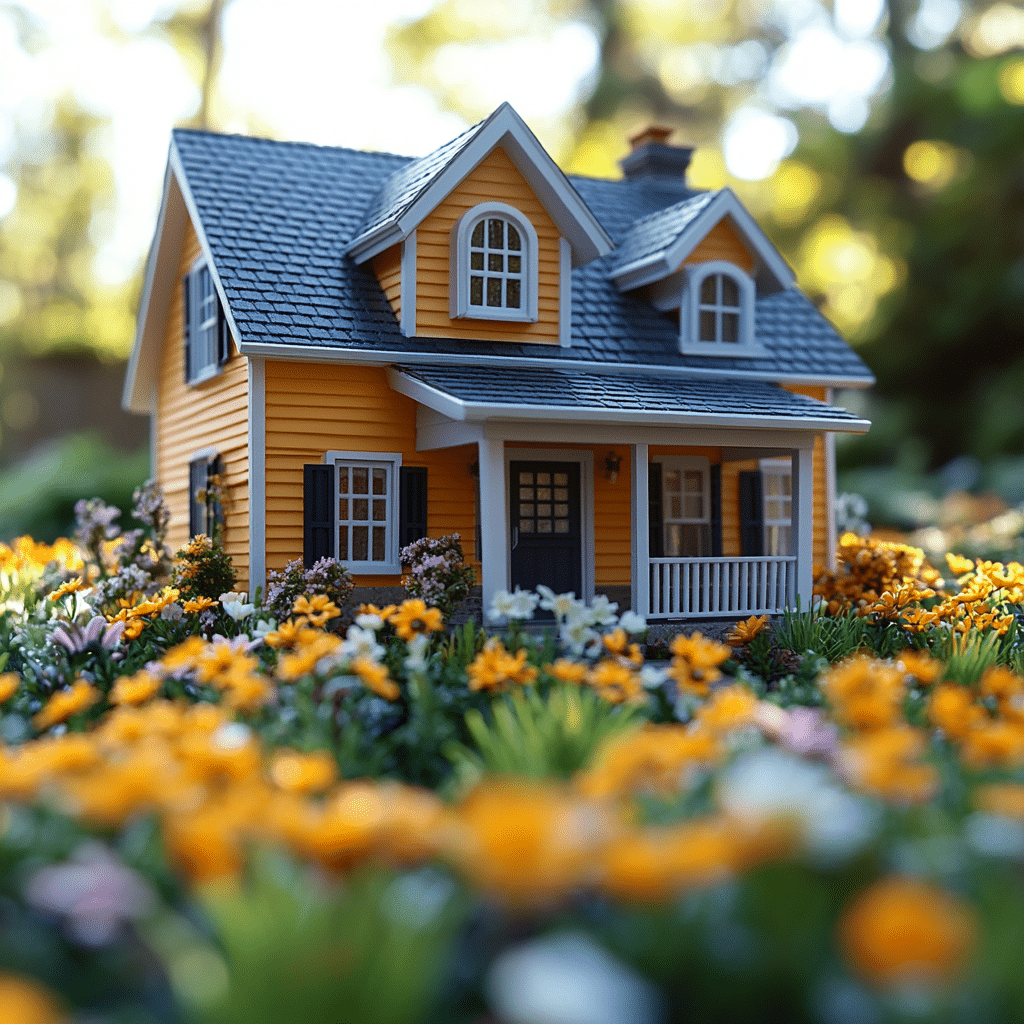

No Sales Reps,

Just the Best Rates

Mortgage Rater makes getting a mortgage fast, easy, and all-digital. No need to talk to a anyone – simply apply online and get the best rates in minutes. By eliminating sales reps, we pass the savings on to you. Simplify your home buying process with Mortgage Rater today!

Find Your Dream Realtor and Dream Home

Browse Home Listings with Realtor Rankings

Story Of Mortgage Rater

Quick, Easy, Simple

Mortgage Rater: The Future of Home Financing

At Mortgage Rater, we revolutionize the mortgage process by making it fast, easy, and entirely digital. Founded with the mission to simplify home financing, our platform allows you to secure the best rates without the hassle of traditional sales reps. By eliminating unnecessary sales, we pass the savings directly to you. From application to approval, everything is done online in minutes, ensuring a seamless and transparent experience. Our no-haggle policy means you get the best rates upfront, with no hidden fees or last-minute surprises.

- Online Approval: No need to speak to anyone

- Cell Phone Documents: Easy, no scanning or faxing

- No Sales Reps: No middlemen, lowest rates

- Instant Pre-Approval Letters: Get pre-approved in minutes

Free Mortgage Rate Calculator

Calculate Monthly Mortgage Payments For Free

Want to know your monthly mortgage payments instantly? Our mortgage rate calculator makes it easy! Just enter your loan details – interest rate, term length, and amount – and get a quick, accurate estimate. It’s fast, free, and always up-to-date with current rates. Simplify your home financing with our convenient calculator and plan your budget with confidence.

Mortgage Rate Calculator

Why get the best Mortgage Rate?

When shopping for a home, one of the most important factors to consider is your mortgage rate. Finding the lowest rate can save you thousands over the life of your loan, so it’s worth doing some research and shopping around. In this post, we’ll explain why getting an attractive rate is so crucial and provide helpful tips on finding one. Stay tuned for more helpful hints on buying a house!

Mortgage rates can differ significantly between lenders, so it pays to shop around and compare offers. Use a mortgage calculator to estimate what your monthly payments would look like with different interest rates.

Once you’re ready to apply for a home loan, select several lenders and compare their Mortgage rates. Don’t forget to factor in other factors like fees, customer service, or the type of loan that fits best into your budget. When you find the ideal rate, lock it in by getting pre-approved for the loan.

Finding the best Mortgage rate is an essential aspect of buying a home, but it’s not the only factor you should take into account. Be sure to compare rates from several lenders and take all other aspects into account before making your final decision.

We hope this blog post was of some assistance! If you have any queries, please don’t hesitate to get in touch – we are more than happy to assist!

Take the First Step

Toward Your Dream Home

Latest Insights

W&2 The Fascinating Journey Of A Visionary Innovator

Apalachicola Florida Mysteries Of The Gulf Coast