Decoding the Arizona Sales Tax Rate: A Deep Dive into the Grand Canyon State’s Taxation Landscape

Well, folks, you’ve landed in the right place to unravel the tapestry of Arizona’s sales tax rate. It’s no simple affair, let me tell you, but with a bit of digging, we can uncover the layers that make up this essential part of the Grand Canyon State’s economy. Buckle up!

The Bedrock of Arizona Sales Tax: Understanding the Basics

Like a grand desert mesa, the foundation of the Arizona tax structure is vast and layered. We’ve got the state transaction privilege tax (TPT), often mistaken for a sales tax, which stands at 5.6 percent. But that’s just the start. Local municipalities say, “Hold my cactus juice,” and pile on additional rates that can soar the total tax rate to as high as 11.2%.

When does the tax bell toll for thee in Arizona? That’s a good question, right away meaning we need to look at the tangibles, my friends. Your classic tangible products are taxable, minus a few exceptions like some groceries, prescription medicine, and a few more goodies. The magic word for businesses is nexus – simply put, it’s that invisible tie that declares, “Yep, time to pay taxes here!” Whether you’re physically camped out in Arizona or hitting significant sales numbers, nexus ropes you into TPT responsibilities.

Legal Forms for Everyone Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much More

$17.99

“Legal Forms for Everyone” is an essential compendium that streamlines the process of managing your personal legal affairs. This comprehensive collection includes ready-to-use documents for common legal needs, covering an array of topics such as residential leases, property sales, estate planning, healthcare directives, and marital arrangements. Each form is designed for ease of use, with clear instructions that help you tailor the specifics to your situation, ensuring that you can secure your legal rights without the expense of hiring a professional for standard documentation needs.

Navigating the legal aspects of significant life events can be daunting, but “Legal Forms for Everyone” brings clarity and confidence to the process. In addition to the forms, this guide offers succinct explanations and guidance for each document type, detailing when and how to use them effectively. Whether you’re looking to avoid probate with a living trust, establish a living will for medical decisions, or manage copyright for creative works, this resource empowers you with the know-how to take action.

For those facing a transition like divorce or the sale of a home, “Legal Forms for Everyone” proves to be an invaluable tool. It not only provides the legal forms but also demystifies the legalese associated with these processes, which can often inhibit people from taking the necessary legal steps on their own. With this product, individuals gain the confidence and autonomy to manage their legal affairs, potentially saving time and expense while still protecting their interests and those of their loved ones.

Beyond the Percentage: The Real Impact of Arizona’s Tax Rate on Residents and Businesses

Now, a stone’s throw away—or maybe a tad further—we’ve got neighboring states with their own drama. Arizona sways in the dance, sometimes stepping higher with rates, other times dipping lower. But don’t let the numbers fool you; it’s not just about who’s got the lower number, but how it plays out in the day-to-day hustle.

The sales tax plays quite the role in the state’s treasure chest, second only to a gripping J Cole song when it comes to making an impact. And believe me, it doesn’t just line the state coffers; it shapes how consumers and businesses tango. From a penny-pinching shopper to a calculating CEO, the tax rate pulls the strings on where and how money flows.

A Timeline of Trends: How the Arizona Tax Rate Has Evolved

Remember Joshua Davis from “The Voice”? Well, the evolution of Arizona’s tax rate has had its own crescendo and diminuendos over the years. Historically speaking, it’s been quite the ride, with each change trying to hit that perfect pitch for economic growth. We’ve seen shifts for better compliance, a nod to the secondary market, and tweaks to ensure the state remains competitive.

As for what lurks on the tax horizon, I’ve got my ear to the ground. We’re talking demographic shifts and e-commerce jigs that might waltz us into new tax territories. Keep your eyes peeled; the times, they are a-changing.

The Intricacies of Arizona’s Taxable Transactions: Exemptions and Variances Unearthed

Tax law, my friends, is like a cactus field—handle with care. Arizona’s got its own set of exemptions, each with more needles than a porcupine convention. We’ve got exemptions that could bend your mind more than property tax Indiana rates bend wallets. Industries from R&D to agriculture have special conditions, and the interplay between sales and use tax? It’s a tango that could trip up even the best of us.

MPC Plug N Play Remote Starter for Ford F Super Duty Gas Key to Start with T Harness OEM Key Fob Activated

$118.95

The MPC Plug N Play Remote Starter for Ford F Super Duty Gas Key to Start with T Harness is a premium aftermarket accessory designed specifically for Ford F-Series Super Duty gas vehicles that use a key-to-start ignition system. Engineered to seamlessly integrate with your vehicle’s electrical systems, this kit includes a convenient T-harness which simplifies the installation process, making it both quick and non-invasive. As a result, your vehicle’s warranty remains intact and the vehicle’s electrical integrity is not compromised. The remote starter is perfect for drivers looking to add the comfort of a warm vehicle on cold mornings or a cooled cabin during hot days without the need for complicated wiring or professional installation.

This innovative remote starter leverages your Ford’s OEM key fob, enabling you to start your vehicle from a distance with the press of a button â typically the lock button pressed three times. This intuitive activation method means there’s no additional remote to carry, ensuring you maintain the convenience and aesthetic of your existing key fob. Additionally, the remote starter features extended range options for starting your Ford F Super Duty from even further away, which can be achieved through compatible long-range RF kits or smartphone control interfaces that are sold separately.

The product is designed with safety and security in mind, as it includes multiple built-in features to ensure your vehicle remains safe when using the remote start function. The system checks for key presence before allowing the engine to turn over, preventing unauthorized use of the remote start feature. It’s also engineered with a brake pedal shut-off requirement, which ensures that the vehicle cannot be driven away without the key physically present in the ignition. With the MPC Plug N Play Remote Starter, Ford F Super Duty owners can enjoy the luxury and convenience of a remote start system that is as secure as it is easy to use.

| Aspect | Detail |

|---|---|

| Arizona (AZ) State Sales Tax Rate | 5.6% |

| Maximum Local Sales Tax Rate | 5.3% |

| Possible Combined Tax Rate | Up to 11.2% |

| State Transaction Privilege Tax (TPT) | Same as state sales tax rate – 5.6% |

| Corporate Income Tax Rate | 4.9% |

| State Business Tax Climate Index Rank | 19th for 2024 |

| Phoenix Minimum Combined Sales Tax (2023) | 8.6% (Total of state, county, and city sales tax rates) |

| Taxable Items in Arizona | Tangible products, with exceptions |

| Non-Taxable Items in Arizona | Certain groceries, prescription medicine, medical devices, machinery and chemicals used in R&D |

Behind the Scenes: The Administration of Arizona’s Sales Tax Rate

Collecting taxes ain’t as simple as shaking down piggy banks. It’s a finely tuned process involving technology sharp as a tack and audits that could make your papers run for the hills. Compliance is a beast, but with the right know-how, it’s a tamed one. Arizona’s not just about the wild west; it’s about a wild web of tax collection and remittance—and it’s not for the faint of heart.

The Tipping Point: Controversies and Debates Surrounding the Arizona Tax Rate

Speaking of heart, let’s not sidestep the heat that the tax rate brings. Public opinion’s as varied as desert flora, and the legislature’s more heated than a Phoenix summer. Controversial propositions toss up more debate than a reality TV show finale; everyone’s got a stake in this game. And lobbyists? They’re weaving through this like a snake in the grass, shaping policies and leaving their mark on the sands of Arizona’s tax landscape.

Unique Perspectives: Stories from the Front Lines of Arizona’s Sales Tax

This story isn’t just numbers and faceless stats; it’s about real folks—business owners, tax pros, everyday Joes and Janes. From mom-and-pop shops to titans of industry, from the man on the street to the bean counters, everyone’s got their Arizona sales tax tale. And when it comes to crafting the dream tax system, opinions are as plenty as stars in our desert sky.

Tax Planning Strategies: Navigating the Arizona Tax Rate Efficiently

Getting around the sales tax maze without a stumble takes finesse—part art, part science. For both individuals and businesses, there are ways to dodge pitfalls and make use of tax perks. Credits, incentives, deductions—they’re out there, waiting to ease your tax burden. Learn to play the game, and you won’t just survive; you’ll thrive.

The Forecast for Arizona’s Tax Rate: Analyzing Expert Prognoses and Economic Indicators

The future of Arizona’s sales tax rate? It’s like trying to predict a desert storm—you know it’s coming, but the how and when are up for grabs. Economists and policy wonks have their eyes on the horizon, gauging growth, inflation, demographics. Peering through the economic crystal ball, they churn out scenarios that could map out our tax landscape for years to come.

Navigating the Tax Landscape: Resources and Tools for Understanding Arizona’s Sales Tax Rate

In this digital age, keeping on top of the tax rate is easier than finding a cold drink on a hot day. With a slew of apps, websites, and tax calculators at your fingertips, you’ve got the tools to tackle TPT. And if hitting the books is more your style, workshops and seminars are serving up knowledge as hearty as Grand Canyon servings.

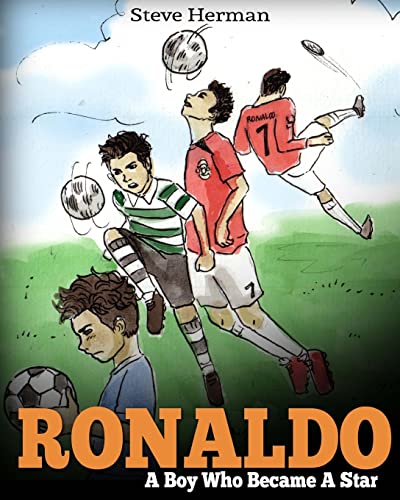

Ronaldo A Boy Who Became A Star. Inspiring children book about one of the best soccer players.

$14.32

“Ronaldo: A Boy Who Became A Star” is an enchanting children’s book that delves into the heartwarming journey of Cristiano Ronaldo, one of the world’s most revered soccer players. The narrative invites young readers to explore the inspiring story of Ronaldo’s rise from a humble beginning in Madeira, Portugal, to achieving his dreams of global stardom. Vivid illustrations complement the text, capturing the essence of every challenge and triumph encountered by the young athlete. This book is an uplifting tale that encourages children to pursue their passions with dedication and hard work.

Crafted to motivate and engage children, the book illustrates how Ronaldo honed his remarkable talent through perseverance and an unwavering belief in his own abilities. The story outlines key moments in Ronaldo’s life, including his move from hometown clubs to playing for some of the biggest teams in professional soccer, all while emphasizing the importance of family, friendship, and determination. Each page is a testament to what can be achieved when dreams are chased with relentless enthusiasm and resilience. “Ronaldo: A Boy Who Became A Star” bridges the gap between sports fans and young readers, offering an accessible role model whose journey can teach valuable life lessons.

Perfect for young soccer enthusiasts and aspiring athletes, this book not only serves as a biography but also as a source of inspiration to dream big and work hard. The accessible writing style makes the complex journey of a professional athlete relatable to kids, highlighting the importance of setting goals and overcoming obstacles. It’s a must-read for any child who dreams of one day becoming a star themselves. “Ronaldo: A Boy Who Became A Star” is more than just a story about soccer; it’s a celebration of the potential within every child to reach for the stars and achieve greatness.

Wrapping Up the Unveiling of Arizona’s Tax Rate Tapestry

Alright, we’ve journeyed through the wilds of Arizona’s tax rate, and what an expedition it’s been! From basics to complex intricacies, from historical shifts to front-line tales, we’ve uncovered a tax landscape as rich and varied as Arizona itself. Take these insights, treasure them, and use them to navigate the tax terrain with confidence.

Engage and Empower: Opening the Floor for Feedback and Further Discussion

So, dear readers, you’ve got the facts; now, let’s hear your side of the story. Your experiences, insights—they matter. Together, let’s enrich our understanding and strengthen our tax savvy community. Bring your thoughts to the table, and let’s shape a tax dialogue as lively and vibrant as Arizona itself.

Trivia: Arizona Sales Tax Rate Exposed!

Well, buckle up, folks! We’re about to take a wild ride through the dusty trails of Arizona’s sales tax rates. I betcha didn’t know that navigating through these rates could be as challenging as finding a cactus in a sandstorm. But don’t worry, we’ve got you covered like a cowboy’s hat in the noon sunshine.

How Low Can You Go?

Arizona’s state sales tax rate might just surprise you! It’s like playing limbo at a desert barbecue – you think it can’t get any lower, but then it does! The statewide base rate is pretty chill at 5.6%. But before you start celebrating with a cacti fiesta, you should know that local areas can add their own twist like a jalapeño in your salsa, which can bring the total sales tax rate up a notch or two.

Mix it Up Like a Monsoon Cocktail

Ready for a curveball faster than a prairie dog dodging a coyote? Counties in Arizona are given the power to impose their own sales tax rates which can vary like the playlist of J. Cole songs on a road trip through the Grand Canyon. Each county dances to the rhythm of its own drum, adding a little bit here and a sprinkle there, making sure your shopping spree keeps you on your toes.

The City Slicker Spin

Hold onto your hats ’cause we ain’t done yet! Cities are the real mavericks when it comes to sales tax. They can shoot up the rate faster than a jackrabbit on a hot skillet. So when you’re chillin’ in one of Arizona’s cool cities, remember that the sales tax there can be as unique as the stories of old gunslingers – each one with its own local flair.

Hold Your Horses! What’s Exempt?

Now, here’s a plot twist you didn’t see comin’ – not all items are subject to sales tax in the Old Pueblo and beyond. Y’know, things like prescriptions and some groceries get a free pass, like a cowboy skirtin’ a showdown. So you might be able to keep a few extra greenbacks in your pocket after all.

A Canyon-Sized Conclusion

Well, there you have it, partner! Arizona’s sales tax rate situation is as varied as the state’s breathtaking landscapes. Remember to keep an eye out for those local rates, ’cause they can make your wallet feel lighter faster than a tumbleweed in a tornado. Stay savvy, shop smart, and you’ll navigate the sales tax trail just fine. Yeehaw!

Real Estate License Exams For Dummies with Online Practice Tests

$17.69

Real Estate License Exams For Dummies with Online Practice Tests is a comprehensive guide designed to help aspiring real estate professionals prepare for their state’s licensing examination. This product offers a smart and efficient way to study, providing readers with a thorough overview of the key concepts and subjects covered on the exams. It is structured in a user-friendly format, with clear explanations and a practical approach to learning, making it accessible for individuals with various levels of knowledge and experience in real estate.

The book is accompanied by online practice tests that simulate the actual exam experience, allowing users to assess their readiness and identify areas where more review may be needed. These practice tests are updated regularly to reflect the latest changes in real estate laws and practices, ensuring that users are studying the most current and relevant material. Additionally, detailed explanations of answers are provided, giving test-takers a deeper understanding of complex topics and the reasoning behind correct responses.

Beyond just exam preparation, Real Estate License Exams For Dummies with Online Practice Tests includes test-taking strategies and tips to boost confidence and reduce test anxiety. It also comes with access to additional online resources such as flashcards and cheat sheets, which reinforce learning and aid memory retention. Whether a newcomer to the real estate field or a seasoned professional seeking licensure in a new state, this product serves as an invaluable tool in achieving exam success and advancing one’s real estate career.

How much is the sales tax in Arizona?

“Oh, the sunny state of Arizona! The sales tax here isn’t a flat rate across the board—it varies depending on the local municipality. But here’s the scoop: as of 2023, Arizona’s state sales tax is set at 5.6%. Remember, though, that local areas can tack on extra, so your final tab could be higher depending on where you’re shopping. Don’t forget to factor that in when you’re budgeting for your desert splurges!

Does Arizona have a high sales tax?

Well, as far as sales tax goes, Arizona might raise an eyebrow or two. It’s not sky-high, but it’s certainly not the lowest around. With a base state rate of 5.6%, plus local taxes that can push the total rate over 10% in some areas, Arizona could make you feel the pinch when you’re reaching for your wallet. It’s like getting a little extra sunshine, but on your receipt, y’know?

What is Arizona sales tax 2023?

Ah, keeping up with the times! As of 2023, Arizona’s base state sales tax rate holds steady at 5.6%. But hold on to your hats—local taxes can increase that rate to upwards of 10% in certain areas. So, when you’re hitting the shops, the tax tag can vary quite a bit depending on where you are. It’s almost like a tax treasure hunt across the state!

What is not taxed in Arizona?

Man, doesn’t it feel good when you snag a bargain that isn’t taxed? In Arizona, some items dodge the sales tax like a pro. We’re talking prescriptions, and most groceries keep their cool, exempt from the tax. But don’t get too carefree just yet; other items like prepared food, soft drinks, and dietary supplements are still on the taxable list. It’s a mixed bag!

What city in Arizona has the cheapest sales tax?

Hunting for the lowest sales tax can feel like chasing a mirage in the desert, but if we’re talking Arizona, look no further than the little city of Somerton! Tucked away in Yuma County, it boasts the lowest combined sales tax rate in the state at just 5.6%. It’s like finding an oasis for your wallet!

Are groceries taxed in Arizona?

When it comes to filling up your pantry in Arizona, here’s a sweet deal—groceries are generally not subject to state sales tax! However, don’t start your happy dance just yet; some cities might still charge a local tax on food for home consumption. So, while you’re mostly in the clear, it’s worth checking the local tax scene before your grocery run. It’s a bit like checking the weather before a picnic!

Why is AZ sales tax so high?

Now, why on earth is Arizona’s sales tax reaching for the skies? Well, one reason could be that the state relies pretty heavily on these taxes as a source of revenue instead of slapping higher income taxes on its residents. It’s like Arizona decided to spread out the burden like a picnic blanket, instead of piling everything into one tax sandwich.

What 3 states have the highest sales tax?

Ready to have your socks knocked off? The three states doing a high jump on the sales tax trampoline are Tennessee, Louisiana, and Arkansas. They’ve cranked it up with combined state and local rates that can hover around 9.5% or more. Yikes, talk about feeling the tax squeeze!

Is Arizona a tax friendly state?

Ah, the allure of a tax-friendly haven—Arizona often winks at retirees with its siren song. While the sales tax might not be the lowest, the state wins hearts with lower property taxes and no estate or inheritance taxes. Plus, social security income is not taxed at the state level. So, if you’re dreaming of sunsets and saguaros in your golden years, Arizona might just roll out the welcome mat for you.

What age do you stop paying property taxes in Arizona?

Say what now? Stop paying property taxes altogether? In Arizona, that’s a no-go. However, if you’re 65 or older, some relief might come your way. The state offers programs like the Senior Property Valuation Protection Option, which can help freeze your property’s value for tax purposes. But, the taxman doesn’t disappear completely, so don’t throw away your calculator yet!

What is Scottsdale AZ sales tax?

For those living it up in Scottsdale, the sales tax as of 2023 combines Arizona’s state tax of 5.6% with a local tax, ringing in at a total of 8.05%. So, while you’re out there enjoying the upscale boutiques and galleries, just remember your total might pack an extra punch—wallet beware!

What is the least taxed state?

If low taxes are your jam, then you’ll want to turn the spotlight on Alaska. With no statewide sales tax and often no local tax either, it’s like a financial breath of fresh arctic air! Plus, with low income and property taxes, Alaska just might be the least taxed state, giving you more bang for your buck in the wild frontier!

What state has the highest sales tax?

Shoutout to Tennessee, the state hitting the sales tax charts like a country music star, with a combined state and local sales tax rate that can top 9.5%! When you shop there, it can feel like you’re getting an encore performance on your receipt—sales tax style!

What state has no sales tax?

If you’re dreaming of a place where sales tax is just a fairy tale, say hello to Delaware, Montana, New Hampshire, and Oregon! These states have waved goodbye to sales tax, making them the unicorns of the U.S. tax landscape. Imagine a shopping spree without that extra tax tacked on—pure magic!

Is Arizona a tax friendly state?

Yup, Arizona gets a nod for being a tax-friendly state, especially for those hitting their golden years. With no inheritance tax, no gift tax, and a sunny disposition towards retirees, your dollars might stretch a bit further here. While you’ll contend with sales tax and income tax, the overall burden is often lighter, like a cactus in the balmy desert breeze.

Who is exempt from paying sales tax in Arizona?

Well, who gets to slip through the sales tax net in Arizona? Government entities, qualified nonprofits, and some out-of-state purchasers can wave goodbye to sales tax on certain transactions. Plus, if you’re a reseller with a valid license, you’re in luck—you don’t pay sales tax on items you’re buying to sell on. It’s a club with exclusive membership, so not just anyone can jump the sales tax queue!”