A Deep Dive into Mobile Home Prices

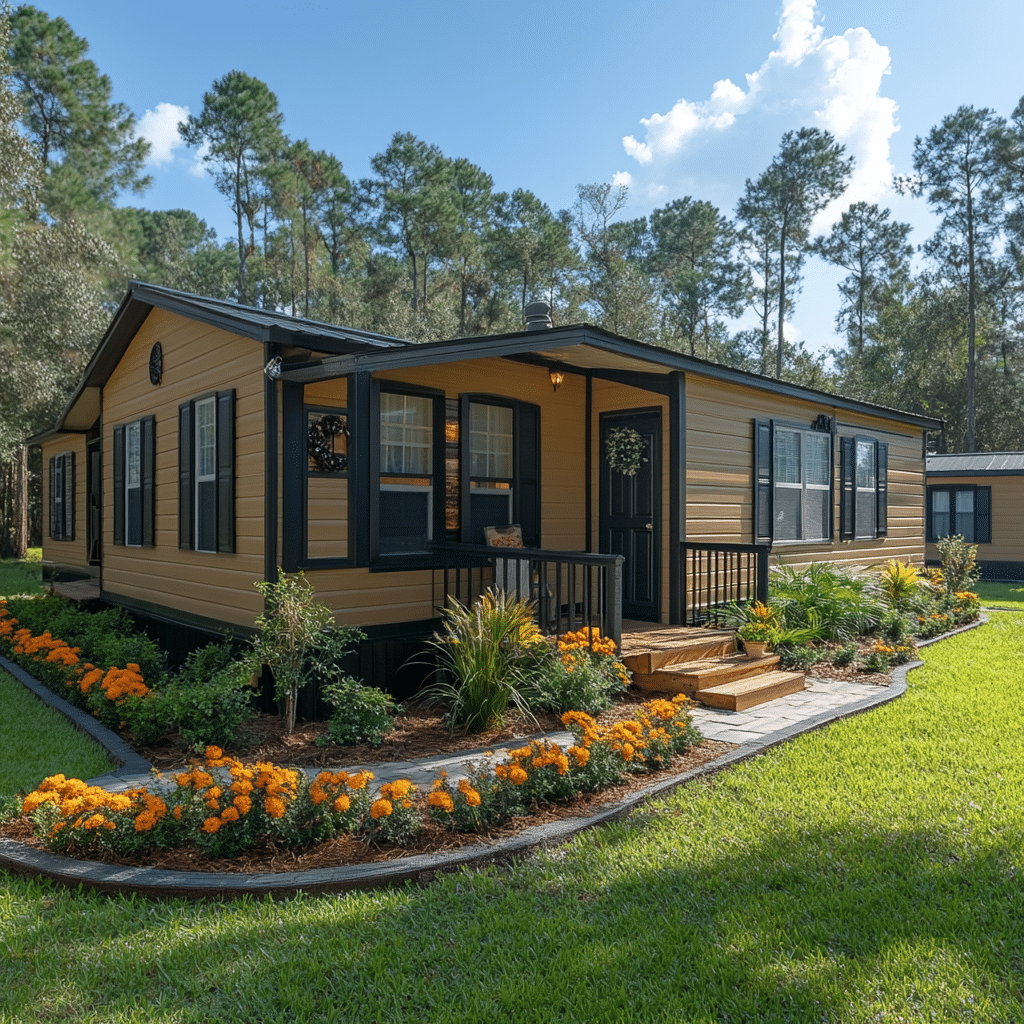

Over the past decade, the landscape of affordable living has dramatically transformed with mobile homes prices emerging as a significant factor. The year 2024 brings new trends and variables influencing mobile homes prices. Let’s explore the driving forces shaping the mobile home market, while dissecting the cost components affecting these housing options.

Market Analysis and Influencing Factors

The mobile home industry has enjoyed an impressive 8% sales increase over the past year. Contributing factors include rising construction costs, regulatory shifts, and a growing consumer preference for sustainable living options. Market leaders like Clayton Homes and Champion Home Builders offer homes ranging from $50,000 to $150,000, varying in size, amenities, and location. The cost of these homes is influenced by materials, labor, and transportation expenses—key elements driving the upward trend in prices.

Industrial growth and the environmental appeal of mobile homes are also noteworthy. Both millennials and baby boomers are attracted by the promise of lower carbon footprints and eco-friendly materials. This growing demand injects further vitality into the market.

Bank Owned Homes: Affordable Opportunities in the Mobile Home Market

Bank-owned mobile homes provide a cost-effective alternative for budget-conscious buyers. Homes foreclosed by banks like Bank of America and Wells Fargo are auctioned at significantly reduced prices, sometimes hitting 20% below market value. Acquiring these properties, however, requires diligence.

Potential buyers should:

– Understand legal ramifications.

– Assess potential hidden costs.

– Secure thorough inspections to avoid unforeseen repairs.

These procedures can help you capitalize on the financial benefits of purchasing a bank-owned mobile home.

| Type of Mobile Home | Average Price Range | Key Features | Benefits |

| Single-Wide | $35,000 – $70,000 | 1-2 bedrooms, 600-1,100 sq. ft. | Affordable, easy to relocate, compact size |

| Double-Wide | $70,000 – $130,000 | 3-4 bedrooms, 1,000-2,300 sq. ft. | More living space, better layout options |

| Triple-Wide | $100,000 – $250,000 | 4+ bedrooms, 2,000-4,500 sq. ft. | Spacious, customizable, luxury options |

| Park Model RV | $20,000 – $80,000 | 400 sq. ft. + loft, full-size kitchen | Affordable, ideal for seasonal use |

| Modular Homes | $100,000 – $300,000 | Permanent foundation, multiple modules | Higher quality, customizable, long-term |

The Ins and Outs of Manufactured Home Financing in 2024

Securing manufactured home financing distinctly varies from traditional home loans. Specialized lenders like Vanderbilt Mortgage and Finance, and 21st Mortgage Corporation offer loan products catered to mobile homes.

Loan Types and Requirements

Two prevalent loan types dominate this sector: chattel loans for homes not placed on owned land, and traditional mortgages for those affixed to land.

Interest Rate Trends

Average interest rates for 2024 hover around 5-7% for chattel loans, driven by economic variables like federal monetary policies and market demand. Understanding these factors is key for prospective buyers seeking competitive rates.

Qualification Criteria

Borrowers need a considerable credit score and down payment. Typically, lenders demand:

– Credit scores above 600

– Down payments ranging from 5% to 20%

– Steady income validation

Comparing Mobile Home Financing Options

Navigating your choices between traditional home loans and specialized mobile home loans is crucial. For clarity, consider these comparison points:

For instance, U.S. Bank offers competitive rates, while Triad Financial Services provides robust loan products tailored for diverse credit backgrounds. Each has nuances in terms, rates, and qualification benchmarks. Carefully evaluating these can guide you towards the optimal financing choice.

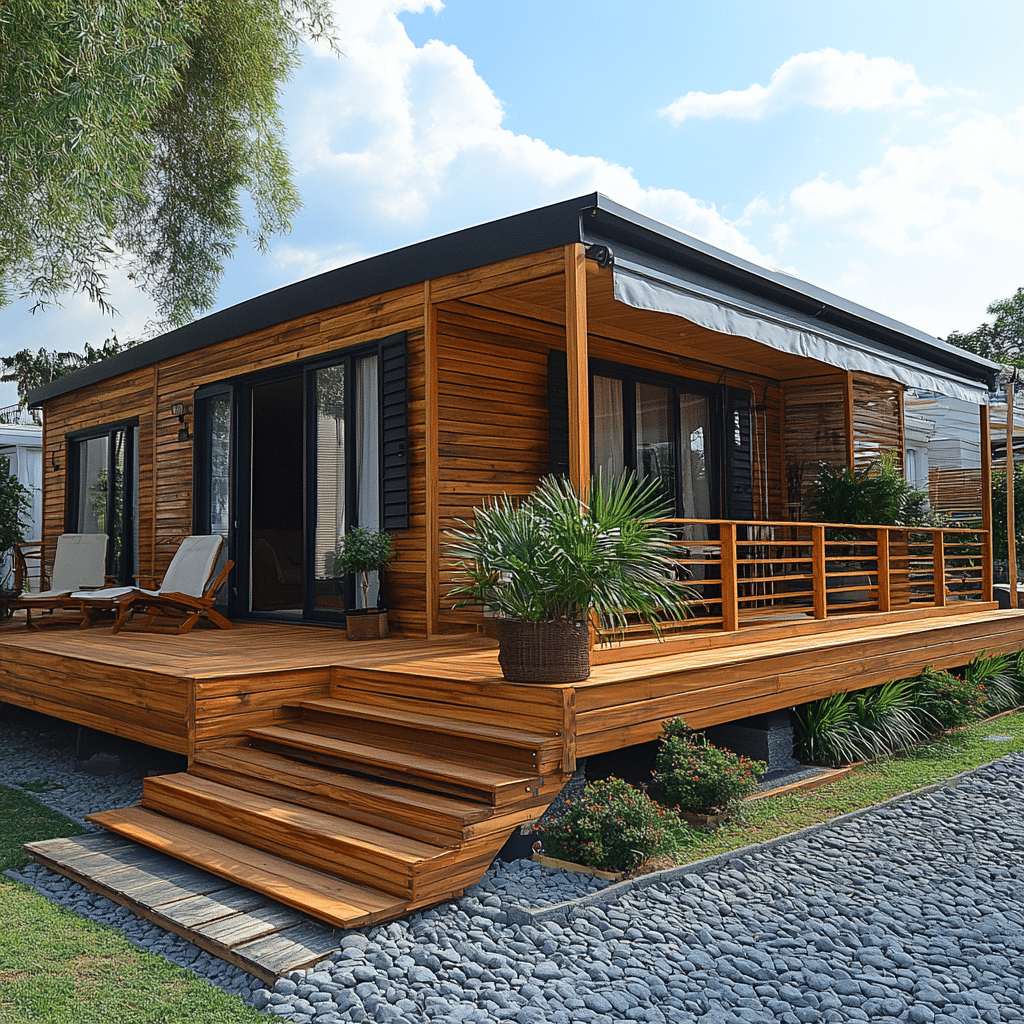

The Rise of Small Mobile Homes: Maximizing Space and Savings

Small mobile homes are gaining traction, maximizing efficiency and minimizing expenses. Brands like Tumbleweed Tiny House Company and Escape Traveler reflect this shift.

Design and Amenities

Cost-Saving Benefits

Market Demand

This trend is catching on among retirees, singles, and eco-conscious buyers who appreciate a minimalist lifestyle.

Trailers Homes: Vintage Appeal and Modern Trends

Trailers homes have maintained their charm while incorporating modern trends. Companies like Airstream and Jayco continue to evolve traditional designs to meet contemporary needs.

Cost and Value Retention

Comparing older trailers to newer models highlights:

– Updated features in new models.

– Longevity and retained value in vintage units.

Living Experience

Owner testimonials underscore the comfort, mobility, and priceless lifestyle trailer homes offer. Nostalgia meets modernity in this burgeoning market.

How Home Financing Affects the Mobile Homes Market

Financing trends have a profound impact on the mobile homes market. Data from Freddie Mac and Fannie Mae reveal national mortgage policies and interest rate trends significantly sway consumer choices.

Factors Influencing Financing

State-by-State Variations

Local regulations introduce unique challenges and opportunities, affecting home financing dynamics. Each state presents a different landscape for mobile home buyers to navigate.

Navigating the Purchase of Mobile Homes

Purchasing a mobile home is a multi-faceted endeavor. Follow these expert tips for a seamless process:

Identifying Reputable Dealers

Research verified dealers like:

– Fleetwood Homes

– Palm Harbor Homes

Negotiation Tactics

Master techniques to secure the best deal, including:

– Comparisons with multiple dealers.

– Timing purchases during off-peak seasons.

Inspection and Maintenance Considerations

Guarantee longevity and value retention by:

– Conducting thorough inspections.

– Prioritizing regular maintenance schedules.

Reflecting on Affordable Living through Mobile Homes

The evolution of mobile homes prices in 2024 highlights their growing role in affordable living. By understanding market dynamics and leveraging sound financing options, buyers can enjoy the flexibility, sustainability, and community-centric lifestyle these homes offer. As design and construction innovations advance, mobile homes will firmly establish themselves as a practical and appealing housing choice for many. For further insights on mortgage trends and financing tips, visit loan company .

In the evolving spectrum of affordable housing, mobile homes continue to shine as a versatile and cherished option. Whether you’re drawn to small mobile homes for their efficiency or trailers homes for their classic charm, the future of mobile living is as dynamic as it is promising.

Mobile Home Prices: Affordable Living Trends

Ever wondered why folks are talking more about mobile homes these days? There’s more to it than just affordability. Let’s dig into some fun trivia and interesting facts about mobile home prices and why they’re catching people’s eyes.

Quirky Origins and Financing

Did you know that the modern mobile home has roots dating back to the 1920s? Initially, these homes were more like travel trailers, but they have evolved significantly. Today, you can even find seller financing Homes as an option, making them more accessible to a wide range of buyers. Fascinatingly, the U.S. has seen growth in this sector partly due to the rise of the gig economy and increasing acceptance of unconventional lifestyles, including what’s known as 420 friendly living spaces in some communities.

The Economics Behind It

Another interesting tidbit: Mobile homes are not just budget-friendly—they can actually be a smart investment! For instance, if you look at a 30 year mortgage rate chart, traditional homebuyers might be surprised at how competitive mobile home financing can be. On top of that, mobile homes are often found for sale in a unique way, like through auction real estate, presenting a treasure hunt opportunity for savvy buyers.

Pop Culture and Legal Perks

For fans of the TV show Supernatural, you might recall the character Joan supernatural, who lived in a modest trailer. It underscores how mobile homes aren’t just for the budget-conscious but also have a certain pop culture charm. Moreover, there are practical benefits too, such as forming an LLC for taxation purposes. The Llc tax Benefits can make owning a mobile home even more cost-effective, providing an extra layer of affordability and legal protection.

As mobile home prices continue to draw attention for their affordability and versatility, it’s clear why they are steadily gaining ground as a favored housing option. Whether you’re in it for the savings, charm, or investment potential, there’s a lot to love about these humble abodes!