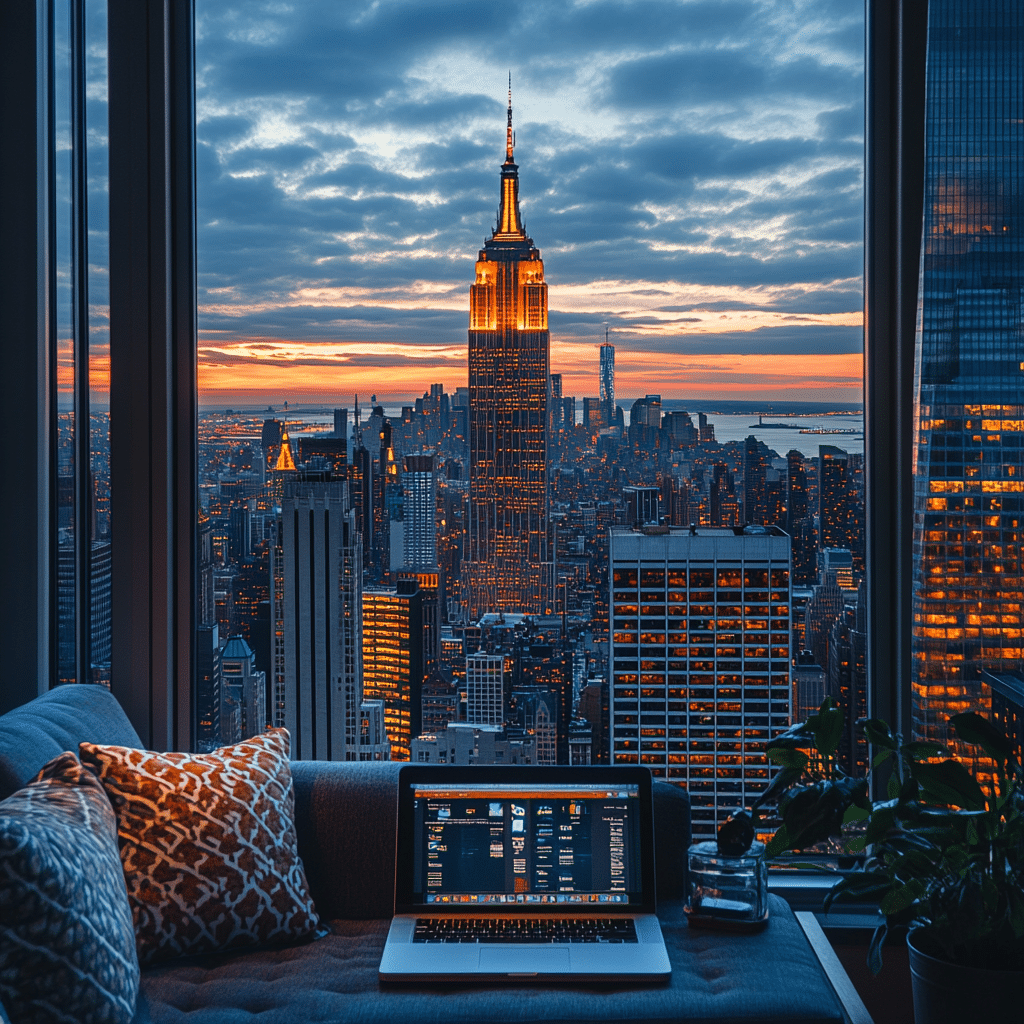

As we dive into 2023, more folks are making the leap to remote work, especially in bustling New York City. With this shift comes a need to weigh the potential expenses working from home NYC 2023 involves. It’s vital to keep your finances in check as you craft your home office haven. From rent adjustments to utility costs, understanding these expenses can significantly shape your budget. Let’s break down the key financial aspects you should keep an eye on.

1. Rent or Mortgage Adjustments for Home Offices

First up, let’s talk about rent or mortgage payments, the big-ticket items that can take a bite out of your budget. While many remote workers love the convenience of working from their living rooms, the costs can add up. In 2023, the average rent for a one-bedroom apartment in Manhattan shot up to about $3,900.

If you’re thinking about jumping into homeownership, you may be wondering, can international students buy homes in the US? The answer is yes! They can, given they meet specific requirements. Whether you’re renting or buying, it’s crucial to figure out what works for your financial situation, especially when considering mortgage details like the 10-year mortgage rates available today.

2. Home Office Setup Costs

Creating an efficient home office isn’t just about finding a cozy corner; it can also hit your wallet hard if you aren’t careful. You’re looking at costs for gear like a high-speed internet connection and ergonomic furniture. A solid ergonomic chair can run anywhere from $200 to $1,000 or more, depending on brands like Steelcase or Herman Miller.

Don’t forget technology! A reliable laptop is no longer a luxury; it’s essential. You could be shelling out anywhere between $1,000 to $2,500 for one. Investing in the right tools can be the difference between a productive workday and a frustrating one.

3. Utility Costs Increases

While working from home saves you from daily commuting, it might make those utility bills spike. According to the U.S. Energy Information Administration, energy costs can climb as you use more electricity during working hours. On average, NYC residents see around $210 monthly in electricity bills.

Think of air conditioning in the summer or heating in the winter; both can add extra dollars to your power bills. It’s smart to factor in these increases when budgeting for your new work-from-home reality.

4. Internet and Phone Services

Let’s not overlook internet and phone bills, which are pivotal for remote work success. Internet plans in NYC often range from $50 to over $100 per month, depending on your speed and provider. It’s essential for video calls and smooth workflow.

Many folks discover the need for a separate work phone or premium mobile plan, which can add around $100 to monthly costs. Altogether, you might find communication expenses easily hitting $200 to $300 a month, making it essential to shop smart for service providers.

5. Tax Considerations for Home-based Workers

Navigating tax deductions might feel tricky, but knowing what you can write off can save you some cash. If you work from home, you might qualify to deduct a portion of your rent or mortgage, utility bills, and office supplies from your taxable income.

However, it’s best to consult with a tax professional or accountant to get the rules straight. For those who are self-employed, having this knowledge can be a game-changer come tax season, helping enhance your financial health.

6. Home Maintenance and Upgrades

Owning a home comes with its share of responsibilities—think maintenance costs. If you’re remote, it can be easy to forget about upkeep while you’re busy at your makeshift office. Still, set aside funds to cover repairs or updates.

Typically, NYC homeowners spend about 1% to 4% of their home’s value yearly on upkeep. So, if your home is valued at $600,000, brace for annual costs between $6,000 and $24,000. It’s crucial to budget for these inevitable expenses to keep your work environment in top shape.

7. Insurance Adjustments

Last but not least, insurance is a biggie. Whether you’re renting or owning, a comprehensive policy can protect your home office setup. Depending on how extensive your home office becomes, your premiums might increase.

On average, NYC homeowners pay about $1,500 annually for homeowner’s insurance. Renters can expect to spend around $200 to $400 yearly. Make sure to review your policy and adjust coverage as necessary when you create your home workspace.

Moving Forward While Weighing Real Estate Investments

As remote work continues to evolve, many professionals are looking beyond the concrete jungle of NYC. Questions like can you buy property in Virginia from NYC spring up as remote work flexibility affords new opportunities. Locations with lower costs of living can be appealing while keeping your job in the city.

Understanding your potential expenses while working from home could lead you to a more sustainable lifestyle, making the costs manageable. The shift to remote work may offer not just personal productivity gains but also intriguing real estate prospects.

By being aware of these potential expenses working from home NYC 2023 entails, you can build the right foundations for a financially sound work-from-home experience. Make that remote office work for you while ensuring a balanced financial outlook by being prepared for the often-overlooked expenses.

Potential Expenses Working From Home NYC 2023 You Must Know

Working from home in NYC can definitely save you some bucks, but it can also come with its fair share of sneaky expenses. Did you know that many remote workers forget about supplies? From printers to paper, you might end up spending more than you think. In fact, a well-equipped home office looks a lot like a chef’s kitchen—complete with a functional saucepan for those lunch breaks. Little things add up quickly!

Hidden Costs of Staying Connected

When you work from home, your internet bill can feel like a hefty hidden monster lurking in your budget. It’s essential to have a reliable connection, especially if you’re collaborating with teams across the globe. Speaking of global phenomena, have you ever heard of “The King’s Avatar”? It’s a wild ride through the digital age’s virtual workplaces, which might just be the kind of inspiration you need while budgeting your interest rate right now for that new mortgage.

Space Considerations Matter

For many, converting a bedroom into an office space is appealing, but it’s also a financial decision. Rent in NYC is already sky-high, but committing a room to work could have tax implications or even boost your home’s value. If you’re considering a more permanent change, checking out Repossessed Homes For sale might just surprise you. Plus, understanding how the 10 year mortgage rates work can give you an edge when making those smart financial choices.

In sum, the potential expenses working from home in NYC in 2023 are multifaceted. From supply runs to connectivity needs, keeping an eye on expenses is critical. Little trivia, big impact! Who knew budgeting could be both fun and enlightening, right?