Are you yet to discover the crazy financial secret that the smart property investors have been shielding right under your nose? That’s right! We’re talking about the NOI formula that plays a pivotal role in understanding the profitability of a revenue-generating property. With its grasp, you don’t need the prowess of an accountant before you can calculate the income you are expected to make from an investment in property.

Unraveling the NOI Formula

What is NOI, you’d ask? NOI stands for ‘Net Operating Income’. A crucial player in real estate finance, and understanding this term unfurls many layers of profitability dynamics. NOI is a pre-tax figure that excludes principal and interest payments on loans, capital expenses, depreciation, and amortization. When you understand how this formula works, you’ll be unlocking a treasure trove of insights into your real estate investment portfolio.

With a keen eye on the Chickens of the Golden Eggs, and knots of the NOI formula untied, we’ll dive right into unraveling this financial secret. Ready to go down the rabbit hole? Buckle up, and let’s journey into the financial Wonderland!

Step 1: Understanding Gross Income

Gross income is the total income generated from a property before any expenses are deducted. This income includes rent from tenants, money received from vending machines or laundry facilities, and even parking fees. However, it excludes income from selling the property itself.

The number one question most people have on their minds at this point is: ‘How is gross income of a property calculated?’ And, in answer, all receipts and tickets that contribute to this income, kept in an orderly fashion, will enable us to calculate gross income.

Step 2: Deciphering Operating Expenses

Operating expenses are costs related to managing and maintaining a property. These can range from real estate taxes, insurance, utilities, to maintenance costs. Essentially, these are all costs incurred to ensure the smooth operation and upkeep of the property.

Characteristically, people raise a brow and ask, “How on earth do I calculate an NOI?” Well, to squash any dread you might have on the NOI formula, the mathematics here are straightforward. You just subtract your operating expenses from your gross income, and voila, you have your NOI!

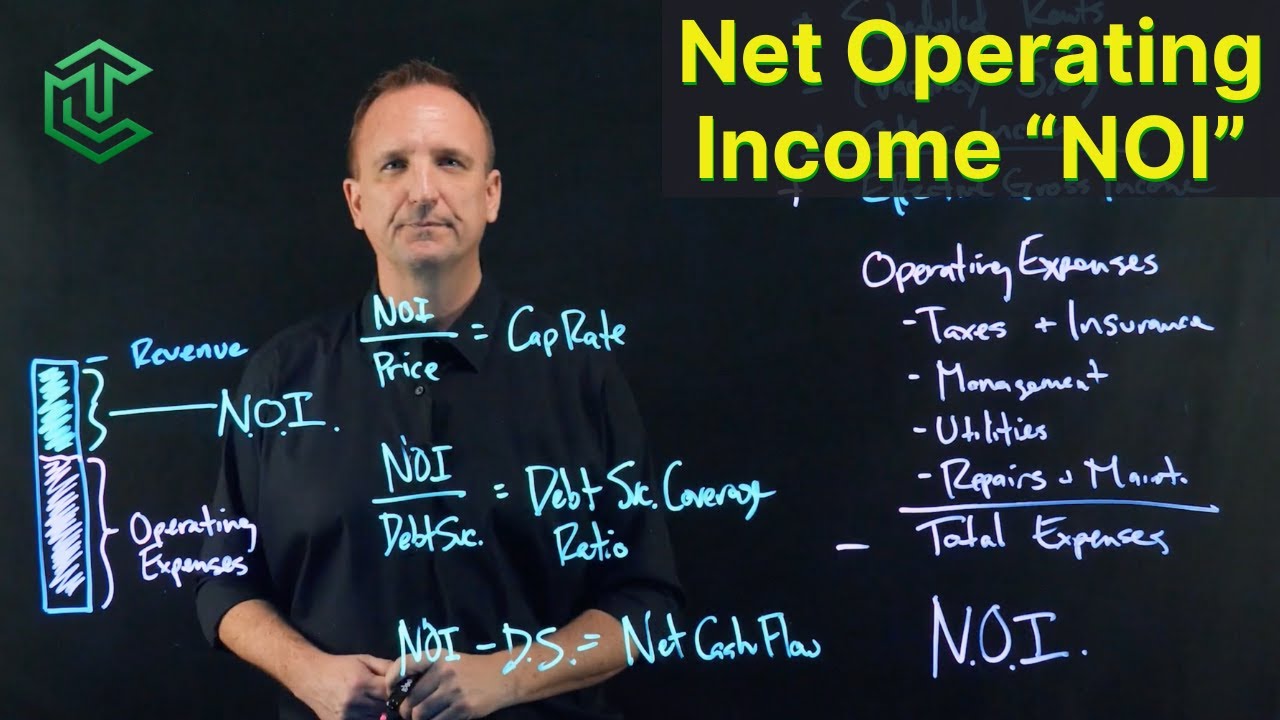

Step 3: Net Operating Income Calculation

So, what is the formula for NOI in finance? Let me do the honors! The NOI formula is simply calculated by taking the Operating Revenue and subtracting the Operating Expenses. It’s straightforward, isn’t it? But, where things get interesting, is in understanding and accurately calculating each of these components.

Delving into each of them individually would take us on a wild ride. But for now, let’s focus on the NOI formula and how it can make a dramatic impact on your real estate investments.

Step 4: Net Operating Income to Cash Flow

Transitioning from NOI to cash flow adds another layer of complexity to this finance game, with the inclusion of other expenses like debt service, depreciation, income tax, etc.

What is the formula for NOI to cash flow? Here it is: Cash Flow is NOI minus all debt service, depreciation, and income tax. As you can see, cash flow and NOI are connected, but not the same thing.

This step helps investors shed light on the clear and actual amount left after all obligations have been met. This ‘leftover’ is the real paycheck that makes all the toil and time invested worth it.

Step 5: Operating Income vs Net Income

Understanding the differences between operating income and net income makes the final lap of this financial race. While operating income excludes interest and tax, net income includes them.

What is the formula for operating income net income? Contrary to its NOI counterpart, the formula requires subtracting interest and tax from NOI to give a clear picture of the net income. Staying ahead of the curve requires that you understand this formula inside and out, to not only make it to the finish line but to also outperform the competition!

Demystifying NOI Meaning in Real Estate

Now, you might be wondering what the NOI formula means in reality. Well, it’s simple. The NOI formula’s meaning in real estate is about understanding how much revenue a property generates. You can learn more about Noi in real estate here. And, with the definitive information lined out, you can make more informed decisions and be prepared with a snappy response, when the question ‘What is a good cap rate?’ pops up in those cocktail conversations.

Mastering NOI: Putting it All Together

It’s time to wrap up our journey into the world of NOI formula. Understanding and mastering this insane financial secret is worth the effort when manoeuvring the real estate investment landscape. It can be the secret sauce that sets you apart from your counterparts.

Applying this knowledge in real life assures a more significant bite of the pie, getting you on the strategic edge of real estate investment. So if you want to make significant strides, don’t just know this formula; master it and watch your real estate investment portfolio grow like Jack’s magical beans!