Navigating the mortgage maze can feel like a wild ride. But having the right info can turn that rollercoaster into a smooth train journey. One essential key in your toolkit is the Bank of America mortgage phone number. Whether you’re a first-time homebuyer or refinancing, this number can connect you to quick assistance at just the right moment. Let’s dig into all you need to know about reaching Bank of America and how it stacks up against lenders like Wells Fargo.

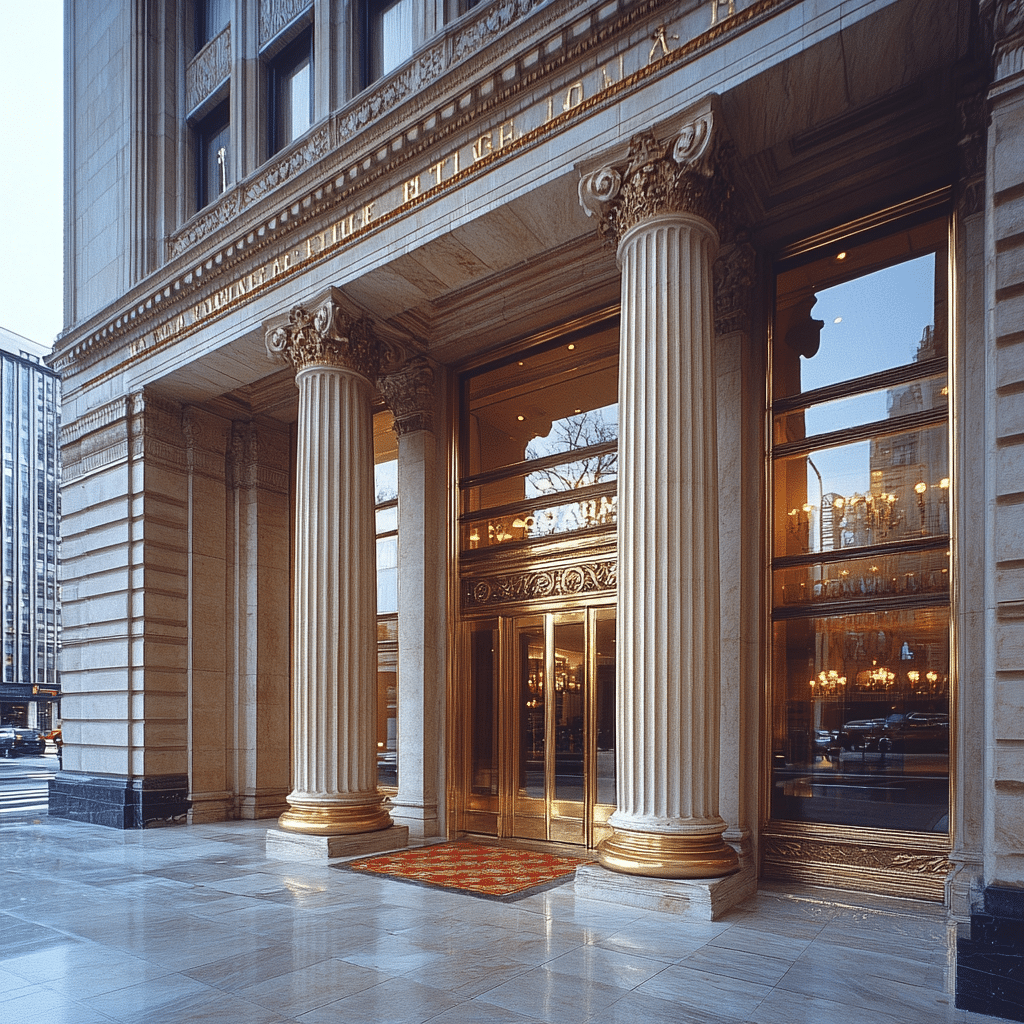

1. Bank of America Mortgage Contact Phone Number: Your Key to Quick Assistance

When you’re in a pinch and need help with your mortgage, knowing the right phone number is priceless. For quick assistance, the Bank of America mortgage contact phone number is (800) 299-9000. This dedicated hotline is your lifeline for any queries about applications, payments issues, or even just general questions about mortgage products.

1.1 Why You Might Need This Number

This handy number can be a lifesaver for numerous reasons:

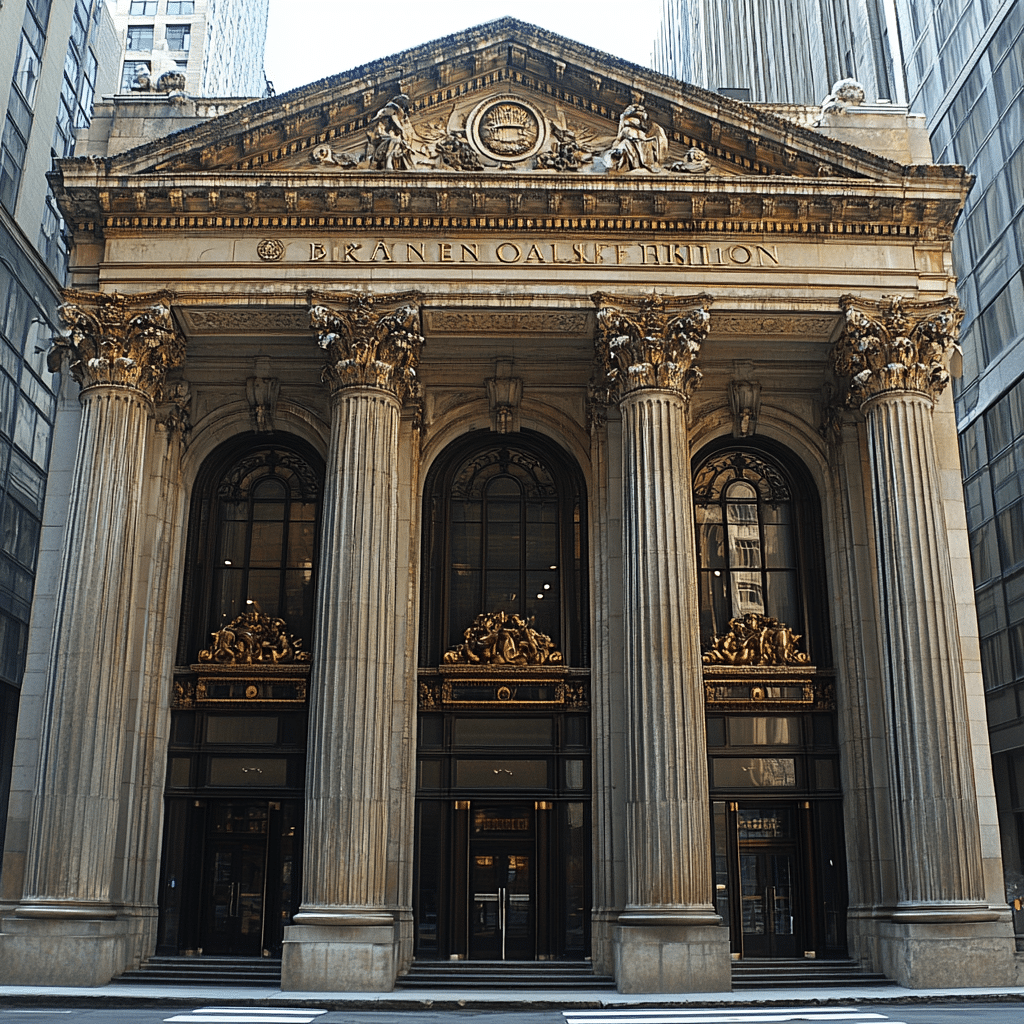

2. How Does Bank of America Compare with Wells Fargo?

Comparing lenders isn’t just smart; it’s essential. For many borrowers, knowing how Bank of America’s support measures up against Wells Fargo can help you find the ideal fit.

2.1 Wells Fargo Mortgage Phone Number

If you’re also looking into Wells Fargo, their mortgage assistance can be reached at (800) 357-6675. They offer similar guidance and support for those knee-deep in home loan questions.

2.2 Customer Service and Assistance

Both lenders offer a strong customer service experience, but each has its own nuances:

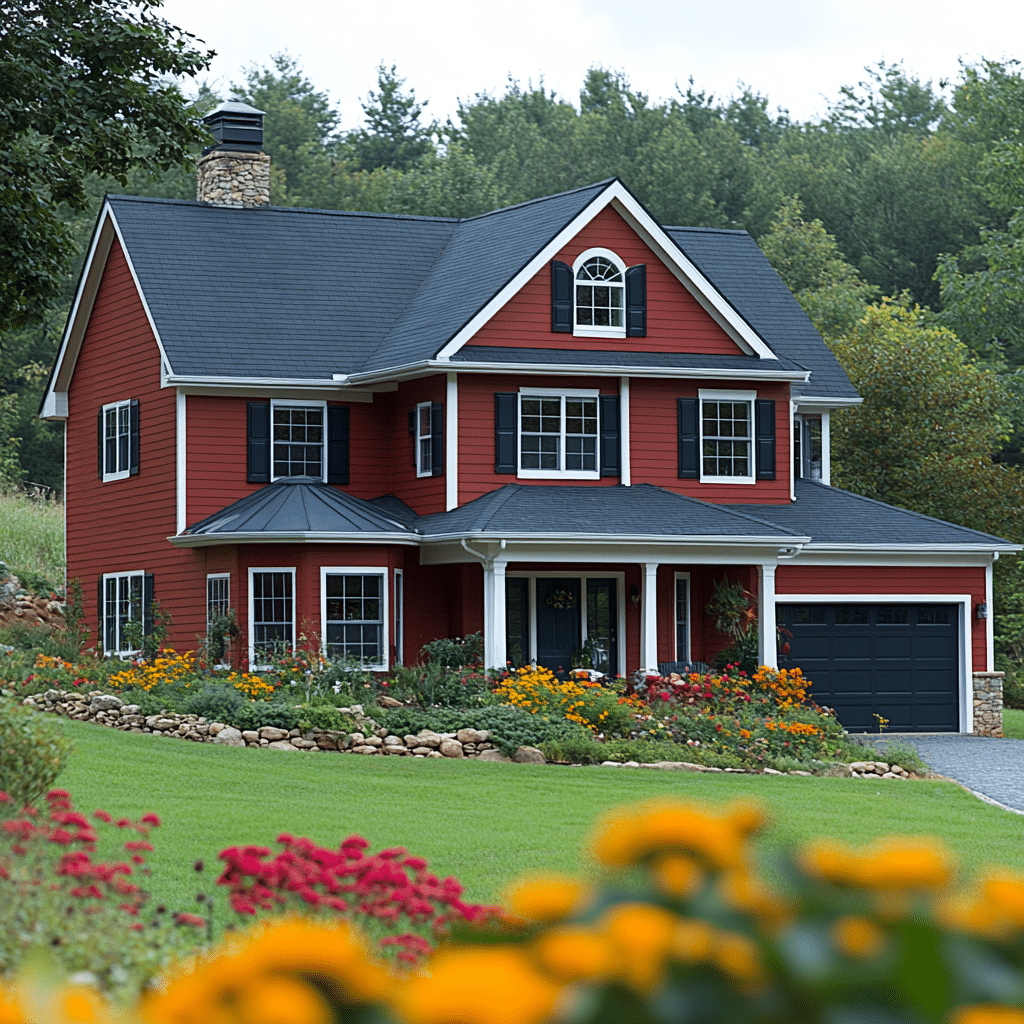

3. How to Value Your Home: Understanding the Bank of America House Value Tool

Knowing your home’s value is key when diving into the mortgage world. Luckily, Bank of America provides an easy way for you to assess your home’s worth through their online resources, also known as the Bank of America house value tool.

3.1 Accessing the Bank of America House Value Tool

You can find this assessment tool right on Bank of America’s website. It’s perfect for potential buyers and current homeowners alike, helping them figure out how much equity they have. This information becomes vital when refinancing or securing favorable loan terms—knowledge is power!

4. Wells Fargo Mortgage Login: A Comparison of Digital Services

In our digital age, many people prefer managing everything online. Wells Fargo’s mortgage login portal has built a solid reputation for being user-friendly and comprehensive too.

4.1 Features of the Wells Fargo Mortgage Login Portal

Here are a few standout features:

– You can check your mortgage balance anytime.

– Setting up automatic payments is a breeze.

– You can easily access tax statements and mortgage documents.

Comparing this to Bank of America, their login portal also includes a wealth of features. However, they’ve faced complaints about usability, with many users highlighting issues with navigation and mobile compatibility. So, if you’re tech-savvy or need efficient digital tools, it’s worth considering this aspect.

5. Tips for Contacting Your Mortgage Lender

When it’s your turn to reach out to either Bank of America or Wells Fargo, keep these tips in mind to enhance your experience:

Wrap-Up: Empowering Your Mortgage Journey

In the competitive mortgage market, having swift access to your lender can ease your worries and improve your experience. If you’re dealing with Bank of America, the mortgage phone number is a vital tool—especially during tough times. As you weigh your choices between lenders like Wells Fargo, gaining insight into customer service and digital tools can empower you to make confident decisions. Embrace these resources to navigate your journey to homeownership or refinancing, making it a whole lot smoother. Remember, knowledge is your best friend in the mortgage landscape, so don’t hesitate to explore all that’s available to you!

Fun Trivia and Interesting Facts about the Bank of America Mortgage Phone Number

Did you know that the Bank of America mortgage phone number isn’t just for queries about mortgage rates? It’s a vital resource for those navigating the housing market, akin to finding a Nigerian restaurant when you’re craving something spicy and cultural. When you dial their number, you can get assistance with everything from loan applications to refinancing options. It’s like having a personal guide in the world of home loans, ready to steer you through the process.

Historical Facts on Mortgage Assistance

Mortgage companies have evolved dramatically since their inception. For instance, the process of securing a home loan today has a lot more structure than in the past, much like the intricate casting process for “Gone With The Wind,” where every actor was meticulously chosen. With so many options, including those that don’t require a credit check, it’s essential to understand the ins and outs. That brings us back to the Bank of America mortgage phone number—your go-to resource for questions about What Does turnkey mean when considering properties or seeking advice on how to choose the right mortgage for you.

Digging Deeper into Mortgage Support

When you’re in a tight spot and need to make an urgent mortgage payment, the Chase mortgage payment telephone number might also come in handy. However, having the right number for Bank of America can save you time and potentially money. Speaking of saving, if you ever wonder about options like a no credit check bank account, they can also guide you on that path. It’s fascinating to think that just a simple call can lead you to better financial decisions, especially if you’re looking for effective strategies amidst a fluctuating market.

So, whether you’re wondering how to assume define things in your mortgage terms or just checking out other options like the Flagstar bank mortgage phone number, dialing the Bank of America mortgage phone number can put you on the right track. Embrace the journey—just like cheering for the Army Navy score on game day—getting your mortgage sorted out is a victory worth celebrating!