Dealing with taxes can be quite a maze. When you’re self-employed, this can become more complex as you navigate the different forms and regulations. In today’s article, we’ll focus on Schedule SE Tax Form, your key to mastering the art of self-employment taxes.

I. Navigating the Maze of Self-Employment Taxes: An Introduction to Schedule SE Tax Form

Let’s start with a basic understanding of the Schedule SE tax form. Have you ever thought about self-employment tax form as the denim skirt of the tax dress code? Just as you can dress it up or down, the Schedule SE is versatile, fit to cater to various self-employment income scenarios. The form in focus, Schedule SE, plays a crucial role in calculating your self-employment taxes and the total tax due on your net earnings.

II. The Key to Self-Employment Taxes: Breaking Down Schedule SE Tax Form

By definition, Schedule SE tax form is used to figure out the tax due on net earnings from self-employment. It’s like a GPS, steering you towards the destination of your tax responsibilities. The Social Security Administration uses the information from Schedule SE in determining your social security program benefits. Essentially, the tax form acts as a bridge between your hard-earned money and the social security program, just as a contractor builds and fortifies a structure.

Speaking of contractors, Schedule SE is as fundamental to the self-employed as contractor Taxes. It may seem complex, but just like remodeling a house, the sweat and effort are worth it.

III. The Key Players: Identifying Who Should File a Schedule SE

Digging deeper into the self-employment tax form pit, you might wonder: who should file Schedule SE? Well, if you have net earnings of $400 or more as a self-employed individual, you must file Schedule SE. It applies to business owners, independent contractors, freelancers, and anyone who is their own boss—just like a proud owner of a denim skirt who wears it with confidence and style.

Think of the form as a rite of passage for those stepping into the world of self-employment, whether you’re operating a farm or a non-farm business or earning certain partnership income.

IV. Decoding Income and Tax Details: Understanding Net Earnings Requirements

Let’s focus a bit on the net earnings. Just as a bird’s net needs strength to hold firm, your net earnings need to hit the $400 mark to require Schedule SE filing. This threshold is worthy to note due to its implications. If your net earnings fall below this benchmark, you are off the hook for filing Schedule SE. However, prudence is always advisable in matters of taxes, just as you wouldn’t gamble on the Wisconsin income tax rate without precise information.

V. The Dynamic Duo: Distinguishing Between Schedule C and Schedule SE

Now, some may ask, what is the difference between Schedule C and Schedule SE? Well, think of them as a dynamic duo, each playing its valuable part. Schedule C calculates your net income, while Schedule SE uses that figure to compute your self-employment tax for Social Security and Medicare. It’s like Batman and Robin, each bringing a unique skill set to the crime-fighting table.

VI. Dual Filing Necessities: Knowing Whether to File Both Schedule C and Schedule SE

Do I need to fill out both Schedule C and SE? If you’re self-employed, most likely. After filling out Schedule C, you’ll likely need Schedule SE to calculate your Social Security and Medicare tax. It’s like buying an ice cream, you often need to buy a cone too to enjoy it properly.

VII. Beating The System: Mastering Your Self-Employment Taxes With Schedule SE Tax Form

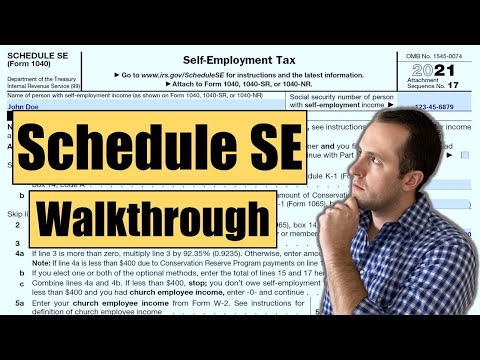

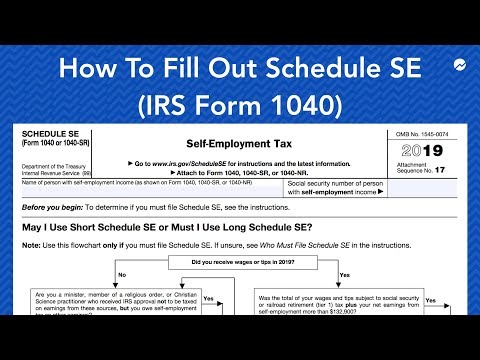

Here’s a detailed breakdown on the 7 steps to filling and filing the Schedule SE tax form:

Remember, it’s not always about outsmarting the system, but about knowing how to navigate it efficiently.

VIII. Unraveling the Power of Knowledge: Demystifying Self-Employment Taxes

As we tie up all the information on Schedule SE, Schedule SE tax form, and self-employment tax form, the concept shouldn’t seem as daunting anymore. Just like discovering that the 1099 form is integral for the self-employed. The demystification process of self-employment taxes is all about breaking down the complex lingo and decoding the tax laws, proving that it’s not as overwhelming as it might initially seem.

And there you have it! Now equipped with knowledge and insights, tackling your self-employment taxes should feel less like a labyrinth and more like a well-marked trail. Here’s your torch, brave self-employed tax payer. Now go, illuminate your path and conquer those taxes!