Navigating the maze of mortgage options can feel overwhelming, but having the right tools at your disposal can make all the difference. Welcome to our ultimate guide on the best mortgage interest calculators of 2024. Here at Mortgage Rater, we understand how critical it is to have accurate and user-friendly tools while making one of the most significant financial decisions of your life. So, let’s dive in and see which calculators deserve your attention this year.

Why You Need an Accurate Mortgage Interest Calculator

In today’s fast-paced real estate market, understanding your mortgage payments is essential. A mortgage interest calculator provides a quick and reliable estimate of your monthly payments, total interest costs, and payment schedules. These tools are indispensable whether you’re a first-time homebuyer or seeking to refinance an existing loan.

Think about it—nobody likes financial surprises, especially not when it comes to one’s home. Accurate mortgage calculations can help you plan better and make informed decisions. They’re your first step towards financial freedom and, ultimately, peace of mind. Just like how Timothy meadows and Angela Miller advocate for responsible financial planning, these tools urge you to act wisely.

Top 7 Mortgage Interest Calculators in 2024

This section is going to break down the top mortgage interest calculators of 2024. We’ve picked these based on extensive testing, user reviews, and expert recommendations to provide you with a given selection:

1. NerdWallet Mortgage Calculator

NerdWallet never ceases to impress. With its intuitive interface and detailed breakdowns, this calculator allows you to input various loan terms, interest rates, and down payment amounts, delivering immediate insights into monthly payments and the total interest paid over the life of the loan.

2. Bankrate Mortgage Calculator

Bankrate is a trusted name in the financial world. Their mortgage calculator offers a sophisticated analysis of your mortgage payments, breaking down principal, interest, property taxes, and insurance.

3. Zillow Mortgage Calculator

Zillow’s tool is perfect for home buyers who want a straightforward and user-friendly experience. It’s particularly valuable for its integration with Zillow’s extensive property listings, making it easier to estimate monthly payments on actual properties of interest.

4. SmartAsset Mortgage Calculator

SmartAsset offers a robust calculator that goes beyond basic mortgage calculations. It includes powerful financial planning tools, advising on how different mortgage terms can impact your financial situation.

5. Quicken Loans Mortgage Calculator

A product from one of the biggest names in mortgage lending, Quicken Loans’ calculator stands out for its precision and reliability. It also allows users to easily switch to the application process with Quicken Loans if desired.

6. Dave Ramsey’s Mortgage Calculator

Financial guru Dave Ramsey provides a no-nonsense mortgage calculator focused on helping users pay off their homes as quickly as possible. It includes options for extra payments and bi-weekly payment schedules.

7. Google Mortgage Calculator

Google’s simple yet effective mortgage calculator can be accessed right from the search engine. It offers quick estimates without the need for navigating to a separate website, though its simplicity may not cater to all needs.

| Criteria/Factor | Details and Examples |

| Mortgage Interest Rate | – As of May 9, 2024: High-6% range is considered favorable |

| – January 2023: A 4% mortgage rate is low compared to a peak rate of 7.06% in late 2022 | |

| – 3.77% rate was common at the beginning of 2022 | |

| Loan Amount & Term | – $500K mortgage, 30-year term, 7.1% interest rate: Monthly payment is $3,360.16 |

| – Payment range for $500K mortgage: $2,600 – $4,900 depending on term and rate | |

| – $200K mortgage, 30-year fixed, 7% interest: Monthly payment is $1,331 | |

| – $200K mortgage, 15-year fixed, 7% interest: Monthly payment is $1,798 | |

| Factors Affecting Interest Rate | – Type of loan (e.g., fixed, adjustable) |

| – Loan term (e.g., 15 years vs. 30 years) | |

| – Individual financial circumstances (e.g., credit score, debt-to-income ratio) | |

| – Market conditions and economic factors | |

| How to Get the Best Rate | – Obtain multiple quotes from different lenders |

| – Compare interest rates, loan terms, and associated fees | |

| Features of Mortgage Calculators | – Estimate monthly payments based on loan amount, interest rate, and term |

| – Calculate total interest paid over the life of the loan | |

| – Provide amortization schedules | |

| – Input variables may include taxes, insurance, and HOA fees to give a more accurate monthly payment | |

| Benefits of Using a Calculator | – Helps in budgeting and financial planning |

| – Allows for comparison of different mortgage scenarios | |

| – Can reveal long-term cost differences between shorter and longer loan terms |

Factors to Consider When Choosing a Mortgage Interest Calculator

When shopping around for a mortgage interest calculator, it’s essential to keep a few key factors in mind:

An intuitive calculator can be a game-changer, giving you a leg up in understanding what your mortgage payments could look like. It’s kind of like comparing Tyler Badie to other running backs—you want one that performs efficiently and gives you the best value.

The Impact of Accurate Mortgage Calculations on Your Financial Health

Accurate mortgage calculations are vital to managing your finances effectively. They help you avoid surprises, plan for the future, and make informed decisions. Calculators that offer detailed breakdowns and extra payment options can show you how to save thousands over the life of your loan.

Take a moment to imagine being a homeowner. Now, think about how much easier your journey could be with tools that break down complicated numbers into simple, understandable payments. Using a mortgage estimator or a mortgage interest rate calculator can be a pivotal move.

Wrapping Up: Empower Your Home-Buying Journey

Finding the best mortgage interest calculator can empower you to make the most informed financial decisions. Whether you choose NerdWallet for its mobile convenience, Bankrate for detailed insights, or SmartAsset for financial planning, each of these tools offers unique advantages. Remember, the goal is to gain a clearer understanding of your mortgage obligations, enabling you to navigate your home-buying journey with confidence.

We highly encourage you to try our mortgage interest calculator here at Mortgage Rater. By leveraging these calculators, you gain a clearer understanding of your mortgage obligations and can go forward with confidence. So, go on, take the first step—do your homework and make informed choices that could change your financial future.

Thank you for joining us on this comprehensive journey through the best mortgage interest calculators of 2024. Looking back, it’s clear—having the right tools at your fingertips is essential. So, what are you waiting for? Dive in, explore, and get ready to make 2024 the year you master your mortgage planning!

Exploring the Mortgage Interest Calculator

Fun Facts about Mortgage Interest Calculations

Did you know that using a mortgage interest calculator can make a world of difference when planning your finances? It’s not just a dry tool; there’s a lot of interesting trivia hidden in its numbers! Back in the day, folks had to rely on manual calculations and spreadsheets, but with modern technology, everything’s at your fingertips. Imagine trying to juggle the numbers for a 30-year mortgage using pen and paper. Talk about a headache! Now, with a click, you can see how small changes in interest rates affect your payments immediately.

The Magic of Numbers

Speaking of magic, did you ever think about what it would be like to wish for lower interest rates? Almost like invoking the legendary dragon from Dragon Ball Z, Shenron. Just as Shenron grants wishes, a mortgage interest calculator helps you “wish” for the best rates by checking different scenarios. While we can’t summon a dragon to lower your mortgage rates, a calculator gets you pretty close by showing possible savings with different mortgage terms.

Trivia that Makes a Difference

A cool trivia tidbit is how these calculators can apply to different mortgage lengths. For instance, figuring out the savings on a 30 year mortgage can be a real eye-opener. You might assume that shorter mortgages save more, but seeing it in numbers can be the push you need to make a thoughtful decision. Plus, the calculators typically include features that let you compare different loan terms, which can dramatically impact your long-term financial plans.

So next time you find yourself stressing over mortgage calculations, remember—you’ve got tools at your disposal that are almost magical in their precision and usability. Happy calculating!

Is 6% interest high for a mortgage?

Today, a 6% interest rate for a mortgage isn’t considered high, especially when compared to the rates that have been seen in recent times. It’s actually fairly acceptable, but always shop around a bit to compare offers.

Is a 4% mortgage interest rate good?

Yes, a 4% mortgage interest rate is good by today’s standards. It’s quite low, especially in light of the rates we’ve seen recently, such as the high-6% range that’s common now.

How much would a 30-year mortgage be on a $500000 house?

For a $500,000 mortgage with a 30-year term and a 7.1% interest rate, your estimated monthly payment would be about $3,360.16. Depending on your specific terms and interest rates, this could range from $2,600 to $4,900.

How much is a 30-year mortgage payment for $200000?

A 30-year mortgage for $200,000 at a 7% interest rate would have a monthly payment of around $1,331. If you chose a 15-year term at the same rate, it would be about $1,798 per month.

Will rates go down in 2024?

It’s tough to predict precisely, but some experts believe mortgage rates might stabilize or slightly decrease in 2024. Always keep an eye on the market trends and economic indicators.

Is 7% interest on mortgage high?

In today’s market, a 7% mortgage interest rate is considered relatively high. However, it’s not out of the ordinary given recent economic conditions and could still be a competitive rate depending on personal circumstances.

Will mortgage rates ever be 3% again?

It’s unlikely that mortgage rates will drop back down to 3% soon. That period was unusual, helped by special economic conditions, and current trends don’t suggest rates will dip that low again any time soon.

What bank has the lowest mortgage rates?

The bank with the lowest mortgage rates can vary based on various factors like location and personal financial situation. It’s best to get quotes from a few different lenders and compare.

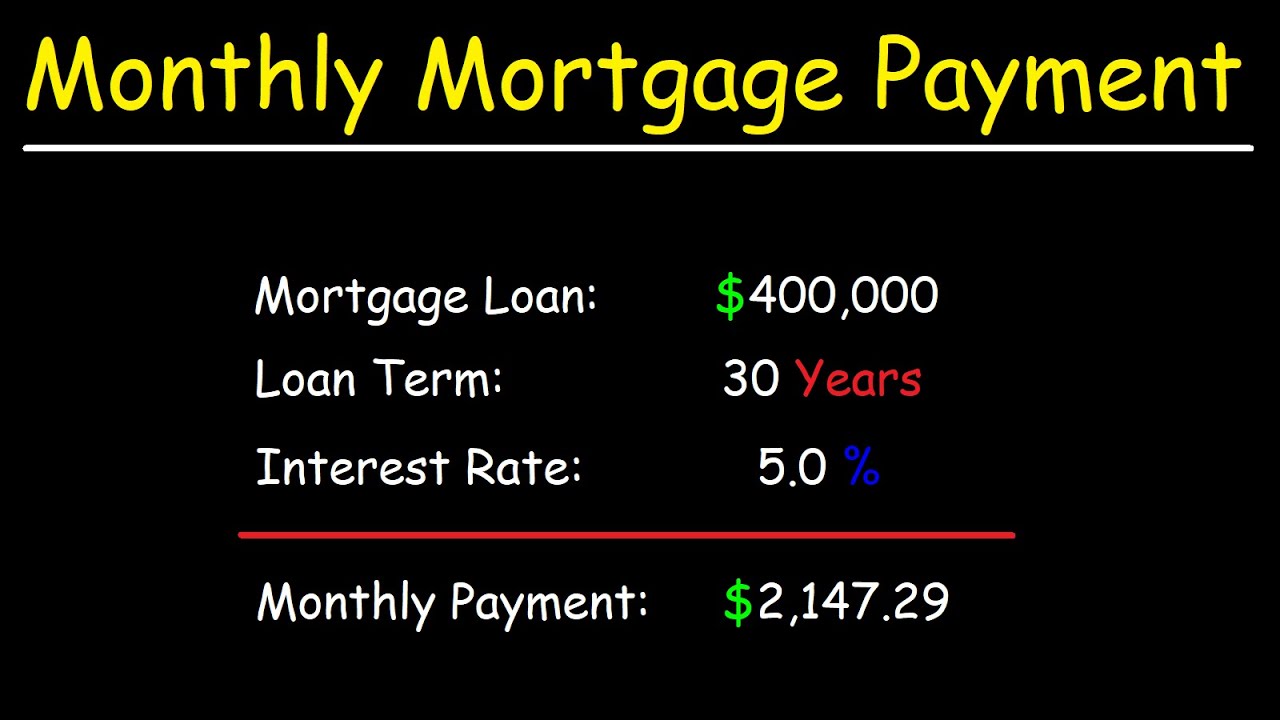

What is the interest rate on a $400000 home?

The interest rate for a $400,000 home depends on the current market rates, credit score, loan type, and other factors. Currently, favorable rates fall in the high-6% range, so plan for something around there, though it could vary.

What credit score do you need to buy a $500,000 house?

To buy a $500,000 house, you’d typically need a credit score of at least 620 for a conventional loan. Higher scores can get better rates and terms, so aim for the best score possible.

What should your income be for a $500000 home?

For a $500,000 home, lenders usually like to see an income of at least $125,000 annually, depending on other debts and expenses. It ensures you can handle the payments and other related costs.

How much is a 150K mortgage payment?

A $150,000 mortgage with a 30-year term at a 7% interest rate would have monthly payments around $998. The exact amount can vary based on the specific interest rate and loan term used.

What credit score is needed to buy a house?

To buy a house, having a credit score of at least 620 is generally necessary for a conventional loan. FHA loans might be available for lower scores, but better scores mean better rates and terms.

How much income do I need for a 200k mortgage?

For a $200,000 mortgage, lenders typically like to see a minimum annual income of around $50,000. This assures them you can comfortably manage your monthly payments and other financial obligations.

How to pay off 200k mortgage in 5 years?

Paying off a $200,000 mortgage in 5 years would require significantly higher monthly payments, approximately $3,872 at a 7% interest rate. It can be tough but doable if you plan strictly and perhaps make additional principal payments when possible.