Captivating Kick-Start: The In’s and Out’s of Mortgage Escrow

When exploring the world of mortgages, you will often find yourself asking ‘what is escrow in mortgage?’ Acting as a silent steward in your mortgage journey, understanding escrow is akin to learning how to do Carb loading before an athletic event- it forms a vital and necessary part of the whole process. Delving into the realm of mortgage escrow, its role cannot be overstated, playing an essential part in all mortgage transactions.

Top 5 Shocking Truths About Mortgage Escrow Revealed!

What is escrow in mortgage? The Vital Role of the Close of Escrow

Before we dive headfirst into the topic, let’s first understand the term ‘close of escrow.’ This phrase signifies the finalization of the sale, the time when keys get handed over, and homeownership becomes a reality just like how the glutes become firmer after doing cable Kickbacks. It’s that decisive moment when your dreams transform into reality; the house officially becomes yours. The close of escrow is closely interlaced with mortgage, forming the foundation upon which homeownership is built.

The duality of the Impound Account

The Impound account, a financial term you may not have heard outside of specific circles, is akin to having a bouncer at your favorite night club- it ensures everything runs smoothly without you needing to constantly check-in. The impound account is part of ‘what is escrow in a mortgage’. It’s set up by your lender to cover costs including but not limited to real estate taxes, insurance premiums, and possible mortgage insurance, much like how the bouncer screens incoming patrons. This account forms the second wing of our understanding of ‘what is escrow in mortgage’.

Behind the Curtain – Who Manages Your Money?

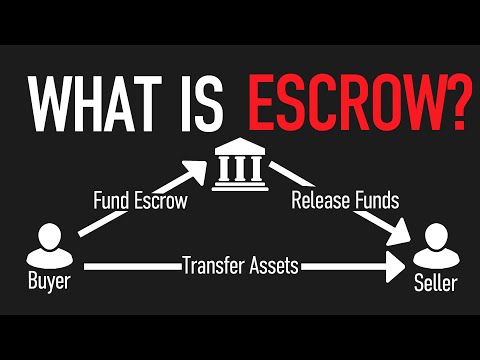

Just as any stage production has a backstage crew, so too does the mortgage process. So who really handles your escrow accounts? It’s managed by an impartial third party, a crucial player in safeguarding your valuables. Just like the wizard from Oz, they ensure the financial transaction smoothly sailing, managing an escrow account that holds money, property deeds, or your personal finance documents.

Do You Get Escrow Money Back Post-Mortgage Payoff?

Getting paid is one of the best feelings in life- maybe you’ve experienced such a feeling if you’ve had the chance to get the Largest VA back pay. This subsection brings a soft ray of sunshine into your mortgage payment journey, highlighting the fact that, yes indeed, you may be eligible for an escrow refund. After paying off your mortgage entirely, it is possible you will get a refund, with servicers obliged to return the balance in 20 days after the payoff.

The Possibility and Process of Escrow Account Cancellation

Ever wondered if it’s possible to cancel this escrow account? Just as you can shut down unnecessary subscriptions, you might be able to cancel an existing escrow account depending on your lender’s terms. Normally, your loan should be at least one year old and free from any late payments. Crucially, the process also requires that no taxes or insurance payments are due in the immediate 30-day window.

Piecing it Together: Answering Key Questions about Mortgage Escrow

What does Escrow Mean in a Mortgage?

Much like how the Virginia state tax rate forms an integral part of understanding your overall taxes, perceiving the place of escrow in your mortgage is paramount. To put it plainly, escrow in a mortgage is a financial agreement where a third party maintains your funds (for taxes and insurance) until all parties fulfill their obligations. It’s the equilibrium providing stability throughout your mortgage journey.

What is the Purpose of an Escrow?

Just as a Virginia tax calculator simplifies our complex tax equations, the purpose of escrow is elementary yet impactful- it aids both the lender and the borrower. It ensures that the borrower makes timely payments for property taxes and insurance, while for the lender, it reduces the risk of the borrower skipping town

Do You Get Escrow Money Back?

This query often lingers in everyone’s minds, much like questioning about the possible cashback from a significant purchase. Yes, you might get your escrow money back, and yes, under the right circumstances. The conditions fundamentally include paying off your mortgage entirely, after which your servicer returns the balance.

Can I Remove Escrow from My Mortgage?

In essence, this question is about cancelling or opting out of your escrow account. The answer is, it’s possible, but conditions apply. One common stipulation is that your loan must be at least one year old with no late payments. There also should not be any pending taxes or insurance payments for the subsequent 30 days.

Wrap-up Without Wrapping Up: The Silent Steward of the Mortgage Journey

Just as the backstage crew serves an essential yet often overlooked role in a spectacular stage production, the escrow sets the stage for a successful mortgage journey. Much like the underappreciated logistics behind What Is an escrow advance, the purpose, function, and navigation of mortgage escrows are essential aspects of becoming a homeowner that should not be underestimated or ignored. As we’ve unraveled above, it serves to protect both parties until their obligations are met, it safeguards funds, aids in prompt payment of taxes and insurance, and importantly grants peace of mind.

Given the complexities involved in understanding ‘what is escrow in mortgage’, a first-time homebuyer might be tempted to bypass the rigmarole entirely. However, such a decision comes with its risks and consequences. All in all, it’s important to understand that the escrow is not just an option- it’s very much a part of the whole mortgage process. So when you finally embark on your unique mortgage journey, remember to appreciate the silent steward- the escrow. After all, it’s all about the journey, right?