As we wade through the ebb and flow of the economy, keeping a keen eye on the average 30-year mortgage rate today is like watching a suspenseful drama unfold – the stakes are high, and every twist brings a new revelation to those of us seeking to own a little piece of the American Dream. And as the sands of finance shift once again, we’re poised on the cusp of a notable dip in these long-term rates, a shift that beckons opportunity for the savvy homebuyer and homeowner alike. But what does this really mean, and how can we best prepare for this welcome reprieve in interest rates? Let’s dive deep and unscramble this riddle, shall we?

Analyzing the Current Average 30-Year Mortgage Rate Today

Historical Context and the Role of Economic Indicators

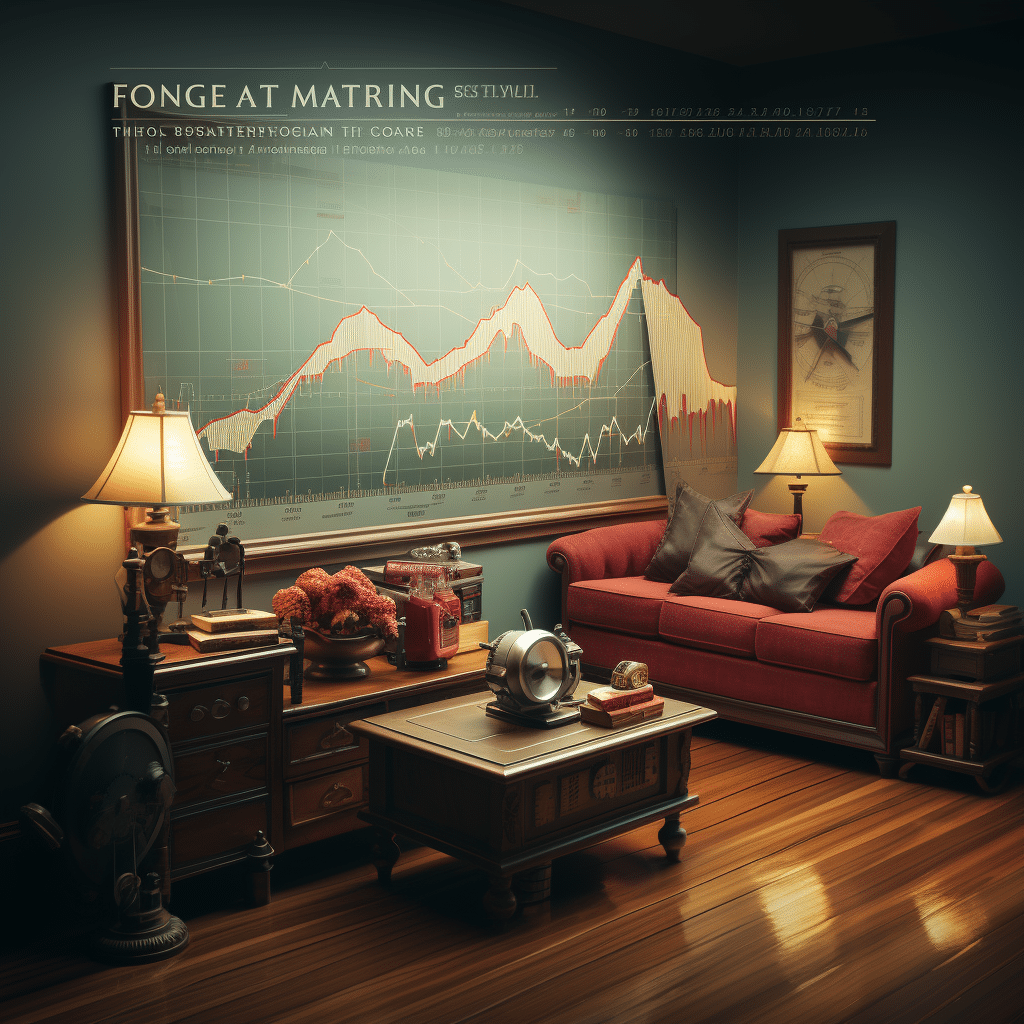

To understand where we stand, we need to peek in the rear-view mirror. Looking back at the period since 1971, the 30-year mortgage rate in the United States scaled dizzying heights of 18.63 percent in October of 1981 before plummeting to a record low of 2.65 percent in January 2021 – talk about a rollercoaster ride! This historical data paints a vivid picture of the volatility that underpins mortgage rates.

Now let’s talk turkey about the current economic indicators that have their fingers on the pulse of the average 30-year interest rate. Inflation, employment rates, consumer spending – they’re like the ingredients in your grandma’s secret recipe, each critical to the final taste. The Federal Reserve dabbles in this culinary art too, with its monetary policy decisions stirring the pot.

Understanding the Forecasted Dip in Mortgage Rates

Buckle up, because we’re due for some relief. The Mortgage Bankers Association has got its crystal ball out and sees mortgage rates dropping from 6.9% in early 2024 down to a more palatable 6.1% by year’s end. It’s like a cool breeze on a hot day, but what’s behind this forecasted dip?

Expert predictions attribute this gentle slide to various factors. Current geopolitical scenarios, for example, are tossing the financial markets around like a salad. Then there’s the dance between treasury yields and average 30-year mortgage rates – they’re in a tango, one leading the other through the complex choreography of global finance.

Implications for Buyers and the Housing Market

First-time homebuyers, listen up! This dip could be your golden ticket, making homeownership that little bit more within reach. For the housing market, this forecast might cool down prices, bulk up inventory, and spark a flurry of “For Sale” signs. And the bigwigs, the prominent real estate economists, they’re keeping their discerning eyes trained on these conditions like hawks, ready to pounce on the next trend.

Mortgage Lenders’ Responses to the Rate Dip

When rates wiggle, lenders like Wells Fargo and Quicken Loans don’t just stand by. It’s a domino effect of key decisions and rate changes that could benefit you. Think of it as a little competitive spirit in the mortgage industry – it’s what keeps the offers juicy and the services top-notch.

| Factor | Detail |

|---|---|

| Date of Information | Today’s date (Note: Specify the actual date, as this will adjust regularly) |

| Average 30-Year Mortgage Rate Today | (Specify today’s average rate) |

| Historical Average (1971-2024) | 7.73% |

| All-time High (Oct 1981) | 18.63% |

| All-time Low (Jan 2021) | 2.65% |

| Current Trend | Declining |

| Predicted Rate Q1 2024 | 6.9% |

| Predicted Rate Q4 2024 | 6.1% |

| Predicted Rate Q1 2025 | Below 6% |

| Association Forecast Source | Mortgage Bankers Association (February Mortgage Finance Forecast) |

How Current Homeowners Can Benefit

If you already own your slice of the pie, consider refinancing. Imagine trimming that monthly payment down! It’s not just a pipe dream; there are real case studies of homeowners who’ve hitched a ride on the dip to save a bundle. And if you’re bobbing in the sea of fluctuating interest, latch onto the advice of financial advisors on mortgage management – they’re the lifeguards on your personal finance beach.

The Role of Technology in Mortgage Rate Accessibility

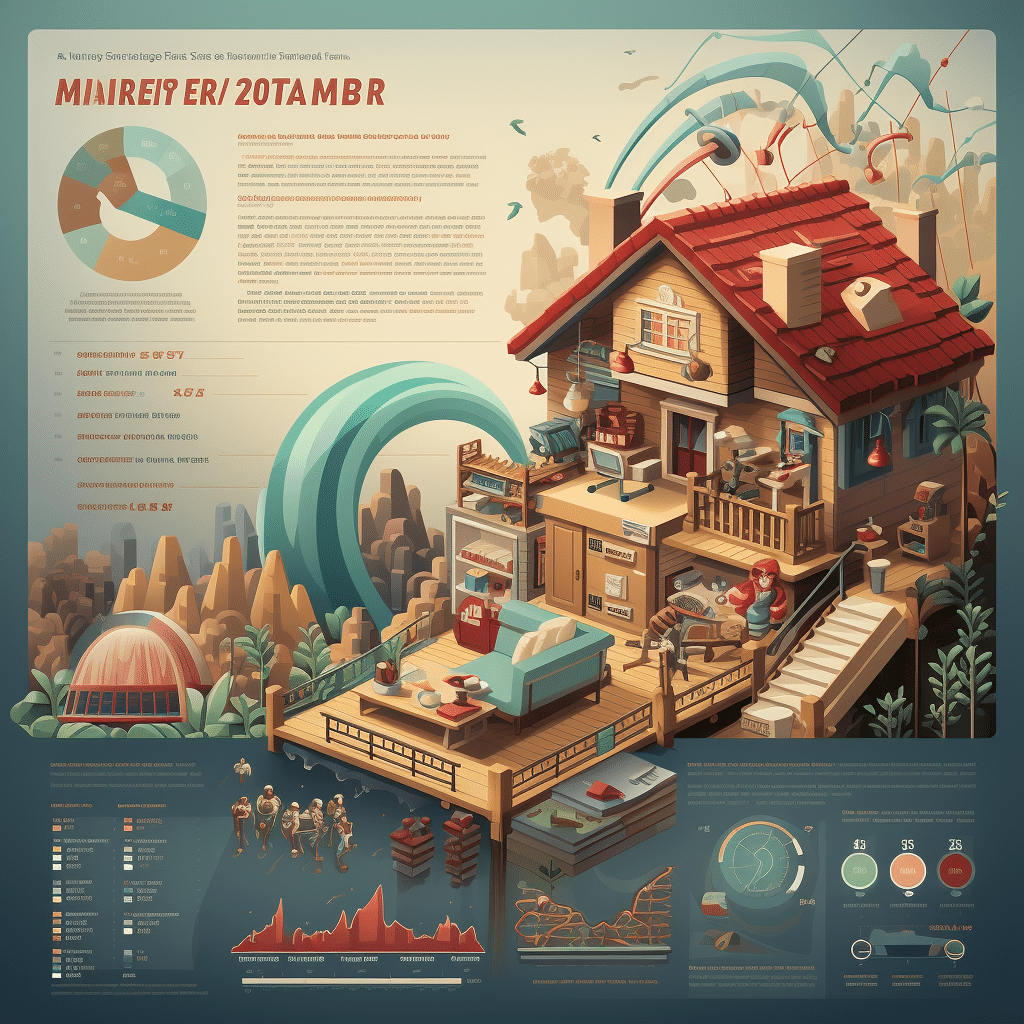

As Bob Dylan once warbled, “The times they are a-changin’,” and so is the way we track the average 30-year mortgage rate today. Fintech is the shiny new toy in the box, simplifying how consumers get their hands on rate information. With online platforms unlocking doors to data that once seemed sealed tight, we’re all getting a fair shot at snagging the best rates. Companies like Zillow and Bankrate are leading the charge with their tech tools, serving up market insights like a waiter dishes out pie.

Preparing for the Next Shift – Expert Advice

Forecasting tools are as invaluable as a Swiss Army knife in the wilderness of rate fluctuations. Interviews with industry trailblazers reveal strategies as diverse as the species in the Amazon rainforest. And don’t forget the bigger picture – investment implications are also swayed by those pesky mortgage rate movements.

Homebuying Strategies in a Fluctuating Rate Environment

With rates bobbing up and down like apples in a barrel, real estate advisors are the wizards you want to consult. They’ve got the lowdown on whether to play the long game or snatch up the short-term advantage, all while keeping a wary eye on how mortgage rate trends jostle with other buying costs.

The Global Picture and Its Influence on U.S. Mortgage Rates

Our fair nation’s rates aren’t immune to the world’s whims. International events can send ripples across the globe, stirring up U.S. rates as they go. It’s a world stage, and America’s mortgage markets are both actors and audience in this grand production.

An Innovative Wrap-up: Adapting to the Ever-Changing Mortgage Landscape

Well, folks, we’ve journeyed through the complex terrain of mortgage rates, from dips to peaks and back. We’ve heard success stories of those who’ve navigated these choppy waters with finesse. But at the end of the day, it’s about staying clued-up, staying nimble, and always keeping one eye on the horizon. So let’s toast to staying informed and proactive in the endlessly fascinating world of homeownership – here’s to you, future homebuyers and the homes that await you.

Remember, keeping abreast of the average 30-year mortgage rate today isn’t just for the number crunchers – it’s for every Suze Orman devotee and Robert Kiyosaki fan who understands the value of a well-timed financial move. Whether you’re toasting to your new low rate with a glass lifted from your Kegerator or practicing your dragon flag to stay physically as resilient as your financial savvy, knowing the ins and outs of the mortgage game keeps you nimble on your feet. So let’s not just wait around like a cast member from The Good dinosaur but be proactive like the teenage witch movie cast in crafting spells for homeownership success.

For the whip-smart homebuyer, staying current with the 30 mortgage rates, 30 yr mortgage rates today, 30-year mortgage rates, and 30-year mortgage rates today is a full-time gig. But with eyes wide open and a heart full of daring, the dream of homeownership in 2024 is not only plausible – it’s well within reach. So let’s roll up those sleeves and get to it, shall we? The mortgage landscape may be ever-changing, but our resolve to conquer it remains steadfast.

Exploring the Ebb and Flow of the Average 30-Year Mortgage Rate Today

You won’t believe this, but the history of mortgage rates is as wild as a rollercoaster ride at an amusement park. Now, did you know that back in the early 80s, folks were actually forking over upwards of 18% in interest for a 30-year mortgage? Talk about wallet-busting rates, right? Fast forward to today, and you’ll see that the average 30-year mortgage rate today is playing nice, giving prospective homeowners a bit of a breather with a more agreeable dip. It’s like comparing a hot summer day to a cool autumn breeze. People back then must have been green with envy seeing today’s interest rates. But hey, let’s not jinx it!

Say, while we’re on the subject, let’s sprinkle in some delightful morsels of trivia that you can toss around at your next barbecue. Picture this: the evolution of mortgage rates over time.(.) It’s been a veritable see-saw of ups and downs, enough to make your head spin! And here’s a juicy tidbit – did you know that the Federal Reserve() plays a bit of a puppet master with these rates? By manipulating the federal funds rate, they indirectly pull the strings that cause mortgage rates to jitterbug up or down. It’s quite the dance!

Now, don’t go thinking that this whole mortgage rate thing is all dry stats and yawn-worthy figures. Oh no, it’s chock-full of curious little nuggets. For instance, the drop in the average 30-year mortgage rate today isn’t just a number game; it’s a golden ticket for many to step onto the property ladder and claim their slice of the American dream. And guess what else? These shifting sands of interest rates have a butterfly effect, impacting everything from stock market performance( to how much bread you can buy with your dough. It’s all connected in this financial web we’re all tangled up in – fascinating, isn’t it?

So there you have it, mortgage rate trivia that’s as engaging as a page-turning mystery novel. With each subtle change in the average 30-year mortgage rate today, a new chapter unfolds in the economic narrative. Who knows what the next twist in the plot will be? But one thing’s for sure, keeping a hawk’s eye on the rates might just give you the edge in this mortgage saga.

Will interest rate go down in 2024?

– Well, if we’re placing bets, it’s looking like interest rates might take a bit of a tumble in 2024! The Mortgage Bankers Association is waving their crystal ball, forecasting a dip from 6.9% down to a more comfy 6.1% by the end of 2024. So, if you’re holding out for lower rates, your patience just might pay off.

What is the average 30 year mortgage rate all time?

– Drum roll, please! Throughout the ups and downs since 1971, the 30-year mortgage rate has averaged 7.73%. Yep, it’s been a roller coaster with sky-high rates in the ’80s and those almost-too-good-to-be-true lows we saw just recently.

What is the US average 30 year mortgage rate today?

– Oh, you’re after the latest scoop? While I can’t spill the beans this very second, you can bet your bottom dollar that the US average rate varies day-to-day. Historically speaking though, it’s danced around 7.73% on average over the long haul.

Is 2.75 a good 30 year mortgage rate?

– Is 2.75% a good mortgage rate? Good? That’s like finding a unicorn in your backyard! Historically, that’s way below the average and closer to the lowest we’ve ever seen. If you snagged that rate, hats off to you!

Will mortgage rates ever be 3 again?

– Will mortgage rates hit 3% again? Listen, I’m no fortune teller, but after seeing rates take a nosedive to historically low levels not long ago, in the wacky world of mortgages, “never say never” applies.

How high could interest rates go in 2025?

– How high could interest rates soar in 2025? While my crystal ball’s got a crack, the experts haven’t made specific predictions for 2025. But history tells us they’ve reached a towering 18.63% before — so don’t count any figure out!

What is the lowest 30-year mortgage rate ever recorded?

– The lowest 30-year mortgage rate ever? It was a jaw-dropping 2.65% in January of 2021. Mortgage hunters went bananas, and for a good reason!

What was the highest 30-year mortgage rate in history?

– The peak of the 30-year mortgage rate mountain? An eye-watering 18.63% in October of 1981. Borrowers back then needed nerves of steel and wallets to match.

What is the highest mortgage rate in US history?

– The highest mortgage rate ever in the US essentially gets the blue ribbon for the same 30-year fixed at a sky-scraping 18.63% back in the ’80s when hairstyles weren’t the only things going through the roof.

Who is offering the lowest mortgage rates right now?

– Who’s got the lowest mortgage rates right this minute? Well, it’s a game of musical chairs out there with lenders constantly shuffling rates, so you’ve gotta shop around, and don’t shy away from haggling a bit for the best deal.

What is the lowest mortgage rate ever?

– The lowest mortgage rate ever? Picture this: a minuscule 2.65% in early 2021. Borrowers were pinching themselves to make sure they weren’t dreaming!

What is the interest rate for a 700 credit score FHA loan?

– Fancy a 700 credit score and eyeing an FHA loan? You’re in pretty good shape, and lenders might cozy up to you with decent rates. Specific numbers are hush-hush and can change faster than you can flip a flapjack, so check the latest offers on the table.

Will 30-year mortgage rates go down?

– As for 30-year mortgage rates, they just might be heading south in 2024. Forecasters are giving us a wink and a nudge that rates could end the year on a lower note.

Why is a 15-year fixed rate mortgage better than a 30-year 35?

– Why pick a 15-year fixed mortgage over a 30-year stretch? Well, you’ll pay less in interest, own your digs faster, and build equity like a boss — that is if you don’t mind a heftier monthly payment.

Are 30-year mortgages worth it?

– Are 30-year mortgages worth your while? Depends on your game plan! They offer lower monthly payments, which is great for flexibility, but you’ll pay more interest over time. You’ve got to weigh up the long game versus monthly cash flow.

What are interest rates expected to do in 2024?

– Interest rates in 2024 are expected to do a little soft-shoe shuffle downwards, as forecasters see them gently sinking to a more soothing 6.1% by year’s end.

What is the interest prediction for 2024?

– The interest prediction for 2024? We’re seeing a potential drop with rates dipping by the time we’re singing Auld Lang Syne, arriving more comfortably under that 6% benchmark.

What will bank interest rates be in 2024?

– Bank interest rates in 2024? It’s the same tune as mortgage rates — experts reckon there’ll be a bit of a decline. Keep those eyes peeled for the latest numbers if you’re in the market.

What is the interest rate forecast for 2024 2025?

– For the 2024-2025 season, the interest rate forecast has got a trend line pointing down. We’re talking possibly under 6% in early 2025—definitely a reason for a high five!