I. Understanding the Illinois Income Tax Rate

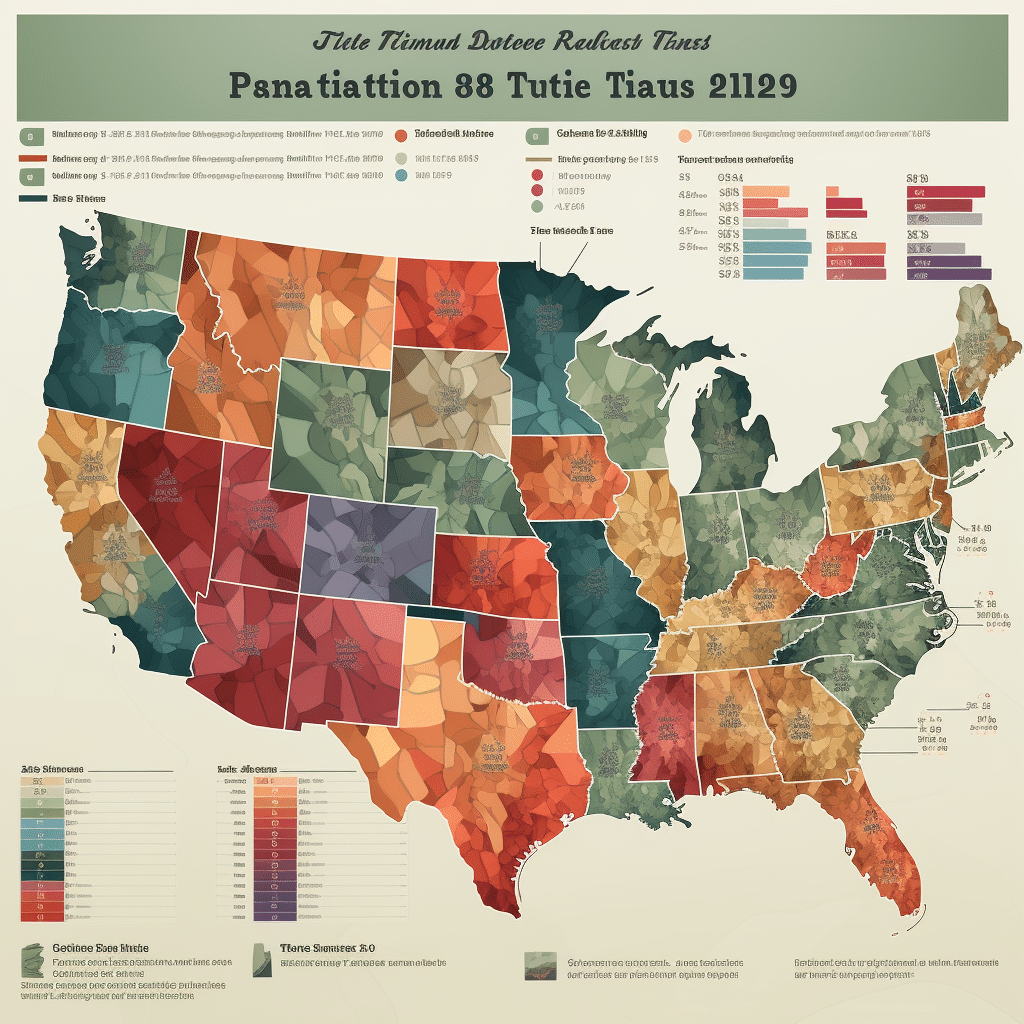

Welcome to the labyrinth that is the Illinois Income Tax Rate. When it comes to this complex world of taxes, there is often more than meets the eye. For instance, a lot of people are surprised to learn that the Illinois income tax rate is a flat 4.95%. This essentially means regardless of your income levels, be it as low as a middle-school treasurer’s savings or as high as Bill Gates’ fancy fortunes, the same percentage applies to your salary. This brings us to our shocking fact number one.

II. The Reality of the Flat 4.95% Illinois Income Tax Rate

Illinois is nothing like the federal government or many other states (cough Tennessee cough) that play the cash version of “dumb Donald” – recalculating tax rates on a sliding scale based on income levels. Nope, Illinois plays it nice, simple, and some might say, brutally fair. It tars all with the same brush, with the flat Illinois income tax rate of 4.95%. No jumping through illinois tax brackets is needed here – it’s all a smooth sail, albeit one that doesn’t seem to differentiate much between the rich and the poor.

III. Is Illinois a High Income Tax State?

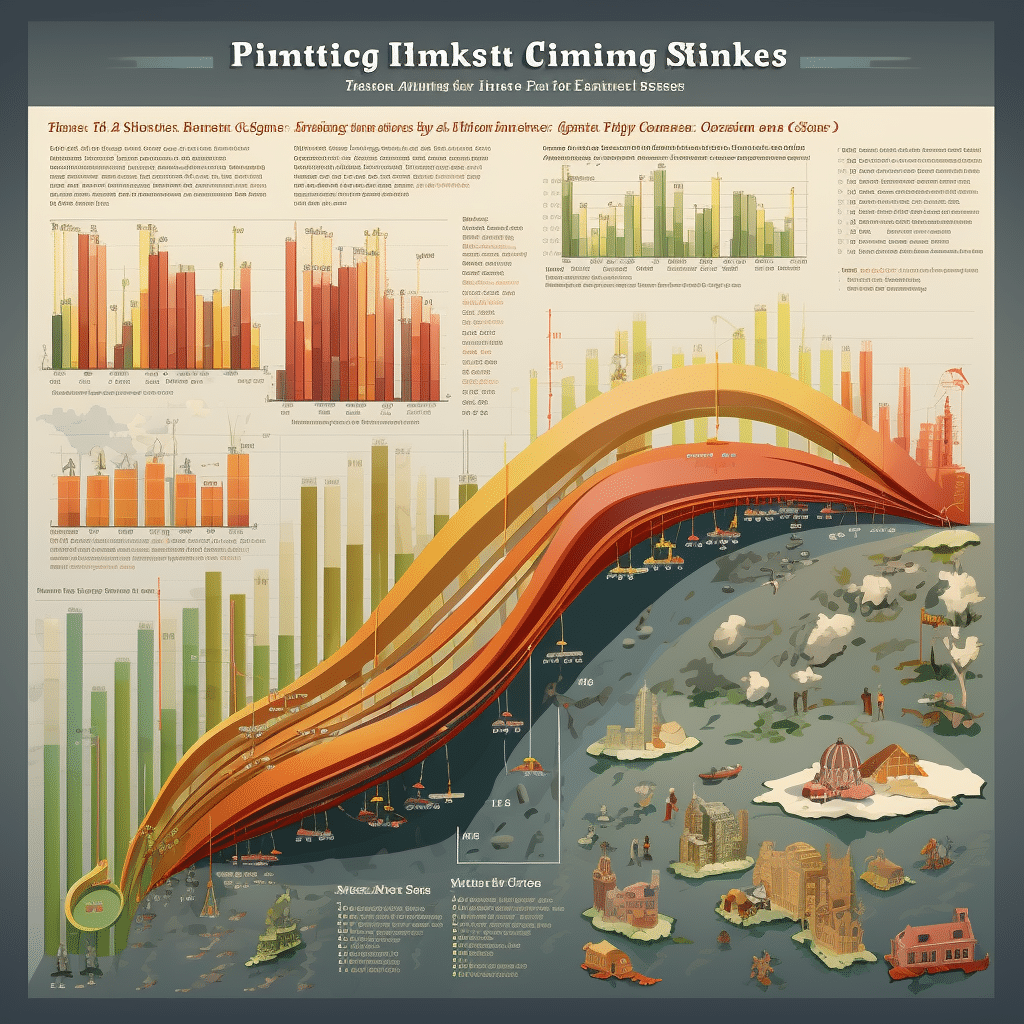

Let’s dissect our shocking fact number two. Do you recall that memorable scene in the Wonderful Wizard of Oz when the curtains are drawn, and the big scary wizard is revealed for what he truly is? Here’s a revelation for you that’s just as startling. Despite its flat nature, with our tax calculations as straightforward as Cheddars menu, Illinois residents still find themselves staring at an effective total state and local tax rate that tips over 15%. You read it right, folks! This sobering figure, straight out of the hat of arithmetic, makes Illinois one of the highest tax states in the nation.

IV. How State and Local Tax Rates Factor In

Alright, let’s peek into the backstage where the real action happens. A State and local taxes are like the side dishes to your tax meal, making the already bitter pill harder to swallow. The fact that the Illinois sales tax rate is also one of the highest doesn’t help the cause. This seemingly innocent addition quietly piles on the overall tax burden like calories on a cheat day.

V. How Much is 100k after Taxes in Illinois?

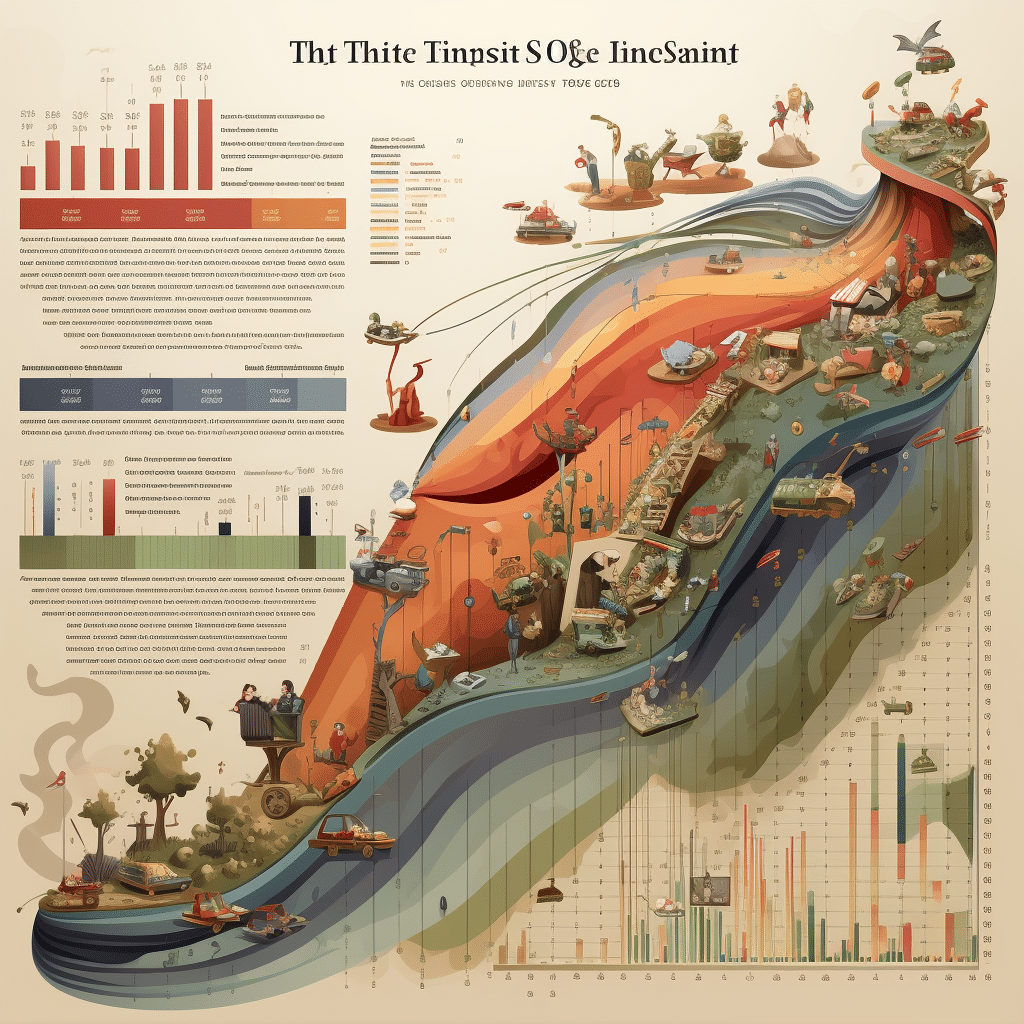

Let’s play with more numbers now. If you’re pulling in $100,000 a year, living in the Land of Lincoln, you’ll be taxed a whopping $27,368. Now, that’s not chump change! Peel off this tax layer and you’re left with a net paydown of $72,632 a year, or approximately $6,053 per month. Ouch! That hurts, doesn’t it?

VI. Estimating Your Take-Home Pay: The $65,000 Scenario

Let’s try another scenario. If your income stream flows to the tune of $65,000 a year (more power to you), you’ll find yourself taxed $15,258. This leaves you with a net pay that whittles down to $49,742 per year or approximately $4,145 per month. Does this seem fair? Perhaps you would like to compare it with the “tennessee sales tax rate” or examine the “residual income definition” to alleviate your budgeting conundrums.

VII. Looking Ahead: The Illinois Income Tax Rate for 2023

The key to any financial decision, be it buying a house, setting up a retirement fund, or even figuring out “How much Does it cost To start an Llc” is prediction. In Illinois tax land, little seems to change. As we step into 2023, Illinois maintains its flat income tax rate of 4.95%, without even as much as blinking. Also, a fun little nugget to keep in your fiscal arsenal: the 2023 personal exemption allowance stays frozen at $2,425 for the new year.

VIII. The Bigger Picture: Seeking Relief from High Taxes in Illinois

Considering everything we’ve learned so far, a skilled financial strategist might consider ways to alleviate this tax burden. While there’s no magic spell to conjure it away, understanding the intricacies of your tax obligations is half the battle won.

IX. Wrapping Up: Tax Wisdom for Illinois Residents

In the storied adventure that is your financial journey, staying informed goes a long way in building lucrative strategies. Understand your tax slab, be wary of sneaky charges, and keep an eye out for those exemptions! Remember, knowledge is power when it comes to the tax game, especially in a high-tax state like Illinois. The more you understand about the Illinois income tax rate, the better equipped you will be to manage your personal finances and possibly come out ahead.