Stepping into the world of mortgages and financial planning can feel like trying to decode an alien language, especially when terms like ‘consolidation’ start popping around. But fear not, brave reader, for today, we’re diving headfirst into the riveting world of debt consolidation, setting sail for financial freedom in 2024. Let’s get stuck in!

Grasping the Concept of Consolidation

Imagine if you could bring together all your monthly bills – the car payment, student loans, credit card debts, etc. – into a single, unified whole. That’s the beauty of consolidation. This financial toolbox allows you to merge multiple debts into one single loan, typically with a lower interest rate.

Grappling with the importance of (consolidation) in financial planning can be as satisfying as savoring a cup of the best coffee burr grinder-brewed java. It simplifies your finances while often providing lower payments over the long haul.

But let’s not get consolidation confused with condensed financial statements. While both aim to simplify, they differ significantly. A consolidated financial statement covers a company and all its subsidiaries in one document. In contrast, a condensed version provides a summary. So, consolidation provides more detail, while a condensed report is a tad more brief.

Establishing the Need to Consolidate Debts

With 2024 in full swing, the rising need for debt consolidation has been as gripping as a Min Hyorin drama series. Increased cost of living, higher interest rates, and mounting personal debts have all played starring roles in this storyline.

One critical trigger for folks opting to consolidate debts is the desire for easier management of finances and reduced monthly payments. Indeed, debt consolidation plays a central role on the stage of financial freedom, like the hero in a classic tale.

| Consolidation Type | Description | Key Points |

|---|---|---|

| Consolidated Companies | The process of bringing together separate parts into a unified whole. For instance, merging of companies. | The new organization contains all the assets and liabilities of the merged companies. |

| Consolidated Financial Statements | These financial statements give information about an organization and all its subsidiaries in the same document. | This includes revenue, expenses, assets, and liabilities of parent and subsidiary companies. |

| Condensed Financial Statements | A summarized version of consolidated financial statements. | Provides a succinct and to the point financial overview. |

| Amalgamation | Typically refers to the merger process, whether with a nature of merger or purchase. | The resulting entity pools all assets, liabilities, and shareholders’ interests of the participants. |

| Excel Consolidate Function | Excel function allows an analyst to combine information from multiple workbooks into one place. | Useful tool for data summarizing and analysis. |

| Unused or Unwanted Items Discarding | Part of consolidation is the discarding of unused or unwanted items in order to streamline and organize. | This is particularly relevant in scenarios such as consolidating a home library or cleaning out a workspace. |

| Consolidated Synonyms | Popular synonyms include solid, tight, circumscribed, compact, confined, and confining among others. | These synonyms shed light on the essence of consolidation; bringing together into a solid, unified entity. |

Understanding the Bank of America Debt Consolidation Loan

One surefire option available for those keen to consolidate debts is the Bank of America Debt Consolidation Loan. Picture it as your trusty sidekick in this financial journey, offering fixed interest rates and flexible loan terms.

The application process? It’s easier than pie! Pop into their website, apply online, and you’re off on your road towards becoming debt-free.

Does Debt Consolidation Hurt Your Credit?

Now, let’s debunk some myths. A common misconception is that debt consolidation damages your credit scores. But truth be told, it doesn’t have to. Done right, consolidation can even spruce up your credit scores!

Sure, there might be a slight dip at first when you apply for a new loan due to the hard inquiry on your credit report. Yet, with timely payments and decreased credit utilization, you could see your credit scores soar soon enough!

First Fast Path to Financial Freedom: Debt Consolidation Loans

Much like a trusty old pickup truck, debt consolidation loans are reliable and straightforward. These loans combine all your debts into one manageable loan with a fixed interest rate, often leading to lower monthly payments.

Folks with high-interest debts such as credit cards or significant loans stand to gain the most from this option. But remember, it’s not a free ride. Ensure to keep up with payments and avoid racking up more debts.

Second Fast Path to Financial Freedom: Credit Card Balance Transfers

Shuffling your credit card balances around may sound like a precarious game of Jenga, but it’s a legitimate strategy! By transferring all your credit card debts onto one card, you could simplify your payments and take advantage of lower interest rates.

But beware of the pitfalls! Some balance transfers come with fees, and the promotional interest rates don’t last forever! Always compare your options before hopping on this rollercoaster ride.

Third Fast Path to Financial Freedom: Home Equity Loans

You’re probably thinking, “But what’s home equity got to do with consolidating debts?” Glad you asked! Using a home equity loan to consolidate your debts could offer a lower interest rate than other loans.

However, it’s not always sunshine and rainbows. The biggest drawback? Failure in repaying could mean you forfeit your humble abode. So, tread carefully!

Fourth Fast Path to Financial Freedom: Peer-to-Peer Lending

Ever considered joining forces with fellow debtors to overthrow the towers of debts looming over your financial landscape? That’s essentially what Peer-to-Peer (P2P) lending entails. It’s a form of debt consolidation where you borrow money from individuals rather than banks.

P2P lending can offer lower interest rates and flexible payment terms. But remember, the risks are shared in this camaraderie of debtors. Defaulting on payments can hurt not just your credit score but your lender’s too.

Fifth Fast Path to Financial Freedom: The Role of Personal Savings

We can’t stress this enough: Don’t overlook your personal savings! These could be your secret weapon in the battle against debt.

However, relying solely on personal savings for debt consolidation could be a tad challenging. It’s like balancing a spoon on your nose; it requires patience, discipline, and a rock-solid savings plan.

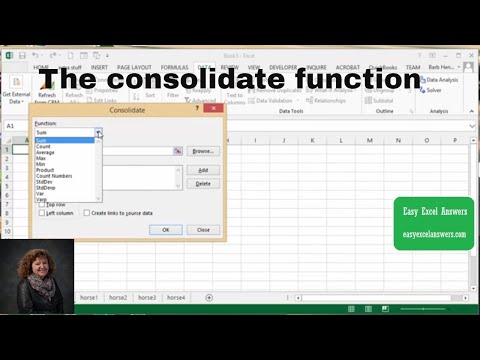

Simple Debt Solutions: Use of Excel’s Consolidate Function and Debt Snowball Method

Before you scoff at the idea of using Excel for managing debts, let us stop you right there. The Excel’s Consolidate Function can be a real game-changer. It lets you combine information from various locations, making debt management more manageable.

Next up is the Debt Snowball Method. It’s a simple yet effective strategy of prioritizing smaller debts before moving onto larger ones. A series of small wins leads to a more significant victory!

Achieving Financial Freedom through Amalgamation

Leaving no stone unturned, it’s time to shine a spotlight on amalgamation. It essentially involves bringing together two or more companies to strengthen their financial stability. When applied in financial planning, it can help reduce liability and consolidate debt.

Steps to Consolidate Successfully and Sustain Financial Freedom

To embark on your journey towards consolidation and financial freedom, you’ll need a dash of discipline, a dollop of determination, and a generous sprinkle of smart planning.

Stay keen as a hawk and maintain financial awareness post-consolidation. And remember, the journey towards financial liberation is not a sprint; it’s a marathon!

Parting Thoughts: Your Personal Roadmap to Debt Free Living!

Congratulations! You’ve now got a good grasp on how to consolidate your debts in 2024. Remember that the path to financial freedom depends on your personal circumstances, including your income, your existing debts, and your financial goals.

As you start out on your road to debt consolidation, bear in mind that your journey towards financial freedom will have its bumps. But with the right mindset and approach, you’re sure to sail through.

Here’s to financial freedom and a life free of debt. Let’s raise a toast to a future where money worries take a back seat, and peace of mind takes the wheel!

What does it mean to consolidate something?

Well, let’s break it down. When you consolidate something, it’s a bit like tidying up a messy room. Essentially, you’re taking multiple elements – it could be files, bills, or even debts – and combining them into a single, more manageable unit.

What is another word for consolidated?

Alias alert! Consolidated can also be referred to as merged, unified, or combined. Language can be oh-so-flexible!

What does consolidate mean in a sentence?

Using the word consolidate in a sentence? Sure, you might say – “I need to consolidate all my scattered notes into a singular report”. That’s essentially mopping up loose ends into a composed unit.

What’s the difference between condensed and consolidate?

Condensed and consolidated, aren’t they the same you ask? Well, no! While both seem to imply ‘reducing’ something, they’re used in different contexts. Condensed typically means to make something shorter or more compact, while consolidating is about merging different elements together.

What is an example of consolidate?

An example of consolidate, you say? How about this: “After her shopping spree, Alex decided to consolidate all her purchases into one bag for easier transport.”

How do you consolidate something?

Now, consolidating something isn’t rocket science. It simply means pulling together similar or scattered items or activities and combining them into one. Like merging your multiple credit card payments into a single loan.

Does consolidate mean merge?

Ah, good question! Does consolidate mean merge? Yes, in many contexts, consolidating does mean merging or combining several elements into one.

What does fully consolidated mean?

Fully consolidated, what’s that? Well, it’s when all subsidiary entities of a company are completely merged into its financial statements. It’s like having all your family members under one roof in the book of finance.

What does most consolidated mean?

Most consolidated, eh? This term is often used to describe the highest level of consolidation, or the point at which something cannot be further combined or merged.

Why do we consolidate?

Why do we consolidate? Well, just as you’d clean up your desk to improve efficiency and organization, we consolidate to make things simpler and more manageable. Heap it all heap into one pile and it’s easier to handle!

Why would you consolidate?

Why would you consolidate? Consolidating can ease your tasks and enhance your efficiency. Instead of juggling several balls, you’re just bouncing one. Makes sense, doesn’t it?

What does consolidate mean in work?

In the work context, to consolidate means to streamline multiple tasks or processes into a single, efficient process. It’s all about making your job easier and more efficient.

What are the two main types of consolidation?

The two main types of consolidation, you ask? Well, they’re financial consolidation (as in business) and data consolidation (like in IT). Essentially, it’s about money and information.

What does consolidation mean in writing?

In writing, consolidation means bringing together different ideas, arguments, or pieces of evidence into a cohesive whole. It’s like quilting with words!

What happens during consolidation?

During consolidation, a number of elements or entities are merged into one unified unit. It’s like the commotion during a school group photo – everyone’s brought together for the final shot.

What does it mean to consolidate tasks?

To consolidate tasks means to unify similar tasks into one single process. It’s about bidding adieu to running in circles and embracing streamlined efficiency.

What does consolidate mean in business?

In business lingo, to consolidate means to merge several smaller entities into a larger one. It’s like making a business smoothie out of various corporate fruits.

What does consolidate mean in Excel?

In the world of Excel, consolidation means combining data from multiple worksheets into a single one. Just think of it as a spreadsheet potluck!

Why would you consolidate?

Why would you consolidate? Well, it’s all about wrapping a plethora of items or tasks into a neat parcel for ease and efficiency. Pretty convenient, huh?