I. Captivating Kick-off: Unraveling the Intricacies of the IL Paycheck Calculator

Let’s dive right in, shall we? Intimidated by the numbers on your paycheck? Don’t fret. That’s precisely where the IL Paycheck Calculator comes into play like our Florida Paycheck calculator. The purpose of this tool – to help Illinois’ folks like you to decode their earnings, deductions, and bring sobriety to the chaos of numbers. This tool acts like your personal financial rover, eliminating uncertainty and making you a master of your own payroll universe. So let’s demystify this essential financial tool and chart our way through the fiscal maze of Illinoisan working life.

II. IL Paycheck Calculator: An Essential Financial Tool

A. What is an IL Paycheck Calculator?

In simple terms, an IL Paycheck Calculator is an online tool tailored to aid Illinois workers in dissecting their salaries. It helps to determine the exact amount of money they receive after taxes and other deductions. These deductions could range from social security and medicare to any health insurance payments or retirement contributions.

B. The Importance of Using a Paycheck Calculator

Having a clear and direct understanding of your paycheck arms you with the knowledge that enables better fiscal management and financial planning. By being in the know, you can accomplish those financial goals; be it saving for that ‘Cami top‘ we all have bookmarked on our favorite online store( or putting some aside for a dream house.

III. Unraveling the Conversion Mystery: 31 an hour is how much a year?

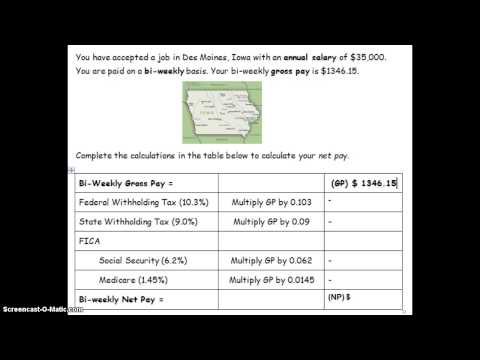

A. How to Calculate Annual Salary from Hourly Wage

It’s as simple as taking your hourly wage, multiplying it by the number of hours worked in a week (typically 40 for a full-time role), and then multiplying that figure by 52 (the number of weeks in a year). So, for those wondering ’31 an hour is how much a year’, the answer is approximately $64,480 before taxes and other deductions.

B. Practical Application of this conversion in Paycheck Calculation

This conversion is handy when using the IL paycheck calculator. You can insert your gross annual salary, deduct essentials, and voila! You have your net income. However, bear in mind the importance of getting the most accurate data for precise calculation.

IV. Work in the Windy City? Get Familiar with the Paycheck Calculator Chicago

A. Introduction to Paycheck Calculator specific to Chicago

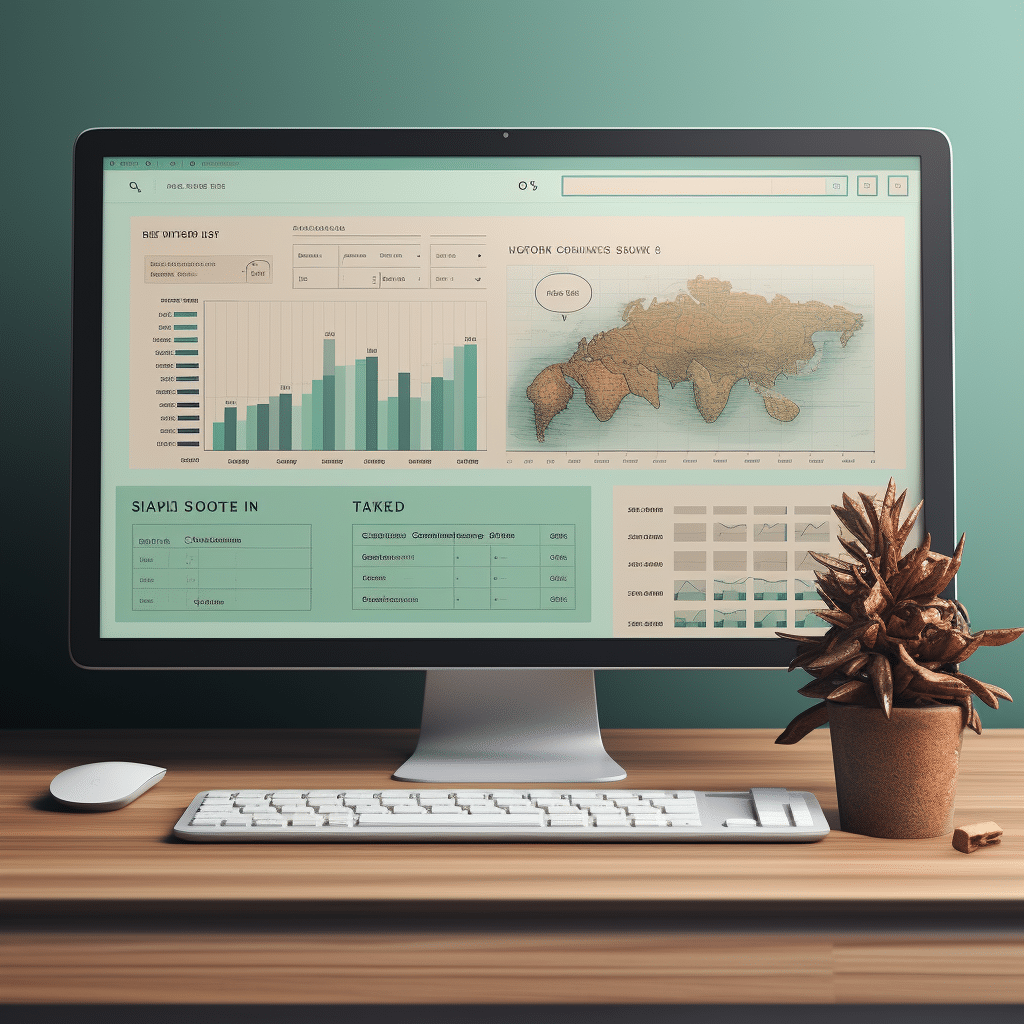

Living in a city like Chicago differs greatly from other places in Illinois in terms of taxes and cost of living. Thankfully, the Paycheck Calculator Chicago considers these factors providing a more accurate estimate of your take-home earnings.

B. Benefits of Using a Chicago-specific Paycheck Calculator

With this tool, you can visualize and understand how local taxes affect your paycheck. It helps you plan better for your city-specific expenses, from your rent to even the costs associated with maintaining your pet “Scp-096” at home (

V. Silhouette your Salary: Top 5 User-friendly IL Paycheck Calculators

Switching gears, let’s meet the top 5 user-friendly pay calculators out there.

VI. Bridging Borders: A Comparison of Paycheck Calculator Indiana and Salary Calculator Michigan

A. Introducing Paycheck Calculator Indiana & Salary Calculator Michigan

Don’t fret if you live outside the Land of Lincoln; tools geared to other states like the Paycheck Calculator Indiana or the Salary Calculator Michigan also exist.

B. Key Differences and Similarities

While these calculators display variation in tax laws and living expenses. Similar functionalities, such as conversion between hourly and annual wages and tax breakdowns, are consistent across.

VII. How to Choose the Ideal Paycheck Calculator?

A. What features should one look for in a paycheck calculator?

Essential features to look out for include state-specific tax information, breakdown of deductions, and an intuitive, user-friendly interface.

B. How different Paycheck Calculators influence the accuracy of your own payroll calculations?

Correctly chosen calculators, like IL Paycheck Calculator or Paycheck Calculator Indiana, can provide reliable estimations for your take-home pay, helping you avoid unnecessary financial surprises. Equip yourself with the right knowledge!

VIII. Do you Know your Net from your Gross Paycheck?

A. Importance of Understanding Different Types of Paychecks

Knowing your gross from your net is crucial. Your gross pay is your pre-tax income, while your net is what you take home after all the deductions are made.

B. Using IL Paycheck Calculator to Understand Net and Gross Pay

With an effective IL Paycheck Calculator, you can easily differentiate between gross and net pay, preventing any choke points when it comes to paycheck transparency and money management.

IX. Demystifying Paycheck Deductions and Contributions with IL Paycheck Calculator

A. Explaining the Concept of Paycheck Deductions and Contributions

Deductions and contributions can be a bit of a head-scratcher. These may incorporate taxes, social security, healthcare, and other voluntary or mandatory contributions.

B. How an IL Paycheck Calculator can Help You Understand Deductions

An IL Paycheck Calculator visually illustrates these computations, paving a more straightforward path towards comprehending your paycheck.

X. Wrapping Up: Stepping Forward Toward Better Financial Planning

To sum up, the IL Paycheck Calculator is essential in your financial arsenal. It demystifies your paycheck and puts you in the driver’s seat of your financial journey. This knowledge, combined with astute financial planning, unlocks the door to your financial freedom. So get ready to conquer your paycheck!