Understanding the nuances of a mortgage can be akin to learning a second language. Yet, it’s crucial we speak this language fluently, especially when it comes to balloon payments—a term that can either elevate your financial game or leave you deflated. Let’s unravel this concept with the same gusto you’d bring to, let’s say, figuring out the Alabama game channel for the big match Ready to kick off?

Understanding the Balloon Payment Definition in Mortgage Terms

A balloon payment is that one guest at the party who waits until the end to make a grand entrance. In loan lingo, it’s a hefty sum due after a series of smaller payments. Picture this: your mortgage is a marathon, and the balloon payment is the final sprint.

A balloon payment is, to put it bluntly, the mortgage equivalent of a final boss in a video game—challenging and sometimes unexpected.

These loans often start with a sweet deal: lower initial payments. However, this honeymoon phase comes with a trade-off—a lump sum payment looming on the horizon.

Standard mortgages are like a steady diet, consistently chipping away at your debt. Balloon payments, meanwhile, might remind you of a kick-ass cast with a spectacular finale

What is a Balloon Payment and How Does it Work?

Still foggy on the balloon payment definition? Consider it unmasked. A balloon payment isn’t a fiesta of helium delights but a mortgage’s endgame—a substantial zap to your wallet.

Forget the myths; it’s not balloon-shaped or fun. A balloon payment is simply a larger-than-life payment punctuating your loan term.

Why choose a balloon payment? Sometimes, it’s the financial flexibility early on or strategies for those flipping houses—think short relationships, not long marriages.

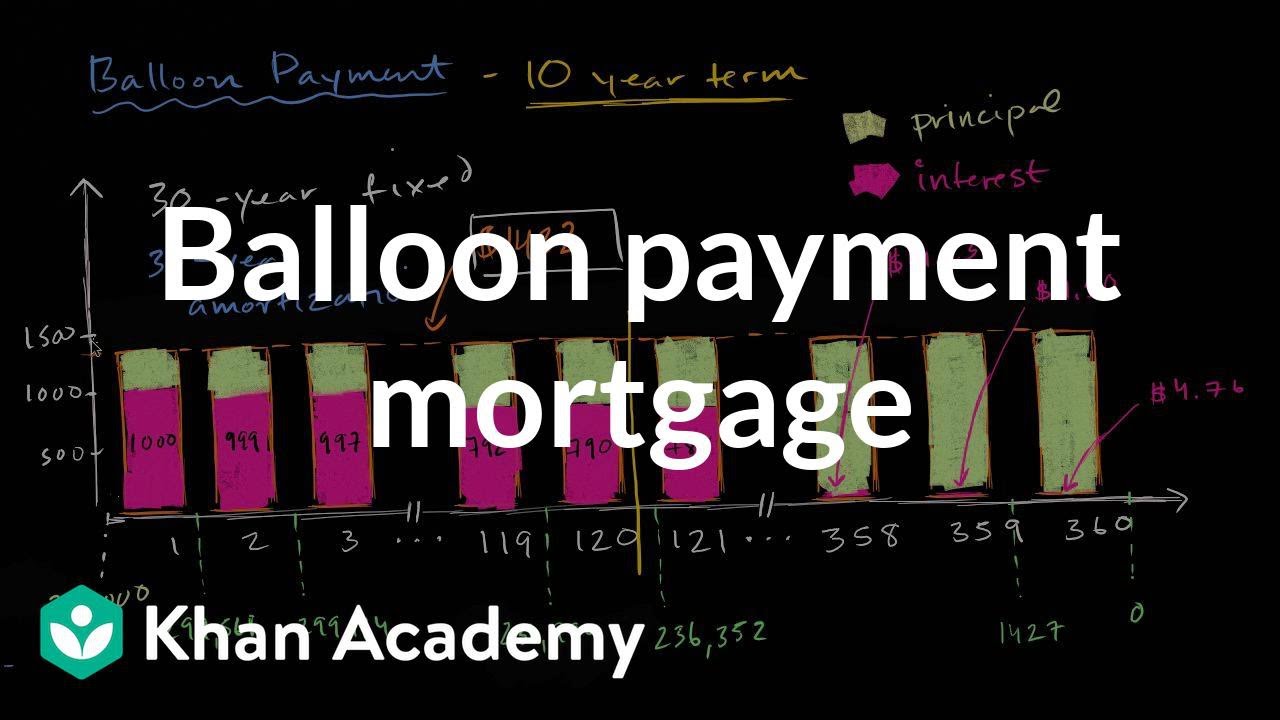

The math? It’s as precise as a factual data credit inquiry The when? Usually after moonwalking through a period of smaller installments.

| Attribute | Definition / Description / Characteristics |

|---|---|

| Definition | |

| Purpose | |

| Common Use Cases | |

| Typical Terms | |

| Monthly Payments | |

| Balloon Payment Amount | |

| Financial Strategy For Borrowers | |

| Risks for Borrowers | |

| Market Condition Considerations | |

| Potential Advantages | |

| Potential Disadvantages | |

| Date of Last Update | |

| Example |

The Inner Mechanics of Balloon Payment Mortgages

Peering under the hood, we find the balloon payment mortgage’s engine purring with short-term temptations and a high-octane finish.

Money now over money later—it’s tempting, like a dessert before dinner. This choice can serve up cash flow now but requires a robust savings strategy for later.

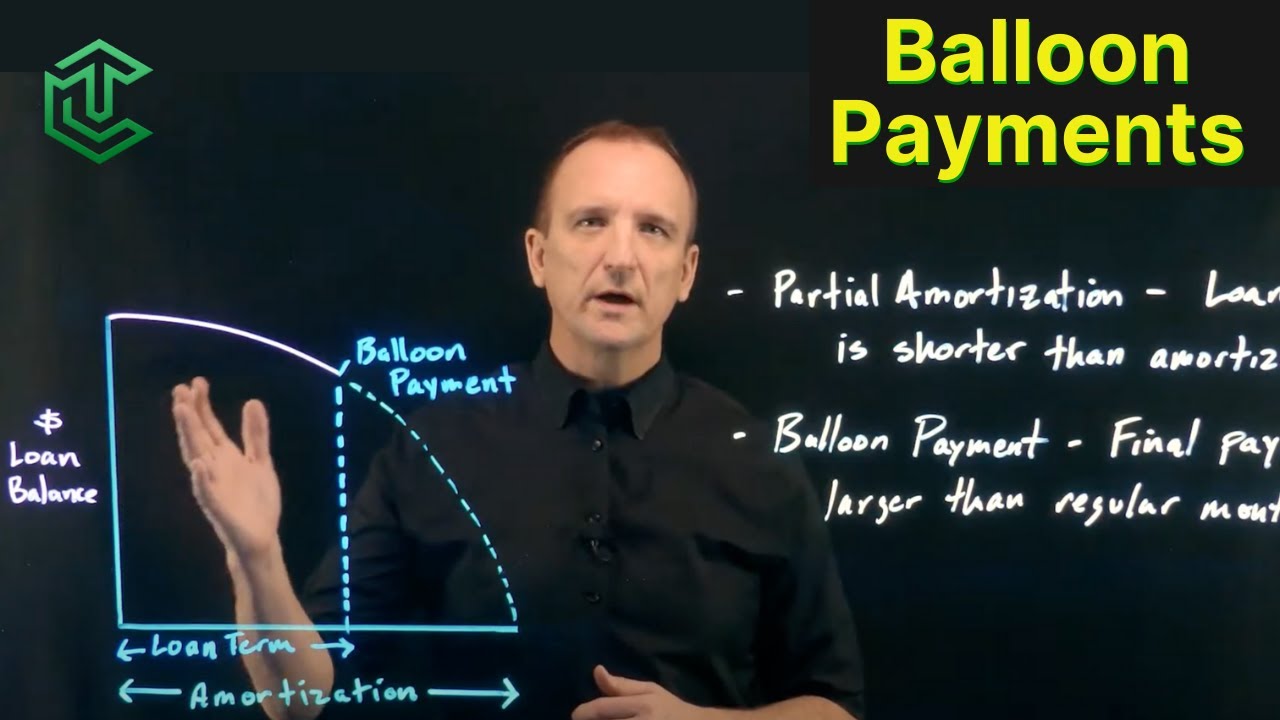

The amortization schedule—less daunting than it sounds—is essentially a financial road trip itinerary. It’s how you travel from Loan Land to Ownership Oasis.

The short game can be shiny: smaller payments can be that financial diet giving you the leeway to invest or spend elsewhere. But beware—diets often lead to a binge later.

Navigating the Pros and Cons of Balloon Payment Loans

Ah, the good, the bad, and the ugly of balloon payments—let’s dissect these like a frog in science class.

Advantages? They’re not mere fairy tales. Balloon payments can be the wind beneath the wings of your cash flow, especially when playing the house-flipping game.

When is it savvy? Perhaps you’re a financial Houdini, plotting an escape through refinancing, or maybe you’re expecting a cash avalanche in time for the balloon bonanza.

But let’s keep it real. The risks are as real as gravity, and falling can hurt. If you can’t manage the finale payment, it might feel like stepping on a financial Lego—painful.

Assessing the Risk Factors Associated with Balloon Payments

In the world of finance, risk is the villain we must all face. So, suit up—let’s delve deeper.

Variables like unstable incomes or market madness can turn your balloon payment into an obstacle course you didn’t sign up for.

History whispers warnings of defaults and foreclosures—tales of woe when the balloon payment became an untamable beast.

Market conditions can either be your Gandalf or your Sauron. If the winds change, that balloon might just carry you away—or drop you like a hot potato.

Balloon Payments in Different Economic Climates: A Comparative Analysis

Like a chameleon, balloon payments change their stripes with the economic weather. Let’s compare the sunny days with the hurricanes.

In past recessions, balloon payments often went pop! Conversely, in an economic boom, they were the toast of the town—bubbly included.

Current climates seem stable, but predictability in finance is like nailing jelly to the wall—tricky.

Experts toggle their crystal balls, but the consensus is caution. Keep an eye on the horizon; things could shift.

Preparing for the Balloon Payment: Strategies and Solutions

If there’s a balloon payment bungee jumping into your future, let’s hatch a plan. No sweat—just some forward-thinking strategy.

Stash that cash like a squirrel with an acorn obsession. Explore saving strategies and budget reconfigurations. Think financial Tetris—make those numbers fit.

Refinancing could be your knight in financial armor. Just like learning How To get closing costs Waived, strategies exist for managing the climax of your loan saga

Money maestros sing in chorus: prep, prep, prep! Start your financial fitness regimen early on, and that balloon payment will seem more featherweight than heavyweight.

Legal Considerations and Borrower Protections Involving Balloon Payments

Just as referees keep sports clean, laws and rights protect borrowers from getting played. It’s time for some legal eagle insights.

In the legal playground, balloon payment loans have their own set of monkey bars and swings—regulations designed to protect you, the borrower.

As borrower rights are your shield, wield them wisely. Should a dispute arise, better to be a lion than a lamb.

Consumer protection agencies—they’re like the friend who tells you when you have spinach in your teeth. They’ve got your back, in case your balloon payment plans hit turbulence.

The Future Landscape of Balloon Payment Mortgages

Peering into the crystal ball, what does the terrain of balloon payments look like? Follow me down the yellow brick road.

Lenders, ever the chameleons, are shaping their balloon payment offerings like clay on a potter’s wheel—responsive to the needs and risks of borrowers.

Regulatory winds may shift, and with them, balloon payment loans might need to adjust their flight patterns. Experts murmur of tighter controls on the horizon.

The sustainability debate rages on like a storm at sea. Will balloon payments sail into the sunset or sink like stones? Industry beacons shine a light of mixed forecasts.

Beyond the Horizon: The Evolving Dynamics of Balloon Payments

In the grand tapestry of financial strategies, balloon payments are but one thread, woven intricately with risk and reward.

In sum, our journey through the world of balloon payments has shown us a landscape dotted with risks like landmines but also sprinkled with the seeds of possible innovation.

Creativity in finance is the name of the game—a game as complex as learning How To accept The license agreement in Rocket League Future solutions may well be innovative game-changers.

The final word on balloon payments? They might be here to stay, or they could fade into the annals of mortgage history. One thing’s for sure: with knowledge as your guide, you’re set to navigate your mortgage journey with confidence and savvy.

Balloon Payment Puzzlers & Perplexities

The Sky-High Finale of Your Mortgage Story

Ever feel like the end of your mortgage is like the climax of an action flick, with one final, make-or-break moment? That’s your balloon payment. It’s the financial finale where you’ve got to be as prepared as the “kick ass cast” when the director yells, “Action!” In simple terms, a balloon payment is like the boss level in your mortgage game—a large lump sum due after a period of smaller monthly payments.

Inflating the Details

So, why is it called a ‘balloon’ payment, you ask? Picture this: each mortgage payment is like a puff of air into a balloon. Month by month, you’re inflating it. Then, boom! The end of the term hits, and you’ve got this ginormous balloon to pop — metaphorically, that is. Imagine a balloon payment as a mortgage version of hitting the piñata at the grand finale of a party—it’s gotta give!

The Tipping Scale of Risk

Balloon payments often hang in the balance—like walking a tightrope over a fiscal canyon. Get it right, and you’re dancing on air. Get it wrong, and it’s a plummet into the risky abyss. Before taking this daredevil leap, ask yourself, “How To get closing costs Waived?” ‘Cause nabbing a deal sweet enough to dodge those costs might just be the cushion you need when the balloon comes knocking.

The Pre-Game Strategy

Taking on a mortgage with a balloon payment is a bit like suiting up for the big game. You’ve got to have your game plan locked down tight. Now, you wouldn’t jump into rocket league without knowing “How To accept The license agreement in rocket league“, right? Ditto for your balloon payment terms. Don’t sign on the dotted line without knowing every play in the book.

Credit Savviness Is Your Secret Weapon

Pssst… here’s the inside scoop: When you’re building up to that final payment showdown, it’s not enough to just save. Being credit savvy can be as crucial as having the right sidekick in a superhero flick. Get to know your financial standing like the back of your hand. Ready to do some sleuthing on your financial history? Check out “factual data credit inquiry” to ensure your credit score isn’t hiding in disguise, ready to throw a wrench in your plans.

So there you have it, folks! Balloon payments might sound like a party, and they can be if you play your cards right. Just like the grand finale in a blockbuster movie, make sure you’re fully prepped for the big ending—because in the world of mortgages, not every hero wears a cape, but every smart borrower has a plan.

What is a balloon payment in simple terms?

Ah, a balloon payment? Picture this: you’re cruising along, paying monthly installments on a loan like you’re on Easy Street, and then—bam!—you’re hit with a whopper of a final payment, way bulkier than the rest.

Is balloon payment a good idea?

Is a balloon payment a good idea? Well, buckle up, it can be a bumpy ride! It’s tempting with those smaller payments upfront, but when that hefty finale comes, you’d better have a stash of cash or a plan B in your back pocket.

Why would anyone do a balloon payment?

Why would someone choose a balloon payment? Call it a leap of faith or a game of financial chicken—they might have a windfall coming or expect to be rolling in dough later on, making that big payoff seem like small potatoes down the road.

What does 5 year balloon mean?

What does “5-year balloon” mean? Think of it like a countdown—tick, tock, five years to pay at a steady pace before the balloon inflates and you’ve got to cough up the full remaining balance. Surprise!

What are the risks of a balloon loan?

Balloon loans have some pretty inflated risks—like a tightrope without a net. If you can’t pay when the music stops, you could be dancing with foreclosure or forced to refinance, often at less-than-stellar terms.

What are the disadvantages of balloon payment?

Disadvantages of a balloon payment? Yikes, where to start? You’re playing hot potato with a large lump sum, risking higher interest rates later or even losing your asset if your wallet’s not ready for that final heavyweight round.

Why do people avoid balloon mortgages?

Balloon mortgages get the side-eye ’cause they’re a wild card. People dodge them to avoid the shock of that mega payment looming large at the end—it’s like enjoying the party but dreading the cleanup.

Who benefits from a balloon payment?

Who benefits from a balloon payment? Well, it’s a sweet deal for someone who’s confident they’ll have the funds down the line, or for risk-takers juggling their cash flow, hoping to come out on top when the balloon pops.

What is the truth about balloon payments?

The truth about balloon payments? They’re like dessert first—a treat at the outset with the potentially tough stuff saved for last. If your future’s as clear as mud, you might want to steer clear.

Can you refinance a balloon mortgage?

Refinance a balloon mortgage? Sure, it’s an option! If you’re coming up short, you can try for a new loan, like calling a mulligan in golf, but it’s a roll of the dice with interest rates and approvals.

Who is responsible for a balloon payment?

Who’s on the hook for a balloon payment? The borrower, no doubt about it. When the party’s over, and the balloon’s fully inflated, you’re the one that’s got to pop it—hopefully, without it bursting your bubble.

How do you beat a balloon payment?

Outsmart a balloon payment? You’ll need to squirrel away funds, scout out refinancing options early, or consider selling off the asset. It’s playing chess with your finances—anticipate the moves!

How common are balloon payment mortgages?

Balloon payment mortgages are like roller skates at a black-tie event—not super common. They pop up now and then, usually for buyers with specific plans or those who like to live on the edge.

What is a 15 year mortgage with a balloon payment?

A 15-year mortgage with a balloon payment is a long hike with a cliff at the end. You pay as if it’s a standard 15-year loan but, surprise! You’ve got to seal the deal with a plump payment well before time’s up.

How do you take advantage of a balloon payment?

Taking advantage of a balloon payment? If you’ve got nerves of steel and a crystal ball, you can enjoy lower payments now and bet on a brighter financial future to handle the upcoming cash crunch.

How do I avoid a balloon payment on my car?

Avoid a balloon payment on your car? One route is to steer clear from the start, picking a standard loan. If you’re already buckled in, keep an eagle eye on refinancing options or get ready to trade-in when the countdown begins.

How does a 5 year balloon mortgage work?

A 5-year balloon mortgage ticks along for five years with manageable payments, then the moment of truth—you’ve got to pony up the rest of the cash or refinance, which can be like hitting the reset button.

What is a synonym for balloon payment?

Looking for a synonym for “balloon payment”? Call it your grand finale, the last hurrah, or the final showdown—it’s all about that one big payment that’s waiting at the end of your loan’s yellow brick road.