In a world where financial surprises lurk around every corner, the allure of quick cash solutions can seem like a beacon in the storm. Cash Depot represents one such harbor, offering payday loans to those in choppy financial waters. But as with any port in a storm, it’s essential to understand the nature of the shelter it provides.

Unpacking Cash Depot: Core Services and Payday Loan Essentials

Cash Depot payday loans are a financial service designed to bridge the gap between paychecks during times of financial strain. These short-term loans cater to urgent needs, providing a lifeline when the timing of expenses doesn’t sync up with your bank account’s ebb and flow.

Cash Depot Terminal Management

$0.00

The Cash Depot Terminal Management system is a state-of-the-art solution designed to streamline and optimize the operation of your ATM fleet. This innovative platform provides an intuitive user interface through which business owners can monitor and manage their terminals efficiently, ensuring maximum uptime and customer satisfaction. The system offers real-time analytics and reporting tools that track transaction volumes, operational status, and maintenance needs at a glance, which helps in making informed decisions and enhances profitability.

With advanced security features, Cash Depot Terminal Management safeguards sensitive data and complies with industry standards, offering peace of mind for both operators and users. The system includes end-to-end encryption, multi-factor authentication, and regular security updates to address emerging threats. Automated alerting and incident response mechanisms ensure that potential issues are identified and addressed rapidly, minimizing disruption to service and mitigating risk.

Moreover, the Cash Depot Terminal Management platform is designed for scalability, accommodating businesses of all sizes from a modest number of ATMs to large, complex networks. Easy integration with existing banking and payment systems allows for seamless operations and continuous functionality enhancements. Furthermore, the system’s remote diagnostic and troubleshooting capabilities enable swift resolution of issues, substantially cutting down on field service costs and downtime. With Cash Depot Terminal Management, businesses can expect an improved operational efficiency that translates into a better end-user experience and a stronger bottom line.

Analyzing the Check Depot Methodology

Delving into Cash Depot’s approach is like dissecting a well-oiled machine. The meticulous method behind their speedy service includes:

| Feature | Description | Potential Benefits |

| Service Availability | 24/7 access to cash through strategically placed ATMs or branches. | Convenience, Accessibility |

| Security Measures | Use of encryption, surveillance, and authentication methods. | Safety of transactions, Reduced fraud |

| Denomination Options | Availability of various bill denominations for withdrawal. | Customizability, Efficient transactions |

| Deposit Services | Capability for users to deposit cash or checks at select locations. | Time-saving, Streamlined banking |

| Fee Structure | Transparency about any charges for withdrawals or other services. | Cost management, No surprise fees |

| Network Coverage | Number of ATMs or branches available domestically and internationally. | Wide accessibility, Travel convenience |

| User Interface | Ease of use and language options of ATM screens or software. | User-friendliness, Inclusivity |

| Customer Support | 24/7 helpline, online chat, or in-person assistance. | Effective problem resolution |

| Technology Integration | Mobile app connectivity, cardless transactions, biometrics. | Modern banking, Enhanced security |

| Compliance | Adherence to local and international regulations (e.g., AML). | Legal reliability, Trustworthiness |

| Business Customer Options | Special services for businesses such as armored transport or cash vaults. | Business efficiency, Secured handling |

Covered 6 and Consumer Protection: Cash Depot’s Safety Measures

Within the fast-paced milieu of payday loans, consumer protection is paramount. Measures ring-fence the vulnerable, ensuring that the fast cash doesn’t precipitate a financial freefall.

Graham Packaging and the Anatomy of Cash Depot Loans

Dissecting the anatomy of a Cash Depot loan reveals more than just numbers—it’s about understanding the economic ecosystem it creates.

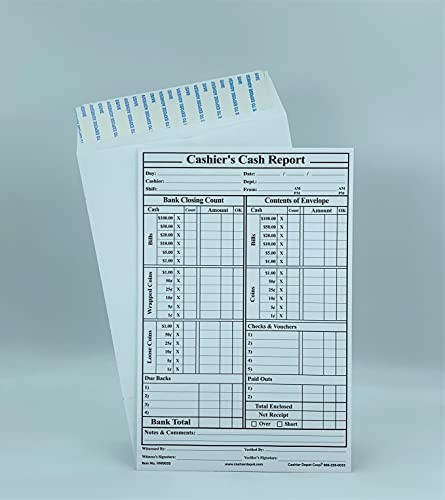

Cashier Depot Cashier’s Cash Report Envelopes, x , Open End, Premium, Peel & Seal Closure, Envelopes (lb. White)

$54.99

The Cashier Depot Cashier’s Cash Report Envelopes provide a highly efficient and secure method for cashiers to manage, organize, and transport daily cash reports. Made from premium, heavyweight lb. White paper, these open end envelopes are designed to withstand the rigors of daily handling and transportation, ensuring that cash reports remain confidential and in pristine condition throughout the process. The envelopes come in a practical “x” size, offering ample space for standard-sized cash report documents and additional records that may need to accompany them.

One standout feature of the Cashier Depot Cashier’s Cash Report Envelopes is the Peel & Seal Closure system, which elevates the convenience and security aspects for users. This innovative adhesive strip along the envelopeâs edge allows for quick sealing without the need for moisture, thereby minimizing the risk of document exposure and enhancing tamper resistance. The strong seal ensures the contents are safeguarded until intentionally opened by the recipient, giving both sender and receiver peace of mind regarding the envelopeâs integrity.

Perfect for retail businesses, restaurants, financial institutions, and any other setting where secure cash handling is necessary, these envelopes assist in the smooth operation of financial management. Further streamlining the cash reporting procedure, the white surfaces of the envelopes allow for easy labeling or writing, so specific details can be added for identification purposes. The Cashier Depot Cashier’s Cash Report Envelopes provide a professional, reliable, and simple solution for managing daily financial transactions with confidence and ease.

The Watco Companies Approach to Payday Lending at Cash Depot

The mechanics behind getting that cash into your hands is a marvel of logistic efficiency, akin to the operations of the Watco Companies.

Assessing Cash Depot’s Financial Impact on the Wholesale Unlimited Demographic

The Wholesale Unlimited demographic represents the wide swath of society that turns to Cash Depot for a financial boost.

In God We Trust All Others Pay Cash

$12.39

“In God We Trust All Others Pay Cash,” an enchanting blend of humor, nostalgia, and social commentary, is a captivating novel by Jean Shepherd. Transporting readers to the midwestern America of the 1930s and ’40s, the book unravels through a series of vignettes, each more delightful and poignant than the last. The narrator’s voice, both wistful and witty, guides us through his childhood memories, where the simplest of episodes are elevated to extraordinary heights through the magic of Shepherd’s storytelling. It’s a heartwarming journey into the past, filled with quirky characters and relatable misadventures, resonating with anyone who revels in the bittersweet tang of nostalgia.

Each tale is framed within the context of the adult narrator’s present-day conversations at Flick’s Tavern, where the currency of choice is not just money, but stories and laughter. The book’s title, “In God We Trust All Others Pay Cash,” resonates deeply, marrying the concept of childhood trust and innocence with the adult realization of life’s practicalities. Shepherd’s work masterfully showcases the shifting perspective from childlike wonder to the more cynical, money-driven mentality of adulthood, inviting reflection on the values and experiences that amount to a life well-lived.

Amidst the humorous anecdotes and larger-than-life characters, Shepherd subtly critiques the consumerism and media influence burgeoning in American society at the time. This timeless classic is not just an escape into the past; it’s a mirror held up to the present, urging readers to ponder the price of progress and the treasures of tradition. “In God We Trust All Others Pay Cash” is not merely a collection of nostalgic tales; it is a treasury of American wit, wisdom, and a reminder that some thingsâin particular, the value of a good storyâare indeed priceless.

Innovative Financial Solutions or Debt Traps? Expert Opinions on Cash Depot Payday Loans

When it comes to payday loans, the jury is out, with opinions straddling the spectrum from savior to shark.

Navigating the Future with Cash Depot: Trends and Predictions

Cash Depot, like any entity, must bob and weave with the tides of financial trends and the winds of change sweeping through the industry.

Steering Clear of Pitfalls: Best Practices for Prospective Cash Depot Borrowers

Dipping a toe into the payday loan pool? Here are some floaties to keep you buoyant.

Echoes from the User Perspective: Cash Depot Reviews and Testimonials

Every borrower’s journey is littered with stories that can serve as lessons or warnings for the fellow traveler.

The Broader Picture: Cash Depot within the Payday Loan Landscape

Cash Depot isn’t an island but part of a vast archipelago of payday lenders, each vying for your attention.

Navigating the Waters of Short-Term Financing with Savvy and Insight

Embarking on a voyage with Cash Depot requires charting a course with care and shrewdness.

In the relentless ebb and flow of life’s financial demands, services like Cash Depot beckon with promises of quick fixes and rapid relief. Yet, they require a navigator’s acute sense of direction and a sailor’s respect for the mercurial nature of the seas. With this comprehensive guide, you stand on the deck, compass in hand, eyes set on the horizon of informed choices.

Cash Depot: Not Your Average Piggy Bank!

Ah, cash depots. You might think they’re just another humdrum part of the financial landscape, but hold your horses! These aren’t your grandma’s cookie jars – there’s a whole lot more jingle in these pockets. So, buckle up as we dive into some nifty trivia and facts that’ll make you the whiz of payday loan banter at your next barbecue!

Money Now, But At What Cost?

Ever been in a pinch where you think, “If only I had a tad more dough to tide me over!” Well, this is where Cash Depot Payday Loans( jump into the fray. It’s like calling in the cavalry when the chips are down. But here’s the kicker—these loans can come with a hefty price tag. The interest rates? Sometimes they’re enough to make your eyes water. So it’s no wonder that payday loans can be as sticky as molasses in January if you’re not on top of them.

The Quick Fix That Stuck Around a Bit Too Long

Pop quiz! When did payday loans first make their grand entrance? If you guessed sometime in the 1990s, give yourself a pat on the back. It all began as a solution to get folks out of financial scrapes, quick and easy. But, whoa Nelly, did it take off like a rocket! Now, cash depots have turned into a multi-billion-dollar industry,( sprawling across the globe. Mind-boggling, ain’t it?

A Worldwide Wallet to Wallet Web

Did you know that payday loans aren’t just an American hustle? You bet your bottom dollar they’re not! These loans have spread their wings worldwide. From the bustling streets of London to the sun-kissed shores of Australia, cash depots are as common as kangaroos. It’s a testament to how the need for quick cash is a shared experience, no matter where you hang your hat.

The Anatomy of a Payday Loan

Let’s break it down now. What exactly goes into a payday loan from a cash depot? Think of it like a recipe. You’ve got your basic ingredients: a smidgeon of personal info, dollops of income proof, and finally, a pinch of bank account details. Mix it all together, and boom—you’ve got yourself a short-term loan( that’s hotter than a June bride in a feather bed. But remember, you’ve gotta have the right seasoning (read: credit checks) for it to work out in your favor.

The Rolling Stone Gathers No Moss, But Does It Gather Interest?

Now, it’s no secret that payday loans have their naysayers. Critics argue that these loans are like rolling stones that gather no moss but definitely rack up the interest! Some folks see them as necessary evils—quick fixes that can turn into long-term headaches if you’re not careful. But on the flip side, proponents will tell you they’re lifesavers during a financial drought.

A Payday Loan by Any Other Name…

Finally, let’s settle this once and for all. “Cash advance,” “check loan,” “deferred deposit transaction.” These are just a few aliases that payday loans are hiding under. But don’t let the fancy names fool you. At the end of the day, they all serve the same purpose: to fill your wallet faster than you can say “show me the money.”

Who knew the world of cash depots and payday loans could be chock-full of such fascinating tidbits? Now that you’re armed with these conversational gems, you can jazz up any talk around the water cooler. Remember, though, while knowledge is power, with great power comes great responsibility—especially when it comes to managing those dollars and cents!

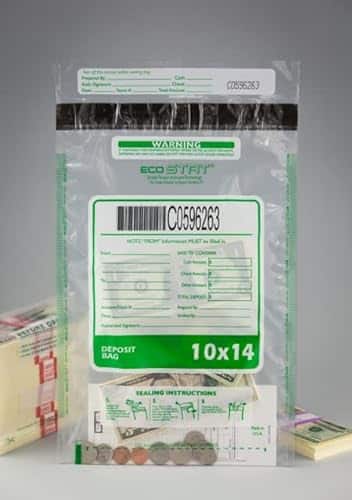

Cashier Depot Tamper Evident Deposit Bags, x Clear, Serialized Numbering, Barcode, Press & Seal Void Closure Tape (Bags)

$34.99

Cashier Depot’s Tamper Evident Deposit Bags offer a high-security solution for handling daily cash and check deposits. These bags are transparent, allowing quick visual verification of the contents without compromising the sealed enclosure. Each bag comes with unique serialized numbering and a corresponding barcode, providing an additional layer of security and ease in tracking and managing deposits. The clear design not only provides visibility but also deters unauthorized access as any tampering attempt becomes immediately noticeable.

Designed with user convenience in mind, these deposit bags feature a Press & Seal Void Closure Tape that ensures a secure, permanent seal. The adhesive closure is designed to display a “VOID” message if the bag is tampered with, indicating potential security breaches. This feature is critical for businesses that require a reliable method for transferring sensitive transactions to banks or financial institutions. Users can trust that the integrity of their deposits will remain intact from the moment the bags are sealed until they’re safely delivered and verified by the receiving party.

These Cashier Depot deposit bags are ideal for a wide array of sectors, including retail, hospitality, restaurants, and any other environment where cash handling and transport is a daily operation. They are an essential tool for loss prevention departments and internal cash transport protocols. With durable construction and tamper-evident features, these bags ensure that businesses can protect their deposits against theft and fraud. The inclusion of serialized numbering and barcodes on each bag allows for efficient deposit tracking and auditing, thereby promoting accountability and enhancing security protocols.