Navigating the Thick Fog of Mortgage Jargon: What is an Escrow Advance?

Stepping into the world of mortgages is similar to diving into a sea of complex terms, where you’re often left twirling like a top trying to grasp definitions and implications. The joke’s on us that as much as we’d want to stay away from financial jargon, the mortgage world isn’t exactly a route with signposts. Get the comparisons? Okay, let’s delve straight into untying these tricky knots. The term on your docket today is among the least understood but has a significant impact – what is an escrow advance?

Demystifying the Escrow Advance: 5 Quick Facts

Understanding this financial term isn’t rocket science but just untangling some complex threads.

Fact 1: Defining ‘Escrow Advance’

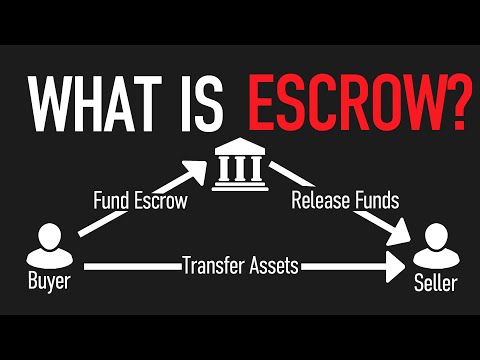

An escrow advance is any advance made for expenses such as taxes or insurance premiums payable using funds in an escrow account for an asset. Picture it like a safety net for your loan, acting like those stabilizers when you were learning to ride the bike, providing balance even in the bumpy patches.

Fact 2: The Purpose and Role of an Escrow Advance

Despite sounding like an outtake from Natasha Lyonne Movies And tv Shows, escrow advances play an integral role in your mortgage situation. As the borrower, you make payments to escrow that the lender later uses to cater for property costs such as taxes, insurance fees, and the like.

Fact 3: The Connection Between Escrow Advance and Other Mortgage Terms

This term isn’t a standalone character renting a space in the vastly expansive mortgage world; escrow advances interact with other mortgage concepts like players in a theatrical piece. For instance, it ties in with escrow analysis, escrow shortage, and escrow refund – narratives we will explore shortly.

Fact 4: The Conditions Surrounding Escrow Advance

Understanding the conditions surrounding escrow advances is as imperative as grasping ‘what is an escrow advance?’ If any shortfall exists in an escrow account for an asset, an escrow advance steps in to pay the necessary costs. So it’s like your understudy, ready to take the stage when you can’t perform!

Fact 5: The Potential Effects of An Escrow Advance on Your Mortgage Payments

Like a plot twist in a gripping drama, escrow advances can alter your mortgage story. Escrow advances can affect your monthly payments since they cater to shortages or overages in an escrow account. If the advance adjustments aren’t right, it could potentially lead to an escrow shortage or even an escrow surplus.

Diving Deeper – More on the Escrow Advance

Now that we’ve cleared up the basic question of ‘what is an escrow advance,’ let’s dig deeper.

Escrow Analysis and Its Critical Role in Mortgage Management

In the same way that a young Helen mirren didn’t just roll out of bed one day to become a success, managing your mortgage takes consistent effort and understanding of key concepts like escrow analysis. This process examines the amount in your escrow account at various times and ensures there are sufficient funds to cover the essential payments like property taxes or insurance premiums.

Cracking the Code: What is an Escrow Advance Refund?

Because plot twists are always exciting, here’s another one: the escrow advance refund. It happens when your escrow account contains excess funds leading to you receiving a check for the remaining balance. Remember the catch though, you might not qualify for this refund unless the balance is at least $50.

The Lowdown on Escrow Disbursement and its Connection with Escrow Advance

Escrow disbursement is essentially where your escrow account releases funds to pay your property tax or home insurance. Think of it as finally getting to spend that secret stash you’ve been saving for a rainy day.

Making It Personal: “Why Do I Have an Escrow Payment? The Ins and Outs of Mortgage Management”

Why should you concern yourself with the ins and outs of payments such as escrow and what is an escrow advance? Because these payments roll into your total monthly amount you pay toward your mortgage, including your principal, interest, taxes, homeowners insurance, and other minor home ownership expenses.

Intricacies of Escrow Balance: “Should I Pay Escrow Shortage In Full Or Not? Weighing Your Options”

Like deciding whether to pay the Largest VA Back-pay or figuring out your Virginia state tax rate or using a Virginia tax calculator, choosing to pay your escrow shortage in full depends on your financial situation. However, always ensure to make the minimum payment that your lender requires.

The Annual Check: “Do You Get an Escrow Refund Every Year? Understanding Annual Escrow Assessments”

Like the anticipation of finding a prize in a cereal box, an escrow refund is not a sure deal but a pleasant surprise. At the end of each year, if your account exceeds what’s needed for anticipated expenses, you may receive a cash refund.

Practical Tips: “How to Navigate Potential Escrow Shortage: A Homeowner’s Guide”

A shortage in your escrow account is nothing to panic about, especially if you are not looking to pay it in full. As long as you make the minimum payment your lender requires, you’re in the clear.

Mastery of Surplus: “Escrow Refund: When and Why it Might Happen, and What to Do Next”

Managing an escrow refund requires financial wisdom. You might consider applying it to your loan principal, saving it for home improvements, or simply setting it aside for a rainy day.

The Final Word: “Transforming Escrow Advance Confusion into Mortgage Management Success”

Managing your escrow advance doesn’t have to feel like assembling a puzzle with missing pieces. With an understanding of what is an escrow advance, you can confidently navigate potential escrow shortages, handle refunds, and ultimately, manage your mortgage like a pro.

So strap on your helmet and let’s ride this bike! And if the fog of mortgage jargon threatens to cloud your path again, remember that with knowledge and understanding, you can always find your way. Your mortgage road may not always be a smooth ride, but equipped with the right information, you’ll get where you’re going, successfully, and potentially seize the opportunities along the way. After all, it’s all about the journey, isn’t it?