Understanding ‘Buy Debt’: A Deep Dive into the Concept

Hey folks, let’s talk about something that most might frown upon or outrightly consider risky. Yes, we’re talking about debt. But wait, don’t make that sour face just yet. We’re here to talk about buying debt and why it may just be an intelligent move in your investment strategy.

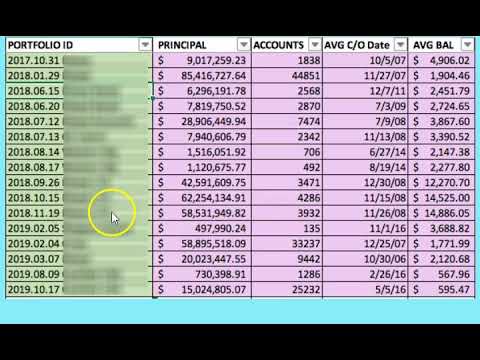

Now, we’re not talking about buying your own debt—that’s an entirely different beast. According to a recent statement on March 1, 2023: “You can’t buy your own debt because no one sells individual debts. Instead, debts are sold in huge portfolios that cover many accounts.” So when we refer to ‘buying debt’, we allude to the act of purchasing another party’s debt instrument.

Purchasing debt, believe it or not, goes waaay back. Both common folk and royalty have used it as an investment strategy since the 12th century, evolving in complexity and scale over the centuries. Fast forward to our era, and the concept is as solid as the cast Of Kaleidoscope—constantly changing, yes, but ever so powerful.

Why Buy Debt? Unearthing the Appeal of Debt Buying as an Investment Strategy

Okay, now you’ve got the basics down. You’re probably asking, “Why in the name of Selma Diamond would I want to buy debt?” Well, my financially savvy crusader, that’s where we delve into the crux of the matter.

Simply put, investors buy debt because there’s money to be made here. Debt buyers are businesses or individuals who purchase debt at a reduced cost, typically for a small percentage of what’s actually due to the original lender. For example, a debt buyer may spend only $100 to buy a $1,000 debt from the original lender. Then, they attempt to collect the full amount, or as much as possible, from the debtor. The difference becomes their profit.

But before you start packing your bags for the gold rush, hold your horses. There’s a flip side to the coin. While the potential benefits are significant, the risks are equally daunting. Debtors may not pay up, legal hassles could arise, or the market conditions could change unfavorably. So, as the financial whizzes often say, “Caveat emptor!” or “Let the buyer beware”—borrowing the tenor of a Reconveyance deed.

| Subject | Description |

|---|---|

| Definition of Buying Debt | Buying debt is effectively loaning money to a company or individual. This process usually occurs when investors purchase bonds issued by companies. |

| Profitability for Debt Buyers | Debt buyers can make significant profits even if they only collect a fraction of the total debt owed. The profit comes from acquiring debts inexpensively and then collecting from the debtors. |

| Price of Buying Debt | The price a debt buyer pays for the debt often amounts to a small percentage of the actual due amount to the original lender. For instance, a debt buyer might pay $100 for a $1,000 debt. |

| Method of Debt Sale | Debt sales rarely, if ever, concern individual debts. Instead, huge portfolios covering many debt accounts are sold to buyers. |

| Considerations for Buying Debt | Investors interested in buying debt should consider the potential yield – the return they get from loaning money. It’s crucial to weigh the initial cost of buying the debt against the potential payout to assess if the investment is worthwhile. |

| Regulations for Buying Debt | It’s essential to note that individuals cannot buy their own debt. No party sells individual debts as it doesn’t make business sense for either side to do this. |

Of Bonds and Defaulted Loans: The Real World of Debt Buying

If you’ve stuck with me so far, congratulations! You’re way past the hurdle of fearing the D-word. So, let’s delve deeper into the types of debt that can be bought—specifically bonds and defaulted loans.

First up are bonds. When companies issue debt, they’re essentially selling bonds. Individuals or organizations who buy these bonds are effectively loaning the company money. The return earned on this loan—through interest paid by the company—is called the yield. It’s like attending a charity dinner—you pay up front, hoping the food and company make it worth your while. Buying debt through bonds is a prime strategy used by large institutional investors.

Next up are defaulted loans. These are debts that the original lender considers ‘bad’ or uncollectible. The lender usually sells these debts for a song to debt buyers, who then try to extract payment— part or whole—from the debtor. Think of this as buying a run-down property and flipping it after putting in some sweat and blood. But remember, this is not a game for the faint of heart. Both bonds and defaulted loans require a keen understanding of the market and a healthy tolerance for risk.

Key Factors to Consider Before You Buy Debt

Alright, now that we know what buying debt entails, we need to talk about the important considerations. Here’s where you need to sit up and pay attention, folks! Buying debt, like any investment, requires careful scrutiny and sensitivity to certain factors.

Risk tolerance is a big one. Can you sleep at night if you know there’s a chance your investment might tank? Next, consider the debtor’s creditworthiness. Is there any realistic chance they’ll pay up? What are the prevailing interest rates? And where exactly does buying debt fit into your investment portfolio?

Essentially, buying debt should be like joining a Homeowners association—you’ve analyzed all the pros and cons, understand the rules of the game, and are ready to make an informed decision.

Techniques of Analyzing Debt Before Buying: Ensuring Prudent Investment

Okay, people, this is where things get analytical and technical. But hold on—it’s essential. The key to beating the market often lies in the details.

First up, understand the fundamentals of the company behind the debt, much like how a broker would scrutinize a property before formulating his broker ‘s price opinion. Look at the financial health, industry position, and market trends. Deep-dive into the financial statements—a jungle of numbers and ratios—to hunt for hidden risks and opportunities.

Next, evaluate the terms of the debt itself. How much interest is the company offering on its bonds? What’s the nature of the defaulted loan? Is it backed by collateral? What’s the total return potential? The finer the details, the more solid your footing.

The Positive Impact and Potential Pitfalls of Debt Buying: An In-Depth Analysis

Like every investment strategy, buying debt has its heroes and villains—its sunny days and rainy ones.

On the positive side, buying debt can provide attractive returns, particularly when the debt is undervalued or when interest rates are high. Moreover, it gives investors a way to diversify their portfolio and can yield consistent returns if done correctly.

However, the potential pitfalls are just as stark. Debtors might default, making your investment worthless. Market volatility can impact the value of debt instruments. Plus, the steep learning curve and potential legal issues can add to the challenges.

So, it’s clear that while buying debt can be a heroic move for your portfolio, it requires caution worthy of a villainous ambush.

Navigating Contemporary Debt Buying Market: The Scenario in 2023

Fasten your seatbelts, folks—we’re getting into the DeLorean and heading straight into the present scenario of debt buying—2023, to be precise.

It’s an era of technological innovations and decentralization, with new players and platforms cropping up quicker than pop-up ads. The rise of fintech firms and P2P lending platforms has created a progressive, dynamic scenario for debt buying. Savvy investors leveraging advanced analytic tools have an edge over their less sophisticated counterparts.

But be warned, the waters have been muddied by issues like rising global debt, economic uncertainties, and increasing regulatory scrutiny. Treading these waters calls for prudence, foresight, and one heck of a reliable life jacket.

Expert Predictions: The Future of Debt Buying as an Investment Strategy

Now, for our final act, we peek into the crystal ball and discern the future of debt buying. No, we’re not fortune tellers. But we’re good at reading trends.

Most experts predict a continued evolution of the debt buying market, driven by technology and regulatory changes. We anticipate a rise in alternative, decentralized platforms offering debt buying opportunities. Moreover, as advanced data analytics become common, expect a more sophisticated debt valuation and management approach.

However, don’t expect it to be all smooth sailing. Economic uncertainties and potential tightening of financial regulations could pose challenges. Remember, navigating the future requires flexibility and an open mind, armed with the wisdom of the past.

Final Thoughts: Deciphering the Path of Prudent Investment

Wow, what a ride we’ve had, from understanding ‘buying debt’ to predicting its future! Here’s the deal, folks: investments are a gamble, and buying debt isn’t an exception. It’s got its high points—it can give your portfolio an exciting twist and potentially lucrative returns. But it demands you roll up your sleeves, hit the books, and keep that thinking cap firmly on.

Bear in mind that investment strategies should be as unique as you are. Remember, what worked for Peter Parker might not do the trick for Tony Stark. Buying debt could be your winning move, or it could be your kryptonite. The trick lies in doing your homework, keeping your eyes wide open and never—ever—stopping learning.

That’s all, folks! Keep investing, keep learning, and above all—keep asking questions. Until next time!

Can you really buy debt?

Well, yeah! You can absolutely buy debt. It’s a common practice – especially among businesses and investors. They literally purchase the rights to collect money owed by others, usually those with overdue accounts, aka debtors. It’s a kind of “one man’s trash is another man’s treasure” scenario!

Is it profitable to buy debt?

Hold your horses, buying debt can indeed be profitable! Although it’s not a piece of cake, businesses that buy debt for a lower price try to collect the full amount from debtors, thereby earning a profit. It’s a bit like finding a tenner in an old coat pocket!

What does it mean to buy debt?

When you hear someone say they’re “buying debt,” it doesn’t mean they’re hoarding IOUs. They’re actually purchasing the right to collect the money that someone else owes. Imagine it like picking up someone’s check at dinner, but expecting the friend to pay you back later.

How much do you buy debt for?

The cost of buying debt isn’t set in stone. Debt buyers often pay only pennies on the dollar for it. This could be anything from less than 1% to nearly 40% of the total debt value. It’s all a matter of negotiating and finding the best bang for your buck!

What is zombie debt?

“Gee whiz, zombie debt” you might say upon hearing this term. It’s a name for old debt – often past the statute of limitations – that comes back to life when debt buyers try to collect on it. A bit like a zombie, hence the name!

How to get $10,000 out of debt?

Climbing out of a $10,000 debt hole isn’t easy, but with a sound game plan, it’s doable. Start by creating a budget, cutting expenses, and seeking additional sources of income. It’s like losing weight – small changes can have big results!

How to make money from buying debt?

Well, isn’t buying debt and making money the million-dollar question! The debt buying business works by purchasing the debt at a lower amount and then trying to recover the full amount, or at least more than what they paid. Bit like buying a fixer-upper house and selling it for much more, after renovations.

How do rich people use debt to get richer?

Rich people often use debt as leverage to increase their wealth. That’s right, they borrow money to invest in opportunities that will generate high returns. It’s all about making money work for you!

Can I buy debt for pennies?

Yes siree, you can buy debt for pennies on the dollar. Debt buyers often purchase debt for a fraction of the total owing amount. In a sense, it’s akin to getting a car at a discounted rate, only to sell it at full price!

Why would investors want to buy debt?

Investors would want to buy debt because there’s a potential for profitable returns. Just like a pot of gold at the end of a rainbow, they’ll buy the debt for less and aim to collect more than what they paid.

Why do investors buy debt?

Investors buy debt as it can be a potential income stream. If they can collect the full amount owed, they’ll be sitting pretty with a tidy profit. It’s a bit like buying low and selling high in the stock market.

What happens after 7 years of not paying debt?

What happens after 7 years of not paying debt? Goodness gracious, it’s not a great situation. Typically, that debt falls off your credit report, but not always. In some cases, your debt can become “zombie debt” and you could still be pursued for it.

Is $5000 in debt a lot?

One might gasp at a $5000 debt but, in truth, whether it’s a lot depends on your personal situation. If you’re earning a six-figure salary, it might be manageable. But if you’re on a tight budget, it could feel like a mountain.

Is $20,000 dollars a lot of debt?

Gosh, $20,000 sounds like a lot of debt, doesn’t it? Again, what’s considered “a lot” depends on your income. To a millionaire, it’s pocket change. But to your average Joe, it could be a huge burden.

Is $1,000 dollars in debt bad?

If you’re asking, “$1,000 in debt, is that bad?” The answer isn’t black and white. It could be, depending on your situation, income, and ability to pay it off. It’s like asking if a splinter is bad – it hurts, but it’s not the end of the world.

What happens when someone buys your debt?

When someone buys your debt, they acquire the rights to collect what you owe. It’s a bit like when your tab gets transferred to another bartender who now expects you to pay up.

Who is buying all the debt?

Who’s buying all this debt? Mostly businesses and investment firms. A bit like how antique collectors invest in old stuff, hoping its value will increase over time.

How many debt buyers are in the US?

As for how many debt buyers are in the US, the number is somewhere in the thousands! Yes, it’s a bustling marketplace, akin to a busy flea market, only the wares are past due accounts, not vintage clothes!

How much do Lowell buy debts for?

Lowell, a debt purchasing company, buy debts for varying prices. Just like haggling at a garage sale, the amount they pay depends on several factors, including the age and type of debt.