Program First Time Home Buyers Low Income Options Available

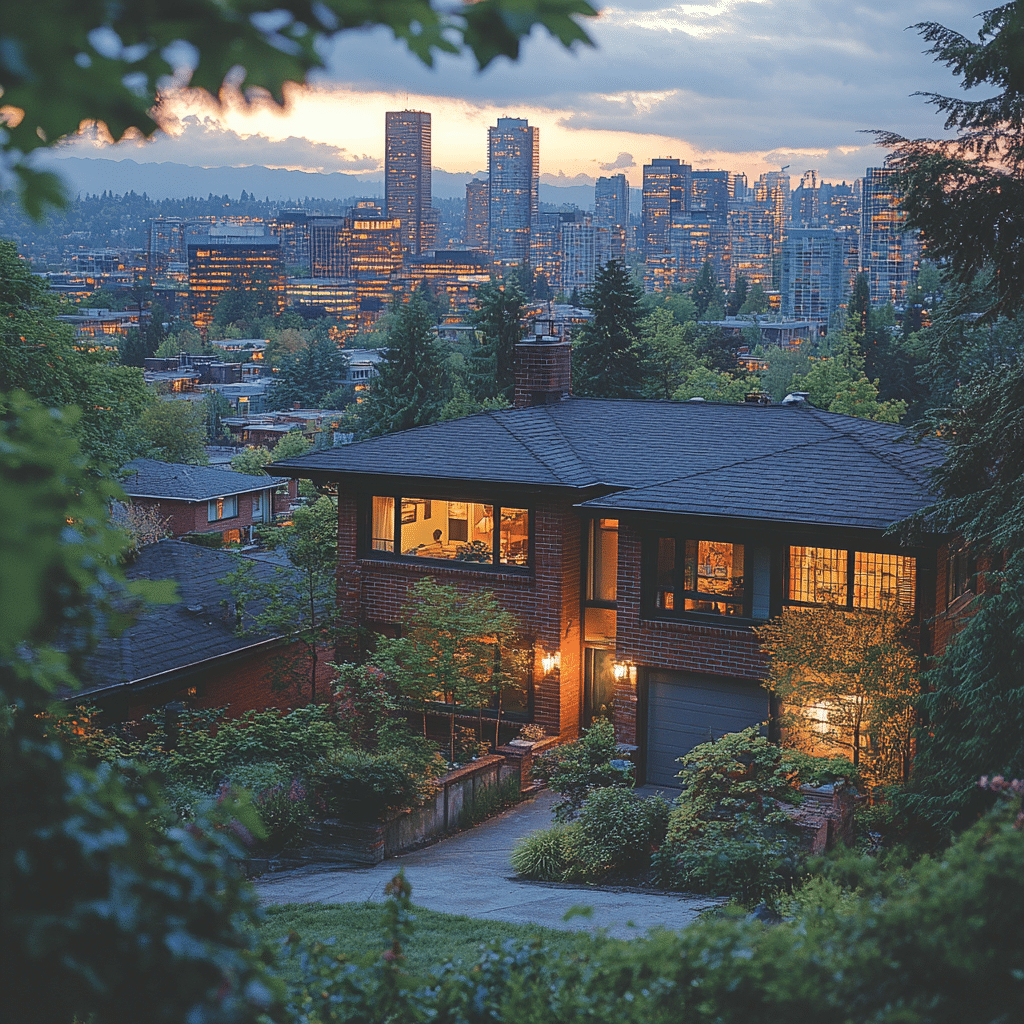

Purchasing your first home can feel like climbing a mountain, especially for low-income individuals and families. No need to fret, though, as there are several programs for first-time home buyers with low income that offer vital support and benefits. This article highlights key advantages and resources available through these assistance programs, focusing on how they help first-time buyers secure the stability and freedom that comes with homeownership.

Understanding these programs can be the missing piece in your puzzle, helping you navigate the road to owning a home. Whether you’re dreaming of a cozy space for your family or a solid investment, there’s no time like the present to dive into these first-time home buyer assistance programs.

Top 6 First Time Home Buyer Assistance Programs for Low-Income Buyers

1. Federal Housing Administration (FHA) Loans

The FHA loans are a lifeline for first-time home buyers. With down payment requirements as low as 3.5%, they cater to folks who might find it tough to save a hefty sum. Additionally, the FHA is pretty lenient with credit scores, making these loans a solid choice for those just starting their financial journey. First-time buyers, check out the possibilities of FHA loans if you’re nervous about conventional financing methods due to credit issues; they could be your best friend.

2. State and Local Homebuyer Assistance Programs

Many states roll out red carpets for first-time home buyers through their own programs. For instance, California’s California Housing Finance Agency (CalHFA) offers down payment assistance loans specifically for low-income buyers. These incentives can range from grants covered by the state to forgivable payments that help ease the burden. Investigate what your state offers; local programs often tailors assistance to community needs.

3. USDA Rural Development Loans

For those who might prefer a quieter setting, the USDA offers great opportunities through their loans. Backed by the government, these loans often demand no down payment and come with affordable mortgage insurance rates. Ideal for low-income families looking to settle into rural areas, these programs would be a smart choice if you value space and tranquility. They could help you turn a property in a peaceful locale into your family’s dream home!

4. Good Neighbor Next Door

The Good Neighbor Next Door program is like a gift for dedicated public service workers, including teachers and law enforcement officers. Eligible buyers can snag homes at a 50% discount in revitalization zones! This program promotes investment in neighborhoods needing a boost, allowing public service professionals to step up as community cornerstones all while saving big on their home purchase. If you fit the bill, don’t miss out on this golden opportunity!

5. HomeReady and Home Possible Loans

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible loans bring flexibility to low-income buyers. These programs allow down payments as low as 3%, and they accept various income sources, including that of non-borrowing household members. This means more family support can help ease the path to homeownership. If you’re looking at options that keep financial strain low, these might just be the ticket for you!

6. Neighborhood Assistance Corporation of America (NACA)

NACA offers a no-nonsense approach to homeownership. Their programs assist low-income buyers with no down payment, no closing costs, and competitive interest rates. Plus, NACA provides support services, including financial counseling and homebuyer education. It’s a win-win, blending accessible financing with educational resources, giving buyers the tools they need for success.

Benefits of First Time Home Buyer Assistance Programs

These programs can be real game-changers, allowing first-time buyers to reach for homeownership when it otherwise might seem out of reach. Here are the tangible benefits you’ll experience:

Overcoming Challenges in Homeownership

Homeownership isn’t without its bumps along the way, especially for first-time buyers. Here’s a look at common hurdles and how to tackle them:

Final Thoughts on First Time Home Buyer Assistance Programs

Stepping into homeownership can be overwhelming for low-income first-time buyers, but help is out there. Diverse programs cater to your specific challenges, equipping you with resources to tackle financial barriers head-on. By tapping into everything from government-backed loans to local assistance, you can carve a pathway toward homeownership—and with it, greater financial stability.

So, take charge and explore these exciting options today! You’ve got the chance to transform dreams into tangible reality, paving the way for a brighter future for yourself and your loved ones. Dive into the available resources and make your first home a place you’re proud to own. Embrace the journey ahead with confidence, and remember, homeownership could very well be within your reach.

For more tailored options, consider searching for a home loan broker near me to guide you along the way!

Program First Time Home Buyers Low Income: Fun Trivia and Interesting Facts

Exploring Low-Income Benefits

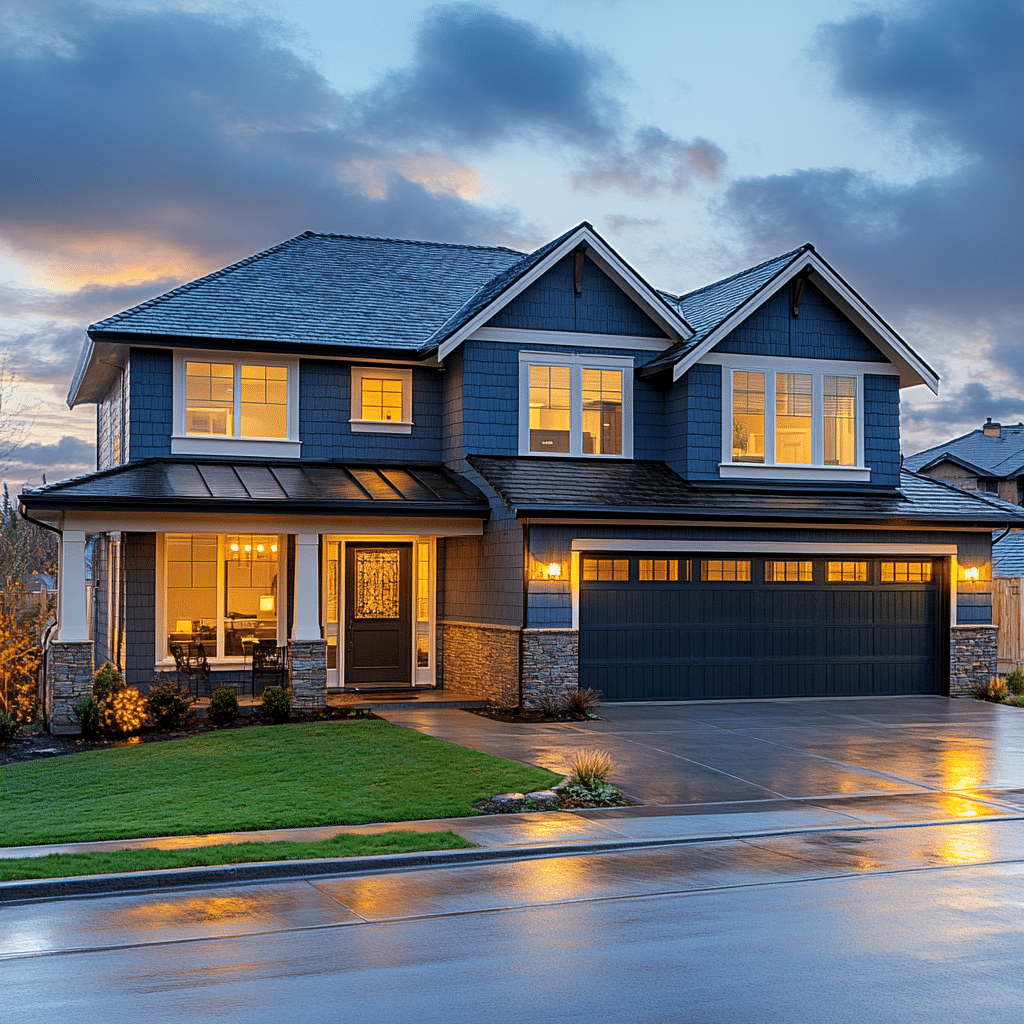

Did you know that there are programs specifically for first-time home buyers with low income that require no down payment? Indeed, many folks dream of homeownership but think it’s beyond their reach. These programs are a lifeline, allowing many to step onto the property ladder without any initial cash outlay. For those considering options, check out how you can access first time home buyer no down payment programs and get the ball rolling on your homeownership journey.

It’s also fascinating to discover that some lenders, like Rocket Mortgage, even assist homeowners by covering their first three mortgage payments! This kind of help can ease the financial burden of getting settled. Additionally, many local organizations provide resources for help moving, making the whole process smoother and less stressful.

Options for Financing

For first-time buyers, loans are available that don’t require any money down, like zero down first time buyer home Loans. Many people are unaware of how these loans can open up opportunities for homeownership they previously thought unattainable. Moreover, programs like the FHA loan can pave the way for individuals with lower credit scores to qualify for home financing. It’s a huge relief to know options such as first time home buyer financing exist to cater specifically to your financial situation.

As a quirky piece of trivia, talking about homes brings to mind the popular culture reference of Fullmetal Alchemist metal. Just as characters in that show often seek the Philosopher’s Stone, aspiring homebuyers are on a quest for treasures like affordable housing! Still, if you’re worried about affordability, remember that no money down Mortgages could make your dreams much more tangible.

Knowledge is Power

It’s essential to familiarize yourself with the various programs available for first-time home buyers with low income. There’s a smorgasbord of options like first time home owner Loans that are designed to empower buyers from different backgrounds. Plus, if you have a knack for adventure, keep in mind that joining a list Of motorcycle Clubs by state could be a great way to meet new friends who also share your passion for travel and exploration.

Lastly, think about how unbelievable it seems that many still ask, are Leprechauns real Homebuying may feel magical sometimes, especially with the fantastic support available for first-time buyers. Navigating the ins and outs of obtaining your dream home doesn’t have to be challenging—just remember the resources at your fingertips and take the leap with confidence!