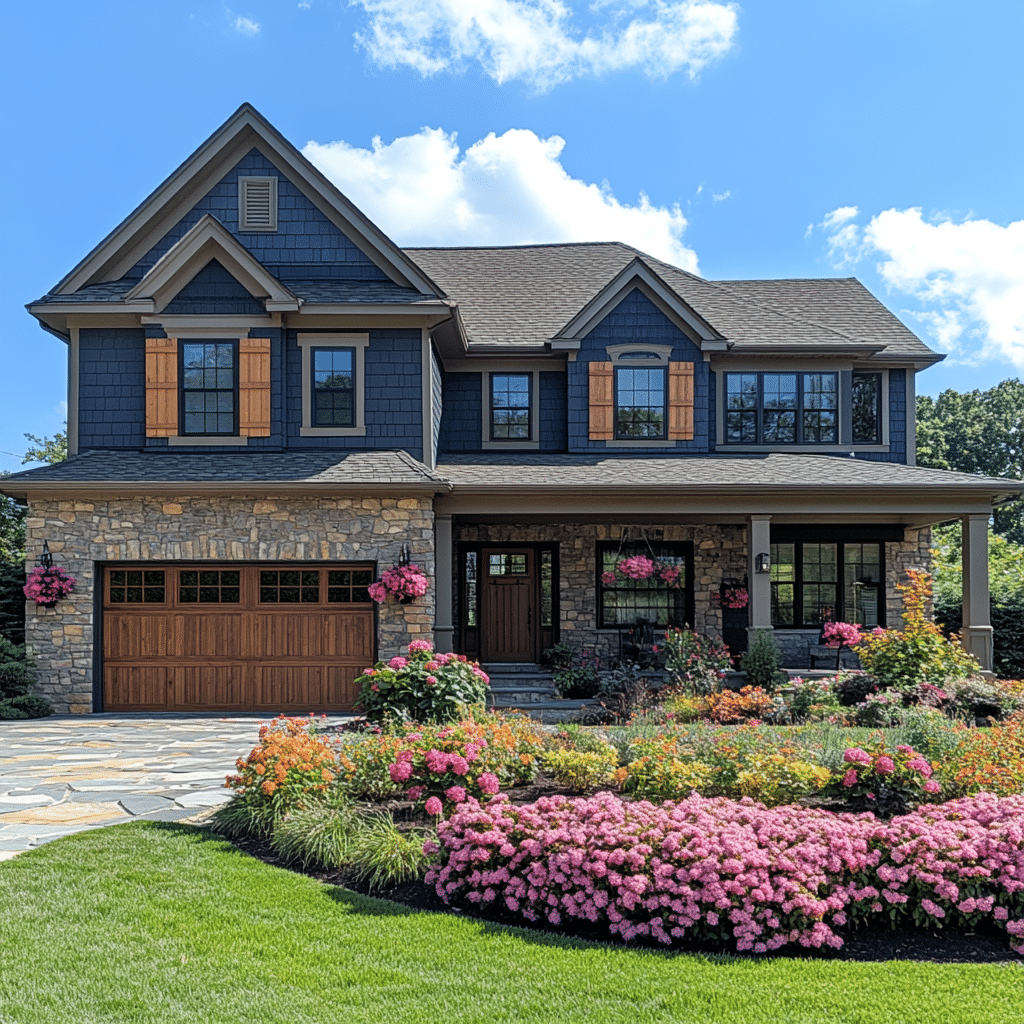

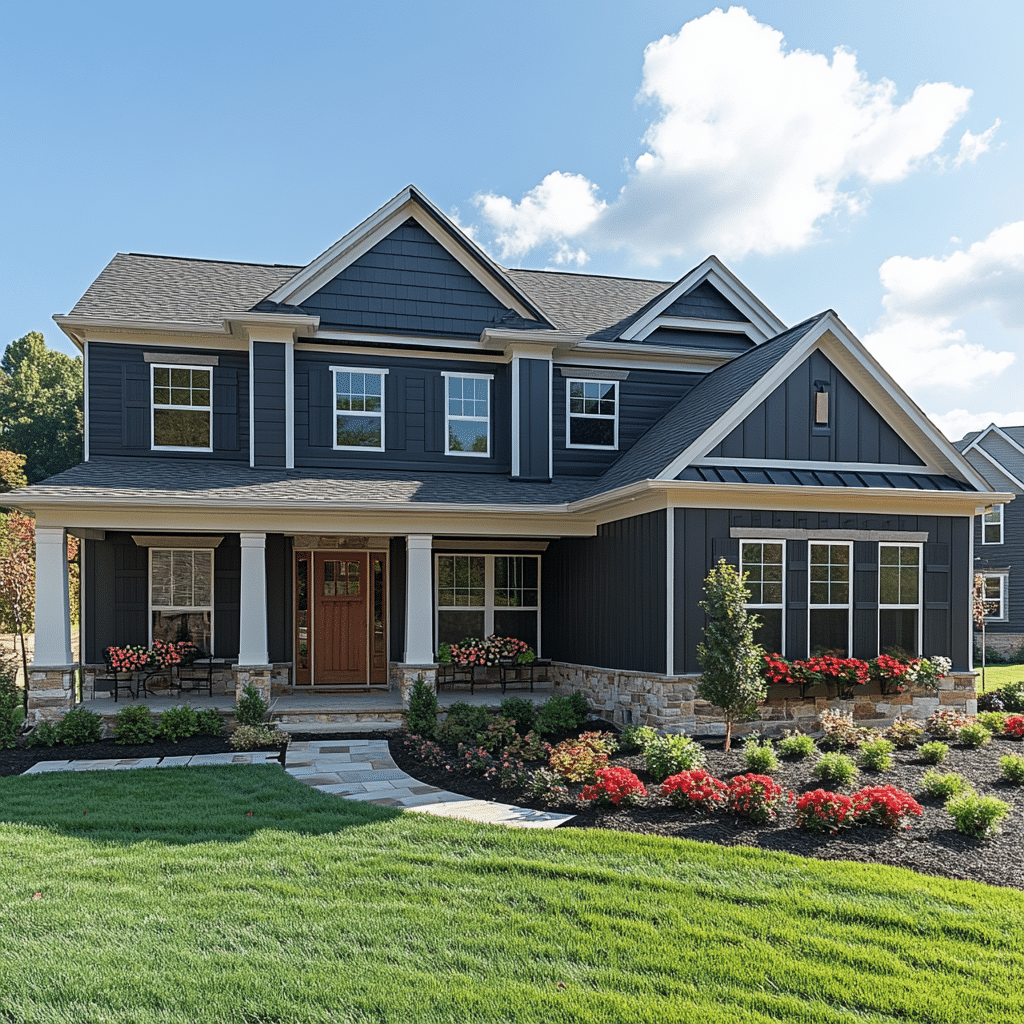

Purchasing your first home is an exciting milestone—especially in a state like Ohio! With the first time home buyer grant Ohio, aspiring homeowners can access financial support that makes homeownership achievable. Whether you’re a young couple looking for your starter home or a single parent wanting stability for your family, the grant offers a stepping stone into the housing market. As outlined by the Ohio Housing Finance Agency (OHFA), these grants are on the rise, indicating a growing interest among new buyers. Let’s dive into what this grant involves and the incredible benefits it brings.

Understanding the First Time Home Buyer Grant Ohio

Ohio recognizes the challenges faced by first-time home buyers. That’s why the first time home buyer grant Ohio exists—to alleviate the financial pressure during the often overwhelming process of buying Your first home. These grants target down payments and closing costs, making it easier for individuals and families to embark on their homeownership journey without the usual financial roadblocks.

Funds from the grant can cover substantial costs, allowing many buyers to navigate the competitive real estate market. With the ongoing shift towards urban living, areas like Columbus and Cincinnati have seen home prices spike, but help is here! In Ohio, you won’t just receive a handout; you’ll find the tools and knowledge to manage your investment wisely. Programs often combine grant money with educational resources to ensure new homeowners are well-prepared for their big leap.

Top 7 Amazing Benefits of the First Time Home Buyer Grant Ohio

1. Financial Assistance

The first time home buyer grant Ohio offers up to $8,000, giving buyers a significant financial boost. This assistance can transform the home buying experience, allowing buyers to focus on what truly matters: finding the right home.

2. Lower Down Payment Requirements

Homeownership doesn’t have to be out of reach! Many grants in Ohio let you secure a mortgage with down payments as low as 3%. This benefit opens the door for buyers with limited savings to finally step into homeownership.

3. Flexible Income Limits

Ohio stands out with its more accommodating income limits, compared to some harsher alternatives in other states. If you’re worried about income caps, worry no more! Ohio opens its arms to a diverse range of incomes, allowing more folks to qualify for this life-changing grant.

4. Increasing Housing Market Access

Competition in real estate can feel fierce, especially in urban hubs like Columbus and Cincinnati. The grant positions buyers strategically to compete in this booming market, giving them an edge when securing that dream home.

5. Support for Underserved Communities

The grant program prioritizes equity in homeownership, directing special incentives to minority communities and low-income areas. These initiatives promote a fair home buying experience, ensuring that everyone has a fighting chance at owning a home.

6. Couples and Joint Purchases

Two can be better than one! The first time home buyer grant Ohio allows couples to pool their resources. This approach maximizes the potential benefits and can pave the way for a successful joint purchase.

7. Education and Counseling Services

Knowledge is power! Many grant programs mandate homebuyer education courses that teach essential tips for managing a mortgage and keeping up with home maintenance. Such resources ensure buyers can confidently navigate their new responsibilities.

Comparing First Time Home Buyer Grants: Ohio vs. Texas and Florida

While Ohio offers a robust grant program, it’s helpful to see what other states are doing.

In Texas, the first time home buyer grants, such as those from the Texas State Affordable Housing Corporation (TSAHC), provide down payment assistance and tax benefits through mortgage credit certificates. This support helps first-time buyers ease into financial responsibilities while managing costs effectively.

On the other hand, Florida boasts generous fixtures too, sometimes reaching up to $15,000 in down payment assistance. However, they come with stricter eligibility requirements that might restrict access for some eager buyers.

What puts Ohio in a sweet spot is its combination of ample funding and relatively relaxed eligibility criteria. This balance enables more residents to pursue their homeownership dreams.

Success Stories: Real Buyers in Ohio Taking Advantage of the Grant

It’s always inspiring to hear success stories, isn’t it? Consider the Johnson family from Toledo. They benefited from a whopping $7,500 grant that covered both their down payment and closing costs, making the path to homeownership smoother than they ever dreamed.

Another heartwarming case is Sarah, a single mother from Cleveland. The first time home buyer grant Ohio played a crucial role in her journey. After utilizing the grant, she found a charming home, creating a stable and nurturing environment for her children. These real stories illustrate how the program can significantly impact lives.

Steps to Apply for the First Time Home Buyer Grant Ohio

Applying for the first time home buyer grant Ohio can be straightforward with these steps:

The Future of First Time Home Buyer Grants in Ohio

As we look to 2024, experts anticipate that funding and support for the first time home buyer grant Ohio will only grow. The state aims to meet rising home prices head-on by expanding these funds, making it easier for everyone to attain homeownership.

Community outreach initiatives will focus on empowering underserved neighborhoods, fostering an inclusive approach to buying homes. Enhancements to online application processes and counseling programs will boost the experience for first-time buyers, ensuring they feel supported and informed throughout their journey.

Wrap-Up: Your Path to Homeownership Awaits

The first time home buyer grant Ohio is more than just financial assistance—it’s a commitment to nurturing a community of homeowners. By educating prospective buyers on the benefits available, we empower them to make informed decisions. Ohio’s initiative alongside other state programs, including the impressive first time home buyer grants in Texas and first time home buyer grants in Florida, illustrate just how crucial these grants are in today’s housing market.

As the landscape continues to shift, the first time home buyer grant Ohio stands as a beacon of hope for those ready to turn the page on their housing journey. If you’re ready to explore the possibilities, take that first step toward homeownership—you won’t regret it!

First Time Home Buyer Grant Ohio: Fun Trivia and Interesting Facts

The Perks of Home Buying

Did you know that Ohio isn’t just a great place for first-time home buyers, but it also offers some of the most appealing grants? These incentives can significantly ease the financial burden of purchasing your new home. For instance, many states have their own programs, like the first time home buyer Programs in Texas or Arizona. It’s fascinating to see how these initiatives vary by state—from grants to low-interest loans designed for first time buyers. When you explore the options in Ohio, you’ll discover that there are probably more benefits than you initially thought!

A Neighborly Comparison

Interestingly, the Ohio first time home buyer grant has similarities with programs in places like Georgia. For instance, both states offer down payment assistance that can make financing your first home feel much less overwhelming. Comparatively, Texas first time buyer Grants pave the way for new homeowners in the Lone Star State. With so many options available, it’s fun to check out how different states cater to first-time buyers. As you dive deeper, getting familiar with first time home buyer Qualifications will only aid your understanding of the process and help you seize these opportunities!

Little-Known Facts and Resources

It’s also intriguing to learn that not all states have the same level of support for first-time home buyers. For example, while Ohio has its own attractive programs, California has specific tailored grants through its CA first-time home buyer programs that can assist those just starting. Beyond Ohio, there’s a wealth of information available to help first-time buyers everywhere. Resources like the first time buyer grants in Georgia and What Is subsidized housing can provide essential insights into financial assistance options. So whether you’re looking to snatch up a quaint bungalow or a modern loft, it’s all about knowing where to look and using the right resources.

In conclusion, the first time home buyer grant Ohio stands out for its benefits, making it a top choice for aspiring homeowners. With all these fun facts and comparisons, we hope you feel empowered to embark on your home-buying journey!