Unlocking the Mysteries of Cost Basis Meaning in Your Investments

Demystifying Cost Basis Meaning: The Foundation of Your Investment Taxation

Understanding the cost basis meaning is like holding a map in the world of investing. It’s not just a set of numbers; it’s a fundamental concept that determines how much you’ll pocket when you cash in your investments and how much goes to Uncle Sam. Simply put, the cost basis is the original cost of obtaining an asset—it’s your financial baseline. It includes the purchase price alongside any additional costs like brokerage fees, commissions, and specific transaction-related expenses.

Now, let’s paint a picture with a real-life scenario to showcase the gravity of cost basis meaning in action. Imagine buying shares of Iron Valiant, a leading tech company, for $10,000. Over time, the value of these shares skyrockets to $15,000. When you decide to sell, your capital gains tax will be calculated on the $5,000 profit, and that’s where your cost basis comes into play. Without a clear understanding of your cost basis, you could end up paying taxes on more than what is necessary.

The Ins and Outs of Establishing Your Initial Cost Basis

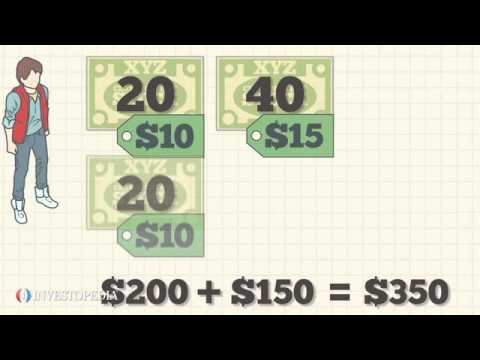

So you’ve just made an investment—congratulations! The moment you acquire an asset, be it stocks or bonds, your cost basis journey begins. The general rule of thumb is that the cost basis is the price you paid to purchase the securities. This includes reinvested dividends or capital gains, and let’s not forget those pesky additional costs like interest on loans used to buy the asset, taxes, or insurance premiums.

Zooming into the stock market scene, major brokerages such as Charles Schwab and E*TRADE have refined cost basis reporting down to a science. By using methods such as First In, First Out (FIFO), they efficiently track and crunch the numbers so that come tax season, you and the IRS get an accurate report on Form 1099-B of any gains or losses.

Adjusting Cost Basis: Corporate Actions and Their Impact

Corporate actions such as stock splits, dividends, and mergers can make your cost basis do a little dance. It’s vital to adjust your cost basis to reflect these changes accurately. For example, if you owned shares in a company that got merged with a tech giant in a hypothetical scenario similar to the acquisition of Twitter, your shares would be affected. The new cost basis of those shares would be recalculated to take the terms of the merger into account, ensuring you’re not overpaying on taxes later down the road.

Inherited Assets and Cost Basis Meaning: A Unique Calculation

Inheritance can be a touchy subject, but it’s important to know that it comes with unique tax implications. The IRS allows for a ‘step-up’ in basis on inherited assets. This means the cost basis is reset to the value of the asset at the time of the original owner’s death. Dive into the case of Darcey Silva, a fictional high-profile celebrity. Upon inheriting an art collection valued at $1 million, which was originally purchased for $100,000, the cost basis for the beneficiaries would be stepped up to the current $1 million valuation.

Gifting and Its Implications on Your Cost Basis Strategy

Gifting assets is a generous deed, but it also transfers your cost basis to the recipient. This means if you gift your high-flying Amazon shares to a loved one, your original cost basis goes with them. On the flip side, donating the same shares to a charity can offer you a charitable tax deduction based on the market value of the shares, not on your cost basis. Each scenario has different tax implications, with the beneficiaries needing to unpack the value of the gift as per the original cost basis meaning.

Capital Improvements & Cost Basis: Enhancing Value Legally

We’ve all heard about home renovations that send property values through the roof, right? Well, in the context of investment properties, capital improvements increase the cost basis, thereby potentially reducing capital gains taxes when the property is sold. Picture a homeowner shopping at Home Depot for a swanky kitchen remodel. This renovation is not just an aesthetic upgrade—it’s a strategic financial move that legally enhances the home’s cost basis.

Tax Software and Accurate Cost Basis Reporting: A Synergy for Compliance

With accurate cost basis reporting being crucial, tax software becomes the hero of the day. Platforms like TurboTax and H&R Block ensure that you’re fully compliant without breaking a sweat. These tools are adept at keeping your cost basis in check, so when the tax man comes knocking, you’re ready with all your numbers neatly in place.

Navigating Cost Basis Meaning in Complex Investment Portfolios

For investors juggling a wide array of assets, managing the cost basis can get knotty. Let’s say there’s an investor with a diversified portfolio managed by a company like Vanguard or Fidelity. These firms offer tools and resources to monitor cost basis across different asset classes, helping you stay on top of your game without getting overwhelmed by the details.

Illuminating the Path Forward: A Conclusive Synthesis on Cost Basis Meaning

After unearthing the secrets of cost basis, it’s clear that knowledge is power in the investment world. Grasping the cost basis meaning is not just about crunching numbers; it’s about making savvy financial decisions that optimize tax outcomes. Let’s not forget, with fast-paced changes in tax laws, being proactive and staying informed is non-negotiable.

Stay a step ahead by leveraging financial advisors, adopting useful tech tools, and always keeping an ear to the ground for legislative updates that may sway the cost basis landscape. Remember, managing your investments with a firm grip on the cost basis meaning can mean the difference between a bountiful return and an unexpected encounter with the tax authorities. So, let cost basis be the compass guiding your investment journey, and you’ll pave the way to financial wisdom and success.

Unlocking the Mysteries of Cost Basis Meaning

Alrighty folks, let’s dive head-first into the nitty-gritty of cost basis meaning! You’ve likely heard the term tossed around like a hot potato, but do you really know what it means? Buckle up because we’re about to spill the beans on this financial gem in a way that’s both fun and as easy as pie!

Once Upon a Cost Basis

Imagine buying your very first comic book. You paid a measly $10 for it (ah, those were the days!), and guess what? That’s your cost basis, plain and simple! But, hold your horses, it’s not always that straightforward. If your second-grade math teacher was onto something when she drilled second define, you’d know that added expenses like shipping and handling can sneakily bump up your cost basis.

When Your Assets Go to the Dark Side

Speaking of sneaky, did you know assets can have a bit of a rebellious phase, too? When it comes to investments, it’s not all rainbows and sunshine. What Is delinquency? you may ask. Picture delinquency as your investment stomping its foot and deciding not to perform as well as you hoped. Things get rocky, but don’t worry; your cost basis remains your financial rock, a stabilizing force amidst the turmoil.

The Plot Thickens with Improvements

Cost basis isn’t a one-trick pony; oh no, it’s got layers, like a good character in a C Thomas howell Filmography. Say you’ve splurged on some ultra-fancy home improvements. Those shiny new additions can increase your home’s cost basis, making your investment story far more compelling when it’s time to sell.

Conventional Wisdom Meets Cost Basis

Now, if we define conventional, it typically means what’s generally accepted or expected—like toast landing butter-side down. However, when it comes to calculating the cost basis, conventional wisdom might as well pack its bags. It isn’t just your purchase price; it’s a dynamic little beast that morphs with market changes, additional investments, and even reinvested dividends. So, my friend, conventional just left the building.

Highs and Lows: Elevation Affects Cost Basis?

You might be scratching your head thinking, “Does Mexico city elevation have anything to do with my cost basis? While it might seem about as related as chalk and cheese, there’s a good lesson here. Just as elevation can influence weather patterns, unseen factors can affect your cost basis. So stay sharp and monitor all aspects of your investments—because what goes up, must come down, am I right?

Cost Basis and Taxes: The Ring Announcer’s Perspective

Now let’s tag in bobby The brain Heenan for a metaphorical wrestling match with taxes. You see, your cost basis gets into the ring when you sell an asset and face potentially hefty capital gains taxes. The higher your cost basis, the lower your taxable gain – think of it like having a heavier-weight champ on your side.

Don’t Forget the Dreamers!

In the whirlpool of financial terms, even dreamers have a seat at the table. What Is Daca status, you ask? DACA recipients, those dreamers we hear about, also have to understand cost basis, especially when they become homeowners or investors in the land of the free. They, too, get to navigate the exciting waters of cost basis.

So, whether you’re a comic book collector, a home flipper, a market watcher, or just a regular Jo looking to make sense of her finances, cost basis is a term you’ll want to get chummy with. Remember, with great investment comes great… need to understand your cost basis! Keep your eye on the ball, and you’ll be a cost basis whiz before you can say, “Show me the money!”

What is meant by cost basis?

– Cost basis? Oh, it’s just the OG price tag for snagging an asset—a combo platter of purchase price and all those pesky extra fees. Over time, this number can play chameleon, changing with the market’s mood swings and any gear-grinding depreciation.

What is an example of a cost base?

– Let’s break it down with an example of cost base: imagine you’re splashing cash on shares. Your cost base is not just what you forked out initially; it’s that, plus a side of reinvested dividends or capital gains and the bite of commission or other fees that you paid to cross the finish line with your shiny new stocks.

How does the IRS know your cost basis?

– Now, how does Uncle Sam’s team keep tabs on your cost basis? Easy-peasy: most brokerages keep score for you, wrapping it up with a bow on IRS Form 1099-B. It’s like having a financial guardian angel, making sure the tax folks are in the loop.

Why is my cost basis higher than what I bought?

– Stumped why your cost basis has ballooned over what you originally coughed up? Well, if you’ve been playing the reinvestment game with your dividends or capital gains, congrats—you’ve been boosting your cost basis. Kinda like hitting the gym for your investments.

Is cost basis good or bad?

– When you ask if cost basis is good or bad, you’re barking up the wrong tree—cost basis isn’t about good or bad; it’s a tool, not a moral compass. It’s just crunching numbers to paint the full financial picture.

What happens if you don’t know the cost basis of a stock?

– If you’re scratching your head over the cost basis of a stock, you’ve got a puzzle on your hands. If you didn’t keep track and the brokerage hasn’t either, you might end up playing a guessing game with the IRS—which, let’s be honest, is about as fun as a tax audit.

How do you calculate cost base?

– Calculating cost base feels like a math test, but here’s the cheat sheet: tack on the purchase price, fees, taxes, and other nibbles to the principal amount of the investment. It’s like tallying up the full tab after a shopping spree.

What is the best cost basis method?

– Picking the best cost basis method is like choosing a flavor at an ice cream parlor—there’s no one-size-fits-all. But FIFO, or First In, First Out, is the go-to sundae. It sells your oldest shares first, which could scoop up some tax benefits.

How do you calculate cost basis on sale of a house?

– To figure out the cost basis on the sale of your casa, you’re juggling more than just your original buy-in price. Throw into the mix improvement costs, fees, and taxes you’ve paid over time, essentially every dime you’ve dropped into it. Time to do the home investment math!

Do I pay taxes on my cost basis?

– Paying taxes on your cost basis? Nope, that’s not how this party works. You’ll pony up for the gains over your cost basis. So, those taxes only rattle your cage when you sell and cash in on a profit.

What happens if cost basis is not reported to IRS?

– No report to the IRS on your cost basis? Cue ominous music—it’s a recipe for a headache. You could be slapped with an estimated cost basis, which might mean Uncle Sam’s hand is deeper in your pocket than it needs to be.

Does cost basis matter?

– Does cost basis matter? You bet your bottom dollar it does! It’s the cornerstone of knowing how much moolah you might make or lose when it’s time to say goodbye to your investments.

What if cost basis is incorrect?

– Incorrect cost basis giving you the blues? Hijinks could ensue come tax time—it could mean either a heftier tax bill or less dough in your refund. It’s worth your time to play detective and get those numbers straight.

How do you lower your cost basis?

– To shrink your cost basis, you gotta be savvy with reinvestments and additional share purchases that can dilute the average cost. It’s like playing Tetris with your investments—every move can change the landscape.

How is basis calculated?

– To get the nitty-gritty on basis calculation: combine your initial purchase price with all the costs of acquisition, like closing fees or improvements for real estate, or commission for stocks. Imagine it’s the grand total at the bottom of a very long receipt.

What is another name for cost basis?

– Searching for a pseudonym for cost basis? Try “tax basis” on for size—it’s the financial world’s alter ego for the same concept, just strutting on the tax catwalk.

What is the difference between cost basis and tax basis?

– Cost basis vs. tax basis—they’re like financial twins. Both refer to the moola you drop on an investment, but while cost basis can get personal, with all your actual costs tallied up, tax basis may don a different outfit to strut in the IRS’s fashion show.

How do you calculate cost base?

– Calculating cost base is like baking a financial cake: you mix the purchase price with a pinch of associated fees and a sprinkle of taxes, then keep a close eye on it as it “appreciates” over time in the oven of the market.

What is the difference between cost basis and purchase cost?

– Cost basis and purchase cost could pass as cousins at a family BBQ. Purchase cost hits the scene as just the price tag you see at the register, while cost basis drops in later with a whole entourage of additional expenses, jazzing up the total you actually shelled out.