, aligning perfectly with Dave Ramsey’s financial philosophy of reducing debt as swiftly as possible.

| **Title: Home Interest Calculator Summary Table** | ||||

|---|---|---|---|---|

| Mortgage Amount | Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

| $300,000 | 30 years | 6% | $1,798.65 | $347,514.57 |

| $300,000 | 15 years | 6% | $2,531.43 | $155,682.69 |

| $500,000 | 30 years | 7.1% | $3,360.16 | $705,462.72 |

| $200,000 | 30 years | 4.33% | $993.27 | $157,576.91 |

| $200,000 | 30 years | 5.33% | $1,114.34 | $201,161.76 |

| Interest Rate Insights | ||||

| In today’s market (as of May 9, 2024), a good mortgage interest rate can fall in the high-6% range. Factors influencing the mortgage rate include the type of mortgage, loan term, and individual financial circumstances. Obtaining quotes from various lenders and comparing them is the best way to understand what a favorable rate looks like for you. | ||||

| Benefits of Using a Home Interest Calculator | ||||

| – Accurate Budgeting: Helps estimate monthly payments and total interest, allowing for better financial planning. | ||||

| – Loan Comparison: Assists in comparing different loan terms and interest rates to find the most cost-effective option. | ||||

| – Early Payoff Strategies: Provides insight into how extra payments can reduce overall interest and shorten the loan term. | ||||

| – Personalized Insights: Accounts for individual financial details to offer a tailored view of mortgage costs. |

Why It’s Important to Choose the Right Home Interest Calculator

Your journey to homeownership is more than just a monthly payment—it’s a comprehensive financial commitment. Selecting the right home interest calculator means finding one that accounts for all facets of homeownership costs. A precise calculator can guide better financial planning, taking into account taxes, insurance, and even homeowner association fees. Most importantly, the tool should offer customization options to fit your unique financial situation and integrate real-time updates to give the most accurate picture.

Features to Look For in a Home Interest Calculator

When selecting a home interest calculator, consider these essential features:

The Future of Home Interest Calculators

As technology advances, we can anticipate more sophisticated home interest calculators incorporating AI for market trend predictions and personalized advice. Enhanced mobile interfaces will also provide better accessibility. Imagine calculators that integrate with financial and credit systems to streamline the pre-approval process. With this futuristic approach, planning your financial future would be even more seamless.

Using the tools and insights from the top home interest calculators, aspiring homeowners can navigate their way confidently through the mortgage process. Leverage these calculators to forecast your mortgage payments and strategically shape your financial future. Whether you’re looking to estimate mortgage payments or need a comprehensive home interest rate calculator, these tools will help you make informed decisions for a more secure financial journey.

By taking advantage of these powerful calculators, you can ensure that you’re making well-informed, financially sound decisions on your pathway to homeownership. Visit Mortgage Rater and explore our home interest rate calculator here to get started. Whether you’re calculating costs for a new home or refinancing an existing mortgage, our calculators provide you with the clarity and confidence needed for one of life’s biggest investments.

Fun Trivia and Interesting Facts About Home Interest Calculators

The Multi-Function Marvel

Ever wondered just how handy a home calculator payment tool can be for your mortgage journey? These calculators don’t just spit out numbers; they’ve practically changed the game for home buyers by simplifying the often bewildering calculations. Fun fact: some advanced calculators even factor in things like HOA fees and property taxes, making them a one-stop shop for crunching all the numbers you need.

From Science Fiction to Reality

A bit of a twist here—these digital wizards might remind you of innovations seen in sci-fi shows. Just like the Shikabane Aggretsuko, an anime character whose adventures blend tech and creativity, home interest calculators offer a blend of tech tools that streamline your home buying experience. Gone are the days when house Inspections near me and mortgage calculations were disjointed; today, it’s all seamlessly interlinked.

History in Numbers

Believe it or not, the history of interest calculation goes way back. Before these smart gadgets, calculating interest rates was as tedious as finding the NJ sales tax rate without the internet. These comprehensive tools have made financial planning significantly more accessible, leveling the playing field for all potential homeowners.

Not Just a Number Game

Interestingly, places like Bigbury have seen a rise in the use of these calculators to plan for retirement homes and vacation spots. The Bigbury( community now relies on these digital tools to make well-informed choices for secondary properties. It’s incredible how these calculators have become indispensable, part of financial planning across diverse scenarios, from first homes to retirement havens.

So next time you marvel at the ease of your mortgage calculations, remember, they’re more than just numbers—they’re essential tools fueling smarter, informed decisions for home buyers everywhere!

How much interest do you pay on a $300000 house?

With a 30-year, $300,000 loan at a 6% interest rate, you’d end up paying $347,514.57 in total interest. If you go for a 15-year term instead, you’d shell out $155,682.69 in interest, saving yourself a hefty $191,831.88 compared to the 30-year option.

How much interest do you pay on a 500k house over 30 years?

For a $500,000 mortgage with a 30-year term at a 7.1% interest rate, you’re looking at a monthly payment of $3,360.16. Over the full term, the combined total of your principal and interest payments for the year would add up to $40,321.92.

How much interest do you pay on a house after 30 years?

On a 30-year mortgage, the amount of interest you’ll pay depends on the loan amount and interest rate. For instance, on a $300,000 loan at 6%, the total interest would be $347,514.57. The numbers change with different loan amounts and rates, so it’s crucial to check your specifics.

Is 6% a good interest rate on a house?

A 6% interest rate can be considered decent in today’s market, but it’s always good to shop around. Rates in the high-6% range are typical now, but factors like your credit score and the loan type can influence what rate you actually get. Compare quotes from multiple lenders to find the best deal for you.

How much is a $200 000 mortgage payment for 30 years?

For a $200,000 mortgage over 30 years at a 4.33% interest rate, your monthly payment would be $993.27. You’d pay a total of $157,576.91 in interest. If the rate bumps up by just 1%, your payment would increase to $1,114.34, and you’d end up paying $201,161.76 in interest.

How much is a 30 year mortgage payment on $400000?

A 30-year mortgage on a $400,000 loan varies depending on the interest rate. With the current rates hovering in the high-6% range, you can expect your monthly payment to be calculated based on that, so it’s crucial to get a precise quote from a lender.

What happens if I pay 3 extra mortgage payments a year?

Making three extra mortgage payments a year can seriously reduce the total interest you pay and shorten the term of your loan. By making additional payments, the extra money goes toward your principal, which means less interest over time and a quicker payoff date.

How much money should you make a year to buy a $500000 house?

To afford a $500,000 house, your annual income should be at least $120,000 to $150,000, depending on other debts and expenses. Lenders usually prefer your mortgage payment to be less than 28-31% of your gross income, so individual circumstances can alter this estimate.

How much do you need to make to afford a 400K mortgage?

Affording a $400,000 mortgage typically requires an annual income between $95,000 and $120,000, although this can change based on other debts and financial commitments. Lenders generally want your mortgage payment to stay under 28-31% of your gross income, so it varies per person.

Will interest rates go down in 2024?

Predicting interest rates is tricky, but many experts suggest rates could either stabilize or possibly dip slightly in 2024. However, economic conditions are unpredictable, so keep an eye on market trends and consult financial experts for the most accurate forecasts.

Why is a 15-year mortgage better than 30?

A 15-year mortgage is better than a 30-year mortgage because you pay off your house in half the time and save a ton on interest. While the monthly payments are higher, the overall interest paid is way less, making it a more economical option if you can swing the higher payments.

What is a good interest rate on a house?

A good interest rate on a house today typically falls in the high-6% range. However, what’s good for you depends on many factors like your credit score, loan terms, and financial situation. It’s best to get quotes from different lenders to see what’s the best rate you can snag.

Are there disadvantages to paying off a mortgage early?

Paying off a mortgage early can save you money on interest, but it might not always be the best financial move. You could lose out on tax deductions, and your money might earn more if invested elsewhere. It’s worth consulting a financial advisor to weigh the pros and cons.

How to get the lowest mortgage rate?

To get the lowest mortgage rate, improve your credit score, save for a larger down payment, and shop around. Compare offers from multiple lenders and consider locking in a rate when it’s advantageous. Timing and financial health are key to nabbing the best deal.

Is it OK to buy a house when interest rates are high?

Buying a house when interest rates are high isn’t necessarily a bad idea. High rates might mean less competition and better prices, and you can always refinance if rates drop later. Weigh the pros and cons and consider your long-term plans and financial situation.