Understanding and managing income tax is akin to piecing together a richly colored quilt. Each square represents a vital snippet of information that, when expertly combined, creates a complete picture of your financial responsibilities and benefits. Tackle Alabama income tax with the savvy discernment of an investment expert and the meticulous care of a wise household budgeter.

Understanding Alabama Income Tax: Basics for Residents and Non-Residents

The Alabama income tax system might seem as complex as a high-stakes poker game, but it doesn’t have to be. At its core, Alabama has a graduated individual income tax, which applies different tax rates ranging from 2.00 percent to 5.00 percent depending on your income level. These are the cards you’re dealt whether you’re a resident with your feet firmly planted in Alabama soil or a non-resident who has sown seeds of income within the state’s borders.

Residents pay Alabama income tax on all their income, no matter where it’s earned. As for non-residents? They are only taxed on income earned in Alabama, a fair turn for their financial dalliance within the state. It’s like visiting someone’s home for dinner—you only chip in if you partake in the feast.

Navigating Through Alabama Income Tax Rates and Brackets

Now, let’s get down to brass tacks. To master the game, you must know the rules—or, in this case, the tax rates and brackets. Alabama’s income tax structure lays it out:

It’s a system that, while progressive, remains relatively straightforward. However, it’s also dynamic. As of our last information update on April 25, 2023, there haven’t been earth-shattering changes, but staying informed is essential for keeping your financial ship steady.

| Aspect | Details |

|---|---|

| State Income Tax Rates | Graduated individual income tax; Rates from 2.00% to 5.00%. |

| Tax Brackets | – 2.00% on taxable income of $500 for single, $1,000 for married filing jointly. – 4.00% for income over $500 to $3,000 for single, over $1,000 to $6,000 for married filing jointly. – 5.00% for income over $3,000 for single, over $6,000 for married filing jointly. |

| Corporate Income Tax Rate | Flat rate of 6.50%. |

| Local Income Taxes | Some jurisdictions collect local income taxes. |

| Tax Base | One of the smallest in the U.S., resulting in lower tax collections. |

| Property Tax Collections | Lowest per-capita property tax collections in the nation. |

| Sales Tax Reliance | High reliance on sales tax, with rates among the highest in the U.S. Applies to groceries and medications, unlike many other states. |

| Sales Tax | State rate is 4%; local rates vary, leading to a combined rate that can exceed 9% in some areas. |

| Tax Refund Status Check | – Online: www.myalabamataxes.alabama.gov – Toll-free hotline: 1-855-894-7391 – Daytime phone line: 334-309-2612 *Allow at least six weeks after filing to inquire.* |

| Comparative Aspect | Despite having graduated rates, Alabama’s overall tax collections are low due to the small tax base and the nation’s lowest property tax collections. The state compensates with heavy reliance on sales tax. |

The Role of Deductions and Exemptions in Your Alabama Income Tax Calculations

Remember, it’s not just about the money you make but the deductions and exemptions that can soften the tax blow. In Alabama, you can claim a standard deduction, which ranges based on your filing status, or itemize deductions if that leads to a greater reduction in taxable income.

Exemptions, like little financial guardian angels, also work to shield portions of your income from being taxed. There are personal exemptions, a boon for taxpayers and their dependents. Keep a keen eye—these can be like finding money in an old coat pocket.

Exploring Tax Credits Unique to Alabama

Venture further down the path and you’ll uncover tax credits waiting to be pocketed. These aren’t one-size-fits-all; they’re tailored to individual and business circumstances. From the Alabama Accountability Act Credit heralding choice in education to credits for those preserving historic structures, these incentives can lower your tax bill significantly, a sweet melody to any taxpayer’s ears.

Filing Your Alabama Income Tax: A Step-by-Step Guide

Stepping through the filing process can be as satisfying as completing a challenging crossword. Residents can use Form 40, while non-residents file using Form 40NR. E-filing is quick and efficient, akin to sending an email rather than a letter by snail mail. Be mindful of April deadlines to avoid racing against the clock more furiously than a time-traveling DeLorean.

Alabama Income Tax Compliance: Penalties to Avoid

Just like in a genteel southern dance, timing is everything. Late filing and underpayments can lead you into the arms of penalties, dancing to a tune of financial frustration. Filing late can incur a 10% penalty on any tax not paid by the due date. Underpayments carry an annual interest rate of 4%. Thus, marking calendars and setting reminders are savvy moves for this fiscal dance.

Potential Impacts of Federal Tax Reform on Your Alabama Income Tax

When Uncle Sam introduces changes to the federal tax arena, these can ripple out and affect your Alabama income tax. Given Alabama’s tax code nuances, such as the impact of federal deductibility—where you can subtract your federal taxes paid from state taxable income—the interplay between state and federal obligations requires keen observation, like a hawk watching over its nest.

Planning for the Future: Alabama Income Taxes for Estate and Retirement

As you glide into the golden years, understanding the Alabama income tax implications for retirement and estates ensures a smoother transition. Most pensions and Social Security benefits are not taxed, providing a comforting blanket of financial security.

Beyond the Basics: The Role of Alabama Income Tax in State Economy and Public Services

Income tax isn’t just about the government reaching into your pocket. It plays a leading role in Alabama’s economy. This fiscal machination supports everything from education to public safety, a spider’s web of delicate threads supporting the state’s welfare.

When Problems Arise: Resolving Alabama Income Tax Disputes

Tax notices and audits can be as daunting as a thorn bush in your garden path. But fear not—Alabama provides avenues for resolution. From appeals to informal conferences, your path to tax resolution can be navigated with proper care and occasional guidance from a seasoned tax professional.

Special Circumstances: How Alabama Income Tax Applies to Self-Employed and Gig Workers

Self-employed individuals and gig economy workers, aligning your enterprise with Alabama’s tax requirements might seem like a solo trek through uncharted territory. Calculating estimated taxes, keeping immaculate records—it’s like laying the bricks for your entrepreneurial path, one careful step at a time.

Capturing Alabama Income Tax Benefits: Tips for Maximizing Returns

There’s an art to maximizing your Alabama income tax benefits. Employ strategies throughout the year—like adjusting withholdings and tracking deductions. Think of it as continuously polishing your financial portrait, ensuring it shines come tax season.

Optimizing Your Approach to Alabama Income Tax

As we pull back the curtains on this elaborate tax tapestry, remember that thriving in Alabama’s tax landscape requires both understanding and action. Engage with your taxes as if conversing with an old friend—regularly, with honesty, and always striving for mutual benefit. Embrace these strategies, and you’ll find yourself navigating Alabama income tax with the grace of a skilled financier.

Bear in mind that the treasure map we’ve unfurled is only as current as our last update. The tax landscape is as prone to shift as the sands of the Alabama coastline. Regularly visit Alabama State Tax for the latest insights, and let’s ensure this fiscal journey we embark upon together leads to a destination of prosperity and peace of mind.

Fun Facts & Trivia: Alabama’s Income Tax Scoop

Hey there, fellow Alabamians and curious minds from afar! You’re about to dive into some quirky trivia and cool tidbits about Alabama’s income tax. Y’all ready for this? Let’s break it down, but not like we’re filing taxes – because hey, we’re here for the fun!

The Hollywood Connection

Now, you wouldn’t normally think that the words “taxes” and “Hollywood” mix well together, unless we’re talking about a blockbuster hit about auditors – but hear me out! Did you know that some of the stars you adore, like the up-and-coming jack champion,” might just be familiar with Alabama’s income tax situation? Especially if they’ve been down to Sweet Home Alabama for filming! Just goes to show, income tax regimes might not be as far-removed from the glitz and glamour as one might think.

High-Flying Taxes or Smooth-Sailing Savings?

When someone mentions the Tri eagle Login,” your first thought might be logging into your account to catch a break on those utility bills with some nifty discounts, right? Well, Alabama income tax has its own version of savings. Unlike the complicated world of energy rates, Alabama aims to keep income tax pretty straightforward – offering a full range of deductions and exemptions that’d make even the savviest saver tip their hat!

Ski Mask the Tax Slayer

Get this – if there were an award for slicing through confusing tax policies, it might go to the one and only Ski Mask The Slump God—now wouldn’t that be a sight in the tax office? While the real Ski Mask slays beats, Alabama slays complication with a progressive tax structure that ranges from 2% to 5%. No need for a tax slayer mask here, though. Alabama keeps it as smooth as a rap verse with income brackets you can easily roll with.

More Than Just Income Tax – Peek at the Property Side

Now, what’s that? You thought we were only gonna chat about income tax? Oh, honey, we’re just getting warmed up! Let’s sprinkle in a convo about alabama property tax because everything’s connected, right? With one of the lowest property tax rates in the nation, Alabama puts the ‘sweet’ in ‘Sweet Home Alabama.’ But remember, our focus here is income tax, so if you’re curious about how your homestead could benefit, give that link a click.

Wrapping It Up

So, whether you’re a Southern belle, a Hollywood star, or just someone trying to figure out where all those hard-earned dollars are going, Alabama’s income tax system might just surprise you with its simplicity. We ain’t spinning yarns here – it’s plain and simple, the Heart of Dixie has something interesting going on with its taxes. And who knows? Next time you’re sipping sweet tea on the porch, you might just ponder these curious facts and feel a bit lighter thinking about good ol’ Alabama’s tax system.

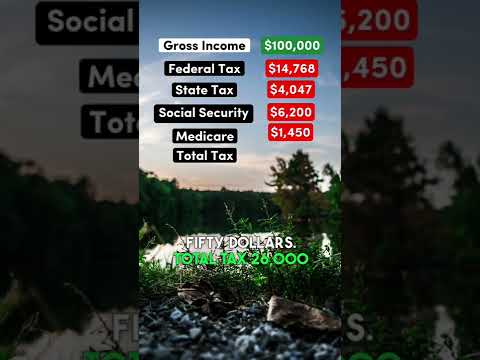

How much tax is taken out of my paycheck in Alabama?

Whew, talk about a sting from Uncle Sam right in your wallet! In Alabama, folks see a state income tax rate that ranges from 2% to 5%, depending on your income level, but don’t forget about federal, FICA, and any local taxes that might nibble away a bit more. There’s no one-size-fits-all answer here – your final tax hit will vary based on your earnings, deductions, and tax credits.

Why are taxes so cheap in Alabama?

Why are taxes so cheap in Alabama? Well, don’t go counting your chickens just yet, but Alabama’s relatively low property taxes and sales tax rates play a part in keeping more cash in your pocket. Another reason? The state government keeps a tight belt on its budget, which can lead to lower state taxes overall. Remember though, “cheap” is in the eye of the beholder (or taxpayer!).

Why are Alabama state taxes so high?

Talk about a head-scratcher, huh? While some folks find Alabama taxes a bit on the lighter side, if you’re feeling the pinch it might be due to Alabama’s state income tax, which can go up to 5%. Also, sales taxes can be heftier in some areas when you factor in local rates. Plus, let’s not ignore those “other” taxes like property and vehicle taxes that can add up.

How do I check my Alabama state income tax?

Checking your Alabama state income tax? No sweat! Just hop online and visit the Alabama Department of Revenue’s My Alabama Taxes (MAT) portal. It’s like having a magic window into your tax world – simply create an account, log in, and voilà! You can peek at your tax info faster than you can say “Roll Tide!”

Is Alabama a tax friendly state?

Is Alabama a tax-friendly state? Well, put on your happy dance shoes because many say it is. With its relatively low property taxes and no taxes on pensions, Alabama rolls out the welcome mat for those looking to stretch their dollars further. But like any good shindig, it has its downsides, like sales tax which can be a bit of a party crasher.

How much is 110k after taxes in Alabama?

Rubbing your hands thinking about that $110k salary in Alabama? After taxes, this sweet sum won’t look as plump, but you’re still in good shape. You could take home around 75-80% of that, depending on various deductions and local taxes. That’s a pretty penny, for sure, but don’t forget to count the beans right – tax calculators can help you get a more precise number!

Is Alabama a high tax state?

Is Alabama a high tax state? Well, that’s as debatable as grits versus hash browns. Alabama typically isn’t seen as a high-tax state, especially when it comes to income and property taxes, which are on the lower end compared to the rest of the country. But hey, don’t ignore local taxes and sales tax which can take a bite like a sneaky mosquito.

What is not taxed in Alabama?

What is not taxed in Alabama? Picture this: You’re skipping down the store aisles because groceries, prescription drugs, and purchases made for the purpose of resale dodge the sales tax slap. On the flip side, almost everything else could be subject to the state’s sales tax touch.

What US state has the cheapest taxes?

What US state has the cheapest taxes? Imagine a place where your wallet isn’t running for the hills – that could be Wyoming, Alaska, or South Dakota! These states boast no state income tax, and they’re pretty generous overall when it comes to keeping taxation on the down-low. It’s like a tax holiday every day!

At what age do you stop paying state taxes in Alabama?

Aging like fine wine has its perks in Alabama! When you hit the sweet age of 65, you can wave goodbye to state taxes on Social Security benefits and possibly get a pass on property taxes, too. But keep an eye on things, ’cause other income might still be on the tax table. Time to cash in on those golden years!

What is the most heavily taxed state in the US?

If you’re wondering what the most heavily taxed state in the US is, brace yourself: New York often wins this infamous crown. With residents facing some of the steepest income, property, and sales taxes, it’s like a tax tornado hitting their paycheck hard. Ouch!

Is Alabama tax friendly to retirees?

Retirees looking for a sunny tax haven, Alabama might just be your beach! The state says “no thank you” to taxing Social Security income and offers sweet tax breaks on pension income. So, if you’re dreaming of sipping sweet tea without the tax-time heartburn, Alabama is smiling at you.

Who must pay Alabama income tax?

Who must pay Alabama income tax? Listen up! If you’re earning a dime in the Heart of Dixie, whether you’re a full-times resident or just breezing through with some cash earnings, you’ll need to pony up for state income tax. And if you’re living elsewhere but have Alabama-sourced income, expect a tax date with AL.

Does Alabama tax Social Security?

Does Alabama tax Social Security? Not on your life! Alabama gives a big ‘ol thumbs-up to retirees by letting Social Security benefits fly tax-free. That’s one less worry for your golden years, and maybe one more round of golf or a few extra beach trips!

What states have no income tax?

Riddle me this: What’s better than a nice paycheck? How about a nice paycheck with no state income tax snipping away at it? States like Florida, Texas, and Nevada say “no thanks” to income tax, leaving you with more loot for your adventures or piggy bank.

Does Alabama have state payroll taxes?

Does Alabama have state payroll taxes? You betcha! While Alabama skips the tax on Social Security benefits, they’re not giving a total free pass. If you’re working in Alabama, you’ll see deductions for state income tax and depending on where you live or work, possibly local payroll taxes too.

What is minimum wage in Alabama?

What’s the minimum wage in Alabama? Call it a case of follow the leader – Alabama sticks with the federal minimum wage of $7.25 an hour, showing no eagerness to top that. Not exactly music to your pocketbook, but it’s the tune Alabama’s playing.

What is a good salary in Alabama?

A good salary in Alabama? That’s as tricky as nailing jelly to a wall since it varies depending on where you live and your lifestyle. But let’s just say if you’re raking in anywhere near the median household income of around $50,000 a year, you should be sitting pretty comfy among the magnolias and BBQ joints.

What’s the federal tax rate?

And lastly, what’s the federal tax rate? Hold on to your hats because this roller coaster has a few loops! The federal income tax system is progressive so rates can shimmy from 10% up to 37%. Where you land on that ladder depends on your income and filing status, so cross your fingers for a gentle climb.