Unlocking the Basics of Adjustable-Rate Mortgage

Let’s dive right in and get to the heart of what an Adjustable-Rate Mortgage (ARM) is all about, shall we? In plain speak, an ARM is like a financial rollercoaster for your home loan – you start with a fixed interest spell, and then, buckle up! You’re on the move with rates that dance to the rhythm of the market.

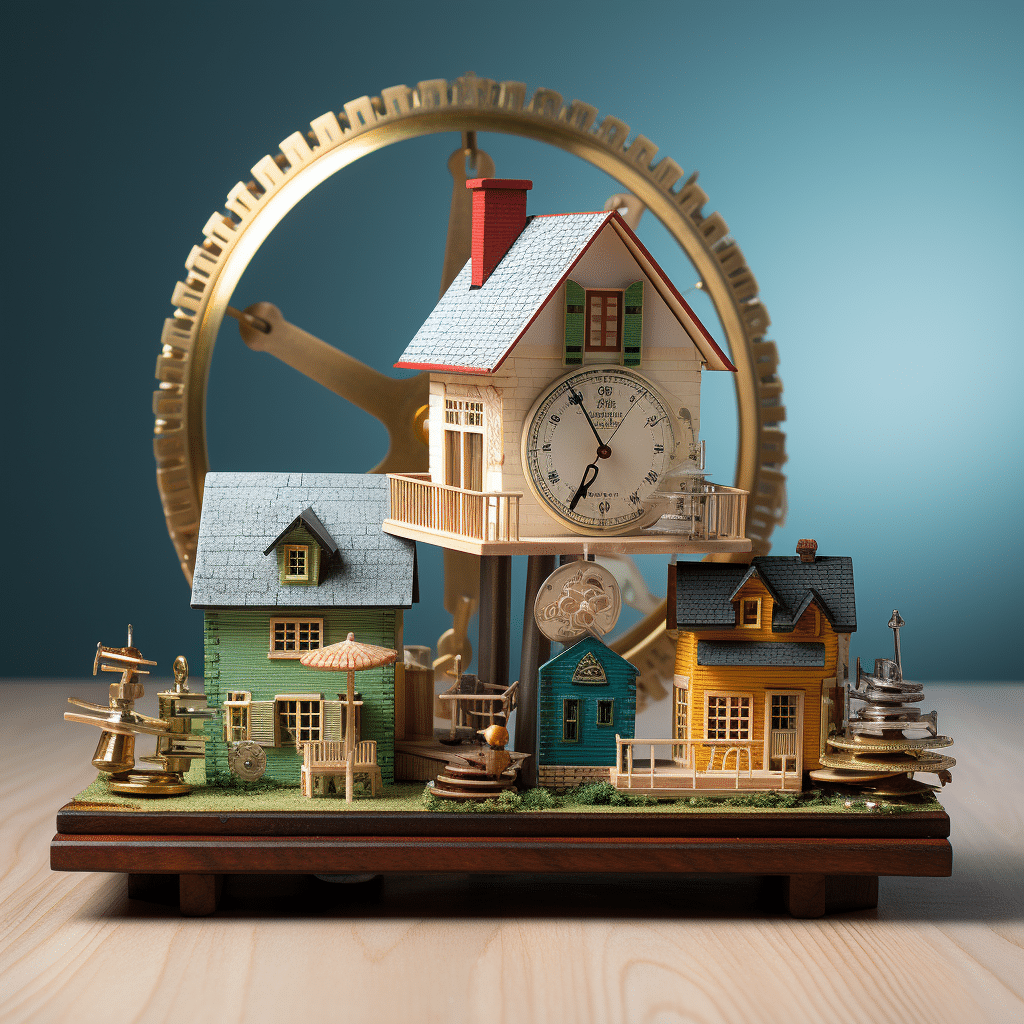

This mortgage shindig has got a bit of everything: an introductory period where your rate stays put, followed by adjustment periods where it could swing up or down. It’s not all chaos, though – there’s a method to the madness. These adjustments are tied to financial indexes, with a predetermined margin for good measure, and don’t forget those oh-so-crucial rate caps that stop your rate from sky-rocketing.

ARMs might seem like the new kid on the block, but they’ve been jiving in the market for quite some time, hitting different strides as years roll by. They’ve had their ups and downs, and just like the latest fashion, whether they’re in demand can change quicker than Miley Cyrus‘ age – and hey, if you’re keen on that, feel free to take a peek here.

Evaluating the Financial Flexibility of Adjustable-Rate Mortgages

The biggest perk that ARMs bring to the party is that initial period with lower monthly payments, making them look pretty appealing compared to their fixed-rate cousins. You might be thinking, “Great! More cash to stash!” and you’d be right – at least in the short term.

For the wanderers and the commitment-phobes, ARMs can be a perfect match. If you’re planning to dash before the rate crashes – say, if you’re eyeing a big move in five years or you’ve got plans juicier than a season finale – then snagging an ARM for its honeymoon phase could be a smooth move.

But don’t get it twisted – we’ve got to think about the long haul, too. An ARM is a bit like that roman chair exercise – it looks manageable at first, but over time, can you keep up the pace? For the long-term planners out there, a fixed-rate might be the steady partner you need. Curious about that roman chair? Take a gander here.

| Feature | Description |

|---|---|

| Type of Mortgage | Adjustable-Rate Mortgage (ARM) |

| Interest Rate | Variable; initial rate fixed for a set period, then adjusts periodically based on a financial index plus a margin |

| Initial Fixed-Rate Period | Commonly 1, 3, 5, 7, or 10 years |

| Adjustment Frequency | Typically annual, but can be more frequent (e.g., monthly) |

| Rate Caps | Limits on how much the interest rate can change at each adjustment and over the life of the loan |

| Index | Benchmark interest rate (e.g., LIBOR, Treasury index) that determines how the ARM adjusts |

| Margin | A set percentage added to the index to determine the ARM’s adjusted interest rate |

| Initial Lower Rates | ARMs often start with lower rates compared to fixed-rate mortgages, leading to lower initial monthly payments |

| Best Suited For | Borrowers who plan to move, refinance, or pay off their mortgage within the initial fixed-rate period, or who can afford potential payment increases later |

| Risks | Monthly payments can increase significantly if interest rates rise, potentially making the loan unaffordable |

| Examples | 5/1 ARM (5-year fixed, then annual adjustments), 7-year ARM (7-year fixed, then adjustable) |

| Payment Stability | Initial period offers stable payments, followed by variable payments that can rise or fall |

| Long-term Cost | Potentially higher long-term cost compared to fixed-rate mortgages if interest rates rise substantially over time |

| Rate Caps Benefit | Protects borrowers from extreme increases in monthly payments |

| Considerations | Financial stability, future income prospects, housing market trends, and rate cap levels should be reviewed prior to selection |

Adjustable-Rate Mortgage’s Impact on Buying Power

ARMs can be your ticket to a fancier pad, for sure. With those tempting lower rates in the early days, your wallet feels a bit thicker, allowing you to cast your net wider in the property pool. Wanna live it up in a swankier spot? With an ARM, you just might pull it off.

But remember, just like in a high-stakes spacebattle, the situation can flip real quick. Head on over here to envision how tactical maneuvers in space (and in mortgage rates) can impact the grand scheme.

Navigating the Risks of Interest Rate Adjustments

Interest rates with ARMs are tricky beasts – they can be as unpredictable as the weather, and when the sun sets on your initial rate period, that’s when they might start to get stormy. If the market’s feeling feisty and rates climb, your wallet’s gonna feel that pinch.

Picture this: you’re sailing smoothly, but then the tide turns and whoosh – up goes your rate. But don’t fret; it’s not all doomsday scenarios. Some folks ride out the waves just fine. It’s all about staying savvy and watching those historical patterns – they’re as telling as an old sailor’s tales.

Adjustable-Rate Mortgage and the Potential for Refinancing

Refinancing an ARM can be as refreshing as a wardrobe overhaul. When the style (read: rate) gets outdated, it’s out with the old, in with the new. Hitting that refinance button when the rates take a nosedive could land you in a more comfortable spot. But like a tailored suit, timing is everything – do it right, and you strut; do it wrong, and well, you stumble.

Bear in mind, refinancing isn’t free – it comes with its own bag of costs. It’s a bit like deciding whether to renovate or move; you’ve got to weigh up those dollars and sense.

How an ARM Can Influence Long-Term Financial Outcomes

Sure, we’ve got tales that could fill a book – some borrowers with ARMs are living the dream, while others are stuck in a cautionary chapter. It’s all about perspective, and putting an ARM under the microscope against a fixed-rate can be a revelation.

Placing an ARM in your financial portfolio is a bit like adding a bold, rare artwork to your collection – it’s not for everyone, but for the right collector, it’s a masterpiece.

Prepayment Considerations with Adjustable-Rate Mortgages

Diving into the fine print about prepayment terms on your ARM can feel like a snooze, but trust me, it’s more significant than that one missing puzzle piece. Making early payments can cushion you against the rate hikes, giving you a buffer that can be as satisfying as a well-timed snack.

But, here comes the kicker – prepayment penalties can snag you. It’s a bit like that early exit fee on your phone plan; you can jump ship, but it’ll cost ya. Wanna understand more about how this works? Amortization is a key concept here, and you can drill into the nitty-gritty right here.

Adjustable-Rate Mortgages: Navigating the Caps and Ceilings

Caps on your ARM are like a safety net under a trapeze – they’re there to catch you if things take a dive. Annually, your rate can only hopscotch up to a certain point, and over the life of the loan, it’s got a ceiling it can’t bust through. It’s like setting parental controls on your internet – there’s only so much mischief allowed.

Real people with ARMs have leaned on these rate caps when the economy decided to shake things up. They’re the unsung heroes, really, capping off your worry along with your rate.

The Changing Landscape of Adjustable-Rate Mortgages

Regulatory plot twists can turn the ARM landscape into a real page-turner. Changes might not always be front-page news, but trust me, they are more gripping than a cliffhanger episode if they affect your loan.

In 2024, the vibe is different from yesteryears, with innovations and product remixes coming out like summer blockbusters. It’s a bit like comparing vintage to modern – each has its charm, depending on your taste. If you’re keen on down-to-the-wire trends, don’t hesitate to consider the aia customer service experience here for cutting-edge industry insights.

In-Depth Analysis: Adjustable-Rate Mortgage and Economic Forecasts

Let’s engage our inner economists and parse out how those daunting economic indicators play ball with ARMs. Expert chatter points to interest rate forecasts crucial to planning your financial defence. It’s like being a goalie; you’ve got to anticipate where that ball’s heading.

Looking back, ARM rates have had more swings than a playground. By understanding how past economic shifts rocked the boat, you can better prep for future flares or dips.

Adjustable-Rate Mortgage: A Strategic Choice for Specific Borrowers

Now, who stands to win big with an ARM? If your stay is short-term, if the thought of lower initial payments makes you giddy, or if you’re financially nimble enough to adapt to payment changes, then step right up! An ARM might just be your golden ticket.

In certain scenarios, the sparkle of an ARM outshines the steady glow of a fixed-rate. It’s about knowing yourself, your goals, and your guts for the game.

Real-world Adjustable-Rate Mortgage Adjustments: Borrower Experiences

Chit-chatting with ARM borrowers is like dipping into a wealth of first-hand intel. Some folks’ experiences could be the deciding factor in taking an ARM plunge. Like how actual adjustments have translated into their day-to-day, not just pie charts and projections.

It’s the real deal – how prepared were they when the rates started hopping, and how did they bob and weave to stay afloat? You might be surprised how much these tales resonate, maybe more than those shirtless men calendars that sell like hotcakes, eye candy that you can scope out here.

Conclusion: Is an Adjustable-Rate Mortgage Right for You?

We’ve romped through the whole shebang – from the highs to the potential lows of ARMs. It’s a bit like reaching the end of an epic novel; you’ve been through storms and sunsets, and now it’s time to reflect.

The question looms: is an ARM the right choice for your slice of life? With the pros and cons now at your fingertips, you’ve got a clearer map for your mortgage journey. Remember, choosing an ARM isn’t just about current perks; it’s about armoring up for what’s down the pike.

Your mortgage isn’t just a monthly debit; it’s a pivotal part of your life’s tapestry. Weigh your options, paddle through the info sea, and if it comes down to it, consult the oracle – your financial advisor. Whether you’re charting a course through calm waters or navigating economic squalls, the wisdom gathered here can be your lighthouse, guiding you towards a decision that not only suits the now but secures a savvy future. So, is the ARM for you? Only you – bolstered by this trove of insights – can make that call.

Adjustable-Rate Mortgage: A Financial Roller Coaster Full of Surprises

Ever feel like you’re on a financial roller coaster, where the dips and twists leave you with butterflies in your stomach? Well, buckle up, because that’s exactly what diving into an Adjustable-Rate Mortgage (ARM) can feel like! A ride not for the faint of heart, ARMs are as unpredictable as April weather, and boy, do they make for some interesting chatter.

Initial Period: The Honeymoon Phase

You know how, at the beginning of a relationship, everything seems sweet and rosy? That’s your ARM’s initial period. Like a honeymoon, your rates are dreamily low, and you’re living large on the savings. But don’t get too comfy in those lovey-dovey low rates because just like a honeymoon, this phase doesn’t last forever!

Now, you might be asking, What Is a mortgage? and why would anyone choose this topsy-turvy ride? For starters, join the crowd in the initial thrills of an ARM where lower rates could mean a bigger house or a fancier zip code without the initial hefty price tag.

Rate Adjustments: The Plot Twists

Did someone say plot twist? That’s right; with an ARM, just when you think you’ve got all your ducks in a row, the rates adjust. It could be a slight jiggle or a full-on shake-up, depending on market conditions. Imagine you’re finally sailing smoothly, then whoosh—a gust of wind sends your monthly payments skyrocketing. Wild, huh?

Caps and Ceilings: Safety Nets or Just for Show?

But hold on, there is a safety net of sorts in this high-flying act, and that’s where caps and ceilings come into play. They’re like those tightropes and safety nets at the circus—there to catch you if you slip. But just like a circus act, they’re not always as reliable as you’d hope. Sure, they limit how much your rate can increase, but they’re also a reminder that you’re not entirely in control of your financial destiny.

The Lifelong Plan: An Amortization Schedule with a Twist

Ever heard of an amortization schedule? Well, in the land of ARMs, it’s a bit like trying to follow a map in a funhouse mirror—distorted and more challenging to predict. While a fixed-rate mortgage follows a straightforward and predictable amortization path, the ARM likes to add a few loops and turns to keep you on your toes.

Planning for the long haul with an ARM means being rolling with the punches. And if you like to have all your ducks in a row, meticulously charting an amortization schedule akin to a fixed mortgage, then an ARM might make you feel like those ducks just jumped into a pond and swam off in different directions.

There you have it, folks! A peek into the unpredictable yet thrilling world of an Adjustable-Rate Mortgage. Like a box of chocolates, you never quite know what you’re gonna get. So, jump on board if you’re ready for a financial adventure that could lead to big savings or go seek calmer waters with a fixed-rate mortgage if you’d prefer a steady ship. Either way, it’s always a ride!

What is an adjustable mortgage rate?

An adjustable mortgage rate? Well, that’s like a financial roller coaster! It’s a type of mortgage where your interest rate can change over time, based on a specific index. So, one day you might be paying less, and the next, you might need to tighten your belt!

Is it a good idea to get an adjustable-rate mortgage?

Is hopping on an adjustable-rate mortgage train a smart move? Hmm, it’s not a one-size-fits-all scenario. While you might start with a lower rate, remember, it’s not set in stone. If rates go up, so does your monthly payment. It’s about weighing the risks and your financial cushion.

What is an adjustable income rate mortgage?

When you hear “adjustable income rate mortgage,” you might scratch your head. It’s a mix-up of terms — we’re likely talking about an adjustable-rate mortgage (ARM), where your payment can fluctuate, not your income.

What is the adjustable mortgage rate today?

What’s the adjustable mortgage rate today? Ah, the million-dollar question! Rates change faster than the weather, so it’s best to check with lenders for the latest numbers. Just remember, today’s rate could be tomorrow’s old news.

What are the dangers of an ARM vs fixed?

ARM vs fixed, what’s the catch? ARMs can be sneaky with low initial rates, but they’ve got a sting in the tail if rates rise. Fixed mortgages, on the other hand, are steady Eddies with constant rates and predictable payments.

What is the main downside of an adjustable-rate mortgage?

The main downside of an adjustable-rate mortgage? Well, it’s about as predictable as a cat on catnip — your rate can jump up, and so will your payments. Not ideal if you’re looking for financial stability.

Why would anyone get an adjustable-rate mortgage?

Why would anyone get an adjustable-rate mortgage? It’s like playing the market — initially, you might nab a lower rate and feel like a smarty-pants. It’s a gamble if you’re planning to sell or refinance before the rates hike.

Is a 7 year ARM a good idea?

A 7-year ARM a good idea? Depends on your game plan. If you’re bouncing to a new home before the 7 years are up, then maybe you’ll save some bucks on interest. But after those years? It’s anyone’s guess.

Is a 7 year ARM a good idea right now?

Is a 7-year ARM a good idea right now? Well, it’s like asking if it’s a good day for a barbecue — depends on the forecast, right? With today’s economic climate, you gotta check the latest rates and trends like a hawk.

Is an ARM mortgage a good idea in 2023?

As for an ARM mortgage being a good shout in 2023, it’s all about timing and your financial goals. With the economy doing the cha-cha, a fixed rate might just give you the peace of mind you’re after.

Can you refinance an ARM?

Refinance an ARM? Absolutely! It’s like trading in a wild mustang for a steady mare. If rates are looking good or you want off the variable-rate merry-go-round, refinancing might just be your ticket.

Is an ARM mortgage a good idea right now?

Is an ARM mortgage a smart cookie right now? Let’s just say, it’s as if you’re betting on your favorite sports team — there are no guarantees. So, tread carefully and do your homework before diving in.

Is a 5-year ARM a good idea in 2023?

A 5-year ARM in 2023, you ask? Depends if you’ve got a crystal ball! If rates soar, you could be paying way more. Best to keep your ear to the ground and eye on long-term goals.

Is a 5-year ARM a good idea?

Is a 5-year ARM a good idea, generally speaking? Maybe if you’re the adventurous type and plan to play the field with houses. But remember, it could get expensive later, so don’t get caught off guard.

How much is a 5-year ARM?

The cost of a 5-year ARM is like a chameleon — it changes with the market. Your initial rate starts off low, but without a heads-up on future rates, better poke around for current numbers and prepare for adjustments.

Why would anyone get an adjustable-rate mortgage?

Why folks choose an adjustable-rate mortgage sometimes is anyone’s guess, but it usually boils down to snagging lower rates early on or betting on future rate drops. It can be a smart move, but it’s risky business.

What is the difference between a fixed-rate and an adjustable rate?

Fixed-rate vs adjustable rate — it’s the battle of predictability against potential savings. A fixed-rate is your steadfast buddy with the same rate for life. An ARM, though, could give you a low rate now but change with the winds of the economy.

What is an adjustable-rate mortgage for dummies?

An adjustable-rate mortgage for dummies? Think of it like a hat with adjustable straps — it fits snug at first, but you can tweak it as needed, except with an ARM, the market does the tweaking, not you.

What is the difference between adjustable rate and conventional mortgage?

Adjustable rate vs conventional mortgage — now that’s a head-scratcher. A conventional mortgage is the typical home loan, and it can have a fixed or an adjustable rate. Yes, an ARM is just one flavor in the mortgage ice cream shop.