Understanding the Concept of a HUD House

So, what exactly is a HUD house? These properties are essentially homes that have been insured by the Federal Housing Administration (FHA) and later repossessed due to foreclosure. The U.S. Department of Housing and Urban Development (HUD) then steps in to sell these homes to the public. The significance of HUD houses lies primarily in their ability to offer affordable homeownership opportunities for families that might otherwise struggle to break into the housing market. For example, when a family faces financial hardship, their home may end up being auctioned off through HUD, making way for a potential first-time homebuyer.

The circumstances leading to a HUD house can vary. Foreclosures create opportunities for savvy buyers, as these homes are often sold for much lower prices than what you’d find on the conventional market. Government assistance programs aim to increase homeownership rates among low-income households, making sold HUD houses an attractive option. Just imagine snagging a house that originally cost $200,000 for half that price! Sound too good to be true? Well, it often isn’t.

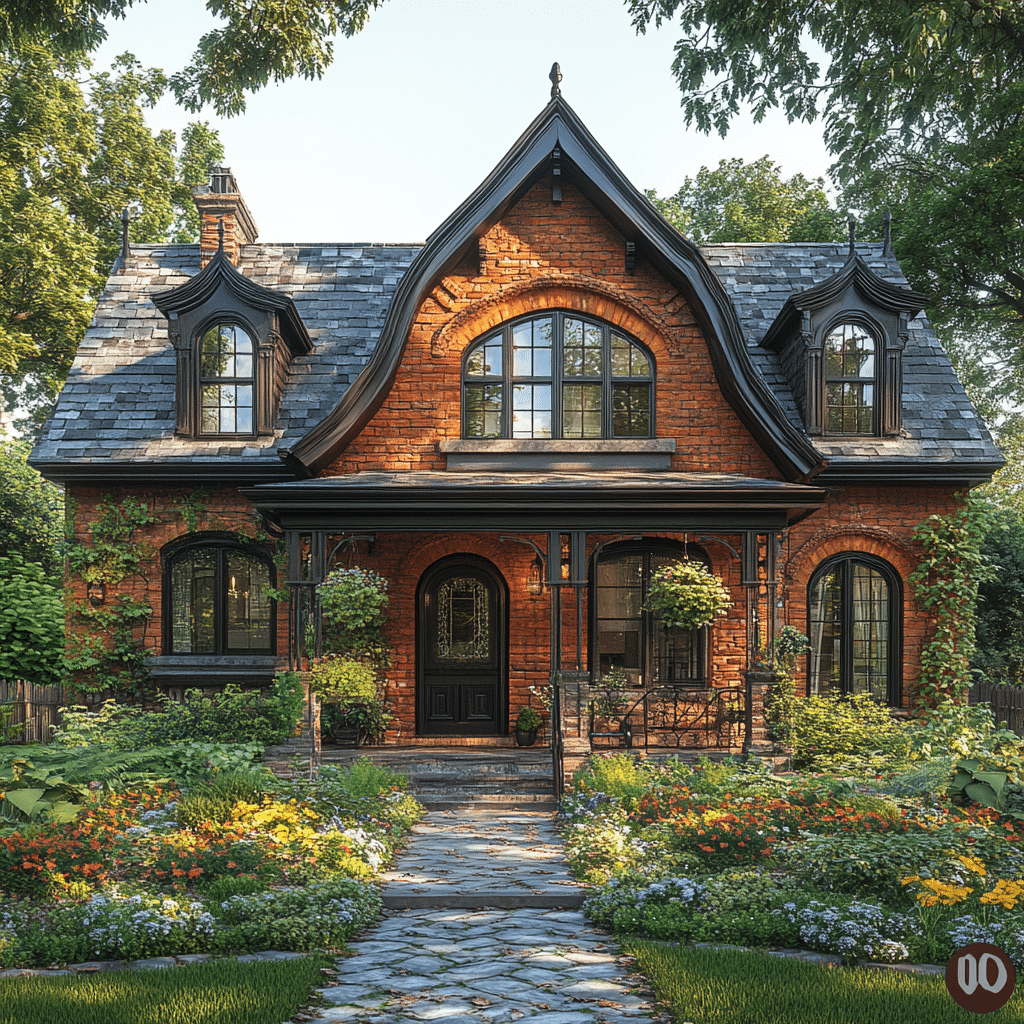

In communities across America, these homes serve as a crucial tool in promoting homeownership. Growing properties provide stability not just for individuals but also for entire neighborhoods. When HUD houses are restored and sold, they breathe life back into communities. Not to mention, there’s nothing PEeved about getting a great deal on a home you can truly call your own! Check out this story about a HUD home based in Baltimore, where families found unexpected treasures in the heart of the city.

Top 5 Advantages of Investing in a HUD House

One of the most striking aspects of HUD houses is their reduced prices. Typically, they are sold at fair market value, but that value is often substantially lower than traditional listings. For instance, a 2023 HUD listing in Milwaukee, WI, was tagged at $130,000, while neighboring homes with similar features commanded prices over $180,000. That’s significant savings for first-time homebuyers eager to make their dreams a reality.

Many buyers of HUD houses can take advantage of Federal Housing Administration (FHA) loans. These loans come with low down payment requirements, making them more accessible. For a first-time buyer eyeing a $150,000 HUD house, the down payment could be as little as 3.5%, which totals about $5,250. How’s that for a financial boost?

Various local and state initiatives provide grants to help cover down payment and closing costs. Take the California Housing Finance Agency, for example; they offer these grants, significantly easing the financial burden for potential buyers. Homeownership isn’t just a dream for some; it’s becoming a reality for many!

HUD houses often find themselves in emerging neighborhoods, which can be a goldmine for buyers. The properties in South Dallas, once sold as HUD houses, are now seeing value appreciation thanks to urban developments and community investments. Buyers looking at a HUD house today could stand to profit in the long run.

The terms associated with HUD home purchases can be more flexible than those of typical sales. This flexibility can include negotiating lower closing costs or adjusting timeframes that suit a buyer’s needs. For those who need a smoother transition into homeownership, this consideration can’t be overlooked.

The Role of a Calc House in Financing HUD Homes

Understanding the cost of homeownership is vital when it comes to choosing a HUD house. Enter the “calc house,” an aspect that helps potential buyers gauge the long-term financial implications of their purchase. Beyond just the purchase price, you must consider costs like insurance, property taxes, and ongoing maintenance.

For example, a home that costs $130,000 may incur property taxes surging around $1,500 each year and possibly another $1,000 for maintenance alone. By utilizing mortgage calculators there’s a way for you to simulate various scenarios that can help you evaluate affordability and plan financially.

Now, think about all the factors involved. House liends, monthly utilities, and upkeep can compound costs quickly. Understanding these aspects will empower you to make informed decisions that align with your financial strategy long-term.

Options to Refinance Your HUD House for Future Affordability

After purchasing a HUD house, many homeowners might explore refinancing options to snag better interest rates. This strategy could also unlock cash for needed home improvements. One standout program to consider is the FHA Streamline Refinance, which significantly reduces closing costs.

For instance, if a homeowner initially secured a 4% interest rate, refinancing to as low as 2.5% can lead to drastic monthly payment reductions. That can make a world of difference in your budget! With the right knowledge, refinancing your HUD home can turn into one of your best financial strategies.

Understanding House Liens and Their Impact on HUD Purchases

Before diving headfirst into the purchase of a HUD house, it’s essential to be aware of potential house liens. Liens can complicate ownership and lead to unforeseen financial responsibilities. A recent story of a couple who purchased a HUD house in Baltimore serves as a cautionary tale. They were excited to renovate their new home but soon discovered an existing lien requiring settlement before they could begin renovations.

This experience underscores the importance of doing your homework before making a decision. Not just for your peace of mind but to avoid future headaches. Knowing how to navigate these situations keeps you from any unpleasant surprises.

Exploring House Hacks: Tips for Maximizing Your HUD Investment

Let’s talk househacks! They can be a game-changer for homebuyers thinking outside the box. A strategic way to utilize your HUD home is to rent out a portion of it, generating additional income. For example, a homeowner in Atlanta converted their basement into a separate rental unit. This smart move allowed them to cover a significant chunk of their mortgage payments, thereby giving them some much-needed financial breathing room.

Realizing that your home can be both a living space and a potential revenue-generating asset is incredibly empowering. House hacking not only offsets costs but also enhances the buyer’s investment potential significantly.

With a solid grasp on HUD houses and the insights provided, potential buyers can take the next step toward affordable homeownership. By capitalizing on these opportunities, you’re not just investing in a house; you’re investing in your future, paving the way for financial stability and a better life. As you’ll see, navigating the world of HUD homes can lead to incredible opportunities, ensuring no one is left behind in the journey to homeownership.

Explore the World of HUD Houses: A Gateway to Affordable Homeownership

Fun Facts About HUD Houses

Ever wondered how many homes are actually in America? Well, there are millions, but HUD houses represent a unique opportunity. Designed to offer affordable options for homeownership, the HUD house program stems from government efforts to make housing accessible to everyone. These charming homes often come from foreclosures or properties owned by the government, making them prime targets for first-time buyers or those on a budget. So, you might find yourself asking, is there a good home To buy near me? With HUD houses, there surely might be!

Interestingly, because these properties are often sold at competitive prices, they’ve gained a bit of a reputation. Some folks might laugh and say that a HUD house can feel like getting a bad house gifted up—after all, some do need a little love. Yet, with a little effort and imagination, these homes can transform into beautiful places to live. And did you know that the process of buying a HUD house can sometimes resemble the energy you’d find in a great song? Just think about the catchy Odetari Songs that get stuck in your head; navigating the HUD market can have that same uplifting vibe.

The Significance of HUD Houses

Buying a HUD house isn’t just about the property; it’s part of a larger story in the housing market. While recent headlines about the news Idaho Murders have dominated the news, the housing journey remains hopeful for many families seeking stability. Consider the opportunities that arise when families invest in these homes—not just as houses but as future memories.

In places like Tracy Home Depot, folks are gearing up to create their dream home post-purchase. And with more affordable housing options springing up, more individuals are empowered to join the homeowner club. Who wouldn’t want to explore the potential of a HUD house? If you or someone you know is considering taking the leap into homeownership, keep HUD houses on your radar; they might just be the ticket to a brighter future, especially for those looking to settle down near local gems like Jordan High school.