A looming mystery in the world of finances has to do with whether bi-weekly means twice weekly or every two weeks. Conversely, does bi-monthly mean twice a month or every two months? It’s easy to spiral into confusion! But don’t fret friend! You’re about to have a “Eureka” moment as we dive into this ‘bi weekly vs bi monthly’ quagmire.

Excavating the Terms: Bi Monthly vs Bi Weekly

Let’s take a journey where prefixes bear different meanings and words can mean two different things!

The Ambiguity of the Prefix ‘Bi-‘

The prefix ‘bi’ in English is reminiscent of a quick-change artist. It can denote either ‘twice within’ or ‘every two’. Therefore, the term ‘bi-weekly’ might infer ‘twice a week’ or ‘every two weeks’. Similarly, ‘bi-monthly’ could be interpreted as ‘twice a month’ or ‘every two months’.

Dissecting ‘Bi-Weekly’: A Matter of Frequency and Advantage

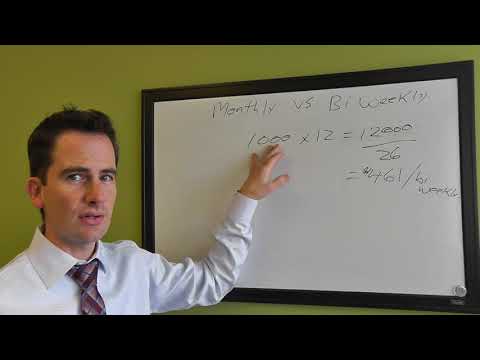

In most contexts, particularly relating to pay cycles and debts, bi-weekly refers to an event occurring ‘every other week’. So, if you opt to make Bi-weekly Payments, it’ll lead to 26 payments a year, which accelerates weekly payments.

Deconstructing ‘Bi-Monthly’: Dual Interpretations and Implications

Wading into bi-monthly waters, things get a tad murkier. It can be interpreted in two ways – as an event happening ‘twice a month’ or ‘every two months’. Your pick, eh!

Is Bi-Weekly Twice a Month or Every Two Weeks?

Clearing the air on our bi-weekly conundrum, let’s remember that language can be a slippery slope.

Exploring the ‘Every Other Week’ Interpretation

Settle into a groove where ‘bi-weekly’ translates to an event happening every two weeks. It’s a handy way when planning mortgage payments!

Delving into the ‘Twice in a Month’ Perspective

Sometimes, just sometimes, ‘bi-weekly’ might be used to describe an event that occurs twice in a month. It’s unusual, but why not add a dash of spice to language?

Is Bi-Monthly Every 2 Months or Twice a Month?

Swinging over to our bi-monthly puzzle, let’s bust its dual identity.

Understanding the ‘Every 2 Months’ View

When ‘bi-monthly’ is used to denote an occurrence every two months, the term aligns more with common usage in budgeting or planning schedules that are not as frequent.

Unravelling the ‘Twice a Month’ Notion

The more popular interpretation of ‘bi-monthly’ is an event happening twice a month. It’s almost like hitting the jackpot — two treats instead of one!

Bi Monthly Pay: A Close Examination

Now that the twin beasts are tamed, let’s dive a little deeper into the dynamics of bi-monthly pay.

Perks of Bi-Monthly Pay

With bi-monthly pay, the wallet sees action twice a month, making budgeting a breeze. Plus, you might just resist that tempting “Samsung washer And dryer” you’ve been eyeing for a while!

Noteworthy Considerations of Bi-Monthly Pay

There’s one hiccup though. Bi-monthly pay doesn’t treat all months equally. Some months stretch longer between paychecks due to their length and the way weekends fall.

Bi-Weekly vs Semi-Monthly: A Compelling Dissection

Moving on to another pressing discourse, the bone of contention — bi-weekly vs semi-monthly.

The Edge of Bi-Weekly Payments: Accelerated Weekly Payments

In the context of mortgage payments, bi-weekly scores a point as it results in additional mortgage payments over a year, aiding in faster loan repayments and interest savings.

The Appeal of Semi-Monthly Payments

In comes semi-monthly payment with its consistent twice a month schedule, like clockwork! It swings you onto a predictable path for planning and budgeting.

Top 5 Unexpected Mortgage Differences: Bi-Monthly vs Bi-Weekly

A Comprehensive Comparison

While the quantum of your paycheck remains the same, whether it’s bi-weekly or bi-monthly, the frequency can impact your budgeting, savings, or overtime calculations.

Utilizing a Biweekly Mortgage Calculator: Gaining Greater Insight

Harness the power of a biweekly mortgage calculator to get a crystal clear picture of possible interest savings and loan-efficiency factors.

Highlighting the Top 5 Differences

Pulling out the magnifying lens, there are five surprising differences between bi-weekly and bi-monthly payments when considering mortgage. You’ll discover the magic of extra payments, compound interest differences, gap in payment dates, budget planning, and how it molds your saving habits.

What Do You Call Every 2 Weeks? Shortlisting Terms

Bi-weekly, fortnightly, semi-monthly? Take your pick! They can all describe an event that occurs every two weeks.

Is it Better to be Paid Biweekly or Bi Monthly?

Choosing between biweekly or bi-monthly pay depends largely on individual financial habits and where one derives maximum benefit.

In the Context of Reducing Debt and Enhancing Savings

A biweekly pay schedule could help you earn an extra paycheck or two, aiding in reducing debt and accelerating saving efforts.

Factoring in Overtime: A Game-Changer for Hourly Employees

Biweekly pay can make calculating overtime much simpler, proving to be a windfall for hourly employees.

Final Walk-through: Decoding your Ideal Mortgage Payment Frequency without the Confusion

Navigating the intricate maze of bi-weekly vs bi-monthly, both with their distinctive pros and cons is like decoding a complex Google Patent! Prioritize your financial goals, assess your budgeting tendencies, and make an informed decision.

Understanding the difference between bi-weekly and bi-monthly as well as assessing your financial habits are key to making the right choice. Remember, the goal is to ensure that mortgage payments align perfectly with your financial landscape, just like state farm home Loans. Now, go forth and conquer your finances!