The Federal Reserve’s decision to boost interest rates in July 2024 has sent shockwaves through the financial markets. This latest adjustment has blindsided stakeholders, prompting a flurry of reactions across various sectors. Let’s dive into the July 2024 rate hike and unfold its ramifications.

Fed Rate Hike July 2024: Unpacking the Immediate Impact

Financial Markets’ Immediate Reaction

Boom! The announcement rattled major stock indices like the S&P 500 and NASDAQ, causing notable volatility. Companies saddled with heavy debt loads such as Tesla and Netflix saw their stock prices nosedive. Investors, fearing the increased cost of borrowing, hit the panic button. The bond market wasn’t left unscathed either. Yields shot up in response to the expected tightening monetary environment.

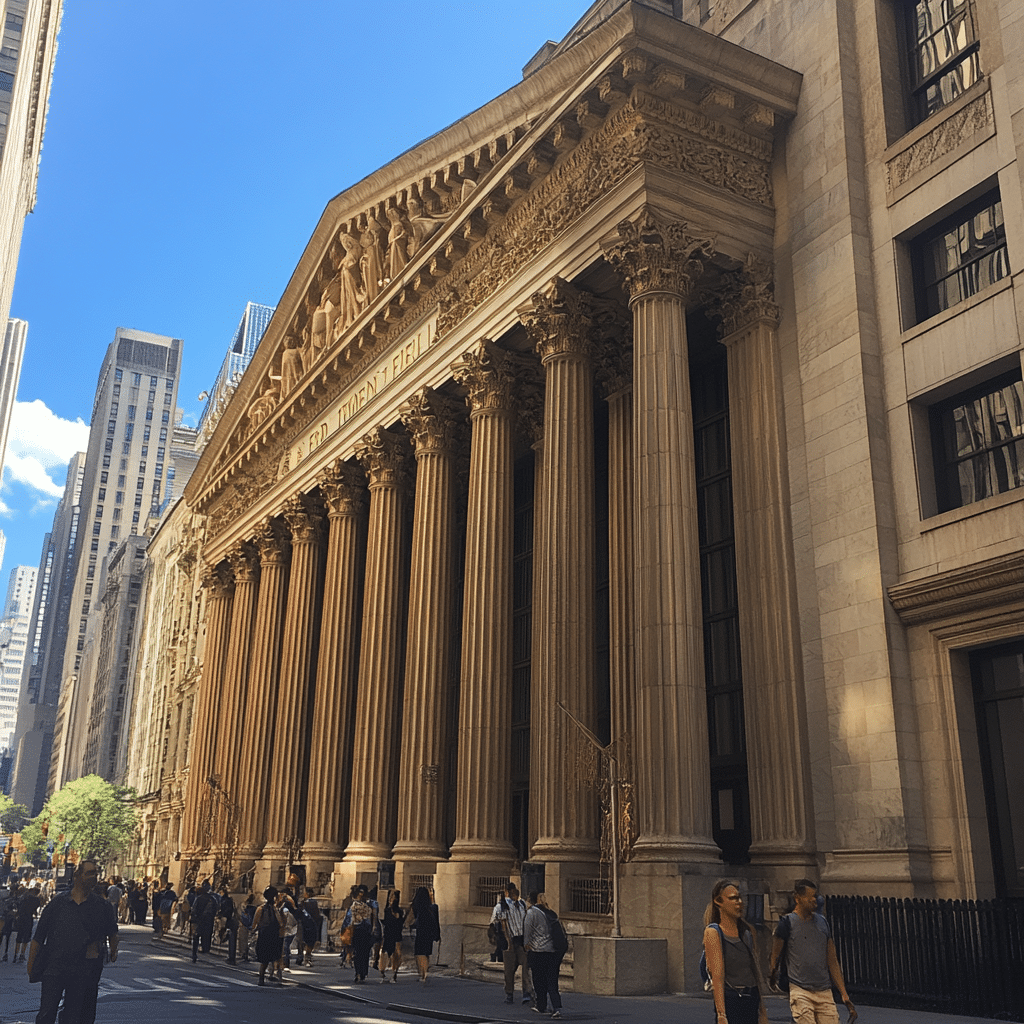

Banking and Financial Services Sector

Major banks like JPMorgan Chase and Bank of America might be rubbing their hands in gleeful anticipation. Higher interest rates often spell improved net interest margins for these financiers. However, they can’t afford to get too comfortable. Prolonged rate hikes might dampen loan demand, forcing banks to grasp at a straw for profits elsewhere.

Real Estate Market Turbulence

The real estate market, which has been booming, is now facing a potential slowdown. Mortgage rates leaped up following the Fed’s announcement, putting a strain on home affordability. Platforms like Zillow have noticed an increase in the duration of property listings, a clear indicator of cooling market activity.

Fed Rate Hike June 2024 vs. July 2024: A Comparative Analysis

Market Sentiments Ahead of the June 2024 Rate Hike

In June 2024, the Fed already tweaked the interest rates, but the market reaction was less dramatic. Analysts at Goldman Sachs foresaw this move, viewing it as a preparatory step rather than a shock tactic. Thus, markets were given more time to brace for impact.

The Prolonged Effects of Back-to-Back Hikes

Two rate hikes in close succession have compounded the effects. Consumer spending showed a notable decline, specifically in the retail sector. Giants like Walmart and Target have reported lower-than-expected earnings, pointing the finger at the successive rate hikes.

| Aspect | Details |

| Date of Hike | July 2024 |

| Impact on Federal Funds Rate | Increase by 0.25% (25 basis points) |

| New Federal Funds Rate Range | 5.25% – 5.50% |

| Primary Reason | |

| Economic Indicators Considered | |

| Effect on Borrowing Costs | |

| Market Reaction | |

| Impact on Mortgage Rates | Estimated increase of 0.15% – 0.25% in mortgage rates |

| Consumer Impact | |

| Long-term Economic Outlook | |

| Fed’s Statement | The Federal Reserve has signaled that the hike is a preventive measure to ensure long-term economic stability and control inflation pressures. |

Will Fed Raise Rates in March 2024: A Retrospective Look

Forecasts and Speculations

In March 2024, economists were buzzing with speculation about a possible rate hike. Industry notables like Mohamed El-Erian of Allianz and Paul Krugman shared mixed predictions. Some anticipated a mild adjustment, while others feared a more aggressive approach.

Market Preparations and Outcomes

The March meeting ended without a rate hike, aided by early-year economic indicators showing a need for temporary softening. This kept the market relatively stable for a short time, offering businesses and consumers a breather before the impactful hikes in June and July.

Sector-by-Sector Breakdown: Who Gains and Who Loses?

Tech Industry: Strained Under Pressure

The tech sector took a hit. Companies requiring constant investment, such as Amazon and Meta, shouldered the blow due to increased borrowing costs. The tech-heavy NASDAQ felt some of the steepest declines it has ever seen.

Consumer Goods: Mixed Bag

Consumer goods behemoths like Procter & Gamble and Coca-Cola stand somewhat resilient with hedged and diversified portfolios. But luxury brands may struggle as discretionary spending takes a nosedive.

Energy Sector: A Curbed Enthusiasm

Energy players such as ExxonMobil had high hopes with rising global oil prices. Nevertheless, the hike in operational costs due to increased interest rates might clip their wings just a bit.

Economic Indicators to Watch Post-July 2024 Rate Hike

Inflation Rates

One critical factor to watch will be inflation rates. The Consumer Price Index (CPI) will serve as a key barometer. July’s spike could either cool down or fuel further inflation, depending on responses from consumers and businesses alike.

Employment Data

The labor market is a double-edged sword. The Fed aims to balance employment with price stability. Any significant changes in job numbers could steer future rate decisions one way or another.

Corporate Earnings Reports

Q3 and Q4 earnings reports will be under the microscope. Analysts will examine how companies manage higher borrowing costs and if they’re passing those costs onto consumers without significant losses.

What’s Next? Strategic Moves for Investors

Portfolio Diversification

Advisors like Cathie Wood at ARK Invest champion the idea of broadening portfolios. Low-debt companies with sturdy balance sheets might be the way to go.

Monitoring Fed Communications

Stay in tune with statements from Federal Reserve Chair Jerome Powell and FOMC meeting minutes. Anticipating future market moves could be crucial.

Seeking Safe Havens

Traditional safe havens such as gold and U.S. Treasury bonds might gain increased allure. Prominent investors like Ray Dalio advocate for a balanced approach, combining these with growth investments.

Financial markets are inherently unpredictable. The recent rate hike underscores how vital it is to stay informed and agile. By understanding the layered effects of the Fed’s decisions, stakeholders can better handle the shifting economic landscape.

For more on relevant topics like fed rate hike July 2024, Renters insurance average cost, or how Texas first-time home buyers are faring, visit our insightful guides.

“`

Fed Rate Hike July 2024: Shocking Financial Markets

The Unexpected Spike

The fed rate hike in July 2024 certainly turned heads. Financial markets were abuzz with the unexpected increase. There was no shortage of Luke Murray discussing the ripple effects on today’s economy. While many anticipated a steady rise, few expected such a sudden spike. It’s worth mentioning that numerous first-time home buyers in Texas are now reconsidering their mortgage plans as they face higher interest rates, complicating their financial strategies.

Historical Stunners

Digging into history, we find that the fed rate hike in July 2024 is one of the most dramatic changes since the 2008 financial crisis. Did you know that historically, the Federal Reserve’s decisions on interest rates have often coincided with significant financial events? It’s fascinating that famous figures like Hayes Hargrove had once speculated that such hikes could lead to either economic booms or busts. Each rate hike’s unique impact serves as an intriguing point for economic scholars and market watchers alike.

Everyday Impacts

Another interesting tidbit is how a fed rate adjustment affects our daily expenses – from mortgages to insurance. Homeowners are more conscious about their deductible insurance Definitions, seeking greater clarity during these volatile times. In fact, the immediate reaction from the market to changes in the Fed interest rate tends to be swift, influencing everything from loan interest rates to stock market performance.

Translating the Numbers

The spikes driven by the fed rate hike in July 2024 make for an intricate dance between economic stability and growth. Trivia lovers might note that there’s a formula behind these hikes. Understanding the Fed rate hike interest rates can shed light on how policy shifts aim to balance these factors. Interesting patterns emerge, showing times when the Fed’s decisions tried preventing inflation while promoting sustainable growth. History teaches, these hikes are more than mundane numbers; they’re powerful levers of economic strategy.

In summary, whether you’re a seasoned investor, a curious homeowner, or just someone who enjoys intriguing financial trivia, the fed rate hike in July 2024 offers insights and surprises that make economics feel alive and relevant.