Understanding the Best Mortgage Cost Estimator Tools in 2024

Mortgage rate fluctuations, the evolving real estate market, and personalized financial goals make calculating mortgage payments crucial for homebuyers. A dependable mortgage cost estimator can make all the difference in your home-buying journey. Accurate estimators help potential homeowners plan efficiently and make informed choices, smoothing out the bumps in the often complex process. This article delves into the most precise mortgage cost estimator tools available in 2024, breaking down their features, benefits, and unique offerings.

Why an Accurate Mortgage Cost Estimator Matters

Getting a mortgage is one of life’s huge financial decisions. Knowing the actual cost of the mortgage means you won’t be blindsided by hidden fees or unexpected changes in payment structures. Here’s why an accurate mortgage cost estimator is essential:

| Mortgage Amount | Interest Rate | Loan Term | Monthly Payment | Annual Payment (Principal & Interest) | Total Interest Paid Over Term |

| $400,000 | 7% Fixed | 15 Years | $3,595 | $43,140 | $247,100 |

| $400,000 | 7% Fixed | 30 Years | $2,661 | $31,932 | $558,960 |

| $300,000 | 6% APR | 15 Years | $2,531.57 | $30,378.84 | $155,684.60 |

| $300,000 | 6% APR | 30 Years | $1,798.65 | $21,583.80 | $348,514.00 |

| $500,000 | 7.1% Fixed | 30 Years | $3,360.16 | $40,321.92 | $705,755.20 |

Top Mortgage Cost Estimators in 2024

1. Zillow Mortgage Calculator

Zillow’s mortgage calculator earns top marks for its user-friendly interface and detailed output. Alongside providing estimates based on current mortgage rates, its integration with Zillow’s extensive property listings gives users a more rounded view of potential costs.

Key Features:

2. NerdWallet Mortgage Calculator

NerdWallet’s mortgage cost estimator stands out for its user-focused detail and financial planning excellence. The tool’s nuanced approach, offering side-by-side loan comparisons, makes it a favorite among serious homebuyers.

Key Features:

3. Bankrate Mortgage Calculator

Bankrate has a long-standing reputation for in-depth financial analysis, and its mortgage calculator is no exception. It’s ideal for those who love diving deep into financial details.

Key Features:

4. Quicken Loans Mortgage Calculator

Quicken Loans, powered by Rocket Mortgage, offers a robust and intuitive mortgage cost estimator. Its seamless integration with the pre-approval process makes it a strong contender for those ready to buy.

Key Features:

5. Redfin Mortgage Calculator

Redfin’s mortgage calculator is lauded for its accuracy and a holistic approach to home buying costs. It accounts for estimated property taxes, insurance costs, and even HOA fees.

Key Features:

6. Mortgage Calculator (Mortgagecalculator.org)

Mortgagecalculator.org stands out thanks to its simplicity and broad functionality. It’s versatile, offering options for different types of loans like FHA, VA, and conventional loans.

Key Features:

7. Chase Mortgage Calculator

Chase, as a leading financial institution, offers a robust mortgage cost estimator aligned with its broader financial products, facilitating seamless transitions from estimation to application.

Key Features:

How to Choose the Right Mortgage Cost Estimator

Choosing the right mortgage cost estimator depends on several factors. Here’s what to consider:

Leveraging Advanced Features for Precision

Many of the best mortgage cost estimators include advanced features that enhance their precision, such as:

Final Thoughts on Mortgage Cost Estimators

Ultimately, the best mortgage cost estimator for you is one that aligns with your financial goals, presents data clearly, and offers accurate and comprehensive information. These tools are invaluable for avoiding financial surprises and ensuring that home ownership remains within your grasp.

By leveraging these tools, you’ll be equipped to handle the often convoluted mortgage process with confidence. Accurate estimations mean fewer surprises and a smoother journey to securing your new home. Explore our Mortgage Cost calculator to get started on your home-buying adventure today.

In conclusion, choosing the right estimator means you’re one step closer to securing your dream home without financial surprises. Make informed, confident decisions with the help of these top-notch tools.

For more detailed guidance, including how to calculate your mortgage payments, check out our Mortgage Calculator monthly payment and Mortgage Calculator online tools for all your mortgage planning needs.

By following this structured approach and leveraging these tools, you’re positioned to turn your dream of homeownership into reality. No more guessing—just clear, actionable insights that keep you on track. Happy house hunting!

Fun Trivia and Interesting Facts About Mortgage Cost Estimator

Are you tired of feeling lost trying to calculate your mortgage payments? A reliable mortgage cost estimator could be your best friend. These handy tools can save you from the stress of manual calculations, providing accurate estimates at the push of a button. Let’s dive into some trivia and interesting facts about mortgage cost estimators that might surprise you!

The Evolution of Mortgage Calculations

Did you know that mortgage cost estimators have a fascinating history? Back in the day, people had to rely on pen, paper, and, if they were lucky, a clunky calculator. Picture this: like watching a heated match between Baltimore and Cincinnati, the process was long and demanding. Nowadays, these online tools use sophisticated algorithms to provide instant results, sparing you hours of number-crunching Baltimore Vs Cincinnati.

Behind the Algorithms

The secret sauce of a great mortgage cost estimator is its algorithm. These algorithms are designed to consider various factors, from interest rates and loan terms to down payments. Think of them as complex as planning the lineups for an intense football match between Hungary and Montenegro Hungary National football team Vs Montenegro national football team lineups. Each element is meticulously calculated to offer you the most accurate payment estimates.

Fun and Fate

Speaking of interesting tidbits, did you know that even celebrity lives can be unexpectedly intertwined with mortgages? For example, Sachi Parker, known for her Hollywood roles, faced housing market troubles just like any of us Sachi Parker. Life comes at us fast, and sometimes having a reliable mortgage cost estimator can provide peace of mind, enabling us to face challenges with confidence.

Odd Connections

Mortgage cost estimators might not seem connected to fake Mums, but both save time and offer practicality. Rather than waiting for real flowers to grow or using cumbersome financial tools, you can rely on quick solutions. Fake mums look good instantly, and likewise, mortgage cost estimators provide instant payment projections Fake Mums.

Stress-Free Precision

Lastly, it’s worth noting that accuracy is crucial for major financial decisions, much like how a university deals with serious events Student Death binghamton university. A mortgage cost estimator gives you the precise figures you need to plan effectively, reducing your stress levels and helping you manage your finances smartly.

Incorporating these little-known facts and trivia helps highlight the practicality and surprising history of mortgage cost estimators, making your journey toward accurate payment calculations all the more engaging.

How much is the average mortgage on a $400000 house?

For a $400,000 mortgage at a 7% fixed rate, the monthly payment would be about $3,595 if it’s a 15-year loan or $2,661 for a 30-year loan. These figures don’t include insurance and property taxes.

How much is a 300k mortgage per month?

On a $300,000 mortgage with a 6% APR, the monthly payment is approximately $2,531.57 for a 15-year loan and $1,798.65 for a 30-year loan, excluding escrow.

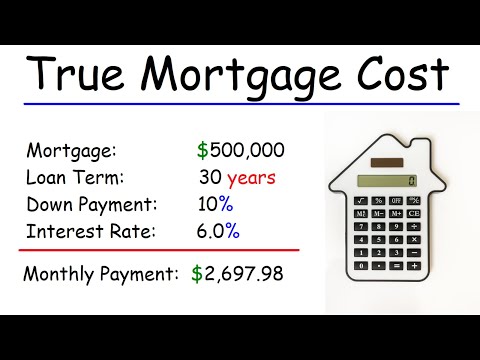

How much is a mortgage on a $500,000 house?

With a $500,000 mortgage for a 30-year term at a 7.1% interest rate, you’re looking at a monthly payment of about $3,360.16. Annually, that’s around $40,321.92 in principal and interest.

How do you calculate the overall cost of a mortgage?

To calculate the overall cost of a mortgage, you’ll divide the mortgage amount and the total interest by the number of payments over the loan term to determine the monthly amount. The interest rate helps calculate the total interest over the loan period.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, try to aim for a mortgage where the monthly payment is no more than 28%-30% of your gross monthly income. You could afford a home in the range of around $210,000 to $230,000, assuming a decent credit score and manageable debt-to-income ratio.

What income is needed for a $500,000 mortgage?

To qualify for a $500,000 mortgage, you typically need an annual income of around $120,000 to $150,000, depending on your other debts and financial commitments.

Can I afford a 300K house on a 60k salary?

With a $60,000 salary, a $300,000 house might be a stretch unless you’ve got minimal other debt and strong credit. Your mortgage payment should ideally be no more than 28%-30% of your monthly income.

Can I afford a 300K house on a 50k salary?

On a $50,000 salary, affording a $300,000 house would be quite challenging. Your mortgage payment should not exceed 28%-30% of your monthly income, making it tough to afford such a home without other support or significant savings.

What credit score is needed to buy a $300K house?

To buy a $300,000 house, a credit score of at least 620 is generally recommended, although a higher score always helps secure better interest rates.

What credit score do you need to buy a $500,000 house?

For a $500,000 house, a credit score of 700 or higher is ideal. This generally qualifies you for better interest rates and loan terms.

Will interest rates go down in 2024?

Predicting whether interest rates will go down in 2024 is tough because it depends on a bunch of economic factors like inflation and market conditions. It’s best to consult with financial experts for more accurate forecasts.

How much is a 3.5 down payment on a 500 000 house?

A 3.5% down payment on a $500,000 house comes out to $17,500. This is the minimum down payment required for an FHA loan.

What is a typical mortgage cost?

A typical mortgage cost can vary widely based on the loan amount, interest rate, and term. On average, for a 30-year loan, expect to pay between 3% and 4% of the loan amount annually.

Do mortgage calculators affect credit scores?

Using mortgage calculators does not impact your credit score. They’re a useful tool to estimate your monthly payments and understand your borrowing capacity without any credit checks.

How much is a 150K mortgage payment?

For a $150,000 mortgage at a 30-year term with a 6% interest rate, the monthly payment would be around $899, excluding taxes and insurance.