As we dive into 2024, it’s essential for homeowners to recognize the potential of the home improvement tax credit. This valuable credit allows you to make significant repairs and upgrades at your home while enjoying financial benefits, especially when it comes to energy efficiency. By taking advantage of these incentives, you can enhance the value of your residential property and even save on your tax bill. Let’s explore the top seven ways to maximize your savings through this enticing tax benefit!

Top 7 Ways the Home Improvement Tax Credit Can Save You Money

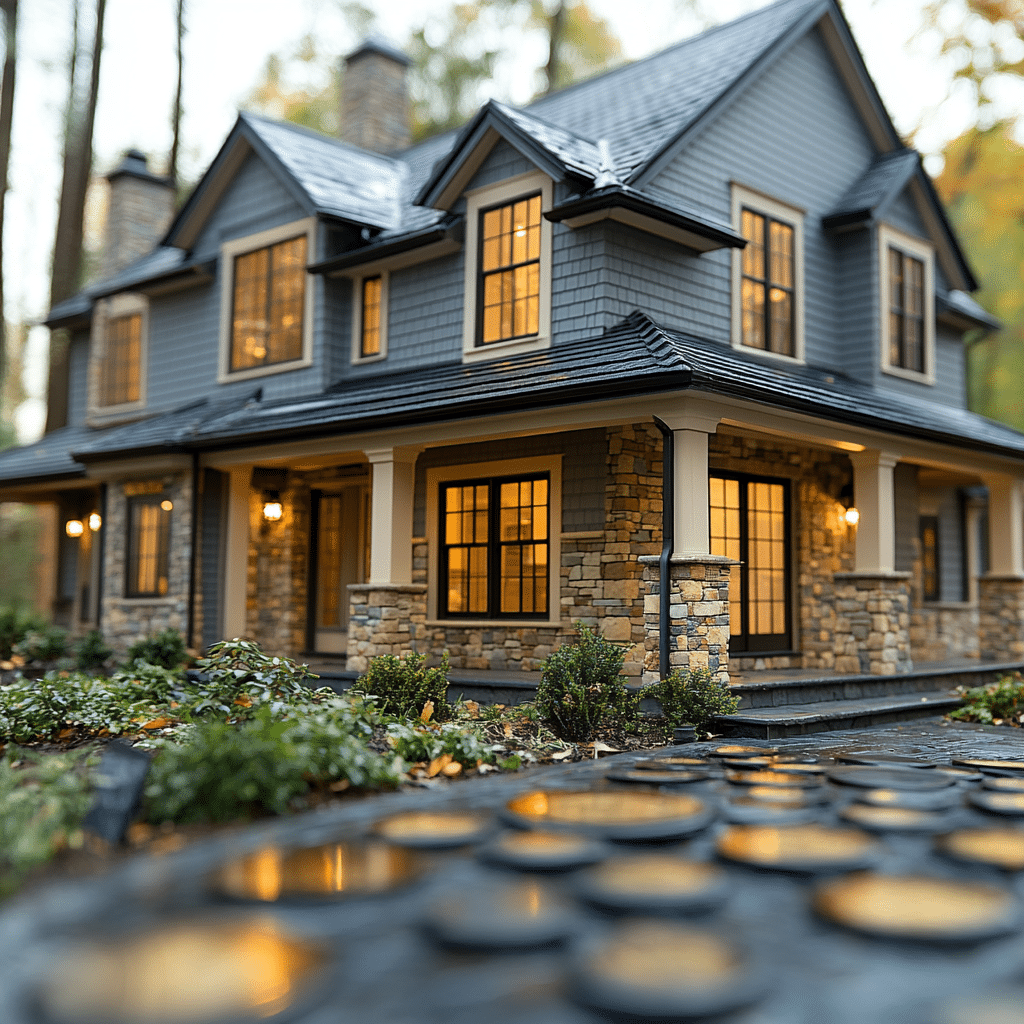

1. Energy-Efficient Windows and Doors

First off, consider investing in energy-efficient windows and doors. Upgrading these can beautify your home and cut utility costs. Brands like Pella and Anderson offer ENERGY STAR-rated products that often qualify for tax credits. You could see savings devour up to $500 in federal rebates, boosting both energy efficiency and your home’s resale value.

2. Solar Panel Installation

Next, let’s talk solar! Installing solar panels on your house has gained popularity, and rightfully so. The federal solar tax credit, also known as the Investment Tax Credit, allows you to deduct 30% of the installation costs from your federal tax return. So, if you invest $20,000 in solar panels, a whopping $6,000 could come back to you! It’s not just an eco-friendly choice; it’s also a financially savvy investment that pays dividends long-term.

3. Green Roofs and Insulation

Green roofs and top-notch insulation systems can also lead to tax savings. They help lower your energy expenses and enhance the comfort of your home. Owens Corning provides some excellent insulation options that could qualify for the home improvement tax credit. So, if you’re feeling a draft, don’t just complain about it—invest in insulation and save on your bills and taxes!

4. Energy-Efficient Appliances

Let’s not forget those energy-efficient appliances! Upgrading to newer models from brands like Samsung or Whirlpool can bring a smile to your wallet. Many of these appliances consume significantly less energy and water—naturally leading to substantial savings. Just make sure these appliances meet federal energy efficiency guidelines to grab that potential tax credit!

5. Home Purchase Tax Credit

Are you considering buying a home in 2024? You’re in luck! The home purchase tax credit can significantly offset costs. Several local governments offer credits for first-time homebuyers, allowing you to claim a percentage of your purchase price on your state and federal taxes. It’s a fantastic way to make the financial burden of buying a home easier on your bank account!

6. Renovation of Historical Properties

If you’re a proud owner of a historical property, you might not know specific renovations could qualify you for tax incentives. The National Park Service administers programs that provide considerable credits for rehabilitating historic homes, especially for those generating income. This could lead to some remarkable savings on your tax bill, making it even more rewarding to preserve our past.

7. Aggregating Home Improvement Tax Credits

Finally, let’s not overlook the power of aggregating your home improvement tax credits. Many homeowners fail to realize they can combine these credits for maximum benefit. By simultaneously upgrading windows, installing solar panels, and enhancing insulation, you can optimize your savings. Federal and state programs often align, allowing you to boost your property value while minimizing your tax burden.

Navigating the Home Improvement Tax Credit with State Farm Home Insurance Hard Credit Check

Understanding how the home improvement tax credit is intertwined with your larger financial picture is essential. If you’re applying for home insurance, such as through State Farm, be prepared for a hard credit check. This inquiry can have a temporary impact on your credit score, which could affect your mortgage rates or future loans for further home improvements. Combining smart financial management and careful planning is the key to ensuring your investments translate into real savings.

Tips for Optimizing Your Tax Credits

Innovative Financial Strategies for Homeowners

To unlock the full potential of your home improvement journey, think strategically about upgrades and financing. By merging tax credits with smart financial choices—like low-interest loans or refinancing—you amplify your savings. For instance, if you invest in solar panels, consider financing through companies like LightStream, which offers competitive rates. This strategy could free up cash while contributing to a sustainable future!

Combining your knowledge about the home improvement tax credit with innovative financing options sets you on the path to long-term financial success. Capitalizing on these credits in 2024 will not only make your living space more enjoyable but also strengthen your financial health. Don’t let these opportunities pass you by—get started today and watch your home and savings flourish!

Home Improvement Tax Credit: Unlock Incredible Savings

The Basics of Home Improvement Tax Credit

Did you know the home improvement tax credit can be a game changer for homeowners wanting to upgrade their spaces? It allows you to claim a substantial portion of expenses incurred for qualified home upgrades. For instance, if you’re considering energy-efficient windows or a new roof, you might just find that the tax credit helps soften the blow on your wallet. Some homeowners jump at the chance to learn more, diving into resources like the Homeowners insurance definition, where understanding your coverage can also lead to savings during major renovations.

Fun Facts that Save You Money

Here’s something to tickle your brain: around 70% of homes in America could benefit from energy-saving improvements. Whether it’s insulation or new appliances, the home improvement tax credit can lead to real benefits. For those living in the Sunshine State, combining this tax break with low Florida mortgage rates can pave the way for fantastic deals. Additionally, the credit isn’t just about energy efficiency; it can help with improvements that enhance safety and accessibility—vital aspects for those who’ll be aging in their homes.

Trends in Home Improvements

Think the home improvement tax credit is just about fixing old houses? Think again! Homeowners are getting creative, opting for renovations that turn dull spaces into stylish hangouts. Imagine transforming a home office into a vibrant workspace. Innovative ideas aren’t limited; some folks even explore programs for low-income housing purchases that encourage upgrades. Plus, as reported by Associated Press News, renovations are gaining ground not just for aesthetics but as an investment strategy too. When reselling, renovated homes often fetch higher prices, especially when mortgage And Types Of mortgage considerations come into play, boosting your potential profit.

In summary, tapping into the home improvement tax credit might just be the key to making your dream home a reality. So, you might want to check out options available, and if diving into homeowners insurance or Pmi meaning helps you save even more, consider it all part of the game. Don’t let this opportunity slip away, as improvements paired with savvy financial strategies can turn the notion of home into a true haven!