Buying your first home is a monumental step in life, symbolizing stability, commitment, and the start of a new chapter. The path to homeownership, however, is not as straightforward as it once was. Economic, societal, and technological changes have reshaped the landscape over the years, influencing the average age of first time home buyers. In 2024, we find ourselves in a world where this average age has become a moving target, impacted by a variety of trends playing out across a broad spectrum of influences.

Trends Shaping the Average Age of the First Time Home Buyer

The journey to owning a home is no longer a cookie-cutter process. Let’s dive into the patterns and predictors that are shaping the age at which people step onto the property ladder.

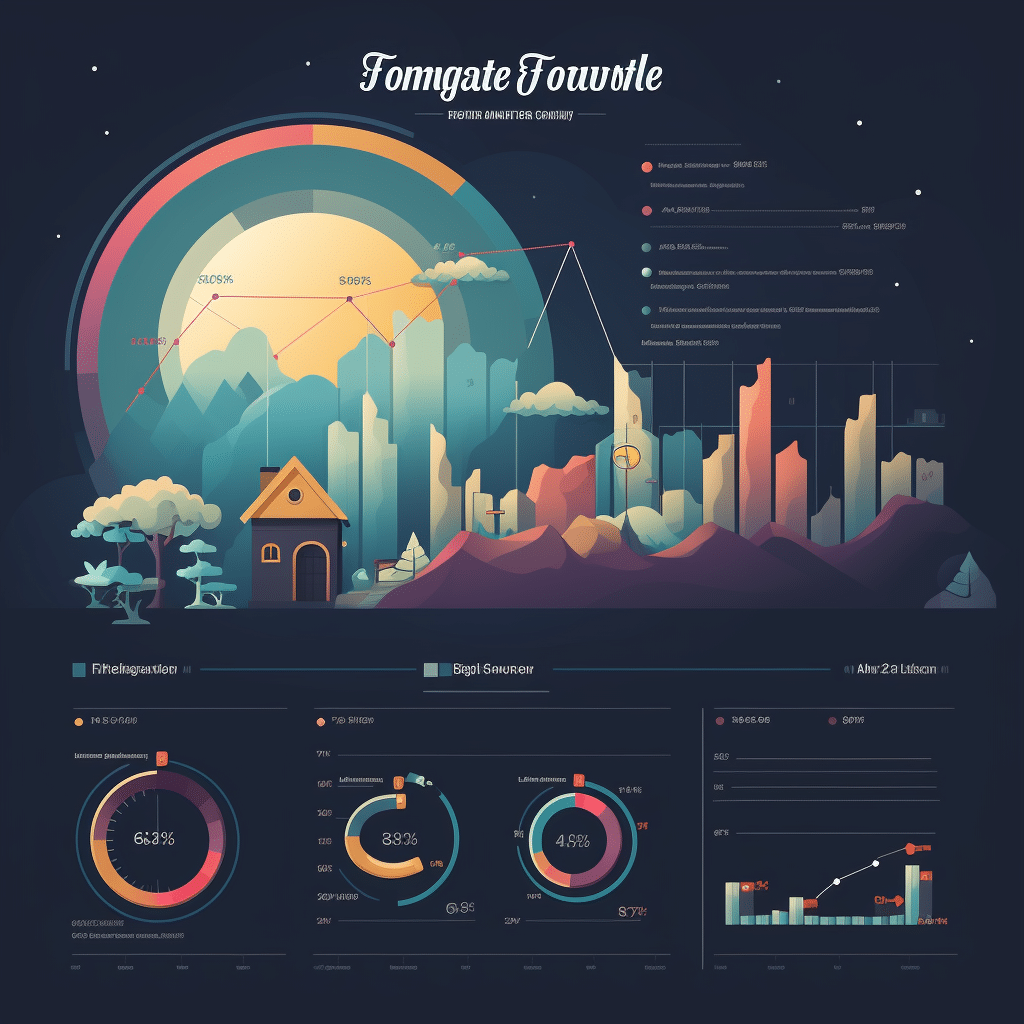

The Evolution of the Average Age First Time Home Buyer Over the Past Decade

Looking back from 2014 to 2024, the home-buying landscape has seen its fair share of ebbs and flows. Here’s a glimpse of how the numbers stacked up:

Current Economic Climate Impacting First Time Home Buyers’ Age

The economic engines of today are quite the rollercoaster, and here’s how they’re affecting first-time homebuyers:

Geographic Variations in the Average Age of First Time Home Buyers

Where you plant your roots can dictate when you plant them:

Influence of Technology on the Average Age First Time Home Buyer

Tech has crashed the home-buying party and it’s not leaving anytime soon:

Societal Shifts and Their Effects on First-Time Home Buying Trends

The white picket fence image of the American dream is fading into something more… fluid:

Financial Innovations Shaping the Average Age of First Time Home Buyer

The financial world is whirling with new toys and tools for homebuyers:

Predictions for the Future: Will the Average Age Continue to Rise?

So, what’s the crystal ball showing for future home-buying age trends?

Unique Perspectives: Stories from First Time Home Buyers

Every stat has a story, and here are tales from the trenches:

-“Loans in San Antonio“? They might just be the stepping stone many first-timers need to cross the threshold.

Bold Steps Forward: Empowering the Next Generation of Homeowners

It takes a village—or perhaps a government and a few pioneering companies—to raise a homeowner:

Pioneering a New Path in Homeownership

Reflection reveals that the average age of the first-time home buyer is more than just a number—it’s a narrative woven from the threads of modern life. What’s certain is that the journey to owning a piece of the pie has become as diverse as the dreamers seeking it. Where the winds of change lead us is anybody’s guess, but armed with a compass of knowledge and the sails of innovation, we’re set for a voyage to homeownership that, while different for every soul, ends in the same cherished destination: Home.

Fun Facts: When Do Most People Take the Home-Buying Plunge?

Average Age Ain’t Just a Number!

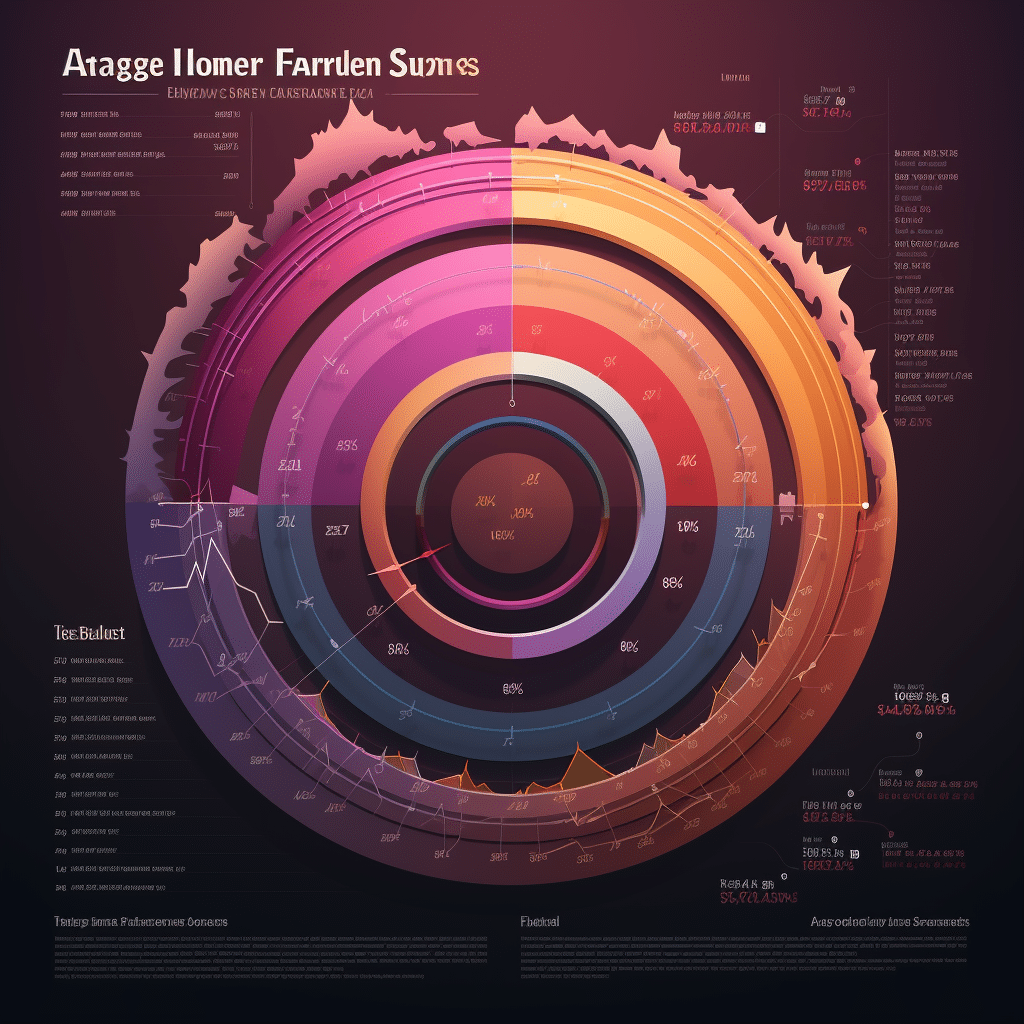

It’s a real mixed bag when we start talking about the average age of first-time homebuyers. You’d think it’d be getting younger, right? With all the tech savviness and go-getter attitudes? Guess what – it’s actually the other way around! The average age has been creeping up over recent years. Believe it or not, a lot of first-timers are now pushing into their 30s before they get those keys in their hands. Talk about patience (or is it procrastination?)!

Credit Where Credit’s Due

Now, you might be wracking your brain thinking about all those expenses, right? Like, Is credit card interest tax deductible when I finally buy my crib?” Who wouldn’t want to shave off a few expenses come tax season? I hate to break it to you, but no — that credit card interest isn’t going to give you a tax break. However, that snazzy interest on your mortgage? Now that’s a different kettle of fish!

The Times Are A-Changin’

Way back when, in the ‘good old days,’ folks were hitching the house wagon a lot earlier. But times have changed, and so have the ages of first-time home-buyers. There’s no rush to the altar of homeownership these days. People are waiting until they’re ripened to perfection, settling into careers, and gathering a nice financial cushion. But hey, slow and steady wins the race…or in this case, the house!

A Penny Saved Is a Penny Earned

When it comes to squirrelling away those pennies for a down payment, you bet the average age is a huge factor. With college debt, living costs, and that ever-present lure of avocado toast (just kidding, sort of), younger generations are hitting the “save” button for a wee bit longer. But hey, all those life experiences count for something when signing on the dotted line, right?

Living Single or Doubling Down?

Ever wonder if flying solo or teaming up has got anything to do with buying a house? You betcha! Single folks often have to hustle harder to cover the costs solo, pushing back the age of their first purchase. It’s like a seesaw, balancing between splurging on a solo pad or coupling up to buy a love nest.

The Crystal Ball Says…

Predicting the future ain’t easy, but if current trends are anything to go by, we’re looking at the average age continuing to inch up. Maybe we’ll be celebrating 40th birthdays and housewarmings all at once. But who knows, really? With the housing market more unpredictable than a game of Monopoly, we’re all just trying to pass Go and collect $200.

So the next time you’re at a dinner party and someone drops the “When did you buy your first house?” question, dazzle them with these tidbits. Who doesn’t love a know-it-all who can talk real estate trends and tax trivia?

How old are most first time home buyers?

Alright, let’s dive in!

What is the most common age to buy a first house?

Most first-time homebuyers are young adults, typically in their early to mid-30s. Wait, don’t rush to conclusions! While that’s the average, there’s a wide range as folks find their feet at different paces.

Is 30 a good age to buy a house?

The most common age to snag that first home sweet home is usually the early 30s. It seems like ages since people waited until the traditional white picket fence stage, huh?

What is the average age of first time home buyers in 2008?

Is 30 the new black for buying houses? You bet! At 30, you’ve had a hot minute to build up some cash and career stability. Buying a house at 30 is like hitting the sweet spot – not too green, not too ripe!

What age do most people buy their first house 2023?

Back in 2008, first-time homebuyers averaged around 30-31 years old. That’s right, even amid the real estate rollercoaster, 30 was the magic number.

Do millennials buy homes?

In 2023, most people grab the keys to their first house in their early 30s. Sure as the sun rises, some things stick around, and this norm is one of them.

Is it smart to buy a house at 25?

Do millennials buy homes? Absolutely! While they might start a tad later than their parents, millennials are making moves and signing deeds. They’ve just got their own style – maybe a tiny home or a fixer-upper.

Is it smart to buy a house in your early 20s?

At 25, smart is what smart does with your money. If your ducks are in a row—solid job, decent savings, and a hankering for stability—then yeah, buying a house could be a genius move.

Is 23 too early to buy a house?

Early 20s and thinking of buying a house? Pretty ambitious! It’s not for everyone, but if you’ve got a stable income and hate burning cash on rent, it’s definitely not a half-baked idea.

Is 28 too old to buy a house?

Whoa, 23 and buying a house? That’s early to jump on the property ladder, sure. But if you’ve got the dough and sense of direction, who’s to say it’s too soon?

Should I own a house by 35?

and worried you’re a late bloomer in the housing market? Chill out, you’re right on time! There’s no expiration date on making a smart investment, after all.

Is 35 too late to buy a house?

By 35, owning a home might feel like a “should,” but it’s no fairy tale deadline. Life’s a journey, so whether or not you’ve nabbed a home by then, you’re right where you need to be.

What age do people move out?

Too late to buy a house at 35? Pssh, not by a long shot! It’s never too late to play the home-buying game—35 is just another number, and frankly, age is just a state of mind.

Why were houses so cheap in 2008?

When do people usually fly the coop? These days, with the bank of mom and dad in full swing, expect young adults to spread their wings around the mid to late 20s.

What’s the average age to have kids?

Why were houses so cheap in 2008? Oh boy, after the market took a nosedive, prices plummeted. It was a financial freakout, making homes as cheap as chips, thanks to a surplus and a pinch of panic.

What age do most kids move out?

The average age to start a family with tiny tots? Most folks are waiting longer now, often until their late 20s or 30s. Times have changed, and so has the ticking of the biological clock.

Is buying a house at an early age good?

Kids packing up and skipping town? Well, these days, it’s around their mid-20s when they decide to stop sponging off the folks and get their own digs.

What percent of millennials own homes?

Gearing up to buy a house when you’re young? Not a bad play if you’ve got the financial game on. It’s a move that could set you up for a cozy future.

Is home possible for first-time buyers?

Millennials and home ownership? Let’s get real. While many are catching up, only about 47% have taken the plunge into the housing pool.